| ON DECK FOR FRIDAY, FEBRUARY 23 |

KEY POINTS:

- Markets on calmer footings to end the week amid light developments

- ECB speakers continue to push back against nearer-term easing...

- ...as key wage figures won’t be available until the June meeting

- ECB’s inflation expectations remain sticky

- Fed-speakers did likewise...

- ...but Waller’s time-dependent guidance didn’t learn from the first time

- Scotia Economics continues to lead Wall Street on the Fed

- The BC Budget fired the opening salvo on big spending this budget season...

- ...and ignored Macklem’s warning almost as if to dare the BoC into Spring

- Quiet US and Canadian calendars today

Sovereign yields were edging a bit higher this morning but have since shifted toward a slightly lower bias as they moderate their initial reactions to Fed and ECB comments plus light data out of Europe. By now, markets have gotten most of the message that officials are in no rush to cut. Stocks are little changed across the bourses for the most part. The dollar is little changed on net. Oil is down by about a buck on supply considerations today.

Fed Officials Continue to Rule Out Nearer-Term Easing

Yesterday’s round of Fed comments carried into the evening and was generally characterized by a tone that pushed back against nearer term easing. Pricing for the May meeting has been reduced by an extra few basis points to nearly nothing. Vice Chair Jefferson, Governors Cook and Waller, Philly’s Harker and Minneapolis President Kashkari have all used different ways of expressing the same sentiment that near-term cuts are out of the question.

How much attention should we pay to what they say? Frankly, they’re in the same boat as everyone else as they watch and wait to see further data and developments. When Waller, for instance, said that they “need to see a couple more months of inflation data to be sure than January was a fluke and that we are still on track to price stability” it gave me a sense he didn’t learn after the first time he boxed himself in with time dependent guidance. Just stop with that. Recall that on November 28th, his remarks set the tone for markets to jump on March cut pricing when he—a perceived hawk, though inconsistent in my opinion—said that if declining inflation persists “for several more months, three months, four months, five months, we could start lowering the policy rate just because inflation is lower.” Ergo, 3–5 months out from late November sounded to markets like March. Not.

And so here we are and Wall Street’s ‘best’ forecasters keep pushing out their calls for the Fed’s first cut and in the process continue to catch up to Scotia Economics. Had to get that in, heh! Why not, support your local research. The ‘best’ were on the March bandwagon that I never subscribed to. Then they shifted to May and that’s likely out of the question, so now they’re shifting to June. Our forecast for a long time was June and we recently nudged that out to Q3 assuming everything goes just peachily. We’ll see. I just don’t see a need to rush given the renewed mild upward trends in m/m core inflation and wage growth, ongoing strong economic growth that indicates no move toward disinflationary spare capacity any time soon, strong household finances, geopolitical risk to shipping costs, strong wealth effects and resilient stocks etc etc.

ECB Speakers and Data Continue to Lean Against Nearer-Term Easing

Across the ‘pond’ we received comments from the ECB that also leaned against doing anything soon, meaning neither March nor April at a minimum. Governing Council member Joachim Nagel said “it is too early to cut interest rates” because “the price outlook is not yet clear enough.” Several officials have persistently flagged the need to see key wage data from the national accounts that arrives only by June 7th, a day after the June 6th ECB meeting but officials like the Chief Economist Lane have intimated they’ll have access to it by that meeting.

We also heard from ECB Executive Board member Isabel Schnabel who said “Our models tend to suggest the peak impact of monetary tightening may now be behind us.” If so, then that’s a hawkish signal in that it implies the economy is arriving toward a new equilibrium in the wake of prior tightening.

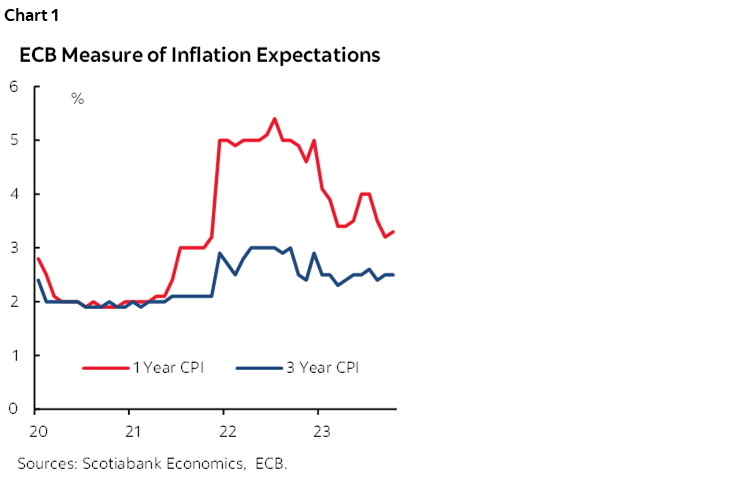

Arriving just ahead of these comments, the ECB’s survey of consumers’ inflation expectations was a bit stickier than expected (chart 1). The median response expects inflation to be 3.3% y/y over the next year which is up a tick from the prior month. The 3-year inflation expectation reading was stable at 2.5%. The 3-year reading has been largely moved sideways for a while now and seems to be settling in a bit above the ECB’s inflation target.

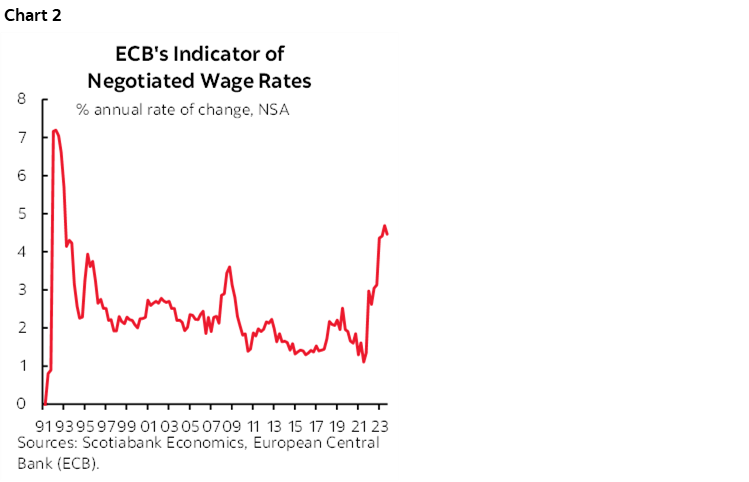

Then Lagarde weighed in, flagged that the tiny improvement in negotiated wages in Q4 (chart 2, 4.5% y/y from 4.7% in Q3) was “obviously encouraging” even though it was a minor move, but then noted that they need to see Q1 numbers that we won’t get until late May. She did so by noting “There are many sectors and employees that are covered by negotiations that will be completed in the course of the first quarter of 2024 and I think that those numbers will—especially if they continue to be encouraging—will be important for us to assess going forward in order to reach confidence.”

German IFO business confidence was little changed overall, but the expectations component edged a touch higher while remaining within the same range since last summer. We now have the suite of soft survey evidence for the month and it showed a mild deterioration in the composite PMI due to manufacturing, a mild pick-up in the ZEW investor expectations survey, and this IFO reading.

There is absolutely nothing of any interest on US and Canadian calendars this morning.

The BC Government Ramped Up Spending as it Gallingly Criticizes the BoC

Check out Laura Gu’s account of the British Columbia provincial government’s budget that was released after markets closed yesterday (here). The NDP government added $13 billion of new spending equal to about 1% of nominal GDP which is classic pump priming ahead of October’s election. Laura goes through the facts and figures in greater detail. This kind of spending is exactly what I’ve been warning about into this round of provincial and Federal budgets. Governments just can’t stop spending and hence adding to inflation risk. What is galling about it all is when they turn around and castigate the Bank of Canada for not cutting rates.

Well, Governor Macklem warned all of these politicians in advance. Back on January 24th during the press conference that followed the BoC’s decision, Macklem said “If governments announce more spending then it could certainly get in the way of that inflation goal which would not be helpful.” He said that after noting that fiscal policy that was already baked in before this round of budgets was adding to growth and fighting the BoC. So what did BC do? It dared the BoC. Taunted it. Eby poked a finger in Macklem’s eye. Ignored the warning. If there is hike risk in Canada, then I condition it upon what kind of picture we face into Spring after more data, more government budgets, and after we have a stronger sense of developments in the rate sensitive sectors and particularly housing with its spillover effects. Inflation expectations remain at or above the upper end of the BoC’s 1–3% target range amid evidence of changed behaviour in wage demands and tumbling worker productivity. When folks don’t believe in your inflation target and move on by changing behaviour in such ways, it can almost be like calling lights out for a central bank.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.