- Economic resilience to higher interest rates is keeping inflation uncomfortably high.

- A slowdown is still expected though a strong start to the year means the moderation is likely to be delayed to the second half of this year.

- Risks to inflation remain tilted to the upside and require continued vigilance by central banks. One more rate increase is expected in Canada and the US, and we are delaying the expected cut in policy rates to the second quarter of 2024.

The resilience of the Canadian and US economies to dramatic interest rate increases of the last year has been nothing short of remarkable. Repeated forecasts of an imminent slowdown on the part of the economics profession and policymakers have yet to materialize in any meaningful ways. While this may very well be interpreted as good news by some, it is not good news for firms and households that must contend with the higher interest rates that result from stubbornly strong economic activity and therefore inflation. It is now evident that slightly higher policy rates are needed in Canada and the US to achieve the slowdown required to ensure inflation slows to 2% over the next couple of years. The Bank of Canada made this clear in its most recent decision to raise its policy rate by 25 basis points and leaving the door open for more hikes to come. The Fed, which opted to keep rates unchanged at its latest meeting, indicated that they believed at least another 50 basis points of tightening was required this year to achieve their objectives. Clearly, policymakers believe a bit more must be done. We agree with them.

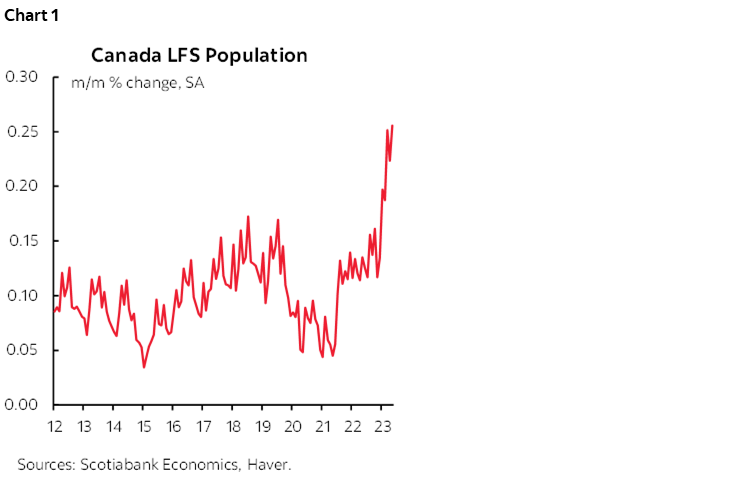

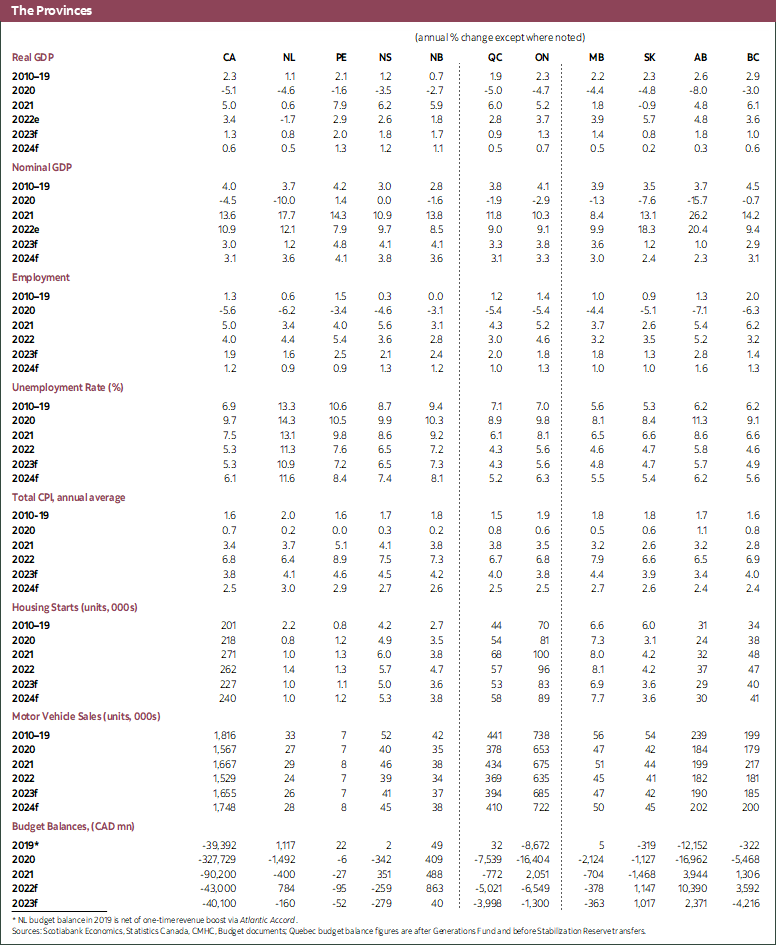

We remain of the view that the policy tightening in this cycle will lead to a modest decline in economic activity in Canada even though the economy is off to a strong start this year. We expect growth to slow from about 1.3% this year to 0.6% next year with a small contraction in economic activity in the second half of this year. Household spending remains remarkably resilient to efforts to slow it, as witnessed by an increase in real consumption per capita in the first quarter of the year. A further driver has been the historic strength in population growth, which has acted as a powerful tailwind for the economy even as the Bank of Canada has been trying to create a formidable headwind with higher interest rates. Higher population growth should increase the economy’s potential to grow in a non-inflationary way, but the short-run demand impacts of new arrivals are undeniable. Population estimates from the Labour Force Survey reveal that the population of 15-year-olds and above has risen at the most rapid pace in history so far this year, with that pace gathering steam in May (chart 1). This strong population growth is likely putting some downward pressure on wages as it makes it easier for firms to source workers, but it is also likely contributing to the decline in productivity growth.

On the labour front, markets remain remarkably tight. Labour markets lag the cycle so we should not be expecting a correction ahead of a slowdown, but there should be some indications of softening by now. The May employment report showed a small decline in employment though that was bizarrely concentrated in younger workers. Survey measures show labour market tightness remains acute. The Canadian Federation of Independent Business’ monthly Business Barometer suggests that the proportion of firms expecting to shed workers in the next 3 to 4 months stands at the lowest level since June 2022. Labour shortages continue to be the most critical obstacle to firm performance according to this same survey. Nevertheless, we expect broader job cuts as the impact of higher policy rates works its way across the economy. Those cuts, however, are likely to be tame by historical standards given the still large number of vacancies. We forecast a modest increase in the unemployment rate from the current 5.2% to 5.6% by year-end and 6.2% by end-2024. This is in sharp contrast to previous cyclical corrections, where the unemployment rate has risen by several percentage points.

Developments on the housing front should be an ongoing concern for the Bank of Canada. The Spring market remains very strong suggesting a lift from housing market activity on the economy as opposed to the impact it has been having since policy rates started to rise. Governor Macklem can ill afford that given the considerable efforts the BoC has deployed to slow the economy. The most recent increase in the policy rate will have some impact on activity in this space but there are limits to what can be achieved by monetary policy in the housing market given the very sharp structural imbalance between the supply and demand for housing.

The stronger start to the year and weak productivity growth continue to suggest that upside risks to inflation should dominate policy concerns. Core inflation should come in just under 4% this year and remain above 2% throughout the next year. This suggests that risks to the rate profile are tilted to the upside as well. As a consequence, we believe Governor Macklem and his colleagues will raise interest rates one final time in the third quarter before calling it quits. We also now believe that the first rate cut will occur in the second quarter of next year as opposed to our previous view of a cut but in the first months of 2024. A similar dynamic is likely to play out in the United States, with the Fed very clearly signalling that it is not yet done raising interest rates. We believe another 25 basis points of tightening will be required there, with evident risks of additional rate increases. It seems inconceivable to us at this time that either central bank will cut rates this year.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.