ON DECK FOR TUESDAY, MARCH 7

KEY POINTS:

- Global markets await Fed guidance

- Powell’s testimony could inform size and peak considerations

- RBA hikes but eases financial conditions…

- …despite continuing to guide that further hikes are needed…

- …because the bias opened up meeting-by-meeting optionality

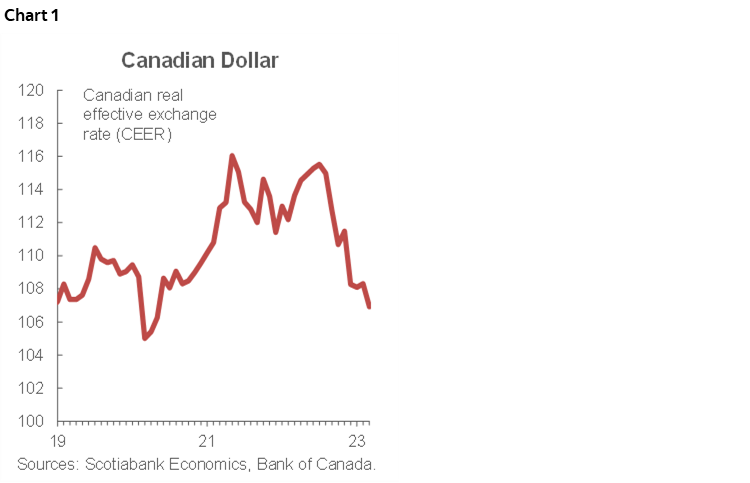

- BoC’s preferred CAD measure at weakest since May 2020…

- …fanning inflation risk...

- …as BoC risks falling too far behind the Fed…

- …despite similar core inflation rates

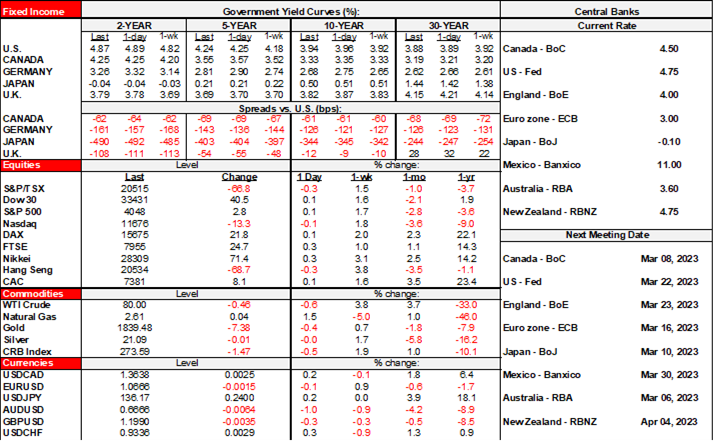

Mixed conditions across global markets await Fed Chair Powell’s testimony as the week’s potentially dominant macro risk. The USD is gaining a little ground, while sovereign bonds rally and equities are generally little changed across most regions except for China where equities fell by 1–2% overnight and where the policy rhetoric from the friends of Russia seems to oscillate by the day. Australia was the stand-out biggest mover across asset classes overnight given what the RBA did.

The RBA hiked by the expected 25bps but its overall communications eased financial conditions overnight. The interpretation of the bias drove a bull steepener move in Australia’s curve as 2s richened by 13bps while terminal rate pricing was reduced by 14bps to now imply about 40bps of additional tightening and the A$ depreciated by three quarters of a cent to the USD.

So what did the RBA say that loosened financial conditions? It tweaked the language in the final paragraph of its statement. The prior statement said that hikes “will be needed over the months ahead” but this one struck out “months ahead” and the prior statement also said that “In assessing how much further interest rates need to increase” but this one said “In assessing when and how much further interest rates need to increase…”. The wording change is deliberate in suggesting that the central bank is more data dependent and on a less committed path of tightening at each meeting. That stops short of the BoC’s move toward a conditional pause in that the RBA is still saying that it thinks rates will have to move higher.

Day 1 of Fed Chair Powell’s testimony before the Senate Banking Committee will start with a written statement before Powell speaks at 10amET and then turns to Q&A. Market sensitivities will particularly focus upon whether he intimates openness to +25bps or +50bps on March 22nd and whether he reveals what either he and/or the committee may be leaning toward in terms of the terminal rate this cycle.

German factory order beat expectations. They climbed by 1% m/m in January (-0.7% consensus) and therefore built upon the 3.4% m/m gain in December. Orders are still 15% lower than the peak in mid-2021 and are hovering around pre-pandemic levels.

The C$ continues to weaken with a further loss of a third of a cent to the USD so far this week as USDCAD rises to 1.363. Of greater concern to the BoC is the broader debasement of the currency using its preferred measure and the risk this poses by way of stimulating trade through easier financial conditions and fanning import price pressures. Monitoring further developments in CAD will inform the risk that Macklem warns about the currency again at some point and reminiscent of when he explicitly did so last October.

Enter chart 1. It shows the BoC’s Canadian Effective Exchange Rate index in real terms. This measures the currency’s movements in trade-weighted terms against a basket of all other currencies of its trading partners and adjusts for relative changes in inflation rates in Canada and its trading partners. The BoC publishes the data on its website with a lag up to the end of 2022. My chart extends this to early March which we can do with reasonable comfort since we know the nominal exchange rates, the trade weights and January relative inflation rates for most trading partners. Relative inflation rates are unknown for February but I’ve assumed them to be unchanged until data arrives. It would take large changes in weighted relative inflation rates that on net move in the same direction to impact the CEER estimates relative to the other known variables.

The punchline is that the CEER measure of the currency is at its weakest since May 2020 and hence around the pandemic’s early days. Relative central bank policy divergence is among the drivers of this depreciation and particularly through the BoC versus Fed connection. Not all of this potential divergence may be priced at this point with markets uncertain toward the Fed’s terminal rate and the relative paths thereafter.

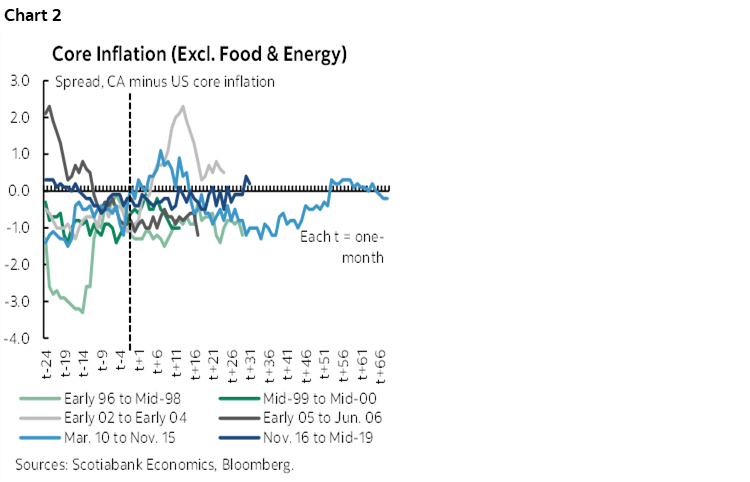

I don’t think that allowing CAD to be debased to this extent is with justification. In the past when the BoC has undercut the Fed it has tended to be because core inflation is materially lower in Canada than the US. Chart 2 is repeated from my Global Week Ahead article by showing core rates of inflation in the lead-up to peak policy rate convergence at time t=0 in past Canada-US monetary policy cycles.

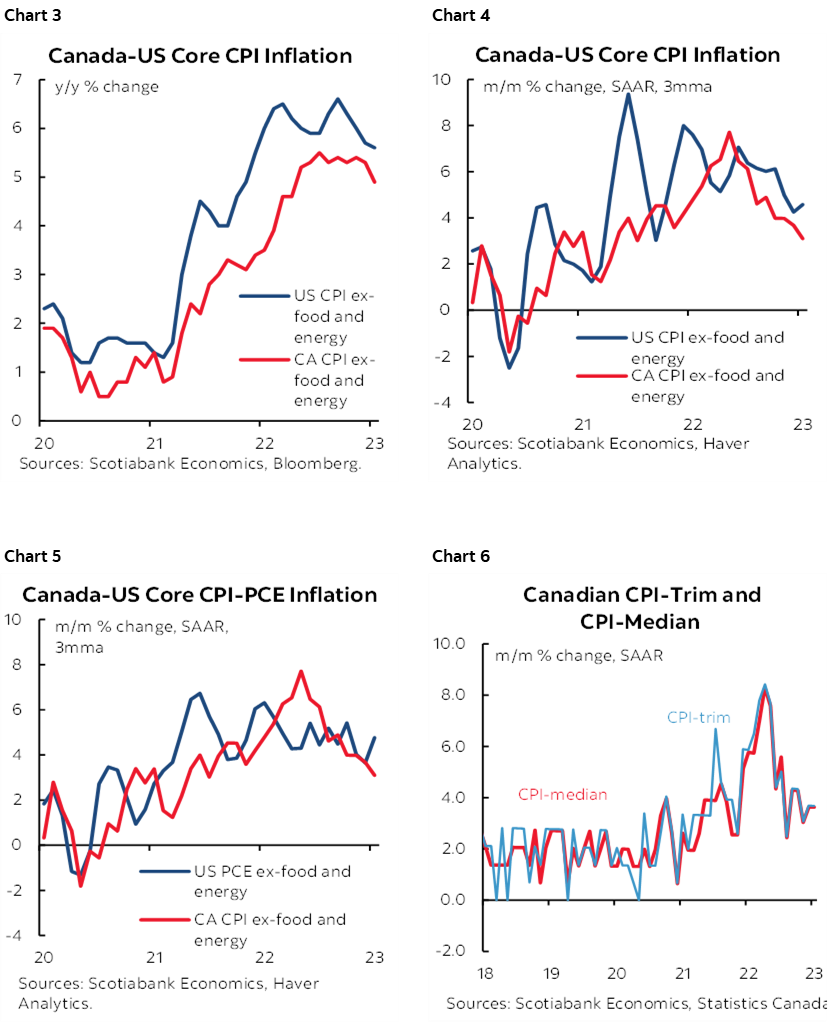

Whether it’s the case now that core CPI inflationary pressure is materially weaker on a sustained basis in Canada versus the US this time isn’t clear to me. Chart 3 shows little difference in one measure being the year-over-year CPI ex-food and energy inflation rates that are 4.9% y/y in Canada and 5.6% in the US which isn’t a meaningful difference in my opinion especially since there are material measurement differences. Chart 4 compares m/m annualized rates of core CPI inflation and arrives at a similar conclusion. Chart 5 compares m/m annualized core CPI inflation to the Fed’s preferred core PCE gauge and reveals something similar. Finally, chart 6 shows the BoC’s preferred trimmed mean and weighted median core CPI gauges that continue to run warm at well above a 2% target rate.

In my view, Canada continues to face more inflation risk over time than the US. Its labour productivity absolutely blows. Its labour market is tighter. Its labour unions are more activist. Its currency is sinking versus a strong USD. Output gaps as a relative driver of inflation? Oh please, gimme a break, it’s totally fabricated and made-up data in a cycle that has little to do with gap drivers of inflation anyway. Canada enjoys an ongoing terms of trade lift to its economy. Its governments continue to spend into another budget season. Its nonfinancial corporate balance sheets are strong. There is very little housing inventory to accommodate surging immigration stimulus with the fastest population growth among a peer group of industrialized nations. There is more services pent-up demand in Canada than the US. Its exports benefit from what is so far a resilient US economy marked by very strong consumer finances. Canada’s household finances are weaker but the one-trick ponies that scream about developments in the tails of the distribution of mortgage debt are ignoring the rest of the macro picture and exaggerating the frailties with 60% of Canadian households not having a mortgage through heavy use of anecdotes. The tail within the 40% who do own a home with a mortgage who are the most pressured who took out variable rate mortgages at the pandemic low for rates and pandemic highs for house prices and didn’t lock in are experiencing unfortunate pain. Unfortunately, however, the purpose of monetary policy tightening is to rein in their activities and to do so in the context of the broader macro picture that has many other moving parts in an open economy that is highly influenced by commodities and external developments. The adjustments they face with their homes need to be considered in the context of the adjustments in response to a massive influx of higher immigration. Further, measures of supply chain progress are mixed as the manufacturing PMI indicates lengthening lead times versus the Ivey PMI’s improvements, while cautioning that Ivey is an overly broad mishmash of public and private sectors.

Last, the inflation fight is about the long game, not the last one or two reports for anything. I’m still of the belief that the inflation regime has pivoted toward permanently higher inflation risk and how the world economy is at a highly nascent stage of addressing this. Debasing the currency in long lived fashion against the backdrop of a holistic interpretation of the macro picture could well prolong Canada’s inflation fight. The country has a choice. More rates pain. Or more inflation pain for longer.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.