- Ignore the small GDP miss…

- ...that was driven by inventory shedding

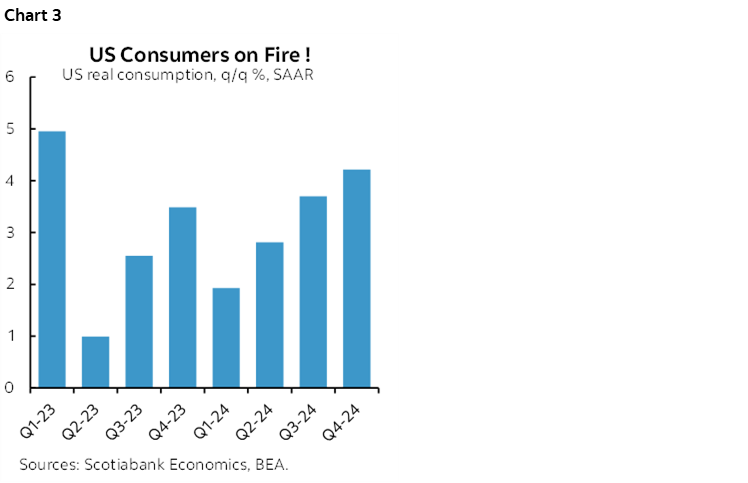

- Key is that consumer spending soared…

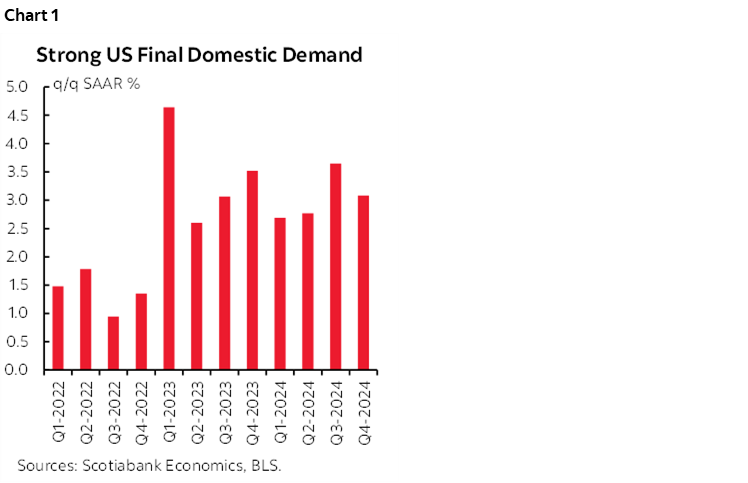

- ...driving an eighth straight quarter of strong growth in final domestic demand

- There is no real macro evidence of tariff front-running—yet

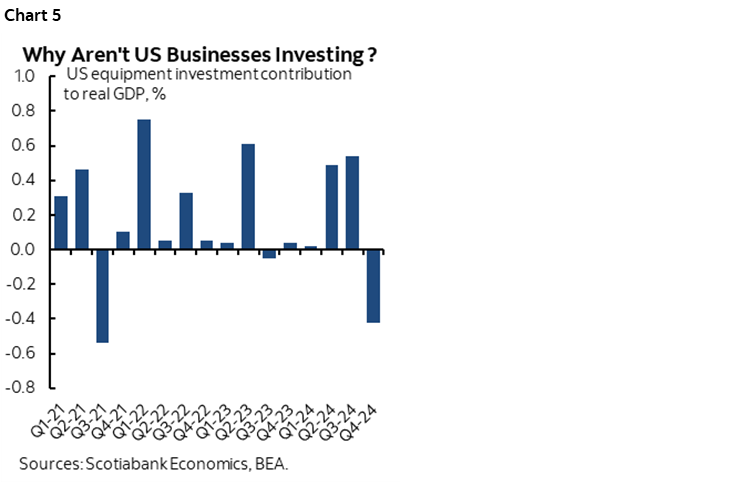

- Why are US businesses not investing despite excess demand and AI?

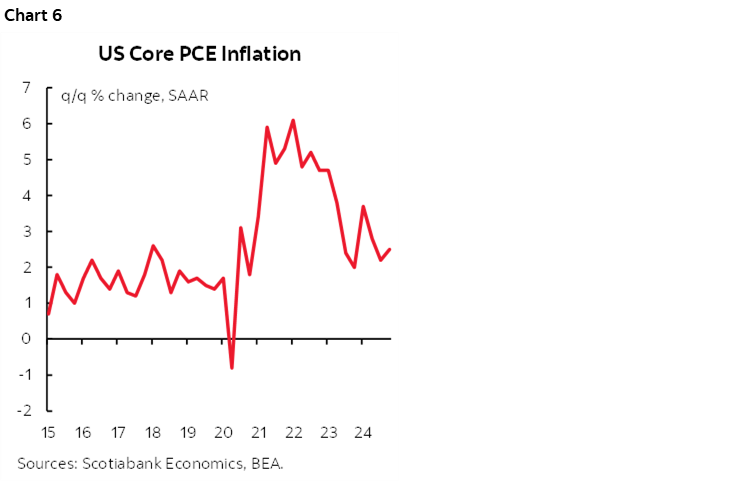

- Net demand pressures on inflation continue to intensify…

- ...as core PCE inflation rises, signals December’s expectations are on the mark

- Overall, data and potential policy shifts support the Fed on a lengthy hold

- US Q4 GDP, q/q SAAR %:

- Actual: 2.3

- Scotia: 2.8

- Consensus: 2.6

- Prior: 3.1

The economy US is absolutely crushing it and this reinforces portraying the FOMC as being on hold for some time in the wake of yesterday’s decision. Key here is what is under the hood. US consumer spending grew rapidly and so did final domestic demand as a measure of underlying momentum in the domestic economy. GDP disappointed a touch, but only in relation to lagging estimates before we got yesterday’s inventory and net trade balance figures and inventory shedding isn’t necessarily a bad thing. A strong demand side and weak investment while shrinking the labour force through emergent changes to immigration policy is not a good combination for inflation risk.

I’ll also explain why I don’t think there is much broad, high level macro evidence of tariff front running in the US economy.

Markets didn’t pay much heed to the strengths. A dovish sounding ECB that cut and had President Lagarde stay committed to a data dependent easing path after Q4 Eurozone GDP disappointed earlier this morning is affecting global yields. A drop in weekly US initial claims was also a moderating influence upon US Treasury yields.

Headline GDP Was Weaker than Expected...

GDP growth of 2.3% q/q at a seasonally adjusted and annualized rate (SAAR) continued the winning streak for the US economy. That was in line with the Atlanta Fed’s ‘nowcast’ after they revised it sharply lower yesterday following the trade and inventory figures but it was lower than most estimates that were submitted before yesterday’s data.

...But the Components Were Very Strong

Final domestic demand—which adds consumption plus investment plus government spending and excludes inventories and net trade—was very strong again and grew by 3.1% q/q SAAR (chart 1).

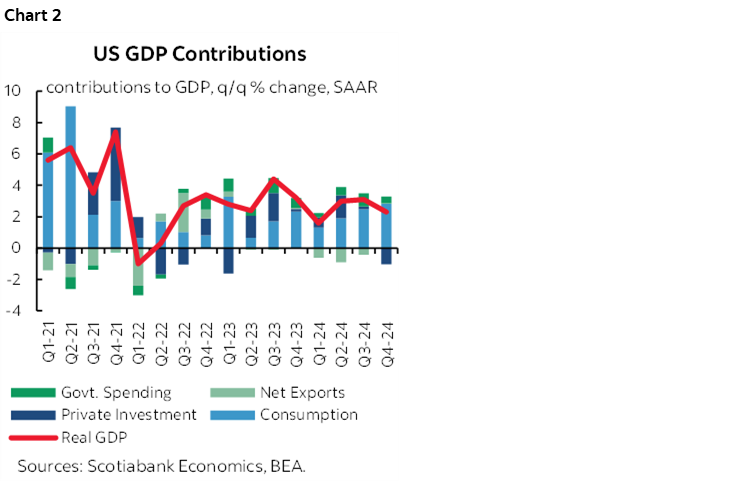

Chart 2 shows the weighted contributions to GDP growth by component. Demand was strong, investment was weak and I’ll return to those implications.

Consumption ripped (chart 3). It was up by 4.2% q/q SAAR and added 2.8 percentage points to GDP growth in weighted contribution terms.

Inventories subtracted 0.9 ppts from growth which explained why headline GDP disappointed. More careful inventory management and draw down is not necessarily a bad reason for weaker headline GDP growth.

Net trade had no effect on GDP growth in Q4. Imports were a neutral contributor in weighted terms (+0.1%) and exports were also neutral (-0.08ppt contribution).

IMPLICATIONS FOR THE FEDERAL RESERVE

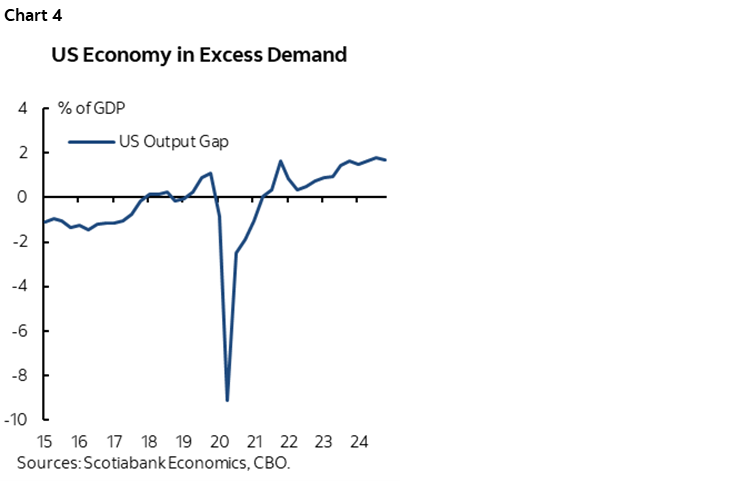

Insofar as the Fed is concerned, obviously it's the dual mandate variables that matter, but they're not disconnected from GDP. GDP growth and employment growth are correlated. GDP growth above estimates of the economy’s noninflationary speed limit (aka potential growth) continues to push the US economy further into excess demand as measured by the positive output gap (chart 4).

With excess demand as the starting point, this is not an economy that needs stimulus. Hence why the FOMC should consider remaining parked on the sidelines for a while to see how conditions evolve. It is also not an economy in need of fiscal or regulatory stimulus, at least not the kind that would stimulate demand versus supply. Monetary, fiscal and regulatory policies make for dance partners and each step affects the other. A strong starting point in excess demand combined with potential fiscal and regulatory stimulus is bound to be sterilized by the combined actions of bond markets, the USD and the Federal Reserve. It is very different now than was the case into Trump 1.0 when the US economy had some slack.

Furthermore, tariff pass through risk is amplified by the fact that the economy is in excess demand as it lends pricing power to US businesses. As I’ve said before, there is nothing more patriotic for American c-suites to do than to jack up prices on their fellow Americans while grinning as complaints rise. Adam Smith was among the fellas who taught everyone about how commercial interests within a set of mercantilist policies did not necessarily serve the country and individuals well. A few hundred years ago.

NO EVIDENCE OF TARIFF FRONT RUNNING ON THE DEMAND SIDE...

What drove the strength in final domestic demand and consumer spending? Was it tariff front running? Distorted in other ways? I’ll explain why there really isn’t anything in these numbers to support the tariff front-running thesis at a broad macroeconomic level.

First, I’m not convinced that consumers are that smart.

Further, the composition of consumer spending leans against the tariff front running interpretation. Consumer spending on services contributed 1.5 ppts to GDP growth, or about 54% of the overall consumption contribution. You don't generally front-run services spending ahead of tariff risk for manufactured items.

Goods spending by consumers contributed 1.4 ppts to GDP growth which was marginally higher than the 1.2 ppts in the prior quarter. That came through durables 0.85% for the strongest contribution since 2023Q1.

Some of that durables strength was through autos and parts, but not much as the weighted contribution from that spending was 0.3 ppts, marginally higher than 0.2 the two prior quarters, so there is not much front-running there, if any especially considering other drivers like hurricane replacement demand etc.

The absence of a material effect on growth from imports also leans against the notion that businesses were rapidly bringing in more goods to get ahead of tariffs.

The inventory draw down effect on growth also leans against tariff front running since it should be the opposite; stockpiling at today’s prices instead of tomorrow’s higher ones.

...BUT WHAT ABOUT THE INVESTMENT PICTURE?

The investment figures are a warning sign though. Equipment spending dragged 0.4 ppts off GDP. Nonresidential structures investment was a flat contributor and it has been weak for three quarters now. The investment side of the US economy is weak. Despite excess demand, US businesses are not investing.

Chart 5 shows that lower investment in equipment was a drag on Q4 GDP growth after two reasonably but not blow out quarters and a highly mixed pattern over recent years. Note the scale, that the contributions to GDP growth average out to be very small over time.

Why this is happening is a good question. All equipment spending components were weak including IT, industrial, transportation and 'other' and so the weakness was broad based. And looking back, equipment spending only made material contributions to GDP growth in two quarters (q2 and Q3 last year) out of the past six.

It is a bit of a macro puzzle why US businesses are not investing despite capacity constraints reflected in measures such as output gaps in excess demand territory. It is a bit of a mystery why US businesses —the innovation hot bed for many emerging new technologies including AI— are not investing.

Maybe they fear AI’s disruptive influences. Maybe it's a lack of confidence in the outlook and building risks. It's probably premature to say it's because they don't know the rules of the game on trade and investing, but maybe there was some of that last year amid election uncertainty. Expect more of it this year. Maybe US businesses are choosing to raise prices and/or keep them high and sacrificing some volume by not investing more in order to maximize short-term profits. And maybe it’s endemic to the whole dang global economy.

The outcome is the same regardless. Strong demand and weak investment do not help the output gap through the combined supply and demand pressures. Boot millions of migrants from the labour force and the supply side tightens further.

Ergo, inflation risk is rising, and the Fed is parked for a while. Perhaps a long while. Forget March. I’m not sure about Q2 which needs a lot to go right.

US CORE PCE PICKED UP, MAY SIGNAL WHAT TO EXPECT FOR TOMORROW’S DECEMBER PRINT

US core PCE landed on the screws at 2.5% q/q SAAR, up from 2.2% the prior quarter (chart 6).

If there are no revisions to the monthly figures prior to December when we get them tomorrow, then December core PCE is implied to be 0.2% m/m SA and therefore on estimate. The usual risk is that we can't tell if they revised prior months by just looking at Q4 and so the base effect jumping off point is always a bit of a wildcard.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.