ON DECK FOR THURSDAY, APRIL 11

KEY POINTS:

- US Treasuries stabilize post-CPI, BoC still ignored

- As markets modestly back off ECB pricing for June…

- …will Lagarde indicate less confidence in easing?

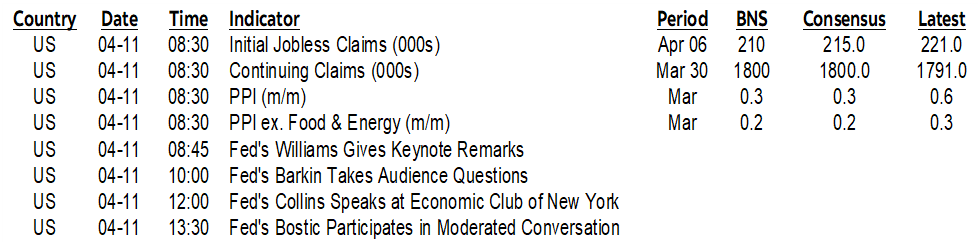

- China’s core CPI was the weakest since the GFC…

- …but distorted by a prior gain on Lunar New Year effects

- US producer prices to begin reflecting higher energy prices

- Oil markets on guard following US warning about Iran’s intentions

- Canada quiet, rest of week may be sensitive to Budget guidance

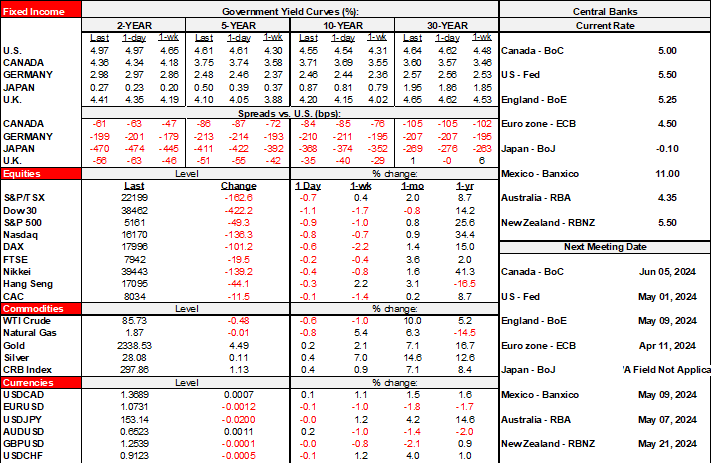

Markets have calmed down somewhat in the wake of US CPI (recap here). Overnight markets reacted in lagging fashion, but US Treasury yields are little changed so far and thus consolidating yesterday’s bond market selloff. Equities continue to edge lower. The next focal point will be gauging ECB confidence. There is no follow through on the BoC’s communications that were ignored yesterday in favour of all the attention that was placed on US CPI and its potential implications for the Fed and by extension the BoC (recap here).

Chinese Core Inflation Weakest Since the GFC

China updated inflation figures for March overnight. The last time China’s core inflation reading was this weak was back in the GFC (chart 1). Core inflation fell -0.6% m/m NSA, or -4% m/m SAAR and ebbed to 0.6% y/y from 1.2% the prior month. Part of the explanation for the weakness has to do with the shifting timing of the Lunar New Year that was on February 10th this year. That was later than average, and it sometimes falls in January, which means that the period of peak holiday spending was well into February. That could explain why February’s core prices were up by 2.8% m/m SAAR and so March retreated from that holiday-driven gain. The details support this view as the weakening was pronounced in categories like recreation and education (1.8% y/y from 3.9% prior) and transport/communications (-1.3% y/y, -0.4% prior). But the magnitude of the retreat also plays to the narrative that disinflationary forces remain prevalent due to excess capacity, just not as acutely as the headline readings suggest.

Should we call it deflation? Not by the standard definition most economists would apply that says deflation occurs when an economy-wide decline in general prices occurs for a lengthy period and is expected to persist while driving changed behaviour that, through postponing purchases into a cheaper environment, drives more downward pressure on prices. That can be a very difficult scenario to turn around and it’s highly premature to be calling what China is experiencing true deflation. More data is required to help inform developments.

Will the ECB Indicate Less Confidence to Ease?

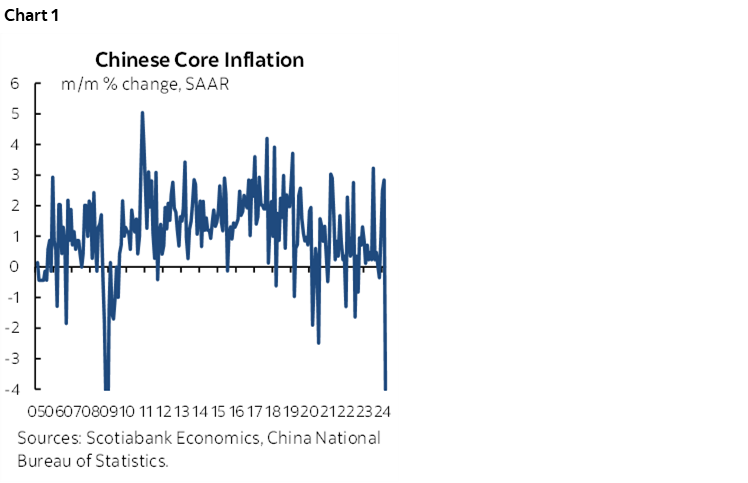

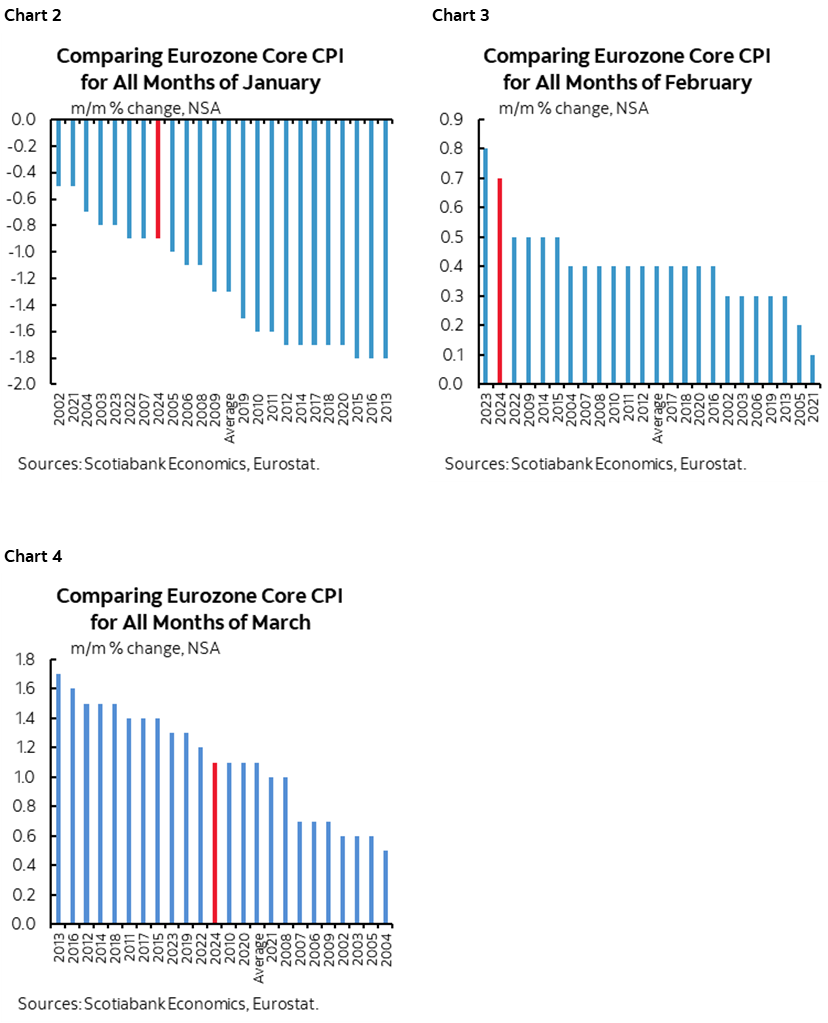

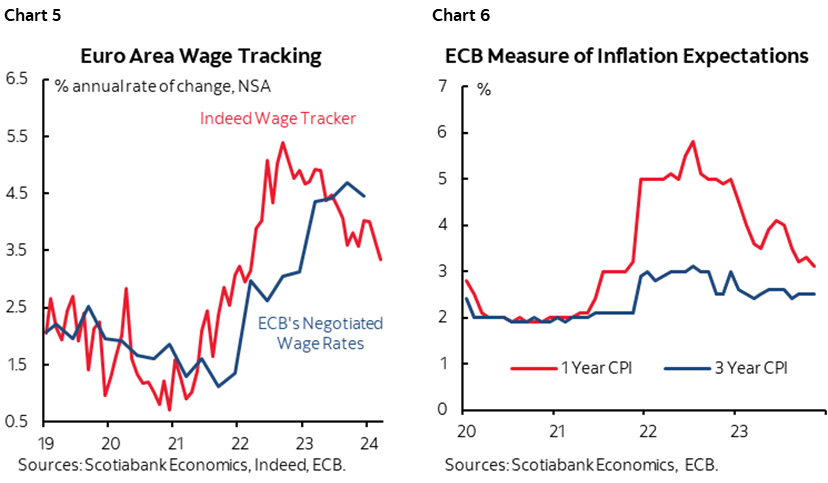

The ECB delivers its statement at 8:15amET and President Lagarde’s press conference will start a half hour later. This one is likely to be a placeholder between forecast meetings and ahead of the key June meeting – unless Lagarde hints that they are less confident toward easing in June than was reflected in the minutes to the March 7th meeting. I don’t think pushing the Fed down and out is something that the ECB can ignore in the wake of another hot US CPI report. Nor can the ECB ignore rising oil prices. Plus, they’ll get two more rounds of Eurozone inflation data and a better feel for the key Q1 wage figures coming out of the start of the year’s collective bargaining exercises before the June meeting. Further, the trend in m/m core CPI NSA has laid down a series of hotter than usual gains compared to like months in history which should merit caution (charts 2–4) amid improved but still elevated inflation expectations and wage gains (charts 5, 6).

It therefore makes sense to me from an uncertainty perspective that pricing for the ECB’s June meeting has backed off from a full -25bps to about -20bps which still seems rich to me.

Several Fed officials will have a chance to react to yesterday’s inflation figures between about 8:45amET and 1:30pm.

US producer prices will continue the focus upon inflation readings (8:30amET). Higher energy prices will probably drive a faster gain in total prices than core prices. Weekly jobless claims are also due out (8:30amET).

Geopolitical risk has oil markets on guard with the US warning that an Iranian missile strike on Israel is “imminent.” Headlines late yesterday were not followed by any developments overnight and so oil prices are slightly softer this morning but vulnerable to any further developments. Strikes could ignite tensions and supply concerns. At clear risk is a sharp escalation of developments.

Canada will be thankfully quiet. Other than home sales for March (tomorrow), the rest of the week’s calendar goes quiet. Watch for any further possible hints at what the upcoming Federal Budget may contain as they release its contents in dribs and drabs. That may be unlikely today, since the PM’s daily itinerary has him tied up with France’s PM, Gabriel Attal. Pay particularly keen attention to anything they may guide on taxes and mortgages given the guidance on both from the PM and FinMin.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.