Latin America has become an area of intense focus for infrastructure investment due to the confluence of a number of key factors. Latin American governments need capital to fund power plants, roads, airports, telecommunication networks, water and sewage systems, and other major projects, and developed-market investors are increasingly searching worldwide for yield in what is still a low-interest-rate environment. However, navigating the mergers and acquisitions (M&A) landscape is an intricate process. Our Managing Director and Head of Latin America Investment Banking, Udi Margulies, shares his insights into recent developments in the infrastructure space and risks and opportunities in the region, as well as the importance of local expertise and resources in investment banking.

Diversified M&A interest in the Pacific Alliance

The Scotiabank Latin America Investment Banking team’s long-term mandate is to originate, advise on and execute M&A transactions for our clients. Our history in the Latin American/Caribbean region dates back to the late 19th century, and this provides us with the perspective needed to observe major trends and anticipate changes in the dynamic Latin American M&A landscape. The Pacific Alliance of Chile, Colombia, Mexico and Peru has been an area of strategic focus for us; this bloc has a combined gross domestic product (GDP) of approximately US$1.9 trillion,1 represents the eighth-largest economy in the world and accounts for 38% of the GDP of the Latin American/Caribbean region.2 2

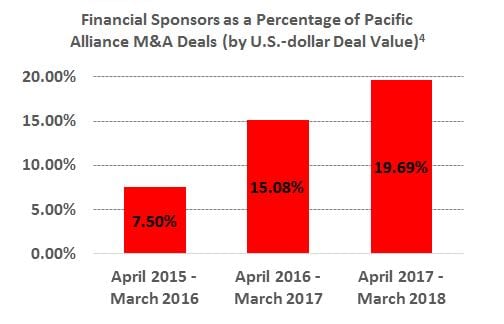

There is still a high volume of international investment flows into Pacific Alliance markets from infrastructure, private equity, sovereign wealth and pension funds. According to a United Nations analysis, all four Pacific Alliance countries exhibit optimal conditions for attracting foreign direct investment, a category shared by the U.S., Brazil, China and others.3 A relatively new development we have observed, however, is the increasing role of infrastructure funds and other types of financial sponsors that are outbidding private equity funds and other strategic investors at auctions and in M&A processes in many cases. This development represents a significant change in the M&A landscape that has emerged during the past decade.

Growing institutional appeal

Pacific Alliance governments opening infrastructure concessions to private capital has enabled these governments to attract international investors hungry for yield. This has resulted in investments in the billions, in U.S.-dollar terms, from financial sponsors who have investment horizons and return expectations that are somewhat different from traditional private equity investors. The long-term tenor of infrastructure concessions makes them more suitable for investments (both equity and debt) with a time horizon of 20–40 years, compared with the customary 10-year lifespan for private-equity transactions in other sectors. The greater stability and lesser cyclicality of such investments have proven to be attractive characteristics for banks, bond capital markets and financial sponsors. These sponsors include many Canadian pensions and sovereign wealth funds.

International capital and the significance of liquidity

The need for infrastructure in Latin America and the desire for yield of developed-market investors have been driving factors behind the increased role of international capital in the regional M&A space. However, the economies we focus on are still emerging markets and, therefore, a discussion of liquidity and risk is warranted.

At present, we’re seeing a different liquidity picture emerging from the Pacific Alliance and from emerging markets in general, compared to the more fertile conditions that were present earlier in the year. At the time of writing, we’re still seeing healthy levels of liquidity, but with signs that risk is being increasingly priced in. Investors need to be aware that the economies of the Pacific Alliance still carry with them the potential for risk and volatility normally associated with emerging markets, such as currency devaluations, policy decisions and geopolitical developments. Currently, we’re closely monitoring the effect of the monetary policy of the U.S. Federal Reserve Board (Fed). Increases to the Fed’s overnight interest rate could moderate some of the international capital flows into the Pacific Alliance, and could pose a challenge to Latin American countries with significant current account deficits. In addition, infrastructure concessions with revenues denominated in local currencies will suffer from foreign exchange volatility.

The importance of on-the ground expertise

Investing in fast-growing regions featuring both robust opportunities and inherent risks requires resources and know-how that can often only come through experience and commitment to these local markets. Scotiabank is a leader in Latin America, where we have approximately 35,000 employees. Alongside Canada, the Pacific Alliance region continues to be our primary strategic focus, and an on-the-ground presence is critical for Scotiabank.

Having a well-coordinated network of local resources means we can provide a truly holistic approach in the value we provide to investors. A recent example of our philosophy in action was our role in the US$1.3 billion Actis Capital acquisition of InterGen Mexico’s portfolio of assets. Our investment banking group presented the investment idea to our client, Actis, and we were brought on board to advise on and execute the M&A transaction. This included underwriting and assisting in the financing of the acquisition, from assisting Actis in designing the capital structure of the acquisition to advising on ratings, as well as providing the capital commitment. This transaction was a classic example of Scotiabank acting as a “one-stop shop” and of the aggregate value our diverse product teams bring to our private equity clients.

Another example is Scotiabank’s role in client Brookfield Infrastructure Partners LP’s sale of its minority interest in ETC Transmission Holdings, SL (the parent company of Transelec SA) to China Southern Power Grid International (HK) Co., Ltd. and the sale of its Chaglla hydroelectric power plant in Peru and Inversiones La Rioja SA’s sale to Grupo Brescia.

As representatives of a leading institution in the region, our team has the ability and expertise to identify opportunities for investors in sectors of the market that otherwise might be overlooked. Our strengths are particularly evident among “middle market” companies in the region, companies that are between US$400 million and US$1 billion in size. These are often family-owned firms that are actively looking for strategic and/or financial investment capital to fund their expansion plans. Many of these companies aren’t listed on an exchange, and they may not have a lot of internal capital-markets expertise. This space is one where, as a top-tier international and local bank in the region, we can step in and provide substantial value to both these companies and potential investors looking for such opportunities.

Scotiabank’s investment banking expertise extends beyond the infrastructure space. We have top investment banking specialists in each Pacific Alliance country, delivering expertise in different industries such as mining, energy, media and retail. Furthermore, Scotiabank’s long legacy and continued growth in the Latin American/Caribbean region has earned us a place among the largest investment banking firms active in the Pacific Alliance, the only Canadian bank in the top 10.

January 1, 2017, to March 31, 2018

| Adviser | Rank (Market Share) | Total Deal Value (millions) |

|---|---|---|

| Banco BTG Pactual | 1 | $10,051.03 |

| 2 | $9,131.95 | |

| Bank of America Merrill Lynch | 3 | $7,887.36 |

| Scotiabank | 4 | $7,103.34 |

| Credit Suisse | 5 | $6,637.61 |

| Banco Bilbao Vizcaya Argentaria | 6 | $6,072.33 |

| Lazard | 7 | $5,955.85 |

| Barclays | 8 | $5,278.21 |

| Banco Santander | 9 | $5,030.22 |

| Morgan Stanley | 10 | $4,956.51 |

The strong foundation built by our past and the innovation that drives our future are what make us proud to represent Scotiabank in the Pacific Alliance markets and to help bring the best of this region to investors across the globe.

For more information on Scotiabank’s investment banking products and services and opportunities in the Pacific Alliance, please contact:

Udi Margulies

Managing Director, Head of Latin America Investment Banking

212-225-5725

udi.margulies@scotiabank.com

- “Canada and the Pacific Alliance,” Global Affairs Canada, March 6, 2018.

- “Pacific Alliance Business and Investment Guide, 2017/2018,” EY, July 2017.

- United Nations Conference on Trade and Development (UNCTAD), 2017.

- Dealogic, as of April 30, 2018.

- Bloomberg, as of March 31, 2018.