ON DECK FOR TUESDAY, OCTOBER 17

KEY POINTS:

- US Treasuries, Canadas bear steepen

- Canadian CPI to inform BoC risks…

- …after surveys indicate a further unmooring of expectations

- Core US retail sales expected to be soft

- Gilts steepen, sterling slips on cooler wage pressures

- NZ$ drops, kiwi front-end rallies post CPI

- The case for BoJ hikes heats up

- A$ climbs as RBA minutes signal “low tolerance” for sticky inflation

- Strong US bank earnings

Bear steepening, until the bottom falls out.

That remains the dominant narrative across the US and Canadian sovereign curves in the context of fluid developments in Israel and the broader Middle East. UK and NZ markets are going the other direction on data, while EGBs mope along. As conditions continue to be monitored amid frenzied diplomatic efforts including Biden’s visit today, we can focus on potentially more pedestrian matters like a heavy line-up of fundamentals to consider. At the top of that list is Canadian CPI that may be the most impactful upon relative central bank narratives. Overnight developments were fairly light ahead of US earnings and retail sales.

CANADIAN CPI’S ‘UPS AND DOWNS’ ARE MOSTLY ‘UPS’

Consensus estimates for Canadian CPI range between -0.1% to +0.3% with equal numbers of forecasters in the 0, 0.1 and 0.2 buckets. I’m in the 0.2 bucket. It’s NSA data at a time of year with positive SA factors, so SA CPI could be up 0.4–0.5% m/m if my estimate is on the mark.

I don’t expect much of a role to be played by gasoline prices or food, which is part of the reason for relatively subdued headline expectations.

It’s not headline that matters to the BoC in this one though. Of course, they target 2% headline over the medium-term, but operationalize achievement of that target by using narrower measures that weed out some of the more volatile noise.

What matters much more are the underlying inflation gauges, namely trimmed mean and weighted median CPI. These measures have been excluding things like mortgage interest and gasoline, so forgot the talk of how the BoC is being fooled into believing that inflation is hot because of their rate hikes. That’s just nonsense. Amateur hour, in fact.

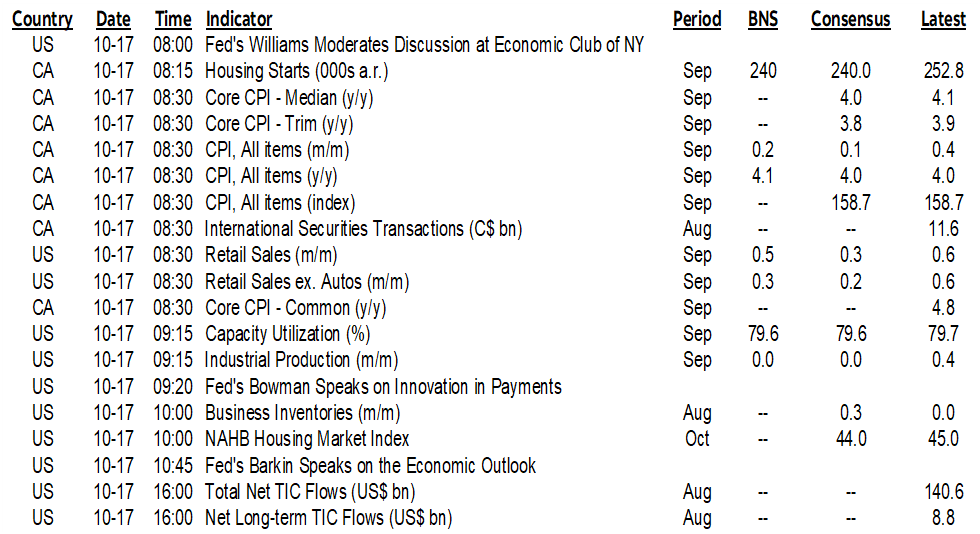

These two measures both landed at 5.4% m/m SAAR in August and are tracking at about 4½% m/m SAAR on a 3-month moving average basis (chart 1). That’s far too hot for the BoC’s liking especially given real wages and productivity, inflation expectations, and other key drivers of the inflation complex. Another hot print could add to pricing for next week with roughly half a hike priced. I’m expecting some heat in seasonal categories that pass through a full year’s worth of cost increases.

How the BoC reads the data is uncertain. Recall DepGov Kozicki’s comment after the August data ripped higher when she dismissed it as data that just follows “ups and downs.” If it’s another up today, that’ll be hard to do in an extension of the heated pattern. If it’s cooler, will it just be “ups and downs” again or will the BoC seize upon the evidence of a cooler print and reveal a rather opportunistic and biased interpretation of the data?

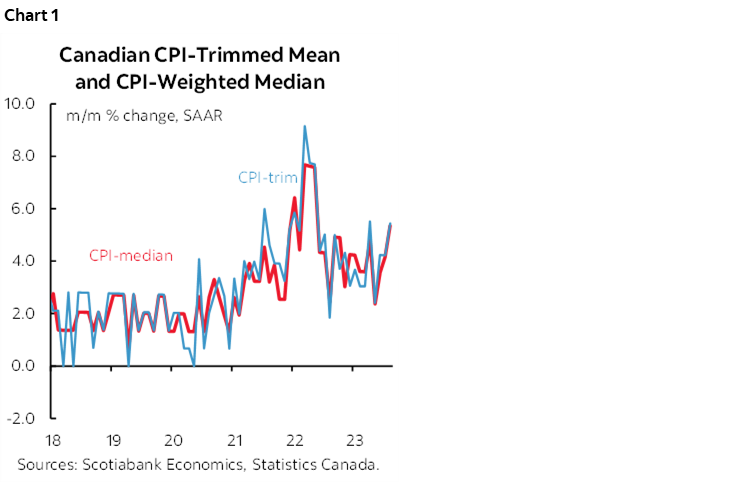

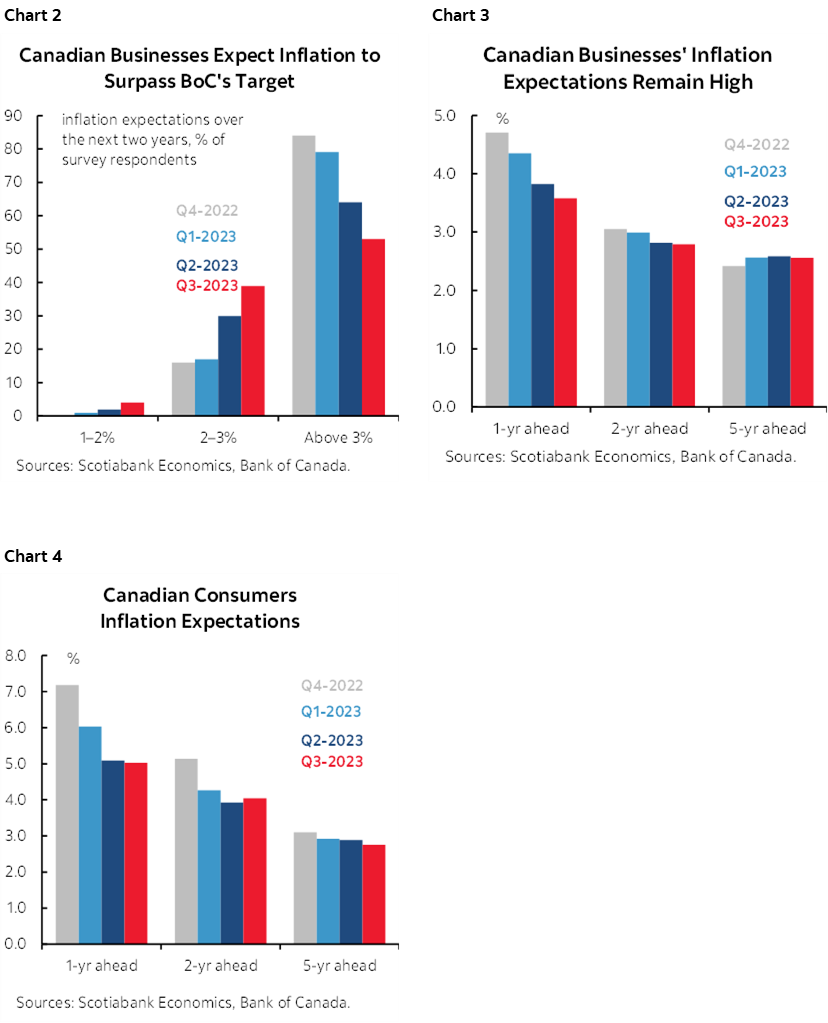

Juxtapose this latest pending evidence on inflation against yesterday’s BoC surveys. Charts 2–4 show that inflation expectations remain unmoored. Charts 5–7 show high wage expectations, although one of either businesses or consumers will be wrong despite both measures being elevated, plus rebounding house price expectations.

In addition to the monthly gyrations in inflation data remains the valid point that we’ve moved into a more dangerous phase for the BoC. One in which behaviour has changed as consumers and businesses give up faith in the BoC’s ability to hit 2% over the medium-term and are thereby adjusting their behaviour and wage setting exercises accordingly.

UK WAGE GROWTH DECELERATES

We got a partial take on the status of UK job markets this morning that should reserve at least some judgement for later. That’s because the more complete Labour Force Survey was delayed until next Tuesday and that’s the source for total employment changes and other details like participation and unemployment rates. So, for now, we have a limited take based solely upon wages and payrolls as a subset of employment that excludes the important small business sector.

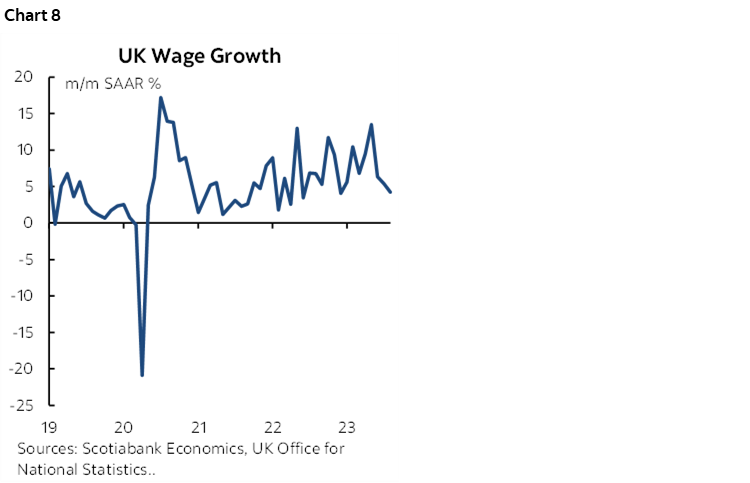

The results drove sterling to compete with the NZ$ (post-CPI) for the status of weakest cross this morning, while the gilts curve bull steepened. It’s not the year-over-year wage figures that matter, it’s the evidence at the margin and free of base effects. Wages ex-bonuses grew by 4.2% m/m SAAR in August for the coolest reading since last December while maintaining a four-month path of decelerating readings (chart 8). We’ve seen decelerations before—including this year—and how they reversed, but for now, markets are taking it as given the BoE’s Bailey justification to go merrily skipping along Threadneedle street on November 2nd.

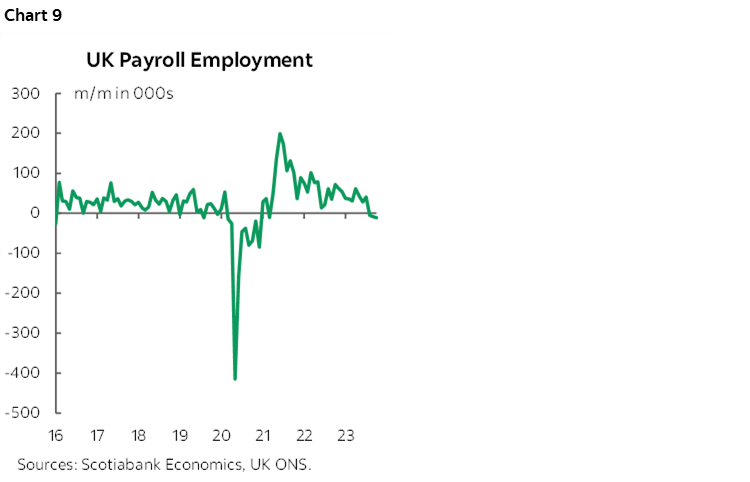

UK payrolls fell 11k in September with slight negative revisions for the third straight decline for about 23k lost payroll positions since June (chart 9). Next Tuesday’s total employment figures will cover August and have been falling for the prior three months.

NZ INFLATION DRIVERS WEAKER KIWI DOLLAR

Shifting gears, NZ CPI was softer than expected and that drove the NZ$ to be the weakest among the majors to the USD while the front-end rallied a touch. To be clear, the numbers were not soft; just softer than the guesses. CPI was up 1.8% q/q in Q3 in NSA terms which was hotter than normal seasonality compared to like quarters in history but missed consensus by a tick. Likewise for non tradeable CPI, up 1.7% q/q, but missed by a tick. Tradeable CPI had the biggest miss at 1.8% q/q (2.4% consensus), even though it too was among the hottest on record compared to like quarters.

US RETAIL SALES

Gains in vehicle sales volumes (+4% m/m SA) and gasoline prices (+1.7% m/m SA) could influence upside risks given that upon weighting them they would add about 0.7 ppts to m/m retail sales for September (8:30amET). One key will be core sales ex-autos that are expected to be soft. Another key will be the retail sales control group that influences how the numbers are captured in consumer spending with the GDP accounts.

BOJ HIKE CASE HEATS UP

Several impactful headlines hit this morning that may reinforce expectations for BoJ rate hikes. Anonymous officials indicated that the BoJ is considering increasing its inflation forecast to 3% this year and raising next year to 2% or higher while maintaining FY25 at 1.6%. Earlier this morning, Japan’s key unions announced it is seeking 5%+ wage gains into the coming Spring round of wage negotiations. If they achieve this, then it would add further confidence toward achieving 2% inflation on a fairly durable basis.

RBA MINUTES FAN ONGOING HIKE RISK

RBA minutes said that “the board has a low tolerance for a slower return of inflation to target than currently expected.” That signals that while the case for a pause was “stronger” at that meeting, should inflation persist higher than expected then they won’t hesitate to hike again. Unfortunately headlines also hit about unionized RBA staff considering a strike in favour of higher wages. They’re human, competing in a market for talent, and dealing with many of the same pressures as everyone else, but the optics of trying to control inflation while your staff goes on strike seeking higher pay don’t exactly sit well with regular folks. Suck it up, except for us...

US EARNINGS

9 S&P500 firms release today including Goldman, BoA and BoNYM in the pre-market. BoA’s release was taken positively by its share price. Goldman’s results look strong across the board.

Other than all of that, we’ll also get Canadian housing starts for September (8:15amET), US industrial production for September (9:15amET) and several Fed speakers throughout the day.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.