- Non-core food and energy inflation upsurge doesn’t seem to stop Banxico’s conviction to cut in March

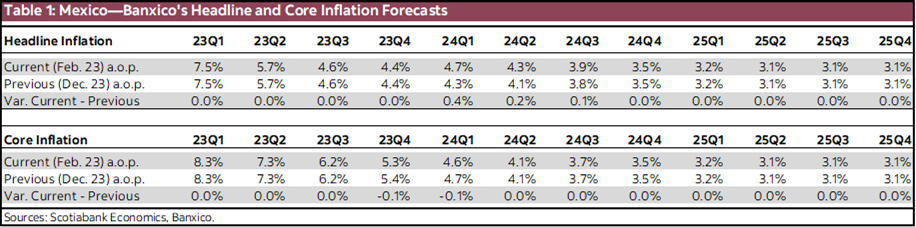

Banxico’s meeting left the policy rate unchanged at 11.25%, as it was widely expected, reinforcing the forward guidance to a first cut at its March meeting. However, the Board of Governors revised its short-term forecast of headline inflation upward again, while still expecting it to reach the target in 2025, and revised core inflation slightly downward in 2024Q1 (table 1). In this regard, the key change in the statement was highlighting that “in the next monetary policy meetings, it will assess, depending on available information, the possibility of adjusting the reference rate.”

All in all, it seems that Banxico feels somewhat comfortable with the core inflation trend, which is more aligned with the monetary policy stance, despite the recent upsurge in non-core items. In this sense, the rebound in inflation in recent months was enough for Banxico to modify its short-term forecast, owing to upward revisions in the non-core part (food and energy). Nevertheless, the statement reiterates that the balance of risks remains skewed to the upside, and includes among the upside risks adverse climate events, and an escalation in geopolitical conflicts, in addition to the risks mentioned in previous statements (persistence of core items inflation, exchange rate depreciation, cost pressures, and a greater than expected resilience of the economy). In this regard, the statement mentions that “disinflation process is expected to continue, in view of the monetary policy stance and the easing of the shocks generated by the pandemic and the war in Ukraine.”

Going forward, we believe that having explicitly mentioned “the possibility of adjusting the reference rate” in the following meetings, together with keeping the expected path of core inflation unchanged, reinforces the view of a first cut in the March meeting.

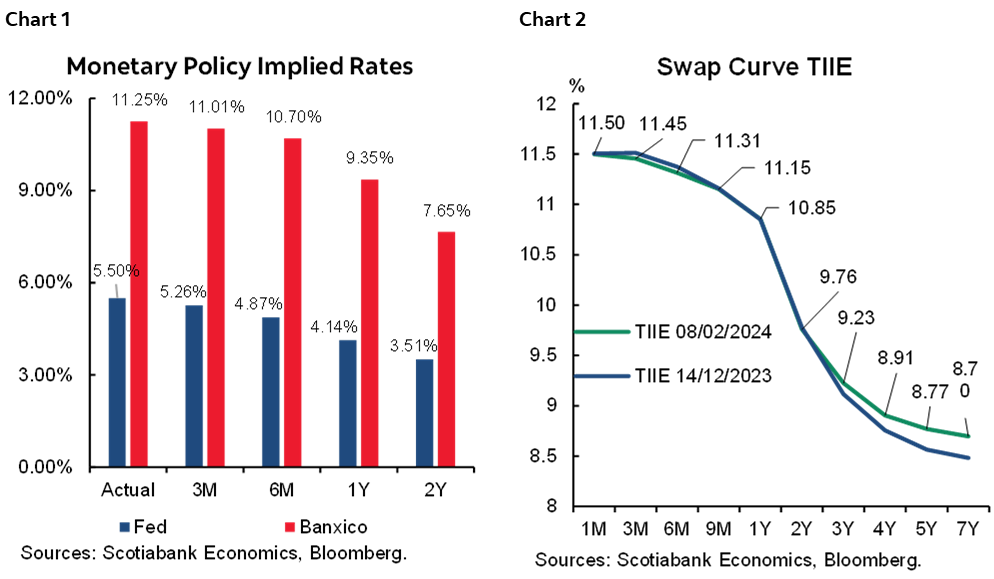

In the Citibanamex survey, there is a broad consensus on the first 25 basis points cuts occurring in March; however, inflation prints could encourage changes in the expected year-end interest rate level, implying the possibility that the pace of Banxico’s cuts will be slower than previously expected. For the time being, the TIIE curve maintains levels close to 9.25% in the two-year node, with no significant changes in the short term, in comparison to the curve observed in December’s decision.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.