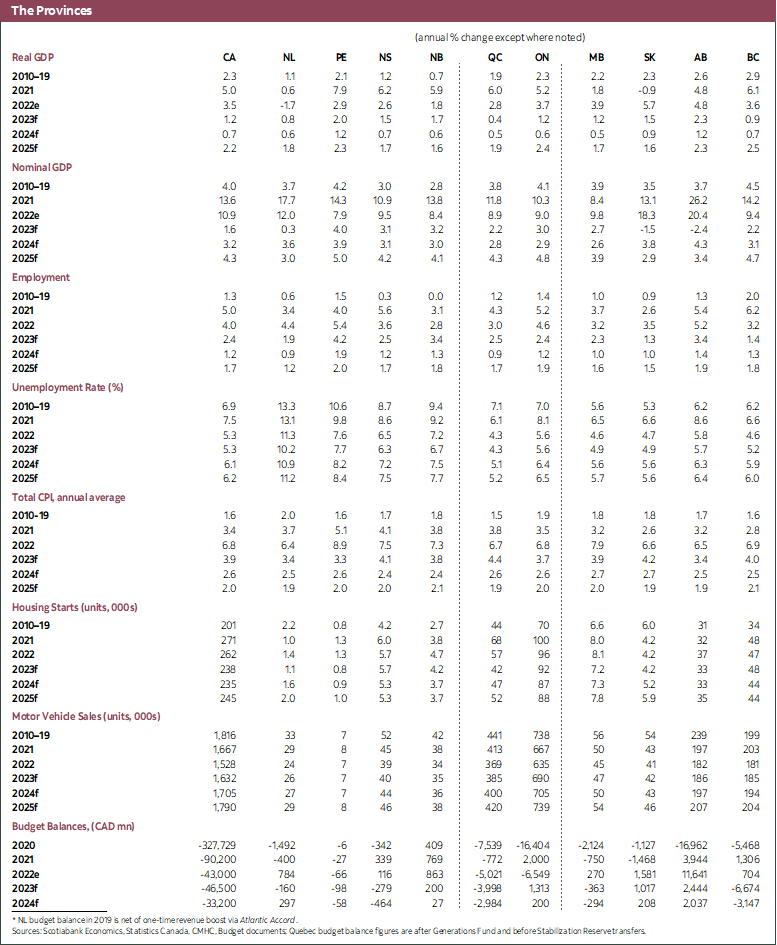

- We continue to forecast a slowdown in Canadian economic activity. A recession seems unlikely given some fundamental strengths, but that hinges to a significant degree on building risks in the global economy.

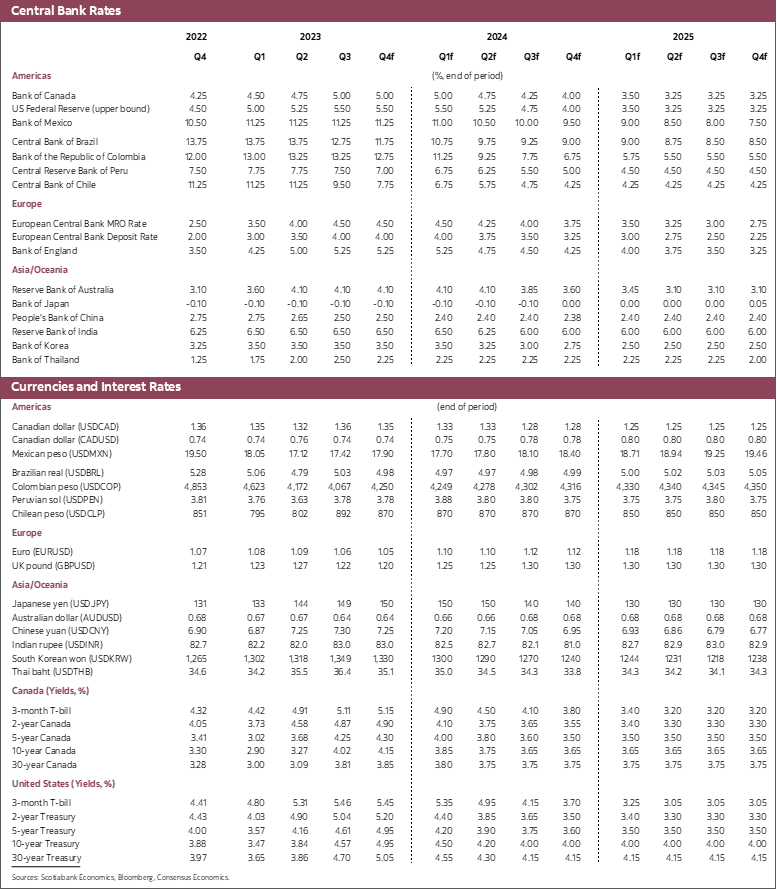

- The Bank of Canada should be done raising rates but volatile inflation readings, high inflation expectations and very rapid wage growth pose significant upside risk to policy rates in coming months. We continue to expect rate cuts beginning mid-2024.

- Key challenges to the outlook centre on the rapid rise in long-term borrowing costs, which we believe are overdone, and the evolution of the Israel-Hamas War.

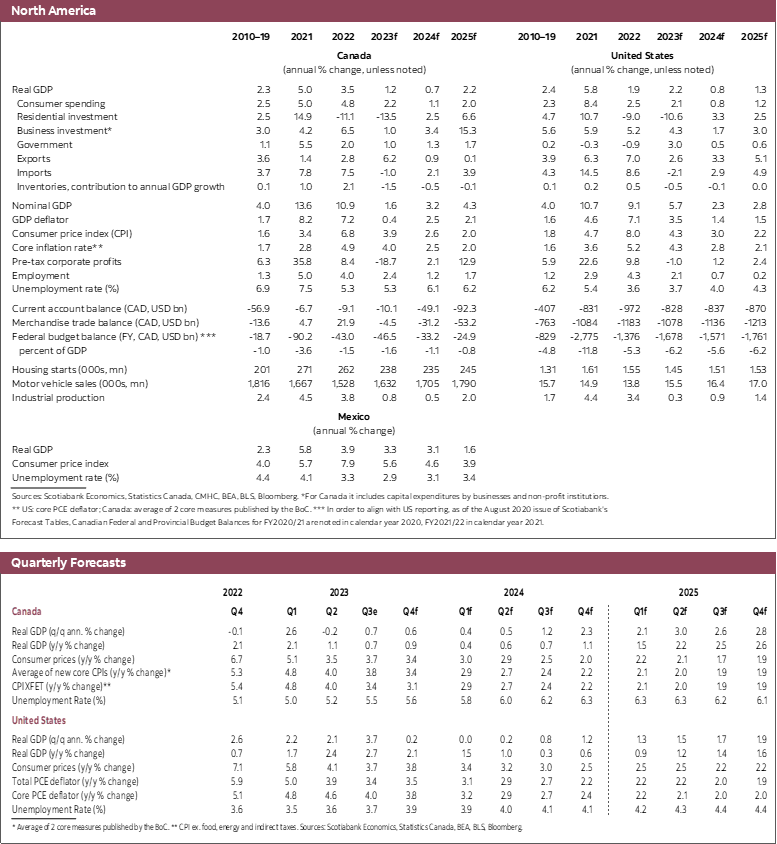

While the outlook for the economy and interest rates remains relatively unchanged from our previous forecast, a number of developments cloud the outlook further. First among these is the impact of the significant, and rapid, rise in yields on government debt. A close second is a broadening of the Israel-Hamas War. Finally, Canadian inflation data have been particularly volatile and continue to point to the need for a high degree of vigilance by the Bank of Canada in its quest to return inflation to target. Despite these developments, we continue to believe that the Canadian economy will avoid a recession and that it is likely to land softly as evidence of a slowdown in growth—but not employment—mounts. As a result, we remain hopeful that central banks in Canada and the US are done raising policy rates, but the risks of higher interest rates dominate for the next few policy meetings.

A major development over the last several weeks has been the rapid increase in the yields on US government debt. This rise has spilled over into international capital markets and led to a similarly large increase in yields on Canadian government debt. As of the time of writing, yields on 10-year US Treasuries are flirting with 5%, almost 50bps higher than they were in mid-October. There is a wide-range of possible explanations for this, as well covered by Derek Holt, but there is little question this represents a tightening of financial conditions. Higher financing costs and the potential impact on US bank balance sheets of unrealized losses on Treasury holdings pose a downside risk to the outlook while also potentially acting as a substitute for higher monetary policy rates. Our view is that the surge in longer-term bond yields is out of step with fundamentals and will gradually reverse itself. Nevertheless, the reversal in these yields is expected to be quite gradual with yields above our previous forecast for much of 2024.

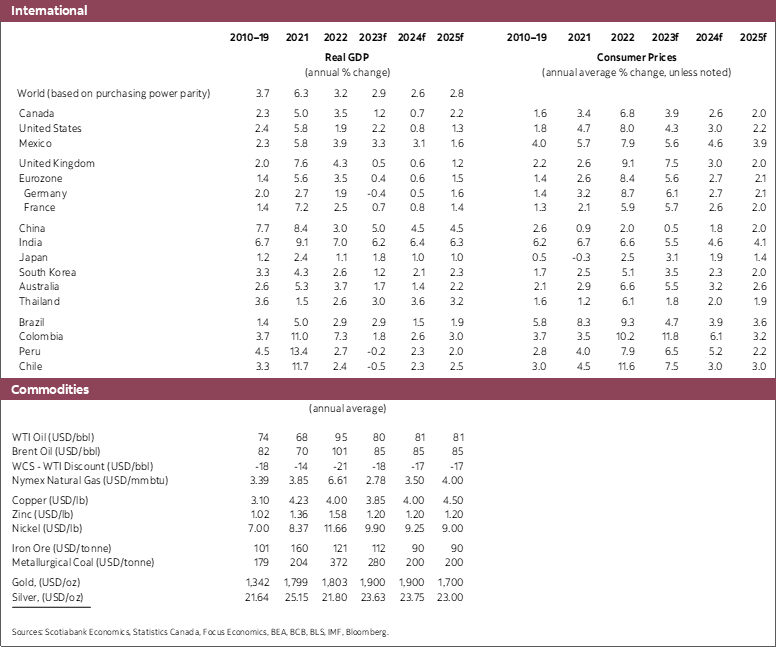

The Israel-Hamas War has so far been of limited macroeconomic consequence outside the region but developments there nevertheless have the potential to dramatically impact the global economy if the conflict escalates and involves nearby oil-producing states. This would undoubtedly send global oil prices higher with the only question being how high those prices would rise. Brent prices are up about 6$ since the conflict began, though a number of other factors have also impacted oil price dynamics over that time. A broadening of the conflict could well see oil prices 10 to 20$ higher than current levels. A shock of this magnitude given the weakened state of the global economy would represent a significant headwind to economic activity. For oil-importing countries, the shock would be stagflationary—lower growth and higher inflation. For oil-exporting countries like Canada and the US, the shock would definitely raise inflation but also possibly economic activity given the improvement in terms of trade. That being said, in the current environment, with the weight of elevated inflation and price levels felt on households, the positive impact of higher oil prices on our economy may well be diminished relative to history. With inflation expectations still well above the Bank of Canada’s target, the inflationary impact of higher oil prices could well force the Bank of Canada to raise rates further.

A further challenge is the inflation outlook in Canada. Inflation has been volatile in the last two months. The August reading showed a marked acceleration in inflation which suggested the Bank of Canada may have erred by not raising in September. Thankfully, the September CPI print reversed much of that surprise. Absent additional upside surprises to inflation, the Bank of Canada should be done raising interest rates in this cycle. That being said, underlying measures of inflation have been pretty stable over much of the last year and remain well above the 2% target. We hope to be surprised on the downside on the inflation side, but history over the last year suggests we are more likely to be surprised on the upside. This, in conjunction with high inflation expectations and real wage growth that is wildly outpacing productivity suggests that risks to the policy rate profile in Canada are firmly tilted to the upside for the next few months. As a consequence of these risks and the stronger underlying momentum in inflation, we have reduced the number of rate cuts expected next year. We continue to expect rates to start their descent at the tail-end of the second quarter and for them to end 2024 at 4%. A further 75bps of cuts are expected in 2025, for a year-end rate of 3.25%. A roughly similar path of rates is expected in the US, though given the higher starting point of the Federal Funds Target rate (5.5% vs 5.0% in Canada), the pace of rate cuts should be stronger in the US than in Canada in 2024. This reflects our view that inflation dynamics are more favourable in the US than they are in Canada.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.