ON DECK FOR THURSDAY, MAY 4

KEY POINTS:

- Global markets pit central banks versus US regionals

- US regional bank woes continue…

- …but markets are holding the fort against systemic risk

- Global central banks are not backing off…

- …with the ECB up next and facing 25 or 50 & bias uncertainty…

- …as Eurozone core inflation and wage pressures intensify…

- …while Norges Bank escalates hawkishness…

- …following this week’s hikes by the Fed, RBA & Negara

- BoC’s Macklem to deliver key inflation speech

- US productivity and labour cost figures to add to inflation concerns

- US mass layoffs picking up, still low enough for net job growth

- German exports give back prior gains

Most of today's focus in the aftermath of the Fed's decisions (recap here) is moving onto renewed concerns around US regional banks and the ECB plus key inflation- and job-related readings in the US and a potentially key BoC speech.

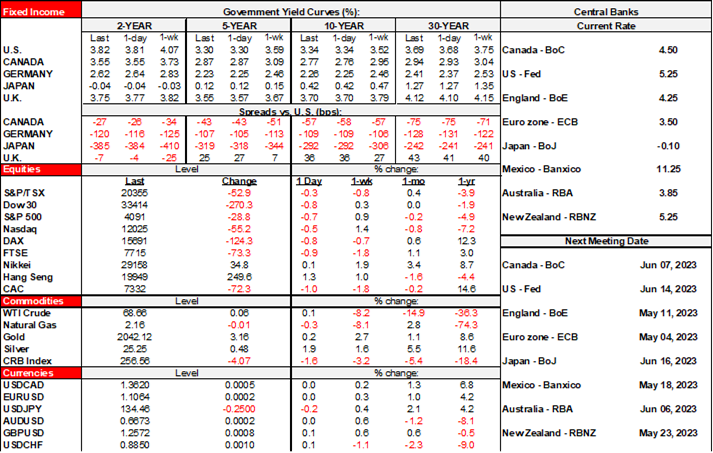

US Treasury yields had been shaking off some of the late day rally as 2s cheapened earlier this morning but are losing much of that with only mildly higher yields at the point of publication. Shorter-dated European yields are largely treadingwater waiting for the ECB. US and Canadian equity futures are a little lower while European equities soften by up to about 1% ahead of the ECB. All of this could easily change in significant ways this morning.

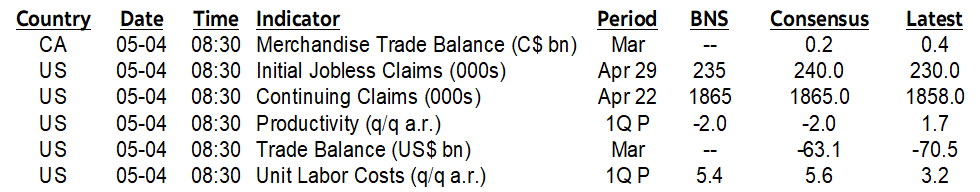

PacWest's headlines after the Fed yesterday afternoon dominated but they are trying to do damage control this morning without much success alongside TD’s cancelled acquisition of First Horizon. Having said that, it’s possible that there is a fallacy of composition bias in much of the coverage of US regional bank woes. In other words, that the problems that plague the US regional banks—that are akin to a developing economy’s banking system— must aggregate up to problems for the entire financial system and absent the tools to accommodate the risks they face. The evidence says other in my view. Enter charts 1–3 that show measures of equity market volatility, interbank risk, and corporate credit spreads. Mild deterioration reflects a natural repricing of cyclical risk, but to this point we’re just not seeing the systemic risk premiums and severe dislocation effects being priced into markets. That can’t be ruled out in future, but so far all of the regional banking turmoil is mostly being taken in stride in a sound core banking system.

Norges Bank hiked by 25bps as widely expected and which was consistent with prior guidance. It not only guided that another 25bps was likely at the next meeting but also said that a soft krone and wage pressures may motivate a higher terminal rate than previously expected. Central banks are hardly backing off across recent decisions by the Fed, RBA, Norges and Negara. The common market narrative that central banks are messing up and markets know better may ultimately come true, but thus far it continues to result in flat out wrong expectations to date. Causing damage through tightened financial conditions and weakened aggregate demand that adds recession risk remain the entire point of the exercise but short of sparking a full blown crisis.

German trade figures cratered in March but that was significantly due to the high starting point created by the prior month's strong gains. Exports fell by 5.2% m/m (prior +4%). Imports fell 6.4% (prior 4.4%).

On tap will be three primary focal points.

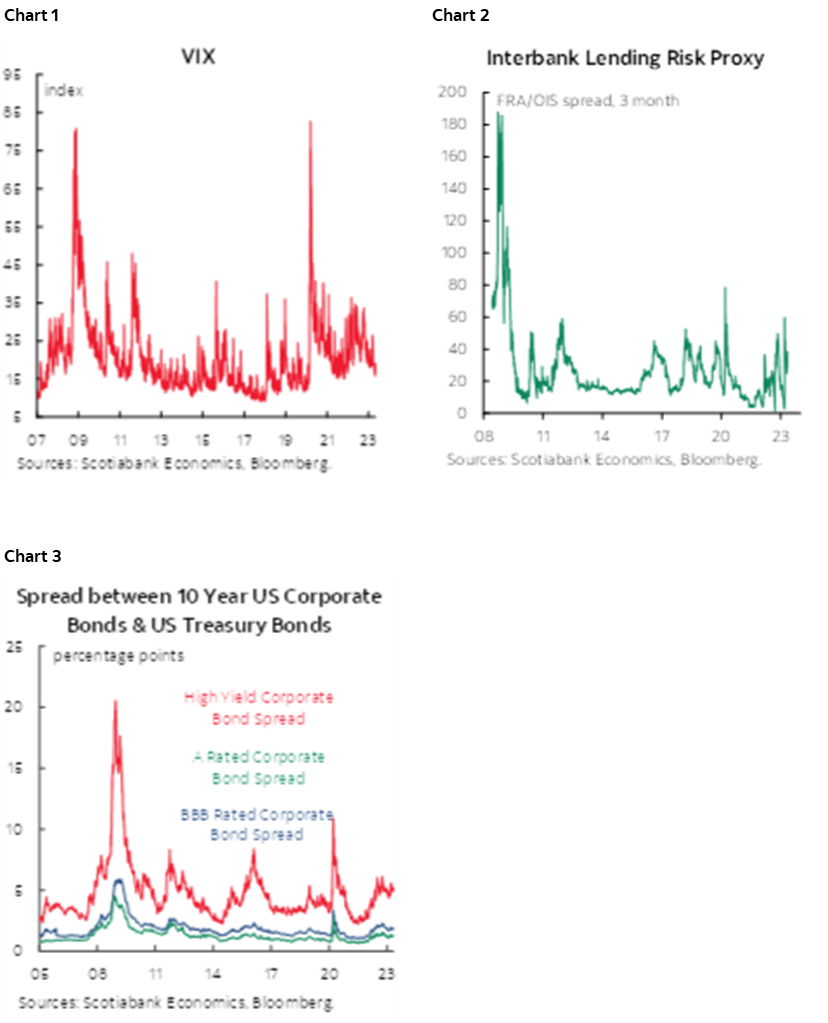

The ECB faces a somewhat divided consensus on whether it will hike 25 or 50 today and how that decision may impact forward rate guidance if provided. The statement lands at 8:15amET and will be following by President Lagarde’s presser 30 minutes later. A significant minority of just over one-fifth in consensus expect a 50bps move and markets are priced for a few points more than a quarter point lift. Some interpreted core inflation as weakening of late by quoting year-over-year figures. I don't think that's the correct approach as core price pressures at the margin remain hot. If the ECB agrees then they may flag persistent concern if not escalating inflation risks. Month-over-month core cpi has been rising by among the fastest rates compared to like months in years past throughout this year with chart 4 repeated from earlier as the latest evidence of high incremental price pressures alongside rising wage pressures (chart 5) that are fanning more inflation than I think some of the coverage is judging.

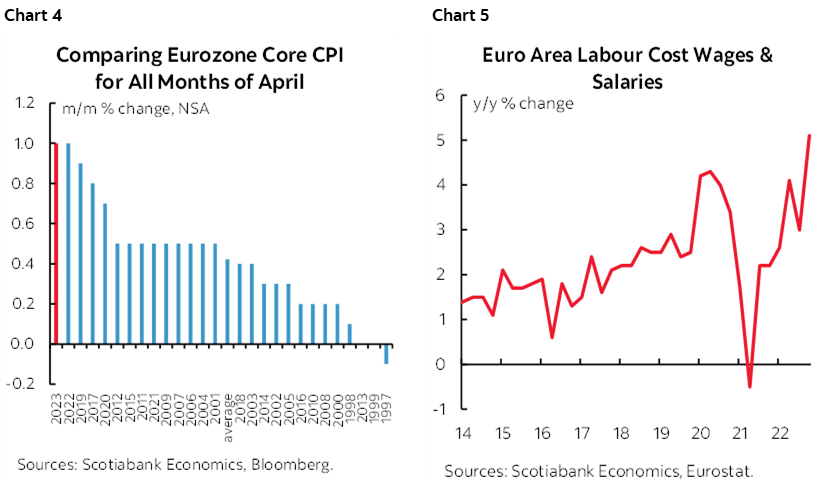

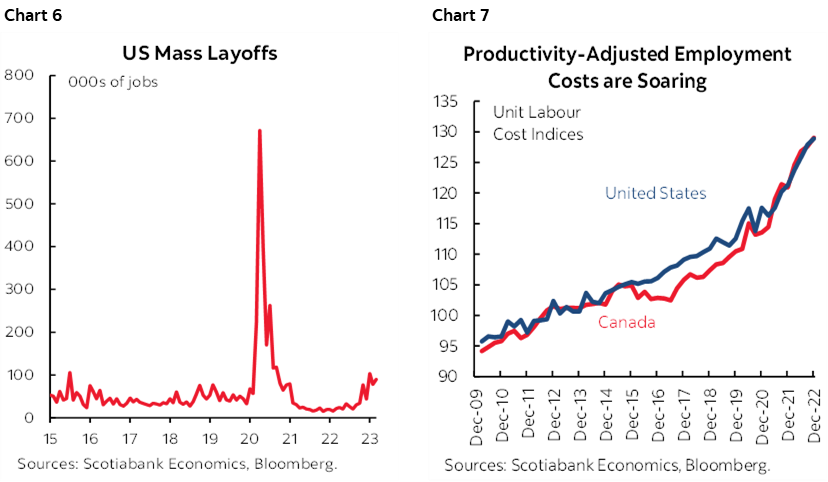

US job market readings will continue to be a warm-up for tomorrow's big payrolls show. Challenger job cuts during April (7:30amET) and Q1 productivity and unit labour costs (8:30amET) are due. Cuts have been rising for a few months but not yet to levels that would threaten bet job gains (chart 6). Productivity is likely to tank given the gain in hours worked and soft headline GDP (even though details were better). That means that unit labour costs (productivity-adjusted labour costs) will probably jump higher and fan more concern around inflation risk (chart 7).

BoC Governor Macklem speaks on inflation (1:05pmET) and with a full press conference this afternoon (2:15pmET). I think inflation is at a renewed upward inflection point and it will be interesting and potentially impactful to hear his views. House price inflation is returning and wage pressures may be intensifying. On that note, the strike by CRA workers ended this morning and the agreement raises wages by about 3% per year from 2021–24 plus a $2,500 lump sum payment per worker. Major wage settlements in Canada are cementing 3% range gains over multiple years which adds upward pressure to the BoC's 2% inflation target. They risk being copied in other agreements.

Canada also updates trade figures for March that are unlikely to garner much market attention but will help Q1 GDP tracking for whatever that’s worth.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.