Export Letter of Credit

A payment undertaking from a bank in favour of a Seller

Enhance your ability to collect payment

Your payment is guaranteed, if you meet all the terms and conditions for drawing under the Export Letter of Credit

Discounting of future payment by Scotiabank, if agreed, may allow the Seller to offer extended payment terms to its Buyer1

Payment can be sent to your account with Scotiabank or another Canadian financial institution

Expertise, opportunities and convenience

Our Trade Finance Specialists are available to guide you through the process and offer expertise

Use your Export Letter of Credit to unlock other financing opportunities, for example Pre-Shipment Finance

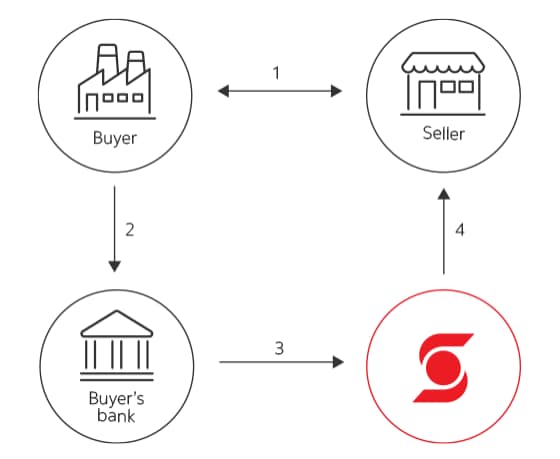

The Export Letter of Credit Issuance Process

- The Buyer and Seller agree on a purchase and sale of goods where the payment is made via Letter of Credit.

- The Buyer completes an application requesting its Bank to issue a Letter of Credit in favour of the Seller.

- The Buyer’s Bank issues the Letter of Credit and sends it to Scotiabank.

- Scotiabank verifies the Letter of Credit for authenticity and sends a copy to the Seller.

Frequently asked questions

For specific questions relating to Trade Finance, please contact

Amit Sharma

Director, Trade Finance, Commercial Sales

Email: amit2.sharma@scotiabank.com