ON DECK FOR THURSDAY, AUGUST 4

KEY POINTS:

- Mild risk-on sentiment is looking past Taiwan

- …and awaiting nonfarm payrolls

- The Fed’s preferred yield curve recession gauge is still not inverted…

- ...but may not matter as opening slack will prove necessary to cool inflation

- Gilts rallied, sterling depreciated on a debatable interpretation of BoE guidance

- BoE hikes 50bps, reinforces paramount goal of hitting 2% inflation…

- …with a forecast recession likely necessary to achieve this…

- …and offered details on its gilt sale program

- Canada’s exports are strongly rebounding while home sales keep sliding

- German factory orders disappoint

- Brazil’s central bank hikes 50bps, guides slowing pace

- US jobless claims & trade land in line with expectations

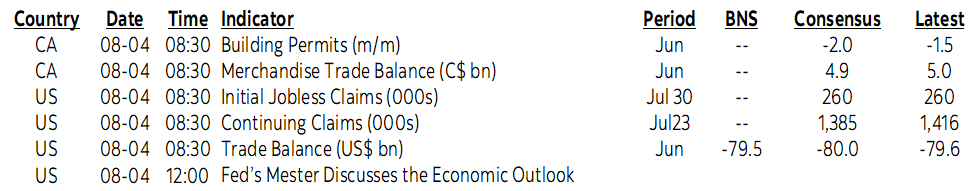

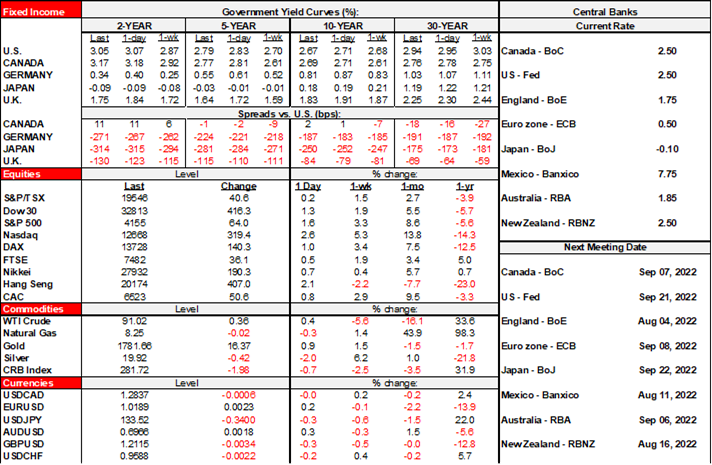

Mild risk-on sentiment is guiding global markets with little to consider by way of global drivers while we wait for tomorrow’s nonfarm payrolls. UK markets are being driven by market interpretations of often cagy BoE guidance (see below). China is showing off its toys around Taiwan and bullying through state-controlled media, but the market feels like its baseline scenario is to largely leave it at that including via mainland China’s equity gains overnight. A deepening 2s10s inversion is flaring interest in recession talk again, but the Fed’s preferred curve measure of recession risk (here) remains positive around its long-run average (chart 1). Mind you, in a sense, who cares in that damaging growth and courting recession risk through policy tightening may well prove to be necessary to bring inflation under control which is a point that escapes too many. So far, August has added a quarter point to cumulative Fed expectations through the end of 2023 and with more to go in my view.

The Bank of England is the main show for UK markets. The MPC’s statement is here, the Monetary Policy report is here, and the accompanying market notice for the asset sale program is here. In a strong 8–1 vote the BoE’s MPC decided to hike by 50bps after needless mystery was created by the Governor’s waffling on the size of the hike. Interpreting the guidance they provided today has to bear in mind that the Governor’s forward guidance is always surrounded by high uncertainty and deliberately so and I’m not sure markets are correctly interpreting what the BoE is saying on inflation and concomitant policy responses. Almost three-quarters of economists including Scotia Economics had expected a +50bps hike and the remainder expected 25 while markets were mostly priced for 50bps. There was a weak case for a dovish surprise with inflation ripping and set to go higher and with the 1.25% Bank Rate still well below neutral and remaining below it at today’s 1.75%.

Gilts rallied in bull steepener fashion and sterling depreciated in the aftermath and largely due to interpretation of forward guidance that was taken by markets as less hawkish than anticipated. Having said that, BoE forward guidance is hardly something to take to the proverbial bank! In any event, the broad tone of the forward guidance paragraph was similar to the prior statement in June with the addition of not being on a pre-set path which is always fairly intuitive in any event:

“Policy is not on a pre-set path. The Committee will, as always, consider and decide the appropriate level of Bank Rate at each meeting. The scale, pace and timing of any further changes in Bank Rate will reflect the Committee’s assessment of the economic outlook and inflationary pressures. The Committee will be particularly alert to indications of more persistent inflationary pressures, and will if necessary act forcefully in response.”

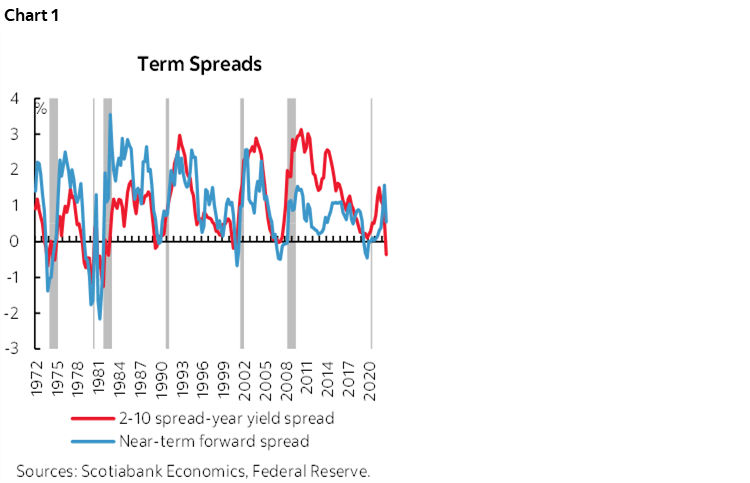

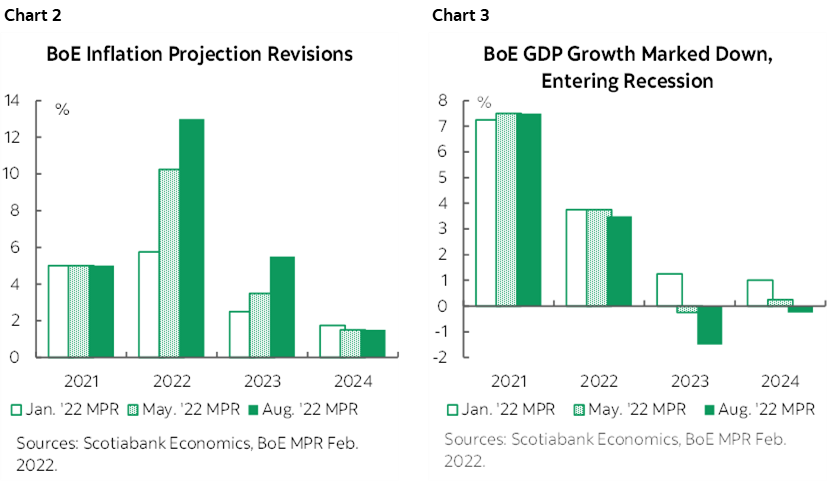

That’s not explicitly pre-committing to further big hikes, but read between the lines. Bailey’s press conference emphasized the paramount importance of achieving price stability around the 2% inflation target. Updated forecasts conditioned upon market expectations for the forward rate path show inflation ending this year at 13.1%, ending 2023 at 6.4% and getting down to around 2% only into 2023H2. As chart 2 shows, this profile has been revised sharply higher in today’s forecasts while chart 3 shows the sharp downward revisions to growth projections. So, at market pricing for Bank Rate before the communications the BoE’s forecasts held out little chance of achieving its inflation target until maybe 2024. Guess which charts speaks to the BoE’s core mandate? On net, this suggests to me that market pricing for the forward rate path was too light in relation to having any hope of achieving 2% inflation within a shorter horizon even before today’s mild rate rally and drop in sterling that may only add to inflation risk. Another 50bps move in September cannot be ruled out.

The BoE also offered details on its gilt sale program in line with prior guidance it had provided to do so at this meeting. Key is this passage:

"The Committee judged that, over the first twelve months of a sales programme starting in September, a reduction in the stock of purchased gilts held in the APF of around £80 billion was likely to be appropriate. Given the profile of maturing gilts over this period, this would imply a sales programme of around £10 billion per quarter."

Also note the BoE’s refreshingly candid talk of an impending recession that other central banks are dancing around:

"The United Kingdom is now projected to enter recession from the fourth quarter of this year. Real household post-tax income is projected to fall sharply in 2022 and 2023, while consumption growth turns negative."

So would central banks be knocked off hiking campaigns by recessions? I continue to think that argument is fully missing the point and frustratingly so since the narrative that central banks wouldn’t want to damage anything through policy tightening is what has wrongly motivated the dovish voices throughout the past year. In order to stand a chance at cooling inflation you’ve got to cool down economies and widen slack and you do that by tightening financial conditions to hit the interest sensitives. Full stop, get over it, and read the memo. Banking on recessions stopping central banks is misguided thinking. Let go of the narrative that has been around as an argument against central banks hiking throughout the whole period to date when they’ve been doing so based upon the view that it would cause some damage when causing some damage is the entire essence of the exercise.

Brazil’s central bank hiked 50bps as expected last evening but delivered softer forward guidance toward “a residual adjustment, of lower magnitude, in its next meeting” which suggests a slowing pace of hiking after a cumulative 11.75 ppts increase since early 2021.

German factory orders slipped in June (-0.4% m/m, -0.9% consensus) but the smaller than expected decline was largely offset by a downward revision (-0.2% m/m from +0.1%). The weakest category was metals production (-2.1% m/m) and the strongest was chemicals (+3.3% m/m). August is all over the map for German data so far given the plunge in retail sales volumes during June, stronger exports, and now weak orders.

US data was generally in line with expectations this morning. Initial claims edged higher to 260k last week from 254k previously and remain on an upward trend since early April. Continuing claims increased to 1.42 million from 1.37 million and have been on a gentler lagging upward trend since June. The US all-in trade deficit narrowed in June to just under US$80 billion in line with expectations largely because we already knew the merchandise component.

Canada’s trade figures, however, were quite strong. Export volumes were up 2.2% m/m in June and import volumes were down 0.3% m/m for an improved balance in volume terms that sets up a strong hand-off to Q3 in addition to the nice end to Q2 from a GDP accounting standpoint. The import surge in Q2 offsets the export surge but some of that likely went into inventories in terms of the net GDP math. Nevertheless, Q2 saw huge rebounds in export and import volumes compared to the softness in Q1 and at least exports have strong baked-in momentum into Q3.

Select Canadian cities continue to report July data for existing home sales with Toronto out this morning (here); flip to the last table to see five straight monthly seasonally adjusted declines and drops in 10 of the past 12 months as weakness preceded rate hikes due to unsustainable price gains before higher borrowing costs took over and did what they are designed to do.

The BoE also offered details on its gilt sale program in line with prior guidance it had provided to do so at this meeting. Key is this passage:

"The Committee judged that, over the first twelve months of a sales programme starting in September, a reduction in the stock of purchased gilts held in the APF of around £80 billion was likely to be appropriate. Given the profile of maturing gilts over this period, this would imply a sales programme of around £10 billion per quarter."

Also note the BoE’s refreshingly candid talk of an impending recession that other central banks are dancing around:

"The United Kingdom is now projected to enter recession from the fourth quarter of this year. Real household post-tax income is projected to fall sharply in 2022 and 2023, while consumption growth turns negative."

So would central banks be knocked off hiking campaigns by recessions? I continue to think that argument is fully missing the point and frustratingly so since the narrative that central banks wouldn’t want to damage anything through policy tightening is what has wrongly motivated the dovish voices throughout the past year. In order to stand a chance at cooling inflation you’ve got to cool down economies and widen slack and you do that by tightening financial conditions to hit the interest sensitives. Full stop, get over it, and read the memo. Banking on recessions stopping central banks is misguided thinking. Let go of the narrative that has been around as an argument against central banks hiking throughout the whole period to date when they’ve been doing so based upon the view that it would cause some damage when causing some damage is the entire essence of the exercise.

Brazil’s central bank hiked 50bps as expected last evening but delivered softer forward guidance toward “a residual adjustment, of lower magnitude, in its next meeting” which suggests a slowing pace of hiking after a cumulative 11.75 ppts increase since early 2021.

German factory orders slipped in June (-0.4% m/m, -0.9% consensus) but the smaller than expected decline was largely offset by a downward revision (-0.2% m/m from +0.1%). The weakest category was metals production (-2.1% m/m) and the strongest was chemicals (+3.3% m/m). August is all over the map for German data so far given the plunge in retail sales volumes during June, stronger exports, and now weak orders.

US data was generally in line with expectations this morning. Initial claims edged higher to 260k last week from 254k previously and remain on an upward trend since early April. Continuing claims increased to 1.42 million from 1.37 million and have been on a gentler lagging upward trend since June. The US all-in trade deficit narrowed in June to just under US$80 billion in line with expectations largely because we already knew the merchandise component.

Canada’s trade figures, however, were quite strong. Export volumes were up 2.2% m/m in June and import volumes were down 0.3% m/m for an improved balance in volume terms that sets up a strong hand-off to Q3 in addition to the nice end to Q2 from a GDP accounting standpoint. The import surge in Q2 offsets the export surge but some of that likely went into inventories in terms of the net GDP math. Nevertheless, Q2 saw huge rebounds in export and import volumes compared to the softness in Q1 and at least exports have strong baked-in momentum into Q3.

Select Canadian cities continue to report July data for existing home sales with Toronto out this morning (here); flip to the last table to see five straight monthly seasonally adjusted declines and drops in 10 of the past 12 months as weakness preceded rate hikes due to unsustainable price gains before higher borrowing costs took over and did what they are designed to do.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.