- Colombia: Economic activity expanded more than expected in February, but thanks to temporary factors

Israel’s retaliatory strikes on Iran shook markets overnight, with huge rallies in fixed income and havens like the JPY against steep losses in high-beta assets. As hours passed with little public acknowledgment by Israel and Iran or signs of imminent retaliation, alongside reports of limited damage, markets have moved to unwInd the bulk of the kneejerk reaction. Though the rates long-end, US equity futures, and the MXN are holding to some of the initial reaction, the front-end is practically back to opening levels, as are crude oil prices, and most major FX are, in fact, now stronger against the USD.

Setting aside military risks, the overnight session was quiet and trading mostly ignored a marginal undershoot in Japanese March CPI and a weaker than expected UK retail sales release. It’s a quiet G10 rest of the day and only a handful of central bank speakers are scheduled in the afternoon, with Israel/Iran headlines remaining the main risk for markets.

Global curves are holding to a bull flattening bias, and yields-wise we’re not too far off from where markets were trading around 7ET yesterday, before hike truism by the Fed’s Williams triggered a selloff in fixed income. WTI/Brent and copper are only marginally higher, 0.2%, and iron ore is flat. SPX futures were already weaker into the strikes reports, to track a 0.5% drop where only about a fifth owes (on net) to risk-off geopolitics trading; SX5E and FTSE suffer ~1% losses..

The USD is mixed, as the CHF leads up 0.4% and the MXN sheds 1.5% after losing upwards of 5% on the day in very thin trading (through the 18 pesos level). Reports of Israel’s strike in Iran saw the MXN spike from ~17.20 to as high as ~18.20 (on my Bloomberg screens), reflecting a combination of thin volumes and the stopping out of MXN longs amid still well-stretched MXN-positive poisoning, In a way, maybe today’s moves helped flush some of these out. Unfortunately for some investors, the MXN is now only about 10pips above the pre-headline levels, around 17.25/30. Note also the CHFMXN was at one point tracking a 6.5% rise to near the 20 pesos level—from trading around 18 pesos this time last Friday.

The Latam day ahead has a couple of things to watch, Mexican retail sales at 8ET, the BCCh’s traders survey at 8.30ET, and Colombian trade balance and imports figures at 11ET. After a weak start to the year, with a 0.6% m/m decline, Mexican retail sales are seen holding unchanged for February, with a ~2% increase in year-on-year terms. For now, data show that Mexico’s economy has not done much growth-wise since late-2024, but forget about Banxico likely cutting again in May (even if H1-Apr CPI misses next week).

In the BCCh survey, we’re watching how the rate cuts outlook has changed since the April 2 decision through the latest episode of soaring global yields and CLP weakness. Chilean swaps markets are now biased towards a 5.75% year-end policy rate—a ~30bps increase from last Friday, and ~50bps from two Fridays ago. Colombia’s data will likely have limited influence on local markets, and the same will probably be true of comments by FinMin/BanRep member Bonilla, a top dove (of course, him changing his tune to more cuts caution would be surprising).

—Juan Manuel Herrera

COLOMBIA: ECONOMIC ACTIVITY EXPANDED MORE THAN EXPECTED IN FEBRUARY, BUT THANKS TO TEMPORARY FACTORS

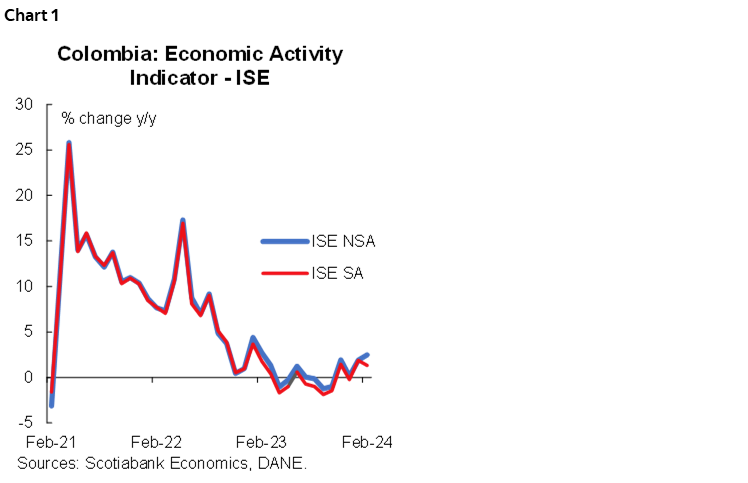

On Thursday, April 18th, DANE published the latest data on the economic activity indicator (ISE) for February. The indicator showed annual growth of 2.49% (chart 1), exceeding analysts’ expectations and our estimates of 1.4% y/y and 1% y/y, respectively. The positive surprise is explained by agriculture and mining, public administration, and public services with the latter probably due to the implementation of the maximum capacity of thermal power plants for energy production. On the other hand, the sector linked to manufacturing and construction remains in negative territory, although contractions are moderating.

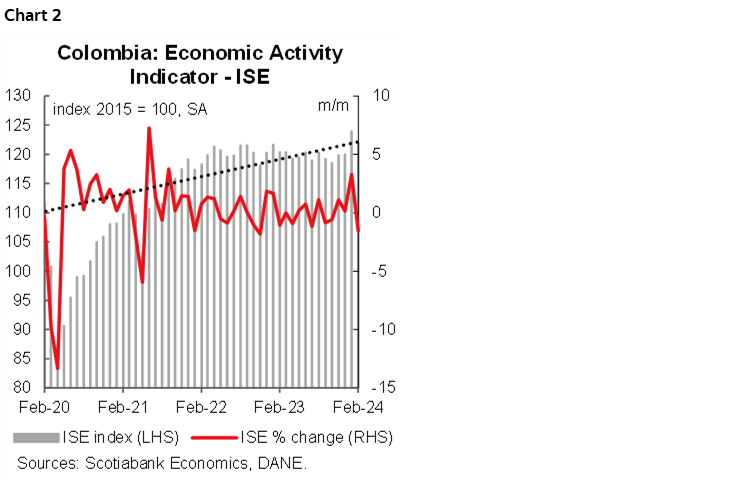

In contrast, seasonally adjusted data showed the economy contracted by 1.6% m/m (chart 2), the most significant contraction in fifteen months (November 2022). This behaviour shows us that the positive performance of January was attributed to one-off effects in some sectors, such as agriculture. Meanwhile, key sectors, such as commerce and financial activities, showed contraction. All in all, we do not believe that BanRep will accelerate the easing cycle; instead, our base case scenario is that the central bank will maintain a rate cut of 50bps at the next meeting on April 30th.

In February, primary activities rebounded with an annual growth of 7.8%, followed by tertiary activities (services) with an expansion of 2.5% y/y. Public services, public administration, arts and entertainment, and information and communication drove the tertiary sector’s growth. It is worth noting that, for the first time after eleven consecutive months in negative territory, commerce, transport, and accommodation rebounded in February with an expansion of 1.2% y/y, a slight upturn in a sector heavily affected by high inflation and high interest rates and where it is expected that some moderate expansion in products related to durable and semi-durable goods will continue throughout the year.

Secondary activities, which include manufacturing and construction, posted twelve months in contractionary territory, contracting -2.6% y/y in February. Within manufacturing, the largest annual declines were recorded in the manufacturing of vegetable and animal oils and fats, non-metallic mineral products, bakery products, and motor vehicles and their engines.

In seasonally adjusted terms, the most significant fall was recorded in the primary sector, which contracted by 3.4% m/m, a significant slowdown after the 7.9% m/m expansion recorded at the beginning of the year. The positive performance in the agriculture sector in January was attributed to the effect of bringing forward agricultural production to avoid adverse effects from the “El Niño” phenomenon, however, we observe that in February this effect is vanishing. In second place is the tertiary sector, which recorded a slight contraction of 0.1% m/m, due to a decline in professional, financial, and insurance activities and commerce, transport, and accommodation, while public administration, arts and entertainment offset the fall, although to a lesser extent than in the previous month. The secondary sector (manufacturing and construction) recorded an increase of 0.5% m/m in February, after two consecutive months of decline.

The activity results suggest that sectors such as industry and construction continue to perform weaker than expected, reflecting the impact of high interest rates on the economy and the decline in household demand. On the contrary, agriculture and mining, along with public services, public administration, and arts and entertainment, are the sectors that have contributed most to boosting economic activity in the second month of 2024, although at a much slower pace than recorded at the beginning of the year. It is worth noting the behaviour of commerce, transport, and accommodation, which showed a slight recovery in annual terms for the first month after being in contraction for almost a year.

Ahead of BanRep’s meeting on April 30th, market consensus and our call, is for a cut of 50bps in the interest rate to 11.75%, probably in a split vote. The board’s main concern remains the risk premiums that could be reflected in the exchange rate and delay the convergence of inflation to the target. However, economic activity continues to show concerning signals in some relevant sectors. We expect the central bank to accelerate the easing cycle towards the end of the year to close at 8.25%.

Highlights:

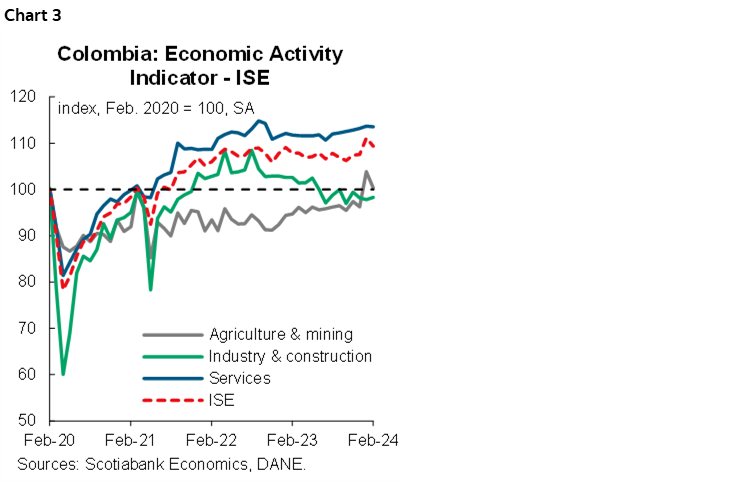

- Primary activities (agriculture and mining) grew at an annual rate of 7.8% y/y, while at the margin it contracted by 3.4% m/m (chart 3). In agriculture, the moderation of producer prices continues to contribute to food production, partly due to the appreciation of the exchange rate and its relationship with the level and statistical base compared to 2023, although at a much slower pace. On the other hand, the effect of the anticipation of agricultural production in January, before the arrival of the El Niño phenomenon, would have faded by February. In the mining sector, oil and coal production would continue to contribute to the improvement in the sector’s results.

- Secondary activities (manufacturing and construction) ended the year in negative territory, registering a contraction of 2.6% y/y, although the rate of decline is the lowest in the last seven months. On the manufacturing side, the decline continued to be mainly due to the decline in the production of durable goods such as vehicles and their components, in addition to the production of non-metallic mineral products. On the construction side, the reduced dynamism of the non-residential sector due to high interest rates and less execution of public infrastructure continues to affect the sector’s results. In seasonally adjusted terms, February saw an increase of 0.5% m/m after two consecutive months of decline.

- The tertiary sector, which includes activities related to commerce, services, and public administration, recorded an annual growth of 2.5% in February. This result is attributed to the growth of public services (+6.2% y/y), partly due to the higher energy production of thermal power plants as a result of the El Niño phenomenon, public administration, arts and entertainment (+5% y/y), information and communication (+3.7% y/y) and real estate activities (+1.7% y/y). Within the commerce sector, transport and accommodation services recovered in February, growing by 1.2% y/y after eleven consecutive months of negative growth. In contrast, finance and insurance activities were the only sector within tertiary activities to contract in February, by 2.9% y/y, the lowest level since January 2022.

In seasonally adjusted terms, the tertiary sector recorded a monthly variation of -0.1%, due to contractions in financial activities (-2.7% m/m), professional activities (-2.6% m/m), and commerce, transport, and accommodation (-1% m/m). These declines were initially offset by growth in information and communication (+1.3% m/m) and public administration, arts, and entertainment (0.7% m/m), although the latter was less pronounced than in January.

—Jackeline Piraján & Santiago Moreno

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.