- Mexico: Banxico’s minutes; GDP revisions raise growth; trade balance reverses

MEXICO: BANXICO’S MINUTES; GDP REVISIONS RAISE GROWTH; TRADE BALANCE REVERSES

I. Banxico’s minutes—rising risk of a 75 bps hike?

Banxico released the minutes from its May 12 MPC meeting, in which the Board voted 4:1 to raise the policy rate by 50 bps. The minutes reveal that most of the Board saw a recent downside bias to the global growth outlook, combined with rising inflation risks stemming from Russia’s invasion of Ukraine that could lead to additional strains on global supply chains. Board members also took note of the accelerating pace of monetary policy tightening globally, with one observing that, if market expectations are correct, the Fed’s policy setting would end up on the tight side.

Based on Deputy Governor Heath’s comments over the past couple of weeks (with which we agree), the best approach for Banxico in the current monetary policy tightening cycle is to look at the spread over US rates (consistent with the policy decisions taken in past monetary policy tightening episodes). In this regard, we also agree with Deputy Governor Heath’s comments that Mexico will likely need to keep a spread of around 600 bps over US rates (Heath mentioned 600–650 bps).

On the domestic macro front, the Board pointed to an improvement in domestic economic activity, which has since been confirmed by INEGI, driven by industrial activity and services. Board members observed that manufacturing continues to drive the recovery in the secondary sector, and pointed to the improvement in services activity, though growth there is much more mixed. The Board also noted that consumption has now overtaken pre-pandemic levels, even if investment remains subdued, while exports have been robust.

Notably, most Board members continues to see slack in the economy (and thus no demand-pull inflation). As we have explained before, we are not convinced, as we believe data used to measure the economy’s recovery is biased by pre-pandemic habits. That said, two Board members acknowledged that spare capacity is uneven across sectors, which we attribute to shifts in spending habits. In this respect, we think the perceived slack in the economy could be overstated.

Board members were unanimous that there has been a deterioration with respect to the outlook for the inflation. Most also took note of the rise in long-term inflation expectations, which points to a possible contamination of the price setting process. The main inflation risks are viewed as coming from energy, agricultural prices, and from persistent high core inflation. In this regard, the majority of the Board not only see upside risks to inflation, but a continued deterioration of the inflation outlook, consistent with repeated upward revisions to Banxico’s inflation forecasts.

These minutes, together with recent comments by deputy Governor Heath, lead us to believe there are rising odds that the Board will support a 75 bps hike in the upcoming meeting. That said, based on the minutes, we think that one or two members remain unwilling to accelerate the pace of hikes.

—Eduardo Suárez

II. Revised GDP for Q1-2022 came in slightly higher than preliminary numbers

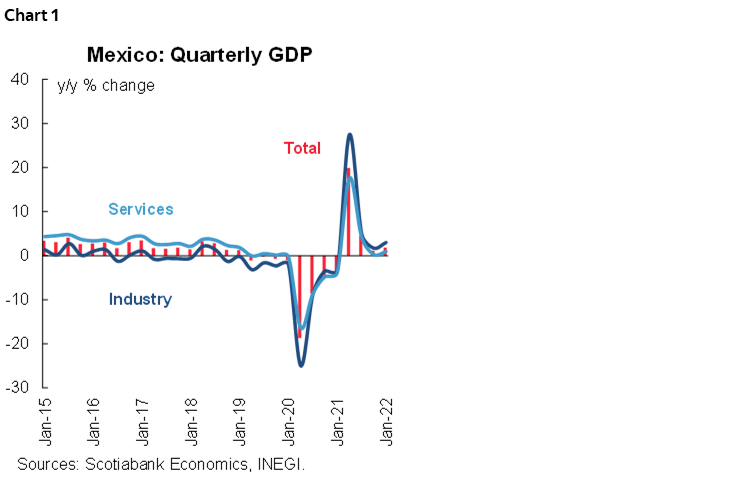

INEGI’s revised GDP numbers for the first quarter of 2022 came in at 1.8% y/y in real terms (1.1% previously) (chart 1), slightly higher than the preliminary figure of 1.6% and in line with expectations. By sector, industry output rose 3.0% y/y (1.7% previously), mainly owing to an increase in manufacturing, which increased 4.7% y/y from 2.1%. The services sector registered an increase of 0.9% y/y (0.3% previously). Tourism services decelerated with respect to the previous quarter, but nevertheless grew by 42.7% y/y, down slightly from 45.7%. Business support services declined at a steep pace, -73.6% y/y (somewhat higher than the previous figure of -70.3%). Primary sector growth slowed to 1.9% y/y from 4.6% in the previous quarter. In seasonally adjusted quarterly terms, GDP accelerated to 1.0% q/q from 0.2% previously. By sector, industry grew 1.2% q/q (0.8% previously), services grew 1.3% q/q (-0.7% previously) and the primary sector fell -2.0% (1.1% previously). Going forward, we expect activity to continue at a moderate pace, affected by supply chain disruptions and higher prices globally. However, we anticipate services, especially tourism-related activities, to continue with the positive trend observed so far.

March’s IGAE indicator of economic activity increased 0.4% y/y, down from 2.5% in February, on a seasonally unadjusted basis. On a seasonally adjusted basis, the IGAE increased 0.3% m/m (compared to -0.1% previously), with the primary sector up 4.5% (-1.4%), the secondary sector growing 0.4% (-1.2%), and the tertiary sector down -0.1% (0.5%).

III. Trade deficit of USD 1.8 bn reverses previous surplus

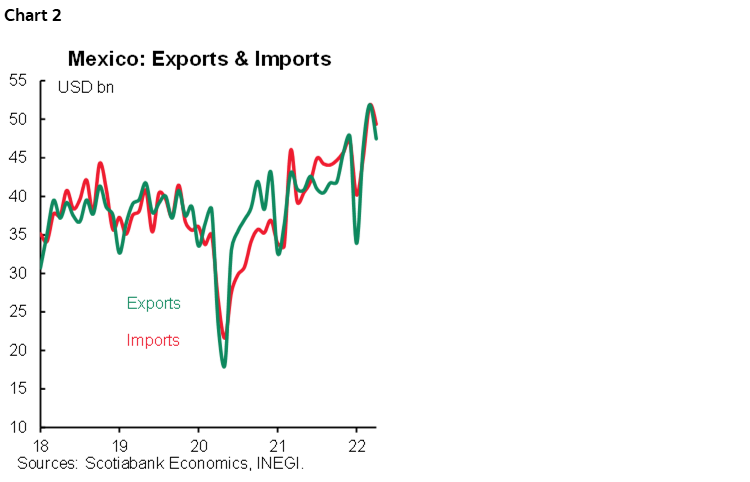

In April, the trade balance registered a deficit of USD -1.8 bn, reversing the previous surplus of USD 104 bn. Exports totaled USD 47.5 (chart 2), equivalent to an annual increase of 16.0% y/y, down from 20.6% in March, led by oil exports (81.3%) reflecting higher oil prices, followed by manufacturing (12.3%). Within manufacturing exports, automotive exports rose by 5.2%, while the rest rose by 16.0%. Imports reached USD 49.4 bn during April (chart 2), accelerating to 25.7% y/y from 12.7% previously. Imports of consumer goods rose 40.6%, followed by intermediate goods (23.9%), and capital goods (22.5%). The accumulated January-April balance recorded a deficit of USD -6.8 bn, with an increase in exports of 17.4% and in imports of 22.1%. Finally, in monthly seasonally adjusted terms, exports rebounded from -2.5% m/m to 0.86%, while imports accelerated from 1.66% to 5.20%.

Looking ahead, we expect exports to continue to advance, driven by a favorable pace in US demand, although with risks from supply chain disruptions limiting production capacity in manufacturing products. On the import side, we maintain an outlook of modest monthly advances, in line with a moderate recovery in domestic demand.

—Brian Pérez

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.