Next Week's Risk Dashboard

- FOMC’s prior lack of a killer instinct…

- …lessens its ability to fight inflation now

- The Fed has other options to explore…

- …before courting massive risks with added hikes

- Nonfarm will be part of a suite of US job market readings

- Tracking Canada’s economic rebound

- Eurozone inflation may face upside risk ahead of key June meeting

- Eurozone GDP will also inform the path to June

- China’s PMIs are likely to signal modest growth

- BanRep likely to cut again

- Norges may have less confidence in an autumn cut

- Will Swiss CPI embolden another SNB cut?

- Is NZ wage growth still too hot for the RBNZ?

- Mexico’s soft economy poised for an update

- OECD to update forecasts

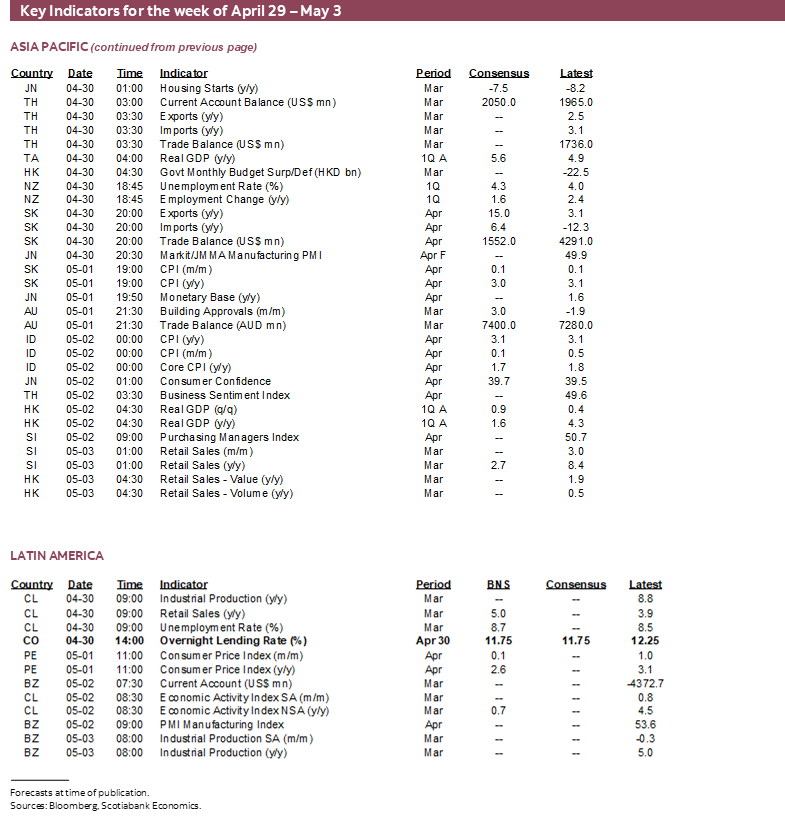

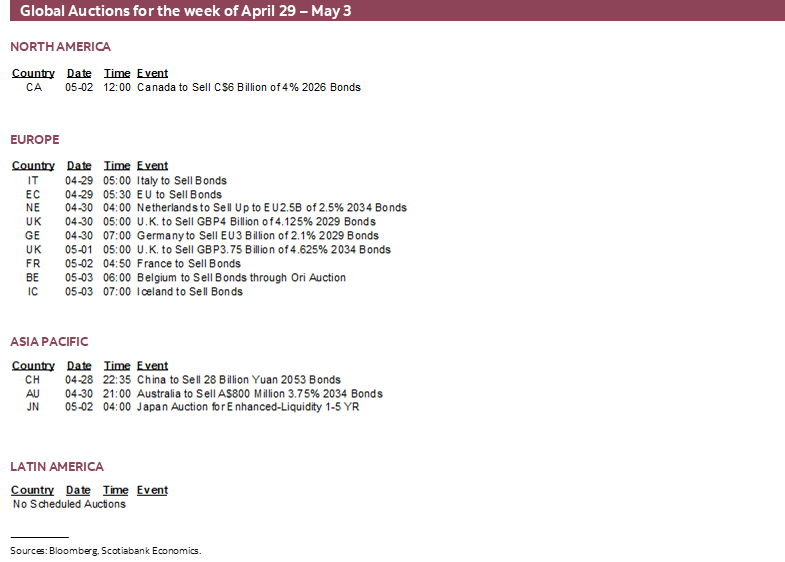

- Global macro

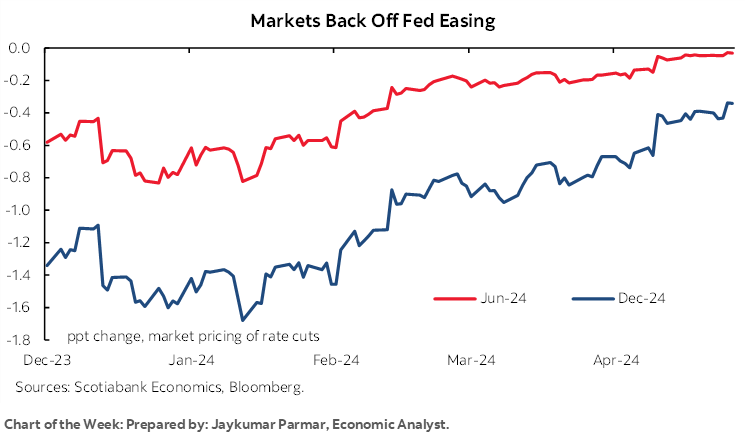

Chart of the Week

A week of marketing with important markets clients in the Middle East and India as part of the Scotia team advanced mutually beneficial dialogue on the outlook for economies and markets and investing opportunities. Many of the debates that were considered will see further advancement this week.

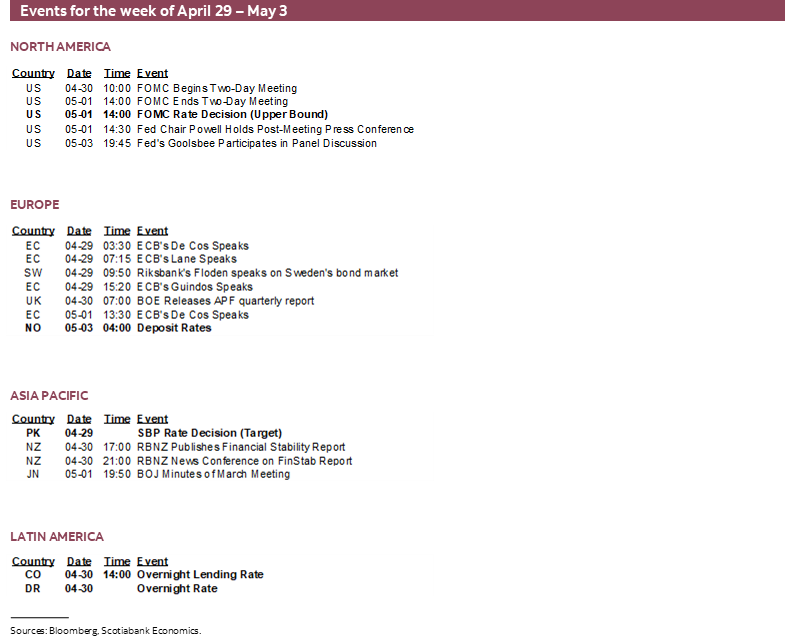

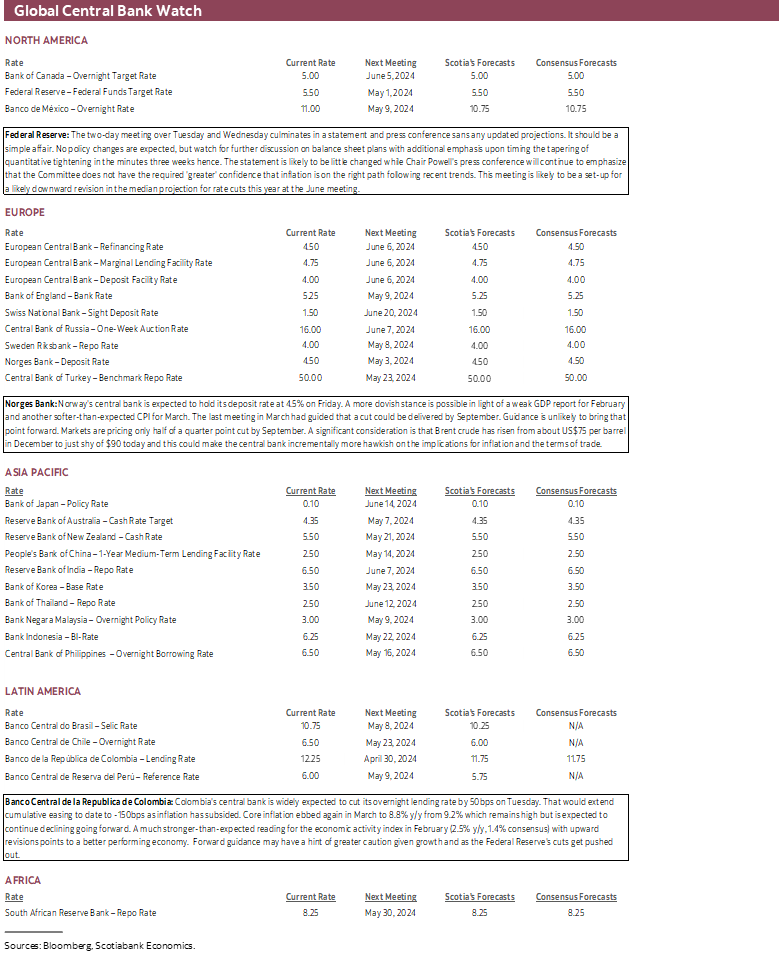

Key will be the tone coming out of the FOMC’s two-day meeting. As argued below, the Fed’s lack of a killer instinct toward getting inflation down at whatever cost explains its persistence today while it’s probably too late to return to hikes relative to other options.

The US economy—especially its labour market—will figure prominently on either side of the Fed meeting, but it would be wrong to go into the week with the kind of US-centric obsession that drives Wall Street’s shops. The world beyond the US will be replete with major developments.

FEDERAL RESERVE—THEY MISSED THEIR CHANCE!

The two-day meeting over Tuesday and Wednesday culminates in a statement and press conference sans any updated projections. It should be a relatively simple affair.

No policy changes are expected but watch for further discussion on balance sheet plans with additional emphasis upon timing the tapering of quantitative tightening in the minutes three weeks hence. We think that the pace of roll-off for Treasuries will be scaled back by June.

The statement itself is likely to be little changed. The description of current conditions could continue to emphasize that inflation has moved lower over the past year but amend it by stating something that acknowledges the resumption of upside risks in 2024.

Chair Powell's press conference will continue to emphasize that the Committee does not have the required 'greater' confidence that inflation is on the right path following recent trends and therefore is not moving toward nearer term easing. This meeting is likely to be a set-up for a likely downward revision in the median projection for rate cuts this year at the June meeting relative to the prior dot plot that showed 75bps of cuts in 2024.

I think all estimates between no cuts and 50bps of cuts this year are reasonable and will be informed by data and developments. It would be optically more problematic for the FOMC to begin easing close to the election on either side and so either they exploit an opportunity before or at the December meeting or pass on the year entirely.

As markets struggle with pricing conviction over how much easing may lie ahead and when, the largely unexplored tail bet of raising the Fed funds target rate presents a potentially much bigger effect. It’s very unlikely that the Fed is going to move in that direction any time soon, yet the question entered the dialogue with clients and often at their prompting this past week in light of views expressed by some pundits and a very light, casual comment by Atlanta Fed President Bostic.

The Window Passed Long Ago

There once was a case for the Fed to adopt more of a crush it mentality. The case was that the Committee needed to act as quickly as possible and at whatever cost to convince markets they will get inflation down given the costs of allowing it to percolate for too long.

In order to achieve this, the Committee would have to invoke greater damage upon the economy and open up material slack in a sign that they are prepared to do whatever it takes. If that meant going six-handled, then so be it.

I had favoured that view and remain of the belief that had the Fed not stopped at 5.5%, then we wouldn't be faced with as pervasive inflation risk today. Forecasting inflation is difficult, but inflation risk remained high and should have been more decisively snuffed out. To pause at 5.5% was a policy error in my view but now we have to live with it.

That window has passed. It would have been easier to continue the trajectory of hiking and risk overshooting than to resume after a lengthy pause that was accompanied by guiding future cuts.

The Bazooka as Last Resort

There is a lot that the FOMC could do to tighten monetary conditions in the fight against ongoing inflation risk before having to consider the enormous consequences to further hikes. Some of that has already been achieved.

For one, they could invoke more language that conveys a much lower possibility of any easing this year. Chair Powell could say in a press conference that it seems rather unlikely that there will be easing by June, July, or by September—if this year at all—and take an incrementalist approach. Signalling that the FOMC does not have enough confidence to ease reduced market pricing for cuts and they could get another 25–50bps of tightening by year-end by sounding more aggressive against cuts.

A stronger option along the same line of thinking would be to more emphatically signal that the FOMC is willing to raise again if inflation at a higher rate than the Committee’s objective proves to be more persistent.

A significant increase in neutral rate estimates might mean further in this direction. The case for raising the FOMC's neutral rate estimate seems to be more incrementalist in nature.

It seems unlikely that the FOMC would delay tapering QT flows as a way of tightening without hikes. For one, this could invite deeper risks in funding markets. For another, the policy rate is the dominant tool.

To immediately go to hiking before exploring other options would seem unwise.

A High Bar and the Bag of Chips Theory

The FOMC has spoken of rate cuts and projected them for so long that to give the heave ho to that narrative wouldn't be taken lightly. The Committee would have to have very high confidence that hiking is the right thing to do rather than doing so on a policy lark.

In order to have such confidence there would probably have to be major new supporting evidence that goes beyond just monitoring data.

If such a bar were met, then hiking should be spoken of in a plural sense. Not singular. The FOMC is about as likely to come back with one measly hike as you and I are to open a bag of chips, take and eat only one, and immediately shut it. Who does that?!

The Complications of Resuming Hikes

Think of the potential consequences to resuming hikes. I'll give an opinion on what I think markets would do, but it's not the only scenario. The scope for severe market volatility around multiple uncertain scenarios upon hiking could be highly destabilizing.

One scenario in response to resuming hikes is that the bond market resets the whole term structure around higher for longer. That if, say, the fed funds terminal rate is six handled then 10s should be much higher with a minimum starting point of 100bps higher than now. I think that's unlikely.

An alternative scenario may be that the market doubles down on pricing downside risk including the extreme scenario of outright policy error. In this scenario, the curve inverts much further and longer yields fall. Under this scenario, markets may believe that the Fed is overdoing it as it has in the past, that the risk of a hard landing in the economy has gone up, and that financial stability risks have also risen.

A whole range of scenarios lies in between. Markets would debate the whole set of them. Market turmoil and volatility could become acute.

The Communications Challenge

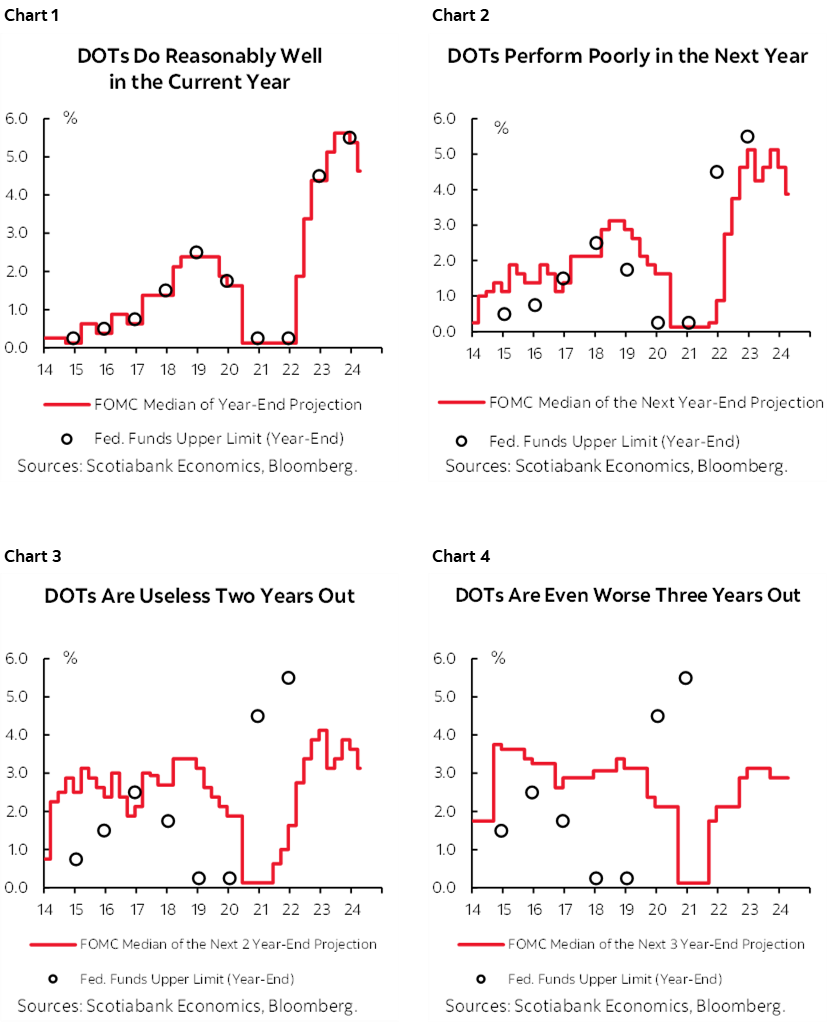

Fed credibility after the resumption of hiking? Oh forget it. Try producing a dot plot and having markets believe any bit of it after spending so long guiding cuts only to do an about face. We already know that the median rate projection of FOMC participants performs poorly as a guide one year out and beyond (chart 1–4). The market's impression of this wouldn't be helped.

As a result, the FOMC would lose ability to influence and manage markets in the aftermath. It has made progress reducing the Committee's own belief in cuts and in reining in markets that undershot that guidance by pricing more aggressive cuts than were in the dots. This progress would suffer a major blow.

In conclusion, whereas the case to hike further was there all along, to do so now would court greater problems than are worth it especially before considering other options first.

CANADA’S ECONOMY—TRACKING THE REBOUND

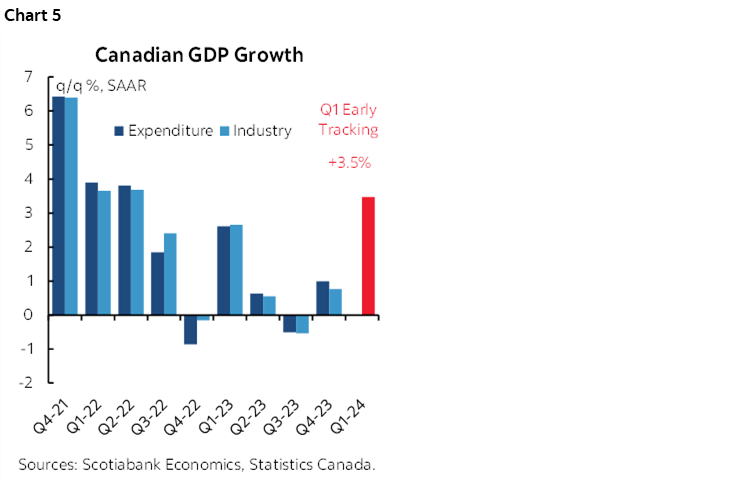

On Tuesday, Canada will update GDP figures for the month of February including preliminary guidance for March and any revisions to prior months. With any luck they’ll confirm the strong rebound in economic activity that is being tracked for Q1 (chart 5).

After posting a whopping 0.6% m/m growth rate in January, Statcan guided on March 28th that February GDP was shaping up to post another 0.4% m/m gain. Governor Macklem was probably too dismissive toward the rebound when he suggested it was driven by the end of Quebec’s public sector strike and I say that for three reasons.

- December GDP—when the strike occurred and ended—only contracted by -0.1%, so a massive 0.6% rebound in January was far in excess of the drag in December. Furthermore, the BoC knew that the strike was long over when it embarked upon the January MPR forecast exercises. Therefore, to pin the large rebound in January and general Q1 momentum on the strike was rather unflattering to its forecasters. Recall that in the January MPR the BoC had forecast Q1 GDP growth of just ½% q/q SAAR and then revised that up by over two percentage points in the April MPR.

- For another, the momentum was sustained in February as opposed to just being a one-off strike rebound effect.

- Thirdly, Statcan had implicitly guided that much of the gain in February had nothing to do with strike effects. The agency said that “broad-based increases, with main contributions from mining, quarrying, and oil and gas extraction, manufacturing, and finance and insurance, were partially offset by decreases in utilities.”

March might have lost some momentum, but it could return when April’s figures arrive a month later. I’m tracking a small dip in March GDP, but it isn’t based on much data thus far. For example, hours worked fell which typically portends weak GDP defined as hours times labour productivity. A solid gain in productivity would be required to offset lower hours and that would be informed by more activity readings than we have so far.

With flat March GDP, Q1 would be tracking about +3% q/q SAAR. With March softening a bit, it could be a little under 3%. But whatever the case, it’s splitting hairs as the economy is vastly outperforming the BoC’s expectations coming into the start of the year and in a way that may be fundamentally challenging Macklem’s narrative that the worst for the economy would be experienced over 2024H1.

At issue going forward is whether this will be sustained into Q2. It’s obviously very early to be tracking Q2 growth absent any data, but if Q1 ends on a soft note then it would mean the economy would face an uphill battle to post a repeat in Q2.

As for the BoC’s June decision, each of June, July and September are ‘live’ meetings but the BoC is signalling extreme dependence on very short-term data. I had been arguing for a while in favour of paying July because markets were pricing significant odds of back-to-back cuts in June and July; markets have since reined in pricing to only one quarter-point cut over the two meetings while leaning toward Q3 that I continue to favour. We’ll get Q1 GDP, another inflation report, plus jobs and wages before the June decision.

EVERYTHING YOU WANTED TO KNOW ABOUT THE US LABOUR MARKET

(Almost) everything you ever wanted to know about the current state of the US labour market will be revealed this week. Chair Powell says he isn’t just focused upon one or two labour market signals and so this week will give him a lot to chew on in the build-up to Friday’s marquee nonfarm payrolls report.

I went with +250k for Friday’s nonfarm payrolls report and a slight downtick in the unemployment rate to 3.7%. The latter is derived from the companion household survey that is unlikely to post the same strength in employment and relative softness in the supply of labour. Wages are expected to post another 0.3% m/m SA gain that at an annualized rate would keep the heat on labour market pressures on inflation.

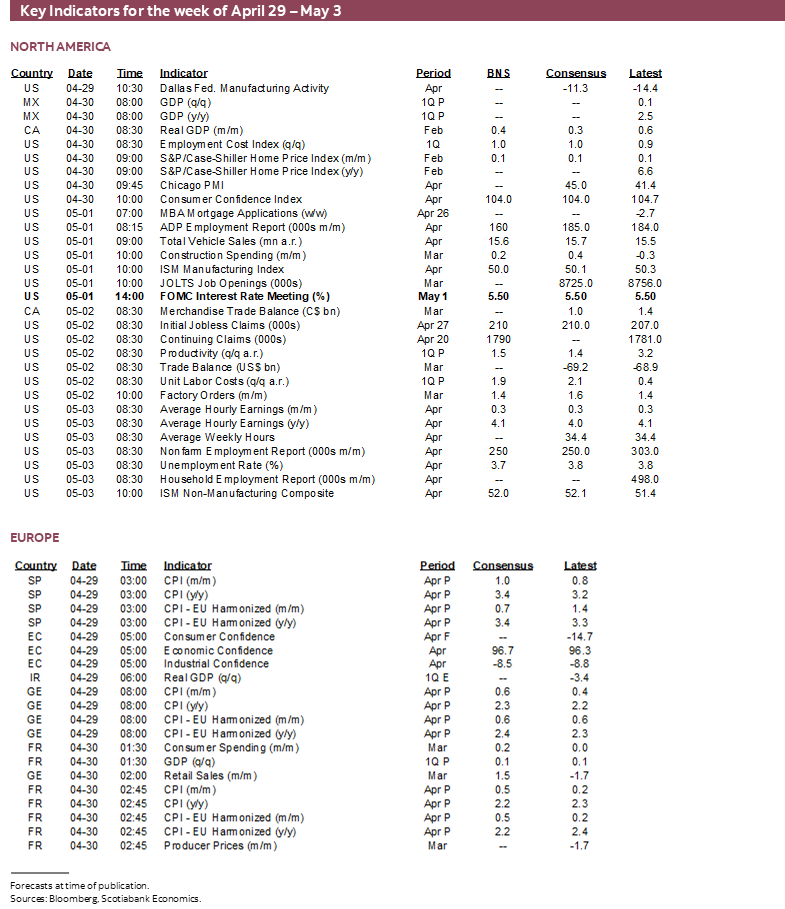

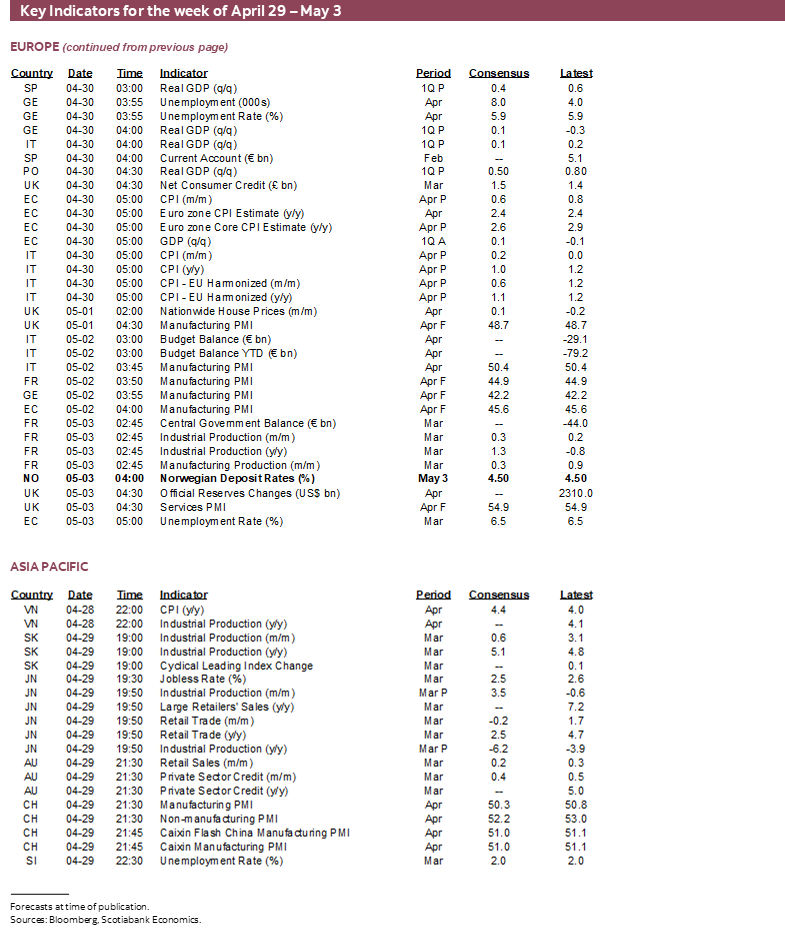

Before we get to payrolls, we’ll have the following readings to consider:

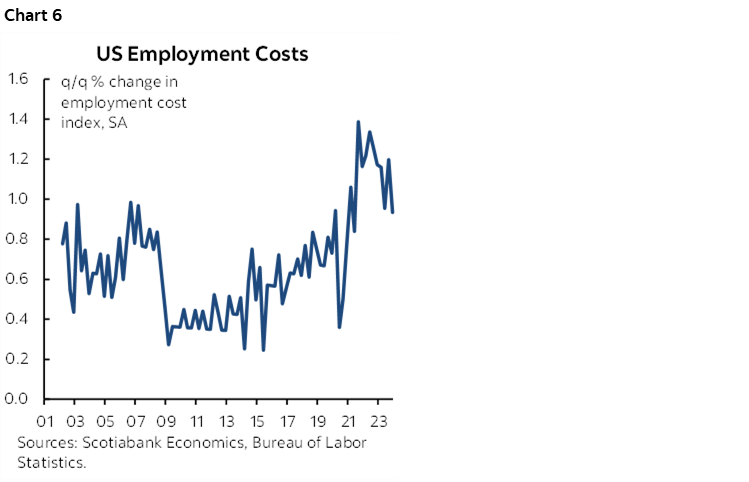

- Employment Cost Index (Tuesday): The Q1 estimate could extend the string of q/q nonannualized SA gains of about 1% or more that has been in place for ten consecutive quarters through 23Q4 (chart 6). Revisions will be offered back to 2019Q1.

- ADP private payrolls (Wednesday): April’s reading is likely to extend the pattern of reporting softer growth in private payrolls than the private part of nonfarm payrolls. They are not typically well correlated with nonfarm payrolls, but markets often react as they pass the time until the measure the Federal Reserve pays closer attention to.

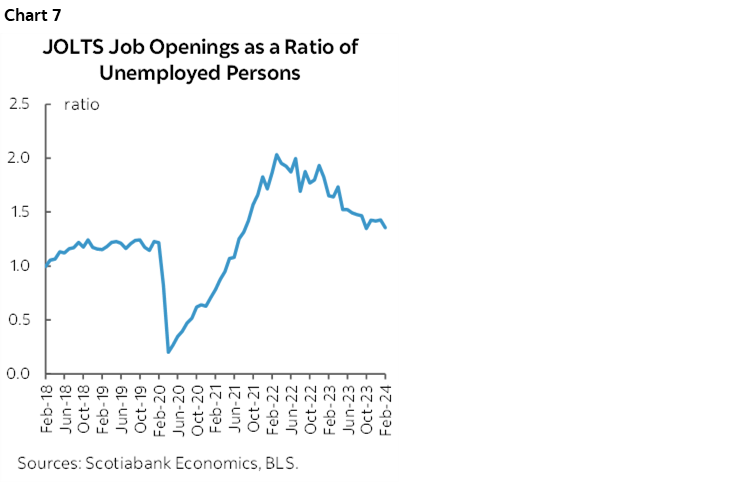

- JOLTS (Wednesday): The report includes an array of measures from job openings to quits. Progress toward sustainably lower job openings has been somewhat erratic. The Fed monitors measures like the openings to unemployment ratio as one indication of the balance between supply and demand for labour (chart 7).

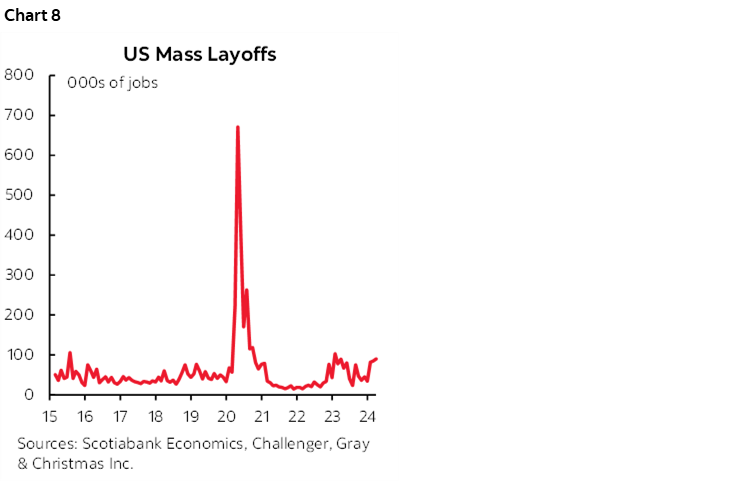

- Challenger job layoffs (Thursday): April’s readings follow a pick-up in March that signalled greater firings but at a level that is still compatible with a strong job market (chart 8).

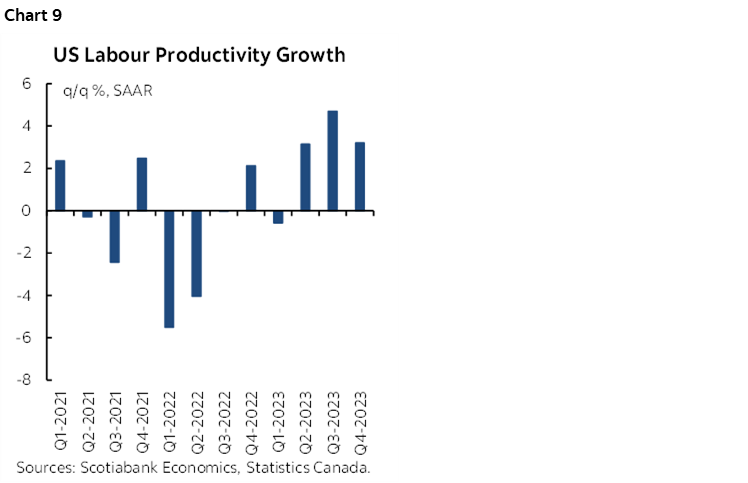

- Productivity (Thursday): Nonfarm productivity growth is likely to slow following the somewhat softer than expected GDP report and gain in hours worked. A one-handled q/q SAAR gain is likely and would halt the string of strong gains from 3.1% to 4.7% to 3.2% over 2023Q2 to Q4 respectively (chart 9). The Fed likes to see more rapid productivity growth as an indication of less inflationary pressure since it signals doing more with the same or fewer inputs.

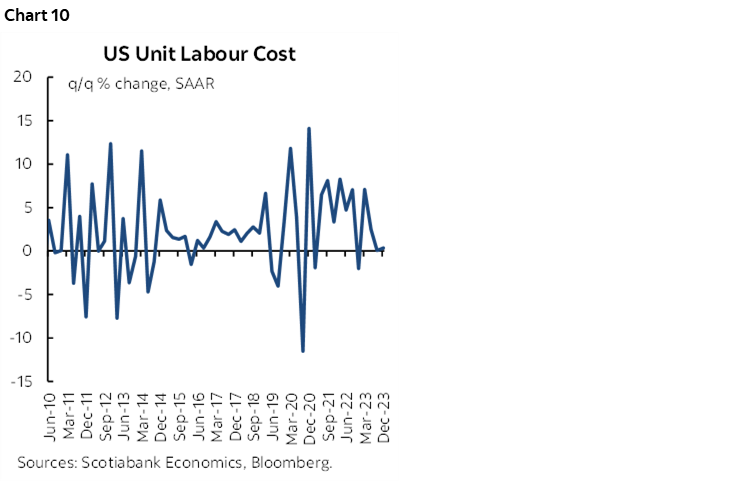

- Unit Labour Costs (Thursday): As a result of weaker productivity growth, productivity-adjusted employment costs probably rose by roughly 2% q/q SAAR in Q1. That would be disappointing from the standpoint of employment market drivers of inflation risk after flat ULCs in Q3 and Q4 (0.1 and 0.4% q/q SAAR respectively) that signalled some optimism following previously strong gains (chart 10).

- Jobless Claims (Thursday): The recent figures dipped again and are indicating a trend strengthening in the job market.

TWO OTHER GLOBAL CENTRAL BANKS

Two other central banks not named ‘the Fed’ will deliver policy decisions this week. Also note that Governor Macklem and Senior Deputy Governor Rogers will deliver routine testimony before the Standing Senate Committee on Banking, Commerce and the Economy on Wednesday. The timing will give them a chance to react to Tuesday’s GDP figures.

Norges—Less Confidence in September?

Norway's central bank is expected to hold its deposit rate at 4.5% on Friday. A more dovish stance is possible in light of a weak GDP report for February and another softer than expected CPI for March. The last meeting in March had guided that a cut could be delivered by September. Guidance is unlikely to bring that point forward. Markets are pricing only half of a quarter point cut by September. A significant consideration is that Brent crude has risen from about US$75 per barrel in December to just shy of $90 today and this could make the central bank incrementally more hawkish on the implications for inflation and the terms of trade.

BanRep—More Careful Forward Guidance?

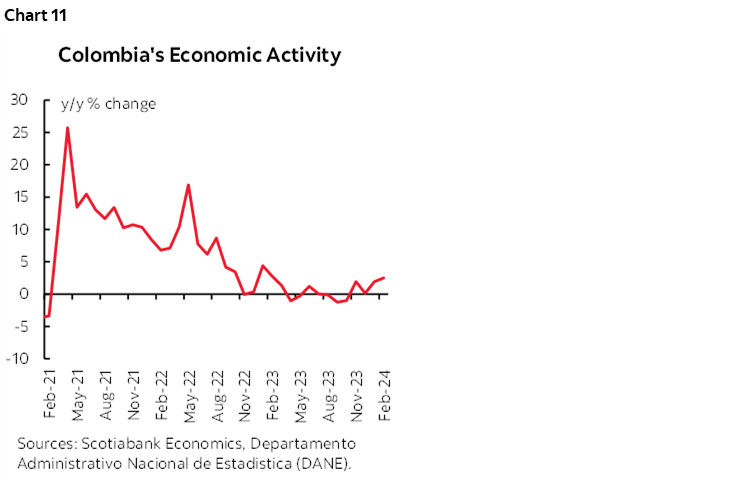

Banco Central de la Republica de Colombia (BanRep) is widely expected to cut its overnight lending rate by 50bps on Tuesday. That would extend cumulative easing to date to -150bps as inflation has subsided. Core inflation ebbed again in March to 8.8% y/y from 9.2% which remains high but is expected to continue declining going forward. A much stronger than expected reading for the economic activity index in February (2.5% y/y, 1.4% consensus) with upward revisions points to a better performing economy (chart 11). Forward guidance may have a hint of greater caution given growth and as the Federal Reserve's cuts get pushed out.

GLOBAL MACRO—HIGH CROSS-MARKET RISK

This will be a heavy week for indicator risk across multiple markets. It will also continue to be heavy on earnings risk. 166 S&P500 firms release this week including tech names like Apple and Amazon. 59 TSX firms also release.

U.S.—Everything Not Called the Fed or Nonfarm

US markets will overwhelmingly focus upon job market readings and the Fed, but there will be a smattering of other readings to consider with key ones being as follows:

- ISM-manufacturing (Wednesday): April’s reading is expected to register little evidence of any growth as it hovers around the 50 dividing line between expansion and contraction.

- ISM services (Friday): April’s reading is expected to continue to indicate moderate growth in the services sector.

- Consumer confidence (Tuesday): Considerations like higher gasoline prices and softer equities could dent April’s confidence reading.

The US will also update repeat sale house prices for February (Tuesday), construction spending during March and vehicle sales during April (Wednesday), international trade figures that tack on the services side to the already known goods balance (Thursday) and total factory orders that should be strong in the wake of a big gain in total durable goods orders fed by a surge in aircraft orders.

China’s PMIs—Cleaner this Time

China’s state purchasing managers’ indices for the month of April (Monday) will offer among the first cleaner readings in the wake of the multi-month distorted readings into and out of the annual Lunar New Year. Watch for continued signs of modest growth led by non-manufacturing activity as manufacturing activity is relatively flat.

Eurozone CPI—Instrumental to the June ECB Meeting

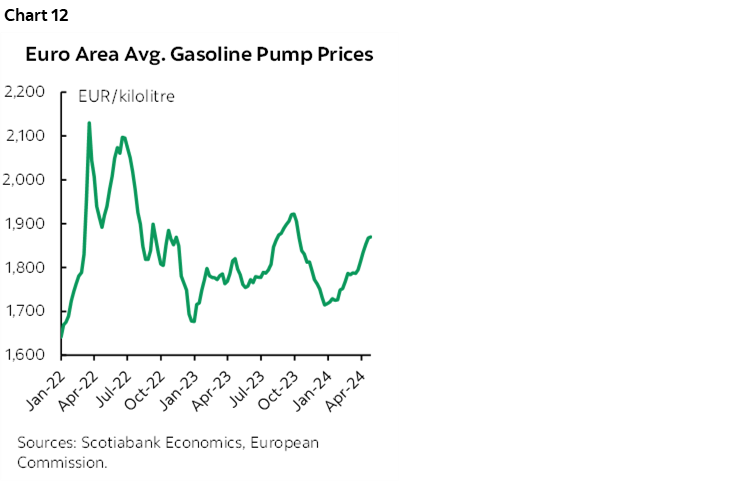

Eurozone CPI inflation (Tuesday) could be highly impactful as it is the second last reading before the hotly anticipated June ECB meeting when many think that the central bank could begin cutting. CPI is expected to hold firm at 2.4% y/y with another 0.6% m/m NSA rise while core ebbs to 2.7% y/y from 2.9%. There may be further upside risk to this expectation. Gasoline prices have risen by 9% since December’s low and were up by 4.3% m/m NSA in April over March which was considerably more than is seasonally normal (chart 12). I don’t subscribe to the case for the ECB to be in a rush to cut.

By the time we get the Eurozone inflation figures markets should have already had a decent feel for what to expect. That’s because Germany and Spain both release their inflation estimates the day before, after which France and Italy will report on Tuesday morning just ahead of the Eurozone tally.

Swiss CPI—Another Cut Coming?

The Swiss National Bank may also be indirectly impacted by the Eurozone CPI readings but also more directly by their own. Switzerland updates CPI for April on Thursday. Another moderate to stronger gain would reinforce the decision to have cut ahead of the ECB and inform the path ahead.

Eurozone GDP—An Awkward Rebound?

Eurozone Q1 GDP (Tuesday) is expected to post mild growth following a long string of reports that basically indicated no growth from 2022Q4 to Q4 of last year. Downside risk would be part of the case to begin cutting in June whereas material upside risk could be part of the case to either postpone an ECB cut in June and/or guide a very cautious path forward after June. Therefore, committed doves that want a cut come heck of high water might do a little dance on bad data and vice versa for hawks. We’ll also get Q1 GDP figures from the biggest Eurozone economies on the same morning.

Other European reports will include French (Tuesday) and German (Monday) consumer spending estimates, French industrial output (Friday) and Q1 Swedish GDP (Monday).

Also note that the OECD issues fresh forecasts on Thursday.

Asia-Pacific Round-Up

Watch for CPI readings for April from South Korea (Wednesday) and Indonesia (Thursday). Both the Bank of Korea and Bank Indonesia are concerned about currency pass-through risks into CPI stemming from pushed out market pricing for easing by the Federal Reserve. That may mean that the latest CPI readings carry less importance than FX-focused forward-looking concerns to both central banks.

RBNZ watchers will be on the edges of their seats this week. In addition to any spillover effects of developments abroad, New Zealand also updates Q1 job growth and wages on Tuesday night (ET). Wage growth has been strong, averaging around 1% q/q SA nonannualized with little variation over the whole period from 2022Q2 to 2023Q4 and a similar reading is expected for Q1 (chart 13). On the same day, the RBNZ updates its financial stability report that informs current thinking about broad financial conditions and risks. There is a customary press conference that may help translate their findings into monetary policy implications.

Hong Kong’s Q1 GDP (Thursday), Australian retail sales (Monday) and trade (Wednesday) will both be updated for March. Japan conducts its monthly data dump at the start of the week including updates on retail sales, industrial output and housing starts all for March. South Korea reports industrial production for March (Monday) and trade figures for April (Tuesday).

A LatAm Trio

LatAm markets will primarily focus upon the spillover effects of the Fed and US payrolls, but three countries will release material local readings. Mexican Q1 GDP (Tuesday) follows a basically flat Q4 reading that ended a decent run of gains stretching back to 2021Q4. Chile updates its economic activity index for March (Thursday) that will help to inform GDP growth tracking. Peru’s CPI reading for April (Wednesday) follows a hotter than seasonally normal reading for March that drove an acceleration of core running at 3.1% y/y over the prior two months as it accelerated. March’s core reading of 0.9% m/m NSA was hotter than seasonally normal compared to prior like months of March.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.