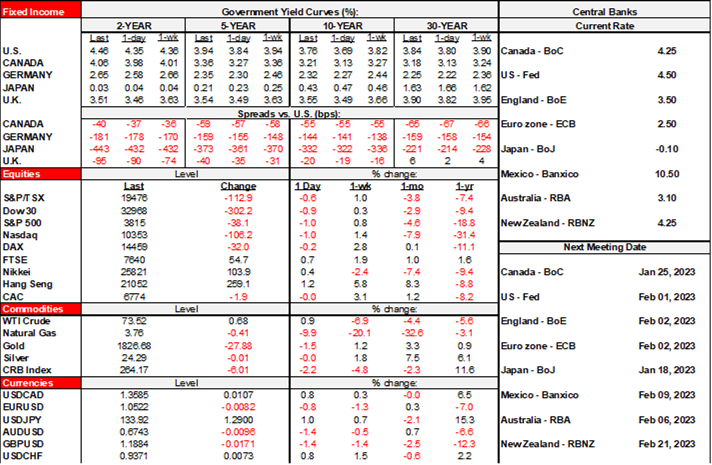

ON DECK FOR THURSDAY, JANUARY 5

KEY POINTS:

- Markets may have overreacted to ADP…

- ...but central banks have trained markets to be uber-sensitive to every data point

- ADP said nothing statistically meaningful about nonfarm payrolls

- US weekly claims may be unreliable

- Takeaways from the FOMC minutes

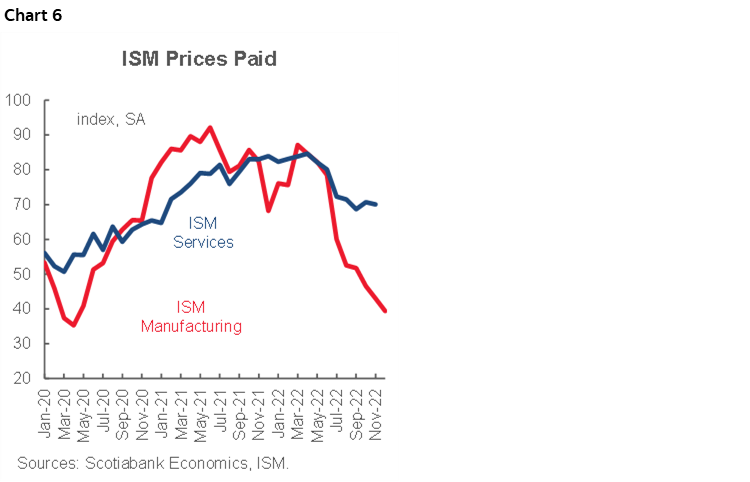

- Don’t exaggerate the significance of ISM-mfrg prices paid

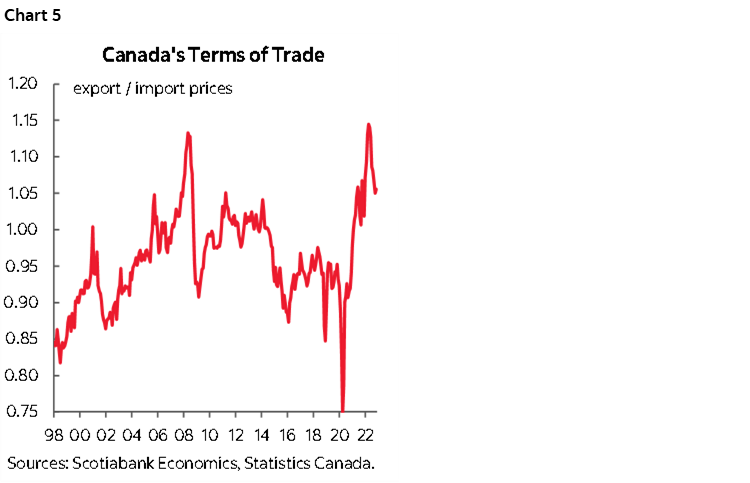

- Canadian terms of trade holding up as trade volumes soften

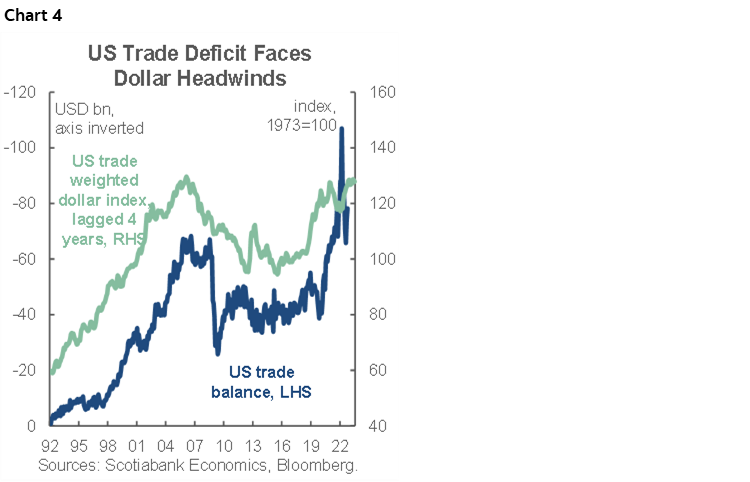

- US trade deficit’s improvement faces dollar headwinds

- Italian CPI surprises by not surprising!

- Colombian core inflation keeps hike pressures alive

Today’s markets are providing an illustration of the extent to which central banks have trained markets to be extremely sensitive to every data point including the shakiest of them all. Normally, markets play it safe ahead of nonfarm payrolls that are due out tomorrow (and Canadian jobs for local content) plus Eurozone inflation, although that has largely been digest by the individual country reports.

Not this time. ADP sparked a pretty significant market response by pushing up yields across the global sovereign curves, strengthening the dollar and knocking the S&P500 down by 1% with spillover effects elsewhere.

DID MARKETS OVERREACT TO ADP?

US ADP payrolls beat the consensus guesstimate (235k, 150k consensus) and were revised upward to 182k the prior month from the initial 127k estimate. There was a swift market reaction as the US two-year yield spiked about 6bps higher, pricing for the February 2nd FOMC decision move about 3bps higher with about 37bps priced and hence closer to a half point expected move that will be further informed by tomorrow’s figures and next week’s CPI.

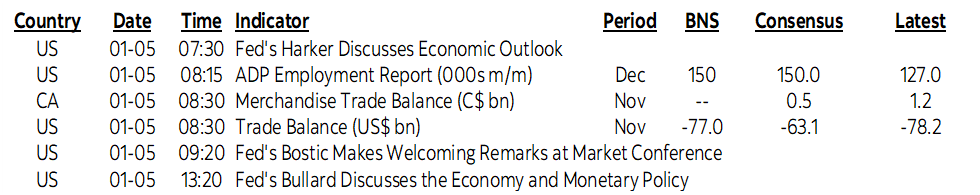

The usual caution is that ADP offers poor tracking of private nonfarm payrolls and has delivered many head fakes over the years in terms of its usefulness as an advance predictor. The spread between this initial ADP print of 235k and consensus expectations for tomorrow’s private payrolls at 183k is about 52k which isn’t very statistically meaningful on two counts. One count acknowledges the +/-120k 90% confidence interval around estimates of changes in nonfarm payrolls. The other count points to chart 1; taking this historical spread between initial (ie: pre-revision) ADP and nonfarm changes over the past decade reveals that the bars from about a 50k positive spread and higher sum to about 26% of all historical spreads. In plain English, it wouldn’t be terribly surprising for ADP to exceed nonfarm by this implied amount going into the numbers.

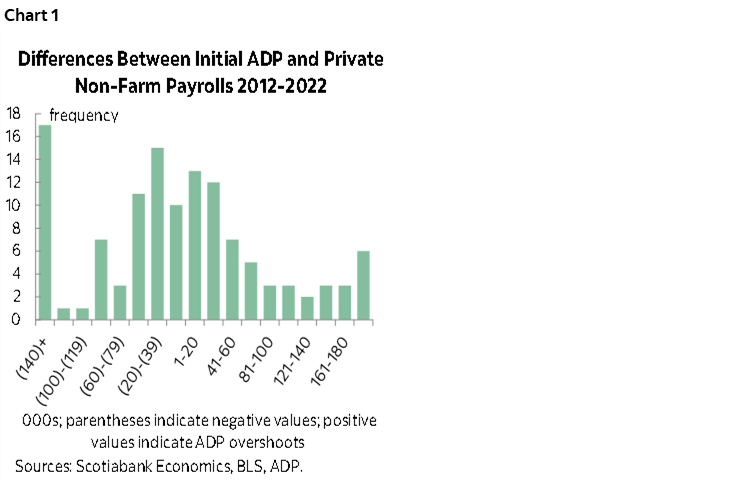

What may be more meaningful is the roughly 20k drop in initial jobless claims in the final week of 2022 (chart 2). They fell to 204k for the lowest reading since September but there are big cautions. For one, some key states offered only estimated readings and not hard data and so data quality is an uncertainty. They included California, Massachusetts, Kansas, and Virginia. For another, oh, let’s just say that perhaps everything is still messed up around holiday points with shifting timing and uncertainty around seasonal adjustments during the whole pandemic era. It’s one week of data and so with these uncertainties let’s see what happens into January.

FOMC MINUTES RECAP

Overall, I don't think the minutes to the December 13th–14th FOMC meeting (here) offered anything materially above and beyond the hawkish message that was delivered on Dec 14th. There was very little by way of any post-minutes market reaction. Here are some highlights of what I thought were the main takeaways.

The minutes further spelled out the FOMC’s tendency to not be overly reactionary to very short-term inflation readings that risk prematurely declaring victory:

"With inflation remaining unacceptably high, participants expected that a sustained period of below-trend real GDP growth would be needed to bring aggregate supply and aggregate demand into better balance and thereby reduce inflationary pressures."

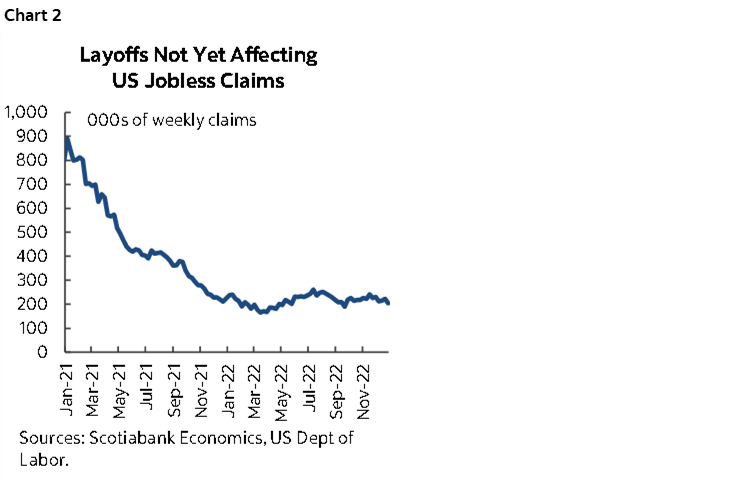

On labour markets, the following comment would be stronger now given yesterday morning’s JOLTS job vacancies that were higher including revisions (chart 3) which keeps alive concern that wage gains will continue to support core inflation especially on the services side.

"Participants generally concluded that there remained a large imbalance between labor supply and labor demand, as indicated by the still-large number of job openings and elevated nominal wage growth."

On reasoning behind why the committee still sees inflation risks as skewed higher they had this to say:

"Participants cited the possibility that price pressures could prove to be more persistent than anticipated, due to, for example, the labor market staying tight for longer than anticipated. Participants saw a number of uncertainties surrounding the outlook for inflation stemming from factors abroad, such as China’s relaxation of its zero-COVID policies, Russia’s continuing war against Ukraine, and effects of synchronous policy firming by major central banks."

The paragraph at the top left of page 10 further explained why the Committee is still tilted toward seeing upside risks to inflation and are more concerned about doing too little than too much. Only "a couple" now see the risks to inflation as more balanced so that view is in the definite minority on the FOMC.

On rate cut hopes, the long paragraph at the top of page 9 in the minutes just reiterates guidance from December 14th on pace and how "no participants" expected rate cuts this year. I also personally think there is a very high bar set against market hopes for rate cuts this year. Logic I’ve heard in support of this expectation points to history, yet pointing to history has been a largely useless approach throughout the unique circumstances of the past three years!

On size and pace of hikes going forward, the minutes just reinforced the Fed’s take-it-as-it-comes bias now that they are in restrictive territory:

"Participants generally noted that the Committee’s future decisions regarding policy would continue to be informed by the incoming data and their implications for the outlook for economic activity and inflation, and that the Committee would continue to make decisions meeting by meeting.”

The minutes spelled out a little more clearly that the Fed is leaning against markets as easing financial conditions jeopardize success in its inflation fight:

"Participants noted that, because monetary policy worked importantly through financial markets, an unwarranted easing in financial conditions, especially if driven by a misperception by the public of the Committee’s reaction function, would complicate the Committee’s effort to restore price stability."

CANADA-US TRADE FIGURES

The US trade deficit narrowed in line with expectations for the month of November. It fell to –US$61.5B from –US$77.8B which is about what was expected given the drop in energy prices and the advance release of the merchandise trade figures onto which the services estimates were added today. This improvement faces forward-looking headwinds via the long lagging effects of dollar strength (chart 4).

Canada’s trade figures deteriorated in November. Export volumes fell 1.4% m/m and import volumes were 0.7% lower. Export volumes are tracking a modest 1% q/q SAAR decline in Q4 and import volumes are tracking a 6% drop. Bear in mind that the prior quarter saw a large surge in export volumes (6.3% q/q SAAR) but import volumes were flat. It’s the trend that matters. Another consideration is that while the decline in commodity prices have put mild downward pressure upon the terms of trade (the ratio of export prices to import prices), they are still very elevated (chart 5). That’s a continued positive by way of basically importing a positive income shock to the overall economy. I think this point still fails to resonate with the camp that’s flapping its arms over housing weakness without considering that Canada’s relative advantage compared to much of the world is that it sells many of the commodities that are still fetching attractive prices through a combination of supply and demand drivers.

OTHER DEVELOPMENTS

On the inflation front, Italian CPI landed on the screws at 0.2% m/m and hence bucked the pattern of downside surprises in Germany, France and Spain. Eurozone producer prices were very slightly weaker than expected on both the December reading (-0.9% m/m, -0.8% consensus) and revisions (-3% m/m from -2.9%). Colombian inflation was stronger than expected at 1.3% m/m (0.9% consensus) with core prices up by 0.9% m/m which is the hottest reading since April which validates BanRep’s 1% hike in December to 12% and keeps alive further hike risk. Thai inflation was in line with expectations as base effects lifted the y/y rate to 5.9% (5.6% prior).

Further on the inflation front is yesterday’s ISM-manufacturing prices paid reading which fell to a sub-40 reading for the first time since April 2020. There are several cautions around interpreting this to mean the end of inflation. First, it’s largely a commodity-driven measure of what manufacturers paid for inputs that reflects drivers like weaker energy prices that we already knew via commodity prices. Second, it’s prices paid for inputs, not prices received, and hence doesn’t necessarily carry implications for prices consumers pay. Third, it’s just the manufacturing sector, whereas the service sector dominates and is much more of the focus at the Fed and service sector prices have been moving sideways of late according to the ISM-services prices paid measure to be updated tomorrow (chart 6) and which has been underestimating service prices received in CPI and PCE. Fourth, an uncertainty is whether global supply chains are going through renewed shocks into the start of this year derived from China’s total mismanagement of Covid and the reverberating effects across global producers.

Bullard’s presentation on the economy and monetary policy (1:20pmET) may be the main draw out of the three Fed speakers on tap today. Whatever they say will quickly fade to the background pending the implications of upcoming jobs and inflation reports for the February 2nd Fed call.

German exports shrank again in November (-0.3% m/m) but it’s tumbling imports (-3.3% m/m) that have been sliding for three months that may be the bigger worry factor by way of what that says about the pull effect from the domestic economy.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.