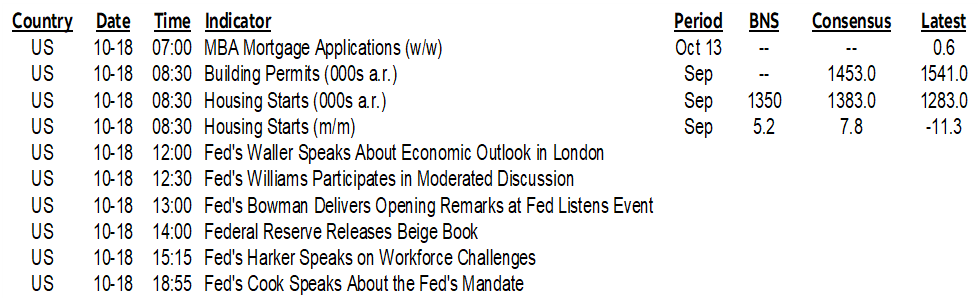

ON DECK FOR WEDNESDAY, OCTOBER 18

KEY POINTS:

- Oil punches higher on Middle East tensions

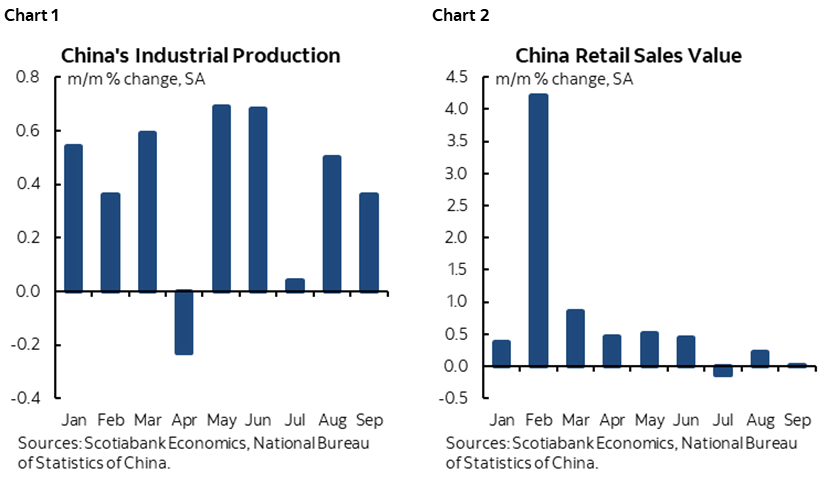

- China’s macro data wasn’t terribly impressive

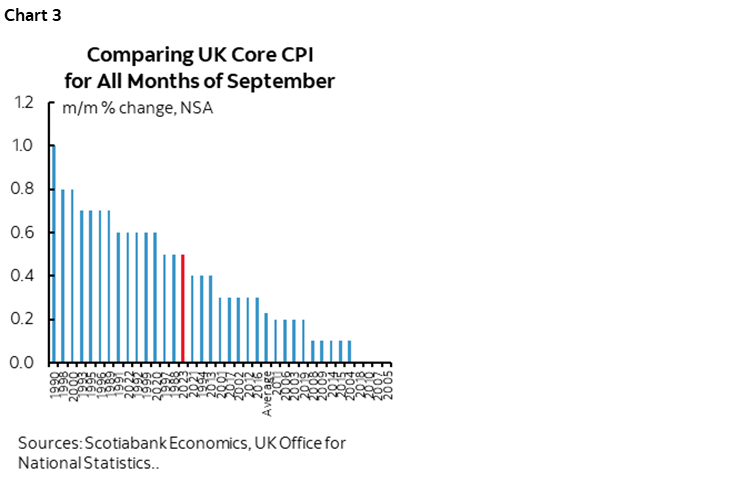

- UK CPI was a snoozer to BoE expectations

- Hawkish RBA remarks push up yields down under

- More US bank, tech earnings on tap

- The head nodding Canadian consensus

It’s a bit of a dull session by way of any truly fresh catalysts as we await Fed Chair Powell’s remarks tomorrow after a string of strong readings from nonfarm to core CPI and retail sales alongside strong GDP tracking. Chinese data didn’t beat by as much as the headlines suggest. UK inflation was a snoozer that probably changed nothing for the next BoE decision. RBA comments were hawkish sounding. Middle East tensions are pushing oil prices up by about US$2½ across WTI and Brent after Iran called for an oil embargo on Israel and both sides levy claims the other one was responsible for a hospital bombing amid shaky proof. There is very little to consider on tap out of N.A. today.

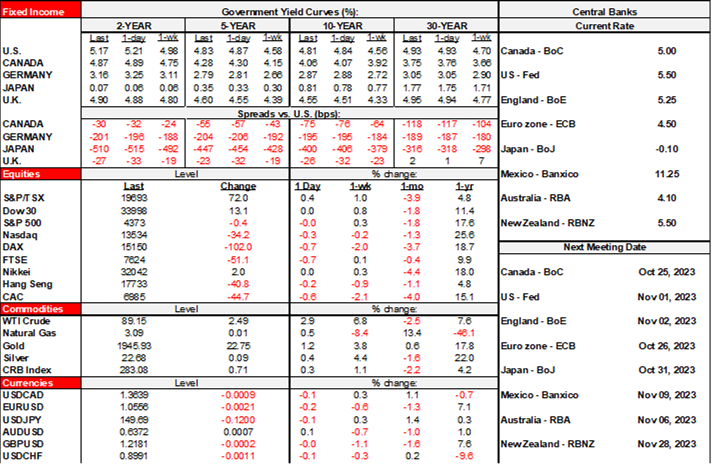

Stocks are mildly lower across N.A. futures and European cash markets. Chinese stocks fell, either because they interpreted the China macro data the way I did, or assumed good news was bad news for further stimulus hopes. US Treasuries are outperforming other curves in bull steepener fashion while gilts underperform post-CPI but not as much as Australian rates after RBA remarks. Canada’s curve is also slightly bull steepening.

China’s economy beat expectations but not by as much as some of the headlines suggest. Q3 GDP grew by 1.3% q/q SA which was greater than the 0.9% consensus, but that was significantly because the prior quarter was revised down by three-tenths to +0.5% q/q SA. A weaker than previously understood prior quarter offered a lower jumping off point off which to post growth. The quarter ended a little more favourably than expected for industry as industrial production (chart 1) was up by 0.36% m/m SA and held at 4.5% y/y (4.4% consensus). Retail sales, however, were flat (chart 2) upon exiting the quarter as they landed unchanged in September (0% m/m SA) despite the y/y rate beating expectations (5.5%, 4.9% consensus).

UK CPI was a bit of a yawner in my opinion. Contract pricing for the November 2nd meeting initially added a couple of basis points or so, and then reversed to being unchanged at a low probability of a rate hike. Gilts are otherwise underperforming most other sovereign curves except for Australia’s, as UK yields are up by 4–5bps across most maturities. CPI was up by 0.5% m/m NSA and in line with expectations while the year-over-year rate was a tick above consensus at 6.7%. At 0.5% m/m NSA, core CPI was slightly firmer than a typical month of September when comparing like months over time given it is seasonally unadjusted data (chart 3), but not by much especially given that the prior month was unusually soft by this same measure.

RBA Governor Bullock gave a speech overnight that upped the hawkish rhetoric. She said “The problem is that we’ve got shock after shock after shock and the more that keeps inflation elevated, even if it’s a supply shock, the more people adjust their thinking, the more entrench inflation is likely to become, so that’s the challenge.” Here here.

More US bank earnings are on tap into the pre-market followed by tech earnings in the after-market. Morgan Stanley and State Street land at 7:30amET and both Netflix and Tesla release in the after-market. The Fed’s Beige Book (2pmET) and several Fed-speakers are on the docket. Otherwise, US markets may spend the sessions nervously awaiting Powell’s speech and Q&A tomorrow.

Canada only digests housing starts (8:15amET).

The head nodding Canadian consensus has everyone aggressively stating that the first sign of an inflation soft patch in yesterday’s numbers (recap here) means that the BoC is done. Clearly. Obviously in fact. Oh yeah, for sure, no way they hike again. Just like in January....and just like the many times they were obviously done before that one as well. The sheep need to give their woolly coats a shake here as the data wiggle doesn’t invalidate the multi-faceted narrative that points to ongoing upside risks to inflation that make getting inflation durably on the 2% target difficult to achieve. I expect another pause next week, but for the BoC to sound less convinced than others.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.