ON DECK FOR THURSDAY, FEBRUARY 23

KEY POINTS:

- Powell overhyped the FOMC minutes…

- …that offered nothing useful and were stale anyway

- US GDP, core PCE revisions on tap

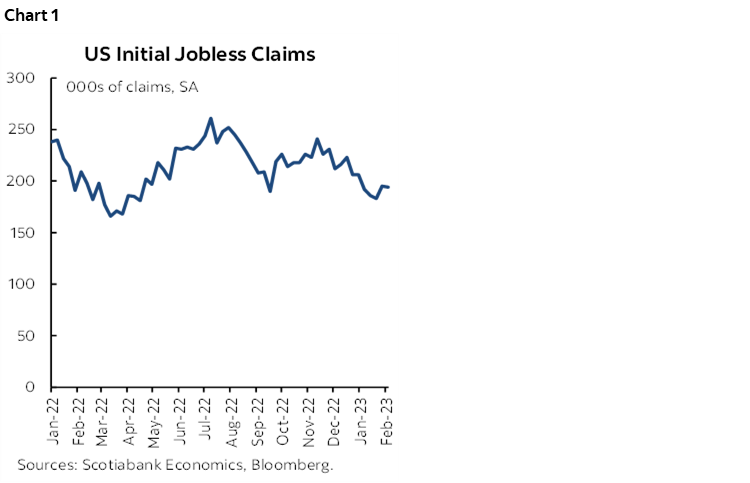

- Are US weekly jobless claims still shaking off layoffs?

- BoK holds but threatens a measly extra 25bps

- Turkey’s central bank cuts by half of what was expected

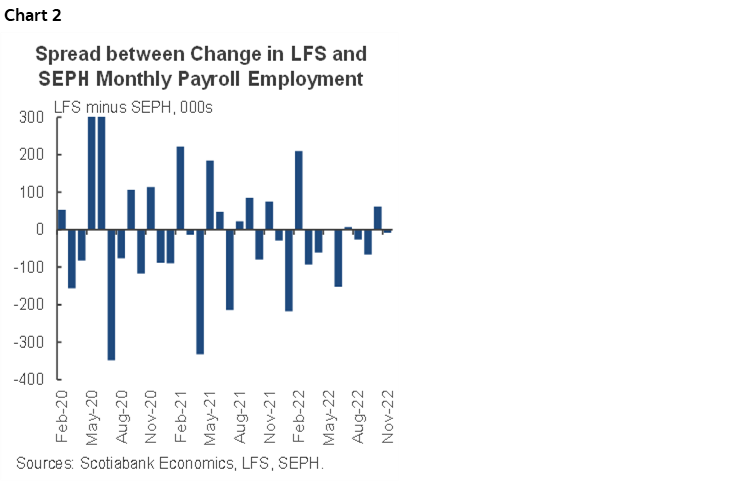

- Canada’s lagging payrolls may spark headlines on differences to LFS

A generally quiet overnight session faces light macro risk into the N.A. morning. This follows the most over-hyped set of FOMC minutes in quite a while after Chair Powell went too far in promising a detailed discussion on the forward rate path on February 1st and then they pretty much failed to deliver that yesterday (see recap below). Very strong US macro readings and firm CPI inflation since then made the light discussion that was offered yesterday a stale account of developments.

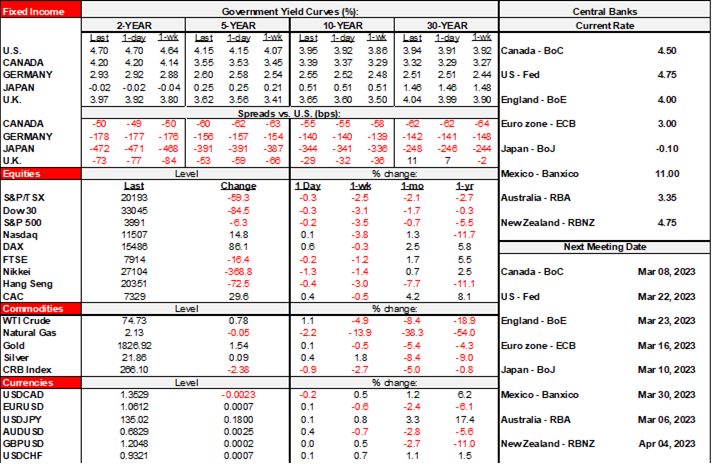

Gilts are underperforming within a general cheapening bias across global sovereign bonds. Equities are mixed with US futures up by ½%, Canadian futures up by a little less, London down a bit but the rest of Europe mostly higher.

The Bank of Korea held its 7-day repo rate at 3.5% as mostly expected but indicated that another hike is possible as five of six board members support a 3.75% terminal rate. Governor Rhee also said “I hope the hold this time isn’t going to be seen as meaning the rate-hike stance is over.” That guidance drove the won to be the top performer to the USD. Then again, why not have just gotten it over if the difference is a lousy 25bps additional hike?

Turkey’s central bank cut by 50bps because of the earthquake and because Erdogan said so, but it was less than the 100bps cut that was expected by consensus.

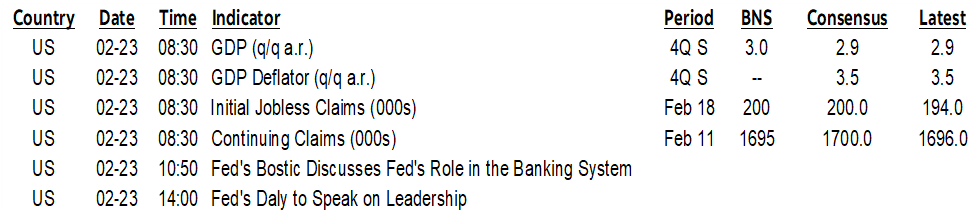

On deck for today will be a handful of US macro updates:

- The first revision to the 2.9% Q4 GDP growth estimate back on January 26th will incorporate further evidence that has arrived since then (8:30amET). The median estimate is essentially unchanged. There is, however, a fairly normal distribution of estimates running mostly from about 2% toward the low 3s.

- Core PCE inflation for Q4 may matter because the initial estimate of 3.9% q/q is subject to revision risk. Core CPI for December was revised up in the January report on February 14th and so that could translate into upward revisions to Q4 core PCE.

- Also keep an eye on weekly initial jobless claims (8:30amET) for evidence that layoffs continue to be modest and absorbed one way or the other (directly or indirectly).

Yesterday’s minutes to the January 31st – February 1st FOMC meeting were a letdown (here). Chair Powell had promised a discussion of the forward rate path during his February 1st press conference but very little was offered. They also had a very stale feeling to them as strong US macro readings (eg. nonfarm, ISM-services, vehicle sales, retail sales, manufacturing output etc) and resulting market moves had overtaken Fed communications. Overall, we're back to monitoring several releases they'll get before the next meeting (nonfarm PCE, another CPI etc). Here’s a short summary of a handful of takeaways.

- it was a very minority voice that advocated a bigger hike than 25bps at the last meeting. Minutes described it as “a few participants” who favoured a 50bps hike. That wasn’t particularly surprising. Bullard and Mester had revealed that they were among the voices.

- There doesn't seem to be any consensus appetite to increase the size of potential hikes again at least at the time of the meeting. That may hold despite strong macro data since the meeting and in favour of sticking to a 25bps hike pace for more hikes toward a higher terminal rate and hanging out there for longer. A terminal rate in the 5.5–6% range remains my view with no cuts for the foreseeable future.

- There wasn’t any guidance on the terminal rate in terms of openness toward adjusting it from the 5.25% mark that was set in December’s dot plot. That was likely because they don’t wish to pre-judge the next meeting on March 21st – 22nd. Not even a more nuanced discussion occurred which had been the expectation.

- They jawboned the importance of a smooth functioning Treasury market but said nothing specific.

- Canada updates its payrolls measure for back in December (8:30amET). Expect headlines that could flag differences between what the Labour Force Survey indicated for job growth in December (~70k) versus whatever SEPH says given monthly variations in the two sources. Sometimes clients ask about it, but I don’t pay much attention to SEPH. First, it lags way too far behind the household survey and in the current climate it’s imperative to have fresh data. I’ll never understand why Statcan can’t turn around both measures on the same day like the US. Second, it only covers firms with formal payrolls and so in a country like Canada that omits an awful lot of small businesses and jobs. Third, you don’t get the richness of information across other labour market indicators in SEPH that you do in the LFS. Finally, notwithstanding monthly volatility that can drive significant differences in the two measures, the trends in the two measures tend to be close to one another over time (chart 2).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.