- Colombia: Citi Survey: Inflation expectations are broadly stable, but there’s disagreement around the easing cycle’s end point

- Mexico: Economic activity rebounded in February as services gain momentum

COLOMBIA: CITI SURVEY: INFLATION EXPECTATIONS ARE BROADLY STABLE, BUT THERE’S DISAGREEMENT AROUND THE EASING CYCLE’S END POINT

April’s Citi survey was released on Monday, April 22nd. BanRep uses this survey as one of its indicators for inflation expectations, the monetary policy rate, GDP, and COP.

Highlights:

- GDP growth expectations are almost unchanged. For 2024, GDP growth is expected at 1.27%, while for 2025, it is at 2.52%, 1bps above the previous survey. For 2026, the expectation is at 2.89%. Previous forecasts point out that Colombia will continue growing below potential for a while and that the economy’s recovery will be slow.

- Inflation expectations with mild changes. Inflation for the end of 2024 is expected at 5.54%, 13bps higher than in the previous survey, while for 2025, the expectation increased by 4bps to 3.74%. Stability on inflation expectations is a positive surprise since, in March, the CPI report surprised to the upside. For April, the survey points to a 0.58% m/m inflation; at Scotiabank Colpatria, the expectation is 0.59% m/m. It is worth noting that the high statistical base effect is vanishing, and given that, inflation could have more moderate progress in forthcoming months. For April, a 0.58% m/m inflation will take the annual headline reading down from 7.36% to 7.16%.

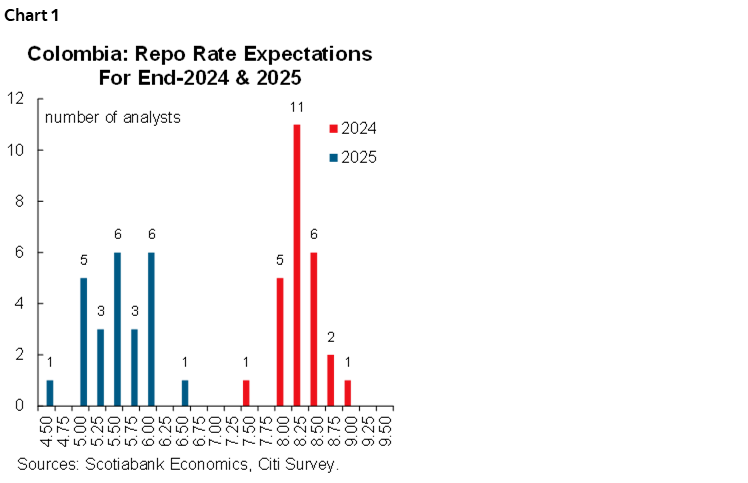

- Monetary policy: Consensus points to a 50bps rate cut in April to 11.75%. Two out of the twenty-four respondents expect a 75bps cut. BanRep is expected to maintain its cautious approach although economic activity is decelerating, and inflation is decreasing as expected. The terminal rate is the point under debate. For December 2024, the expectation is at 8.25% with a range between 7.50%–9.0%, while for Dec-2025, it is at 5.50% with a range between 4.25% and 6.50%. At Scotiabank Colpatria, we expect the monetary policy rate to close at 8.25% in Dec-2024 and 5.50% in Dec-2025 (chart 1).

- Finally, economist consensus expects the exchange rate to average 4003, below the previous survey level of 4035 pesos, while for 2025, it is expected to be 4,002 pesos. Scotiabank Economics’ projections show an exchange rate of 4,116 pesos in December 2024 and 4,150 pesos in 2025.

—Sergio Olarte & Jackeline Piraján

MEXICO: ECONOMIC ACTIVITY REBOUNDED IN FEBRUARY AS SERVICES GAIN MOMENTUM

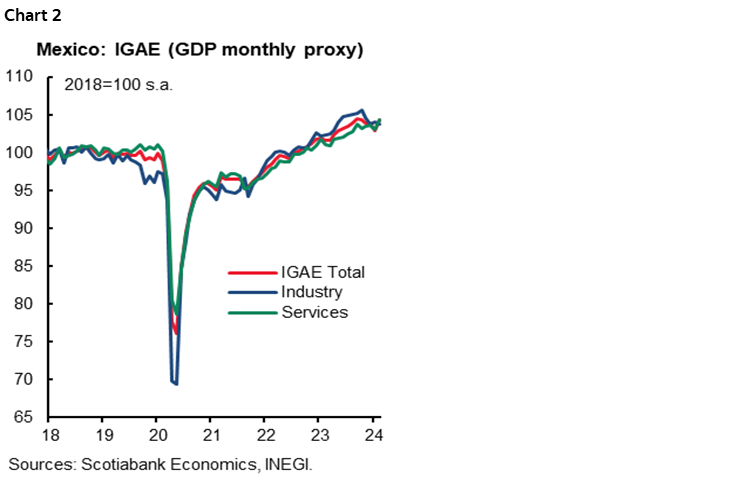

In February, according to the monthly GDP index (IGAE, chart 2), economic activity rebounded on a monthly sequential basis after four consecutive setbacks, from -0.9% to 1.4% m/m. The advance came from a rebound in services, which rose from -0.5% to 1.2% m/m, while industry fell -0.1% from a previous weak advance (0.2%); likewise, primary activities rebounded—with notable volatility—to 16.5% from -13.0%.

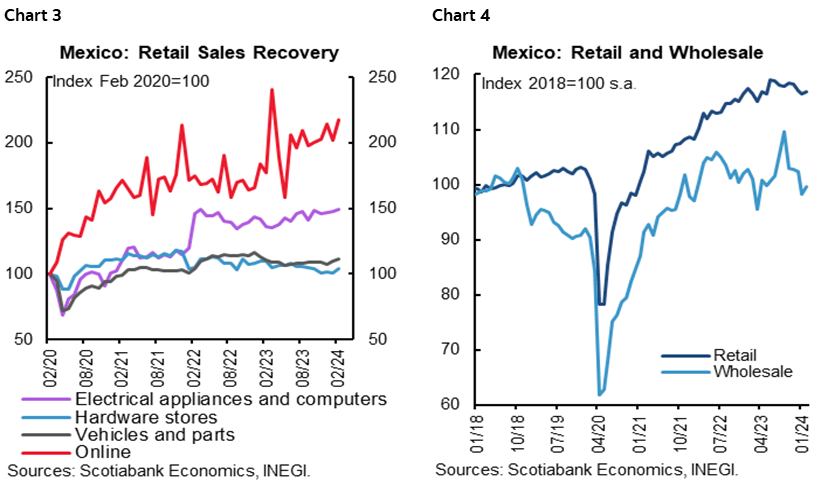

In its annual comparison, economic activity rose 4.4% from 1.9% y/y previously. By sectors, services continue to lead, rising from 2.2% to 4.8%. The boost from public spending is beginning to be felt, with election-related services already showing a greater advance, such as wholesale services (12.8%), retail services (3.6%), transportation and storage (8.25), and media information (5.9%, charts 3 and 4).

Industry increased 3.3% y/y (2.7% previously). Construction repeated a double-digit increase (10.4%), although they maintain a slowing trend after the most vigorous increases observed in the previous year, up to 30% in August 2023. We believe that a strong dynamism will persist in the following months, as the government rushes to complete the infrastructure projects of the current administration. On the manufacturing side, manufacturing rebounded 2.3% y/y from 0.1% previously. We believe that the advance continues to be concentrated in the exports-oriented sectors of transportation equipment and computer equipment.

Looking ahead, we consider that in the short term, services will continue to lead economic activity, benefiting from the boost in public spending; in addition, the outlook for industry is favourable thanks to higher growth expectations in the United States, which could boost manufacturing exports, as well as new construction projects that take advantage of the relocation of supply chains.

—Brian Pérez & Miguel Saldaña

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.