ON DECK FOR WEDNESDAY, APRIL 19

KEY POINTS:

- UK inflation roils global markets

- UK core CPI posts hottest back-to-back gains on record…

- ...lighting up BoE pricing and adding to sentiment after jobs and wages

- US bank earnings beats continue, giving the further all-clear for hikes

- Gauging Canada’s strike effects

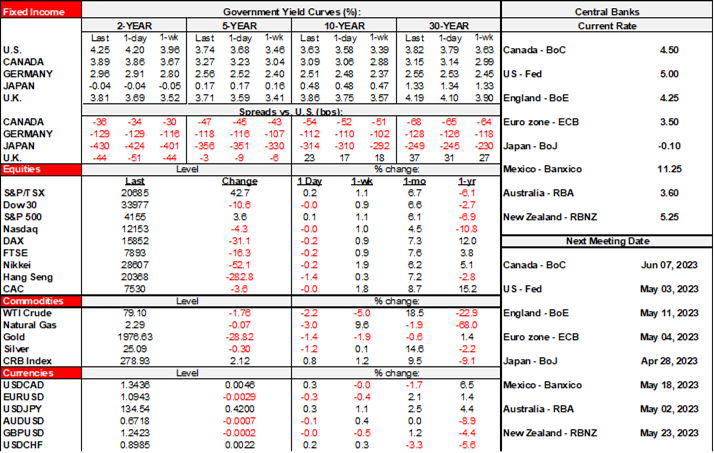

Fear of central bank hikes is denting risk appetite this morning. Risk-off sentiment picked up steam when European market participants came in and stared at another upside surprise to UK inflation that lit up BoE bets. S&P futures were softening before that point but picked up the pace as soon as the data hit. The same holds true for European stocks as the FTSE fell right at the 2amET mark when CPI was released. Overall, we have N.A. futures down by either side of ½% across benchmarks and most European benchmarks are down by up to ¼%. Sovereign yields are pushing higher everywhere—led by gilts, but also spilling over into US Treasuries with 2s cheaper by about 6bps and Canada 2s are outperforming but generally going along for the ride. Fed funds futures added a little more to June meeting expectations after UK CPI. The USD is broadly stronger, although sterling is slightly outperforming other crosses.

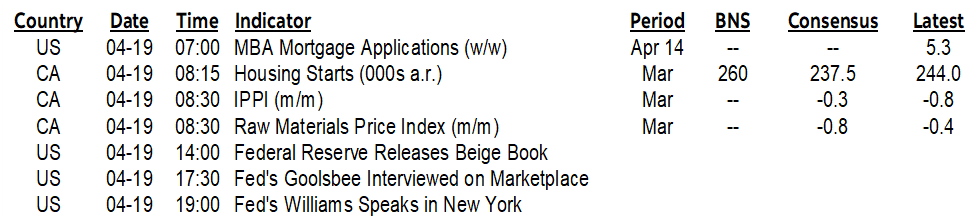

UK inflation beat expectations and that is driving the yield on UK 2s up 13bps in a bear flattener move that has markets pricing in more than a quarter point hike for the May 11th meeting and a terminal rate that is 16bps higher and toward 5% from 4.25% now. At 0.9% m/m NSA, core CPI was tied with March 2022 for the hottest m/m reading since at least 1988 and hence it was firmer than is seasonally normal (chart 1). This follows the hottest gain for a month of February on record. It also arrives in the wake of the previous day’s strong jobs and wages in setting what is very likely to be a hawkish tone at the BoE.

Morgan Stanley beat estimates for earnings and revenues and thus continued the general pattern of stronger than expected Q1 bank results. Tesla reports in today’s after-market and the Fed updates the Beige Book at 2pmET.

I doubt we’ll hear anything new from Governor Macklem’s second round of parliamentary committee testimony with another opening statement due at 11:30amET. Otherwise, Canada will focus on gauging the effects of the federal strike that was called overnight, plus housing starts that disappointed for the month of March; they landed at about 214k, down from 241k as both singles and multiples fell.

A portion of Canada’s Federal government workers have launched a general strike commencing today as talks failed to reach an agreement by last night’s 9pmET deadline. Gauging the effects could become important.

Unlike the US that has rather perfected them I’d say, government shutdowns of any sort are pretty rare in Canada. This partial one could risk being the biggest, longest, most disruptive and politically dicey one. 1991 and 2004 and Ontario’s Days of Action over the 1996–98 period are the closest but still very different parallels.

Just under half of the Federal civil service is affected and after excluding essential services that means about one-third of all Federal government workers will walk off the job today. Difficulty monitoring employees in a virtual work-from-home setting may result in some cheating against the union, but then again who knows how many others may work to rule in sympathy toward their PSAC brothers and sisters.

What could be the impact on GDP? That depends critically upon how long the strike lasts and so we need to be very careful not to reach overly hasty conclusions just yet while nevertheless putting market participants on watch for a few things. A crude back-of-the-envelope approach could say that for every day that one-third of the Federal workforce remains off the job and assuming that the effect on Federal government spending is proportionate, the hit to government spending would be about $200 million based on GDP accounts. A one-month strike, for example, would therefore reduce quarterly NGDP by 0.2 ppts that when annualized is a growth hit of around 0.8% q/q SAAR. Then add multiplier effects as other levels of government, households and businesses would be affected and it’s not inconceivable that the ceiling to the hit is toward 1% of NGDP. In reality, spending is very unlikely to be proportionate to each and every job in the civil service and in the case of the workers behind this strike the impact is likely well under this ceiling.

Still, the BoC projects Q2 GDP growth at just 1.0% q/q SAAR and so if they are right in terms of the baseline expectation then a strike like this could matter more than if the baseline forecast continued to expect strong growth. The risk of a Q2 contraction cannot be dismissed. The BoC would nevertheless be very likely to look through the effects as an intertemporal shock with activity punted to the next period, although it could cloud the data.

The BoC may instead have a keener eye on any wage agreement and potential spillover effects that could carry longer-lasting effects than the temporary effects on growth as argued in the Global Week Ahead. A very tight labour market risks seeing public sector wage gains being copied in other parts of the public and private sectors and flowing through toward higher-for-longer core inflation. If so, then this could be a part of the narrative that the BoC may not be done hiking due to idiosyncratic Canadian risks. That one-third of air travel in Canada may also be disrupted should WestJet pilots go on strike next month adds to the feeling that strike risk is very much in the air this Spring.

There will also be effects on other considerations of importance to markets such as government data releases. From what I understand the releases themselves will still be available, but advance, embargoed media lockups will be cancelled which probably hurts the media outlets that benefit from them more than markets in my opinion. Further it’s not inconceivable that Statcan’s common website problems at the best of times may be further disrupted and so there could be delays.

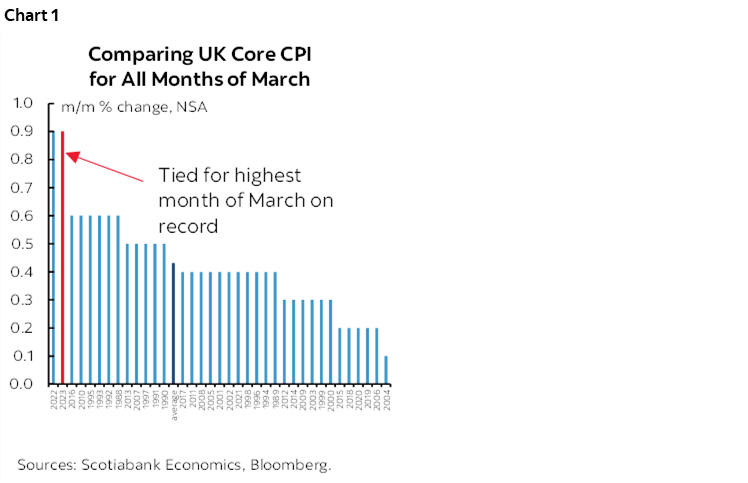

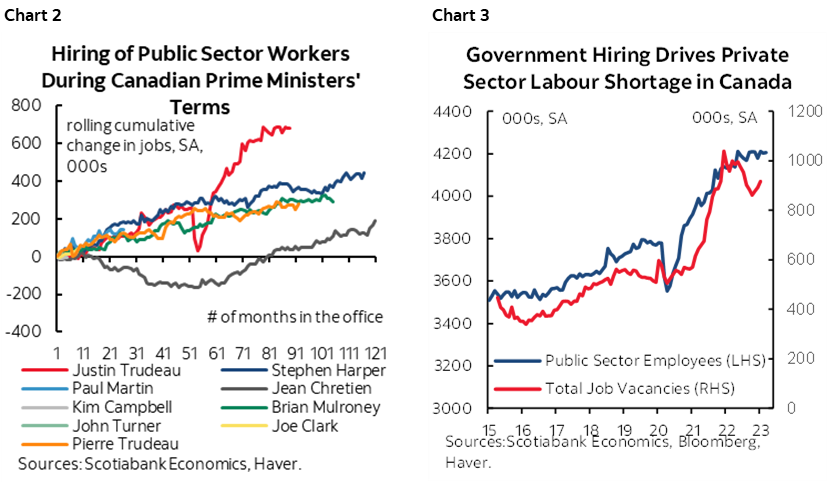

I’m not optimistic that this walkout could be short lived, but it’s not impossible assuming that the government’s chequebook hasn’t run out of cheques! The NDP’s Singh knows his base—hence his public opposition to back-to-work laws that have been used in the past. Maybe the Liberals pair with the Conservatives on such legislation (although they are quiet on the issue…), but then the trilemma is that the Libs could lose Singh’s support in a confidence motion and perhaps that sails through. Voters may not be too receptive toward cutting juicy deals with a public service that has grown faster under PM Trudeau than any other PM since at least the inception of the Labour Force survey in the 1970s and it’s not even close. As a reminder see chart 2. Also see chart 3 that vividly depicts how soaring job vacancies that are overwhelmingly in the private sector occurred simultaneously to heavy government hiring that crowded out private employers and induced such worker shortages. This started well before the pandemic that amplified the trend. The public sector has been competing against private business for workers for years now and with that has gone foregone output and wealth creation.

Election risk is therefore not assured but it could be hanging in the air. In that scenario, in exchange for possibly having to pay more to Federal workers, voters may seek offsets like a hiring freeze, allowing attrition to reduce the size of the workforce and perhaps more aggressive reductions to what was shown in chart 2. The better ones would be snapped up by private businesses that are starved for workers.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.