ON DECK FOR THURSDAY, OCTOBER 19

KEY POINTS:

- Powell, BoJ speculation tag team to drive heightened market caution

- Powell should sound more hawkish than some other FOMC members

- BoJ speculation intensifies

- Bank Indonesia’s surprise hike did nothing to stem rupiah weakness

- Australia’s soft jobs report

- Light US, Canadian data on tap

He hasn’t even spoken yet and the Powell effect is rippling through global markets this morning.

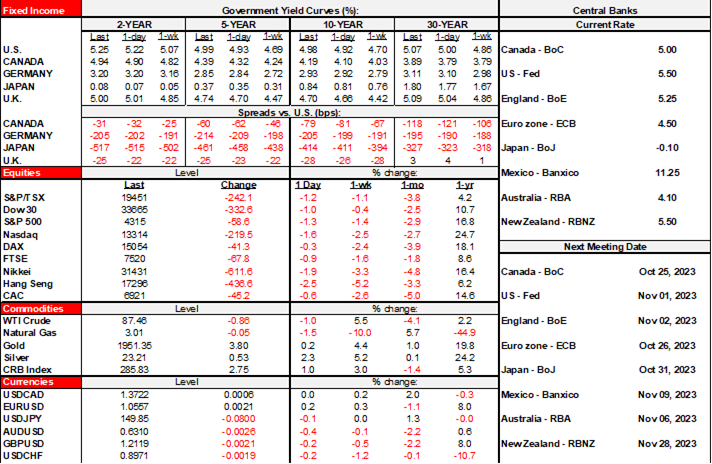

The USD and euro are broadly stronger along with safe havens like the yen and Swiss franc. Sovereign yields are under mild upward pressure including further slight bear steepening in the US and with Canada’s curve slightly underperforming. Rising bond yields are performing like one of those annoying Alexa devices. Alexa stop. Alexa Stop. ALEXA STOP! <window opens, Alexa learns to fly…>. Stocks are mildly in the red across N.A. futures, European cash markets, and after Asian benchmarks sold off by 1–2% overnight. Oil is down by over 1% as it tangoes with the dollar. Or maybe it’s the cha-cha.

The main focal point will be Fed Chair Powell’s appearance before the Economic Club of New York today at noon. I don’t see it listed so far under live events on Bloomberg but it will be available on youtube here https://www.youtube.com/federalreserve, although you may need to use your other devices to get around any employer blocks. The FOMC slips into blackout on Saturday, and so if he has anything to add by way of influencing expectations ahead of the November 1st decision, then now is the time to do it. He will deliver formal prepared remarks and then engage in Q&A.

There is plenty of scope for surprise in this one. I’m sure that one thing he won’t say is to provide a definitive all clear on further potential hikes being ruled out. The risk is slanted toward being hawkish. Data has been very strong. Two years into higher market yields and resilience remains the theme. GDP is out next week and likely to arrive at around 4% q/q SAAR. Payrolls are strong after the 336k gain in September alongside +199k in revisions. Core CPI has been firming again. Oil prices have been trending higher since July and this time they can’t deploy the old playbook that looks at this as a relative price shock that’s disinflationary on second round effects; higher consumer capacity to pay and passthrough effects at an inflationary starting point make for a different dynamic upon recalling the dangers of monetary accommodation 70s style. Strong retail sales are adding to the narrative on the generally strong state of the consumer.

With that as the backdrop, the dots signal one more hike this year, but several Fed speakers have indicated they are fine with taking a pass at this meeting in order to assess further information.

- Does the Chair agree with the ones who have weighed in?

- How he judges inflation risk is going to be closely followed especially following a pair of recently firmer core CPI readings with core PCE due one week from Friday. Powell spent a lot of time in his last press conference talking about surprisingly resilient GDP growth and what that means to future inflation risk and the data has strengthened since then.

- will he update thinking on higher now versus higher for longer and relying on lag effects? To date he has tended to walk somewhat down the middle by referencing lag effects while nevertheless saying they are shorter today than in the past (ergo why is everything so resilient?).

- Will he slant his speech toward signs of softening as indications tighter monetary policy is working? He could point to credit figures and housing data amid expectations for further tightening of financial conditions.

- How does he view bond market developments? As a substitute for hikes? As over tightening? Does the selloff merely reflect higher for longer guidance? Should the Chair embrace former NY Fed President Dudley’s QT-or-bust advice, with two more years of aggressive run-off regardless of Treasury market volatility? Or will he address other drivers, some of which I’ve written about? I would expect him to be rather circumspect toward bond market developments not least of which to avoid the kind of hubris that marks some of the commentary.

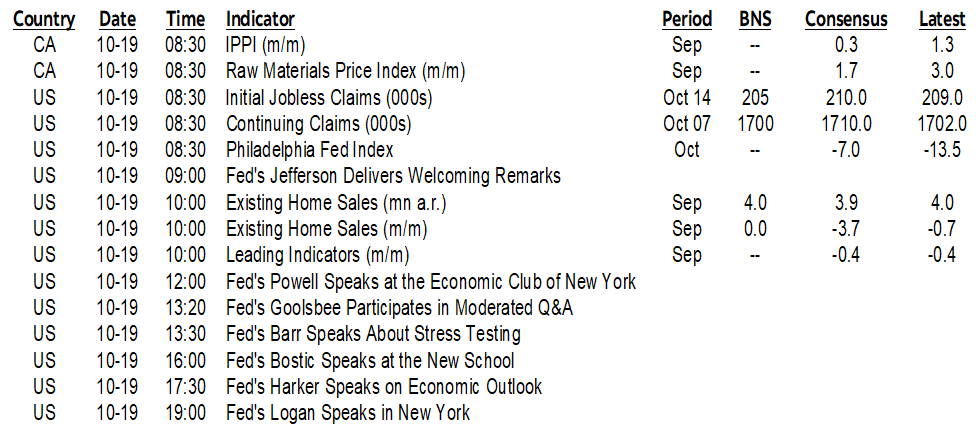

Further speculation toward Bank of Japan moves contributed to a JGB sell off that’s also not helping other sovereign bond markets this morning. A former BoJ board member, Makoto Sakurai, said the BoJ could hike and eliminate its negative policy balance rate at either the October 31st or December 19th meetings this year. That sounds like trick over treat on Happy Halloween. OIS markets were already largely priced for such an outcome. The rest of the curve may not be, alongside the possibility of further measures, so JGB 10s remain a one way trade that has rocked global bond markets since summer (chart 1).

Australia’s modest 6,700 employment gain was marred by soft underlying quality. Full-time jobs fell by 40k and so a 46.5k jump in part-time jobs drove the small net gain. The labour force shrank as the participation rate fell three-tenths to a still high 66.7%. Hours worked fell by 0.4% m/m SA and have been on a slight softening trend since April. The A$ dipped a touch on the release but I wouldn’t say it was any worse of a performer to the USD than many others given broad USD strength. The Australian front-end shook off the report.

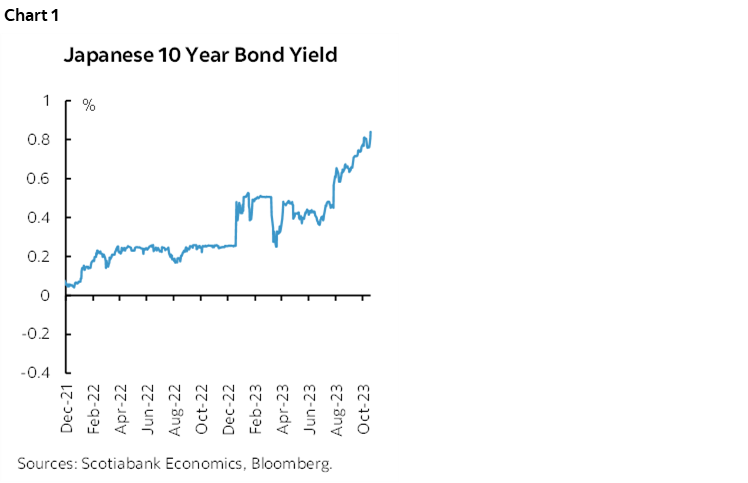

Bank Indonesia surprised markets with an unexpected 25bps hike that took its 7-day reverse repo rate up by 25bps overnight. Only one economist out of 31 locals got it right. The stated aim was to address weakness in the rupiah that raises risks to financial stability and imported inflation. It didn’t work. All the rupiah did post-announcement was to reverse some of the appreciating pressure into the decision and wind up weaker on net for the session and extend the pattern of softening (chart 2). Broadly based USD strength was too powerful for BI’s decision to stand much of a chance.

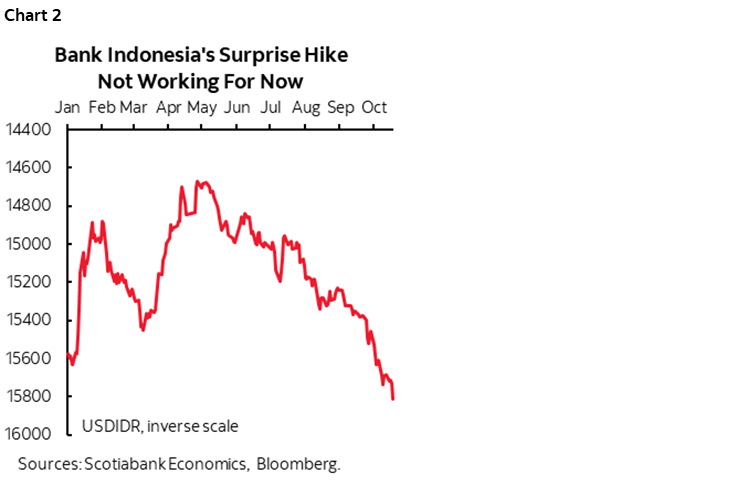

There will also be some light US data before we get to Powell for anyone who cares about anything other than the war in the Middle East, Fed guidance, or Jim Jordan’s rejection along with his extreme ideology. Weekly jobless claims have been trending very low (8:30amET). The Philly Fed’s gauge will further inform risks on the path to the next ISM-manufacturing report (10amET). Existing home sales are expected to fall again (10amET). Canada updates producer prices with no real implications for next week’s BoC (8:30amET).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.