ON DECK FOR TUESDAY, MARCH 1

KEY POINTS:

- Risk-off sentiment as Ukraine war enters a nastier stage

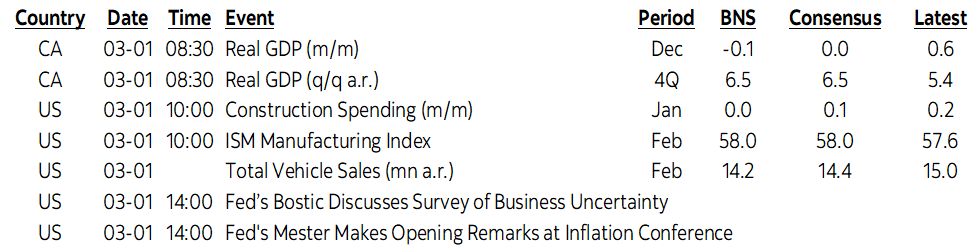

- Russia’s probability of default is slightly higher than even odds

- Canadian economy: strong Q4, before it temporarily stumbled

- US ISM-mfrg to inform supply chain pressures

- More evidence of surging Eurozone inflation

- China’s PMIs unchanged

- RBA remains ‘patient’

- A strong CDN bank earnings season

- Biden’s SOTU speech tonight: inflation, Russia, pandemic

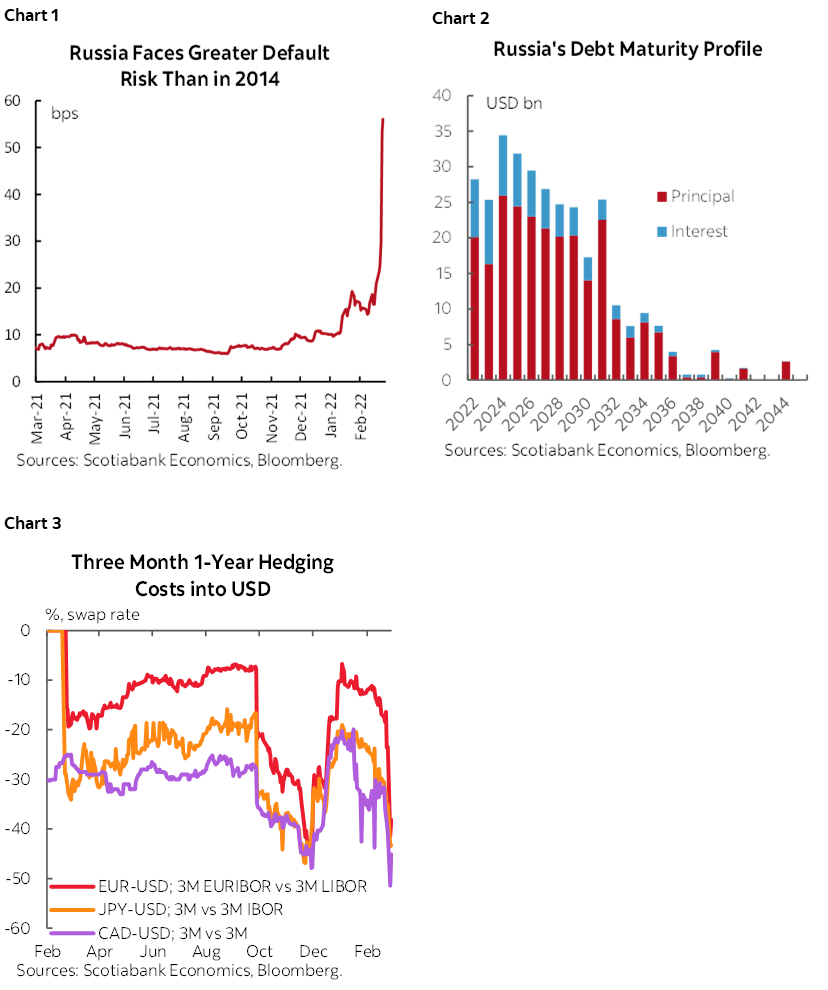

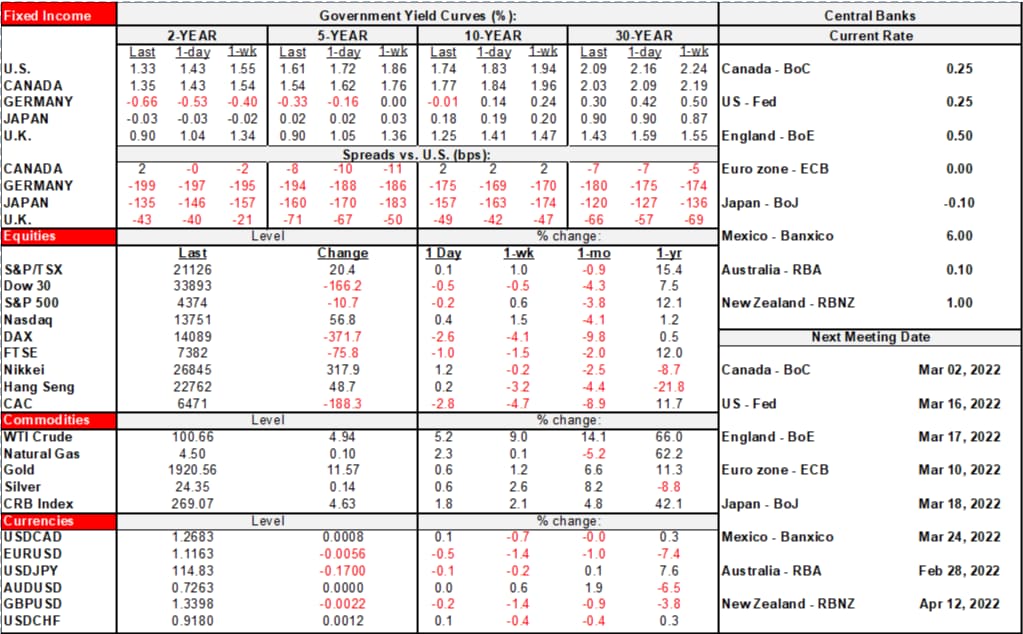

Risk-off sentiment continues given the situation in Ukraine with a long Russian convoy on the outskirts of Kyiv and Russia repeating guidance that it intends to press on. Russia is reportedly increasing the targeting of civilian areas with rockets and using or positioning weapons such as the TOS-1A rocket launcher and cluster bombs. A more vicious approach focused upon civilians is intensifying. At the same time, the probability of Russian default driven by sanctions continues to rise to better than one-in-two odds (chart 1). Russia’s debt distribution of principle and interest payments is shown in chart 2. Measures of liquidity and systemic risk such as currency conversion costs (chart 3) are little changed this morning versus yesterday.

N.A. equity futures are down by about ½% with European cash markets mostly lower by 1 –3%. Sovereign bonds continue to rally with US 2s down 13bps and 10s down 9. Similar front-end moves are occurring in Europe but with 10 year yields down ~16bps across gilts and EGBs. The USD is a touch stronger but with the yen, A$, NZ$, krone and CAD holding their own and most of the weakness occurring across European crosses. Oil is up another ~5% across benchmarks.

Overnight releases included the following:

1. China PMIs: The state’s composite PMI was unchanged (51.2, 51 prior) net of statistical noise. The manufacturing PMI was unchanged (50.2, 50.1 prior) but the non-manufacturing PMI edged up to 51.6 (51.1 prior).

2. RBA: The overnight statement repeated guidance that the RBA is prepared to be patient as it continues to assess the durability of inflationary pressures. Ukraine was positioned as a major source of uncertainty. The A$ shook it off but is among the outperformers this morning.

3. Eurozone inflation: Ahead of tomorrow’s EZ tally, both Italy and probably Germany added to the stronger than expected readings from France (Friday) and Spain (yesterday). Italian CPI was up 0.8% m/m (0.2% consensus) and 6.2% y/y (5.5% consensus). Individual German states are tracking gains that on net are stronger than the 0.8% and 5.4% /y that is expected with the national add-up at 8amET.

4. CDN bank earnings: Add two more beats to make it 5 of 6 so far. BNS landed at adjusted EPS of C$2.15 (consensus $2.04) this morning. BMO also beat a short time before that (EPS $3.89, consensus $3.29).

On tap today are the following:

1. Canadian GDP (8:30amET): Preliminary January guidance may be where more of the risk is focused in terms of how bad it was given restrictions and the 200k loss of jobs. December is expected to have been little changed but the overall fourth quarter likely grew by ~6 ½% q/q SAAR. The BoC would be inclined to look through January due to the restrictions and the fact omicron is fading. I think that on Wednesday they’ll balance out heightened geopolitical tensions (dovish) and higher oil prices (hawkish) to an incrementally neutral-hawkish.

2. US ISM-mfrg (10amET): little change is expected in the headline reading. Watch supply chain and pricing signals etc.

3. US President Biden’s SOTU speech is tonight (9pmET). It’s usually just political theatre, but obviously the war changes the focus somewhat in terms of guidance he may give.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.