Financial Standby Letter of Credit / Guarantee

Financial Standby Letters of Credit are irrevocable undertakings by a bank to make payment to the beneficiary in the event the applicant fails to perform a financial obligation

Accept open credit terms knowing you have a safety net

Facilitates structuring with no requirement for cash as security against any breach of payment performance

The Beneficiary has additional security of bank payment obligation

Can be structured with an auto-extension clause – no need to reapply

Get the security you need with a cross-border guarantee

May serve as security for the Beneficiary when they are unsure of the Applicant’s ability to pay

Ideal for international projects involving foreign buyers or governments

May help you secure a bank loan in a foreign country

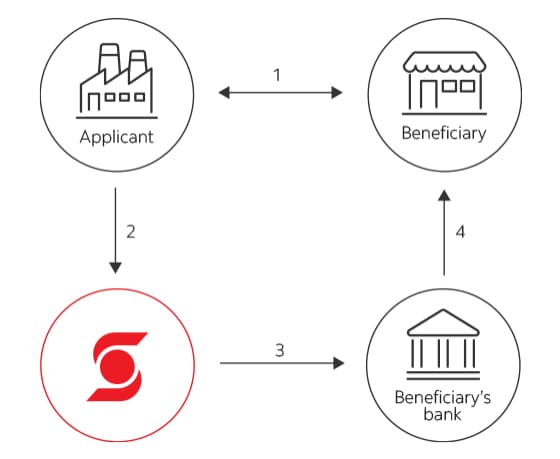

Standby Letter of Credit / Guarantee Issuance Process

1. The Applicant and Beneficiary agree on a sales contract. A Standby Letter of Credit would be required to support the Applicant’s payment obligations under such contract.

2. The Applicant completes an Application for Standby Letter of Credit/Letter of Guarantee1 requesting Scotiabank to issue an SBLC/LG in favor of the Beneficiary.

3. Scotiabank issues the Standby Letter of Credit and sends it to the Beneficiary’s Bank.

4. The Beneficiary’s Bank verifies the Standby Letter of Credit for authenticity and sends the original to the Beneficiary.

Frequently asked questions

For specific questions relating to Trade Finance, please contact

Amit Sharma

Director, Trade Finance, Commercial Sales

Email: amit2.sharma@scotiabank.com