- Weather-related events and the port strike are muddying the outlook but underlying growth dynamics suggest the economy is slowing gradually. A rebound from those disruptions is likely to provide a modest boost to growth in the later months of this year but will not alter the underlying path for the economy.

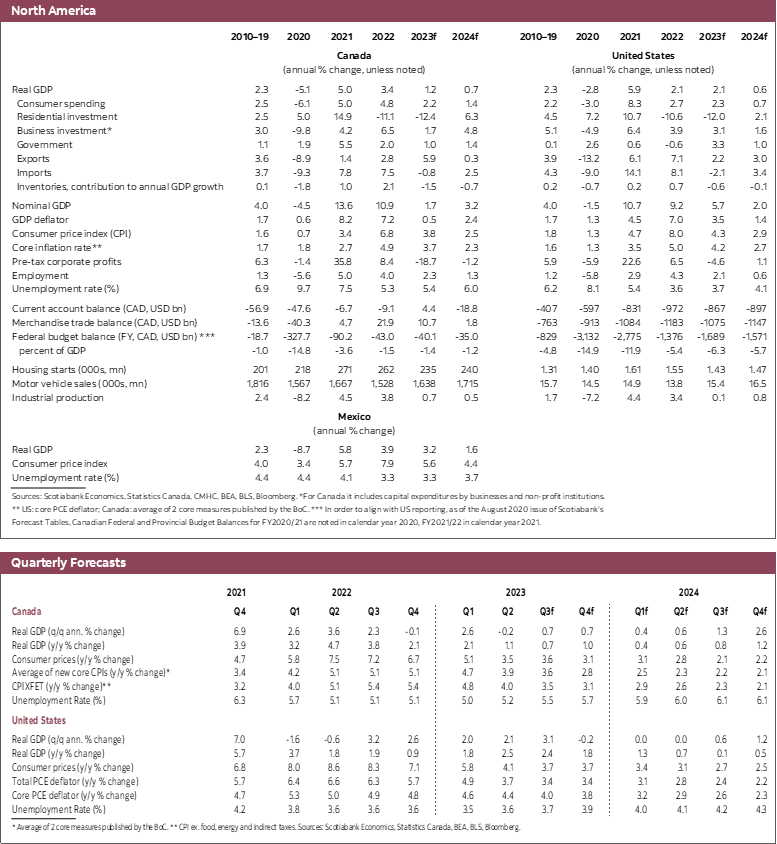

- After roughly accounting for these disturbances, we continue to expect a basically stalled economy for the next few quarters. We now expect growth of 1.2% this year followed by a small expansion of 0.7% next year. These outcomes would be well below our estimate of potential output and put downward pressure on inflation as a result.

- We are hopeful that the Bank of Canada is done raising rates, but core inflation measures remain stubbornly high. We expect a moderation of inflation but Governor Macklem will need to raise rates further if core inflation exceeds our forecasts. Given the stability of core inflation in recent months, the risks to the inflation outlook are definitely tilted to the upside, meaning that risks to the policy rate are also tilted in that direction.

A number of unusual and powerful factors have buffeted the Canadian economy through the summer. Wildfires affected most provinces for much of the last few months. Major flooding in a few areas had major impacts on economic activity in those areas. And of course, the strike at the Port of Vancouver had a major impact on trade. Each of these factors impact our ability to get a clear picture of how the economy evolved in the second and likely third quarter, but we remain of the view that the Canadian economy is gradually slowing and that activity will essentially stall over the next few quarters when looking through the impact of these temporary shocks. As a result, we now expect the Canadian economy to expand by 1.2% this year, below our last forecast of 1.7%. In 2024, the economy is expected to expand by a very modest 0.7%.

Assessing the impact of these weather-related disturbances and the strike is critical to the Bank of Canada. Governor Macklem has been looking for evidence that the economy is slowing as he fine tunes policy settings. It is impossible at this stage to have a firm view on the impact of these shocks. We know they had a sufficient drag on the economy in Q2 to lead to a decline in GDP. Under normal circumstances, our economy would rebound from temporary distortions in the quarter or two following the disturbance. That extent of that rebound, however, is very much clouded (no pun intended) by the July strike, and the wildfires impacting western Canada through much of August. We have reflected that in our view, held back growth in Q3 to incorporate these factors. Relative to our last forecast, the catch-up is more likely to be felt in the final quarter of the year.

To be very honest, we do not have a good read on the sum total of these impacts and their timing. Incoming data will provide key insights on that. August employment data, for instance, which showed a strong rebound in employment and hours suggests that things will completely rebound sooner than we currently think. The US economy is showing remarkable strength in the third quarter, which should see some that bleed into Canada in Q4 if historical relations hold. What is more important in our view is to assess the impact of expected growth on the Bank of Canada’s policy setting. Governor Macklem chose to keep rates steady in September owing to evidence that the economy is weakening, despite clear concern about the stubbornly elevated levels of core inflation.

Accepting the uncertainty around potential outcomes in the short-run outlook, we undertook to evaluate what growth profile might trigger another increase by the Bank of Canada, or alternatively what quarterly profile might cause an earlier cut in interest rates. Generally speaking, anything less than a 1.5% decline in GDP growth in Q3 (or equivalent spread out over Q3 and Q4) would not be cause for the BoC to advance the cuts we continue to foresee in 2024Q2. On the other hand, given the current level of inflation, a more modest positive surprise leading to a growth of 2.4% could force at least one other move by the BoC. Since our current view is growth of 0.7% in each of the next two quarters, that suggests that minor wiggles around our view would not be enough to force a change in path for the Bank of Canada.

It is a very different story on the inflation side. Though we expect core inflation to decelerate in coming months, Governor Macklem has very little ability to tolerate a rise in core inflation. A very small rise in core inflation, or if core inflation were to remain at current levels beyond this quarter, would force the Bank of Canada to raise its policy rate further. That remains the dominant concern in our view. While we expect rates to remain on hold at current levels until 2024Q2, that depends critically on a reduction in inflation. Given the stickiness of recent core inflation readings, this means risks are clearly tilted to the upside as they concern interest rates.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.