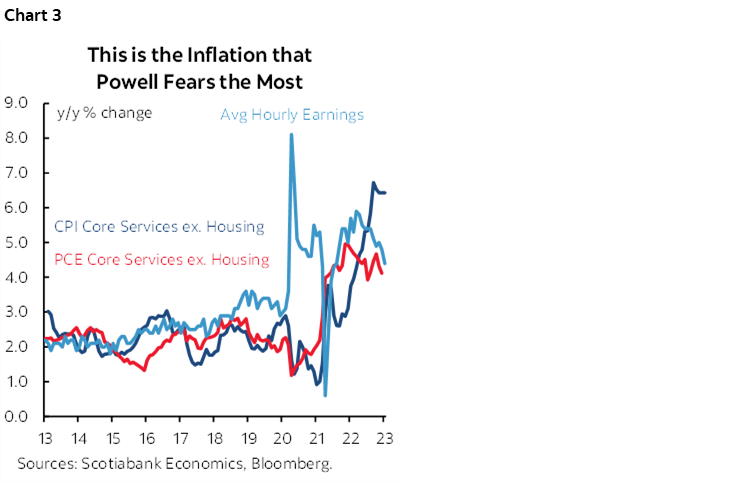

ON DECK FOR TUESDAY, FEBRUARY 14

KEY POINTS:

- Global markets await US CPI

- US core CPI expected to be firm

- Gilts cheapen, sterling rallies post-UK jobs & wages

- Yen shakes off GDP miss, Ueda nomination

- NZ$ dips on lower inflation expectations

- Fed officials to weigh in post-CPI

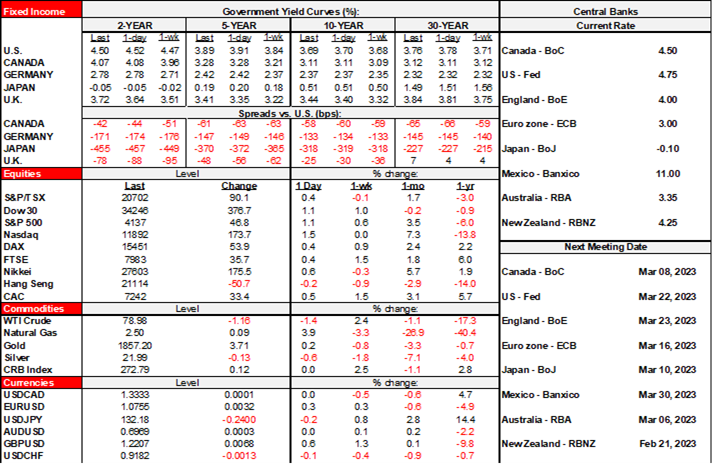

Global markets await US CPI and for now are in risk-on mode. The USD is slightly softer. European cash equities are up by about ½% across exchanges while US equity futures are up ¼% and TSX futures are flat. US Ts are slightly richer and gilts are underperforming post-jobs. Oil is down a buck again and is only about a buck higher on net compared to just before Russia announced it would cut a half million barrels per day from production late last week.

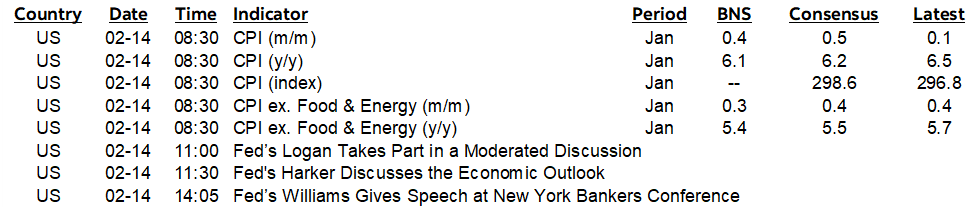

UK job market readings prompted sterling to appreciate and the gilts curve to mildly bear flatten. They also reaffirmed quarter-point pricing for the March 23rd meeting and added about 4bps to terminal rate pricing. It’s not clear that this should have been the reaction. On the plus side, payroll jobs were up 102k in January. Lagging total employment (including off-payroll jobs) was up by a mild 32k in December and only 74k on the rolling 3-month convention which is soft but still on the plus side. Earnings ex-bonuses were up 6.7% y/y (6.5% consensus and prior), but herein lies the rub: on a month-over-month basis, wage growth decelerated in seasonally adjusted terms at an annualized growth rate (chart 1). All of which is a potential sideshow anyway ahead of UK CPI tomorrow.

The yen largely shook off both GDP and the official nomination of Ueda as Governor of the BoJ pending parliamentary approval. Japanese GDP missed expectations (0.2% q/q, 0.5% consensus) with a slight negative revision to Q3 (-0.3% q/q from -0.2). Inventories, exports and business investment were all a touch weaker than expected while consumption growth generally performed as expected.

The NZ$ is the weakest performer to the USD this morning after the central bank’s survey of businesses showed that 2-year inflation expectations pulled back from 3.6% to 3.3%

All of which is a bunch of sideshows. US CPI will dominate global market attention given how it impacts the Fed, given the dominance of the dollar and the sheer enormity of the US Treasury market that spreads its tentacles through so many financial vehicles. The extent to which markets have been impacted by nonfarm including its large positive revisions may mean markets could be *relatively* more vulnerable to a downside surprise than a more significantly priced upside surprise imo. US 2s have cheapened by about 45bps since nonfarm and terminal rate pricing has edged up to 5¼% which brings markets into alignment with the December dots, but not any possible upward revision at the March FOMC. Then we’ll get another payrolls report, plus PCE, plus one more CPI report before that FOMC meeting and its revised SEP.

Here are expectations for US CPI // core cpi that is due out for January at 8:30amET.

Consensus: 0.5% m/m // 0.4% m/m

Scotia: 0.4% m/m // 0.3% m/m

Range: mostly 0.4–0.5 // mostly 0.3–0.4

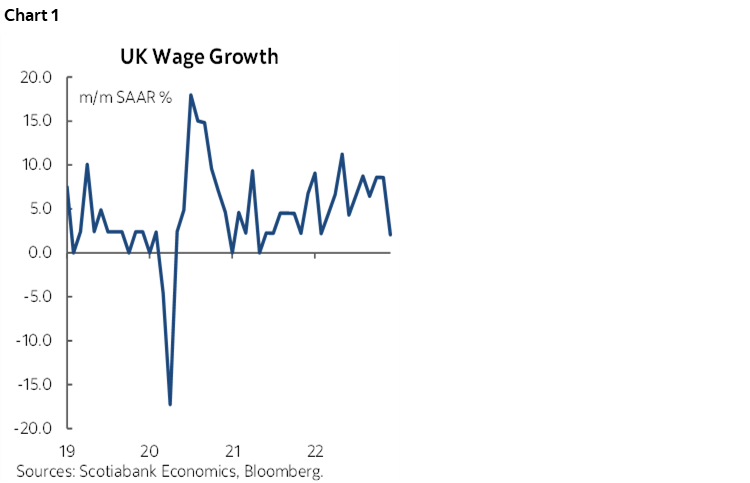

Cleveland Fed’s ‘nowcast’: 0.65% m/m // 0.46%

Drivers:

- The Cleveland Fed’s nowcast has overestimated inflation for a few recent reports but it performs reasonably well over time and points to upside risk to my estimate and consensus. Chart 2.

- headline should get a boost from higher gasoline prices (+4% m/m NSA, +3.5% m/m SA). That would add around 0.15% m/m in weighted SA terms to CPI.

- Headline CPI NSA will also benefit from January being a seasonal up-month for CPI NSA

- OER is expected to be strong again as the lagging influences of cooler market rent gauges still lie ahead

- New and used vehicle price changes were minimal in January according to industry sources (not Manheim).

- Food price inflation has ebbed the past couple of months and is well below the 1% m/m increases up to last July. A modest contribution is factored in.

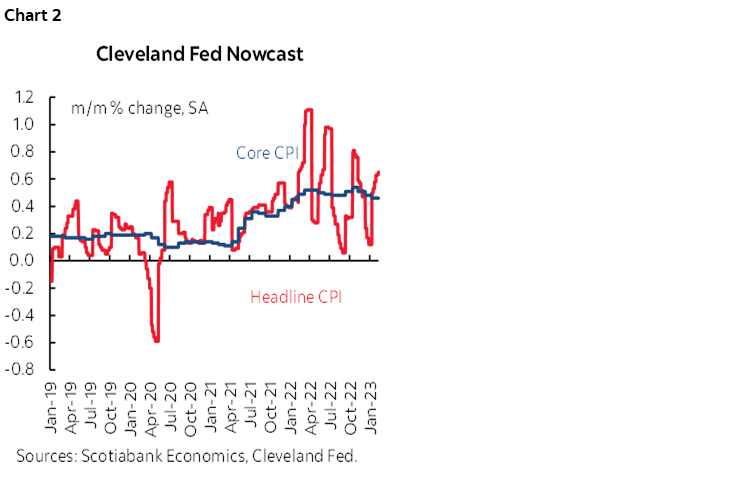

- Another solid gain of 0.4–0.5 m/m is expected for core services ex-housing (Powell’s fave measure these days).

- What should we watch for signs inflation is being licked?

- focus on core PCE, not core CPI: Among the many methodological differences is that PCE has half the weight on shelter that CPI does and so housing disinflation wouldn’t be anywhere close to the same issue in dragging down PCE. PCE is the Fed’s preferred gauge.

- ignore base effect influences as year-ago comps shift. That’s how the Fed/BoC etc got into trouble in 2021 and argued it was all just base effect driven inflation, which it never was. I doubt they’ll be fooled again which is why some Fed officials have also been emphasizing m/m.

- you’ll need to see core PCE coming down toward 2% on a durable basis that will take a long time to evaluate. We’ll also need to see how the breadth evolves. If goods disinflation keeps shaking out and we rebase then that part of inflation could be subject to renewed future gains in 2024–25. If housing largely finishes pushing through inflation readings—and much less so for PCE as per above comment—by 2024H1 then the Fed could misinterpret cooling inflation if it doesn’t control for this. Last, pay attention to when Powell says he’s watching core PCE services ex-housing that dominates over half of the core basket. That’s driven more by wages and given an extremely tight labour market this could prove to be a persistent form of inflation (chart 3).

- regime shift. Regular readers know my views on how developments since 2016 and ongoing adjustments make for higher long-wave inflationary pressures than the pattern after China’s entry to the WTO and especially after the GFC.

The Fed is once again looking for another #2 as the Biden administration rewards Vice Chair Brainard for her qualifications and her loyalty to the Democrats’ causes over the years. The longstanding rumour that she was being considered as the Biden administration’s top economic adviser appears to be on the mark with a formal nomination coming perhaps as soon as today. There will also be a fair amount of Fed-speak today including Richmond’s Barkin (9:30amET), Dallas President Logan (11amET), Philly’s Harker (11:30amET) and the NY Fed’s Williams (2:05pmET).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.