ON DECK FOR TUESDAY, JULY 16

KEY POINTS:

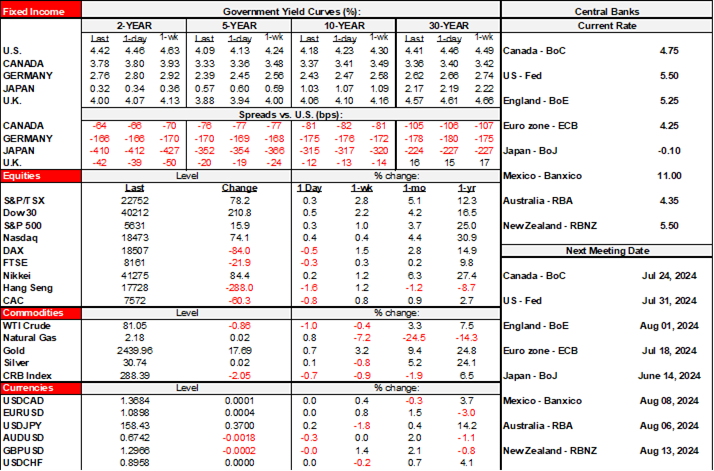

- Sovereign bonds rally, equities little changed to lower ahead of key data

- US retail sales are expected to be soft

- Canadian CPI may not matter to the BoC whatever happens

- Trump’s VP pick doubles down on a deeply divisive agenda with market implications

- US bank earnings continue

Sovereign bonds are richer, while stocks are flat in N.A. and mostly lower elsewhere. Taken together, markets are signalling a bit of unease this morning but with no material overnight developments to consider and after Chair Powell’s interview yesterday was a dull non-event. Canadian CPI and US retail sales will land at the same time which could complicate any hope of a clear reaction in Canadian markets. US bank earnings continue this morning with the focus on Bank of America and Morgan Stanley.

Canadian CPI—Hot or Cold, it May Not Matter

I went with 0.1% m/m NSA and SA for Canadian CPI and 0.2% m/m NSA or 0.3% m/m SA for traditional core CPI (8:30amET). I can’t tell you what to expect for trimmed mean or weighted median in m/m SAAR terms. No one can if they are being professionally honest.

If TM and WM are soft, Macklem cuts on July 24th by pointing to 5 out of the last 6 reports as having been weak and reinforcing that with freshened forecasts.

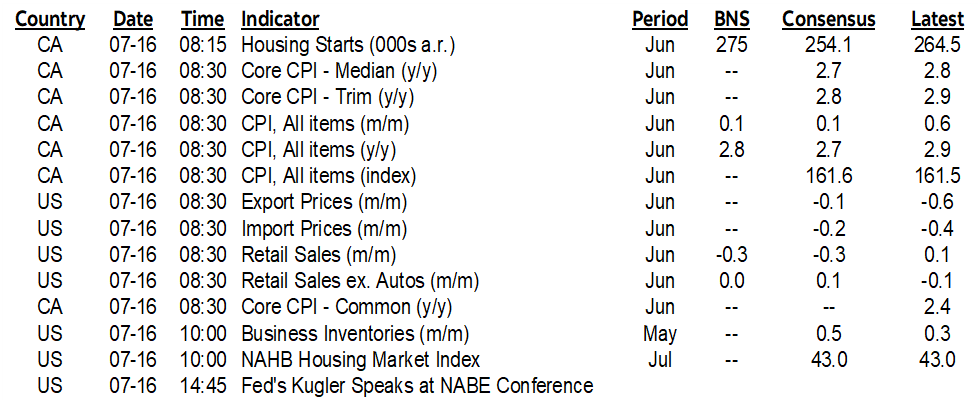

Another hot month following May’s reacceleration to 4.1% m/m SAAR for both preferred core measures (chart 1) makes a July 24th BoC cut more complicated, but not at all out of the question. Macklem has pivoted more toward how the BoC forecasts inflation to be on target well within the medium-term and relatively away from pure data dependence that he expects to be volatile. Their forecast for 2% inflation embeds an unknown path in Governing Council’s collective mind for the policy rate; if Macklem’s guidance that “several cuts” are reasonable to expect is not delivered, then they are signalling that inflation would be more likely to undershoot.

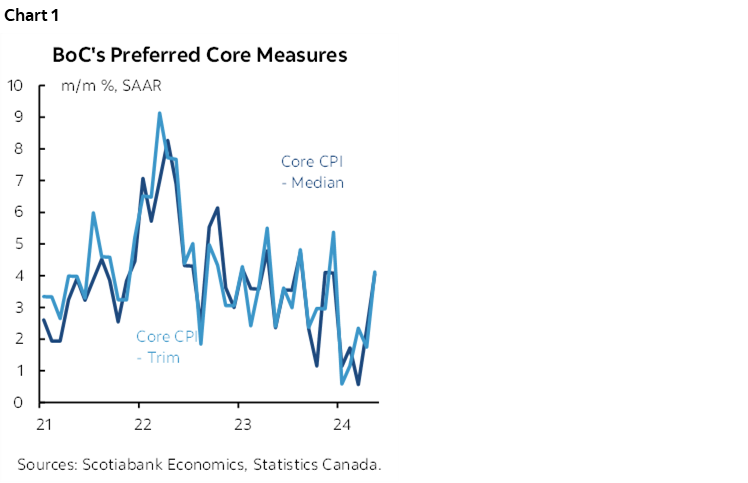

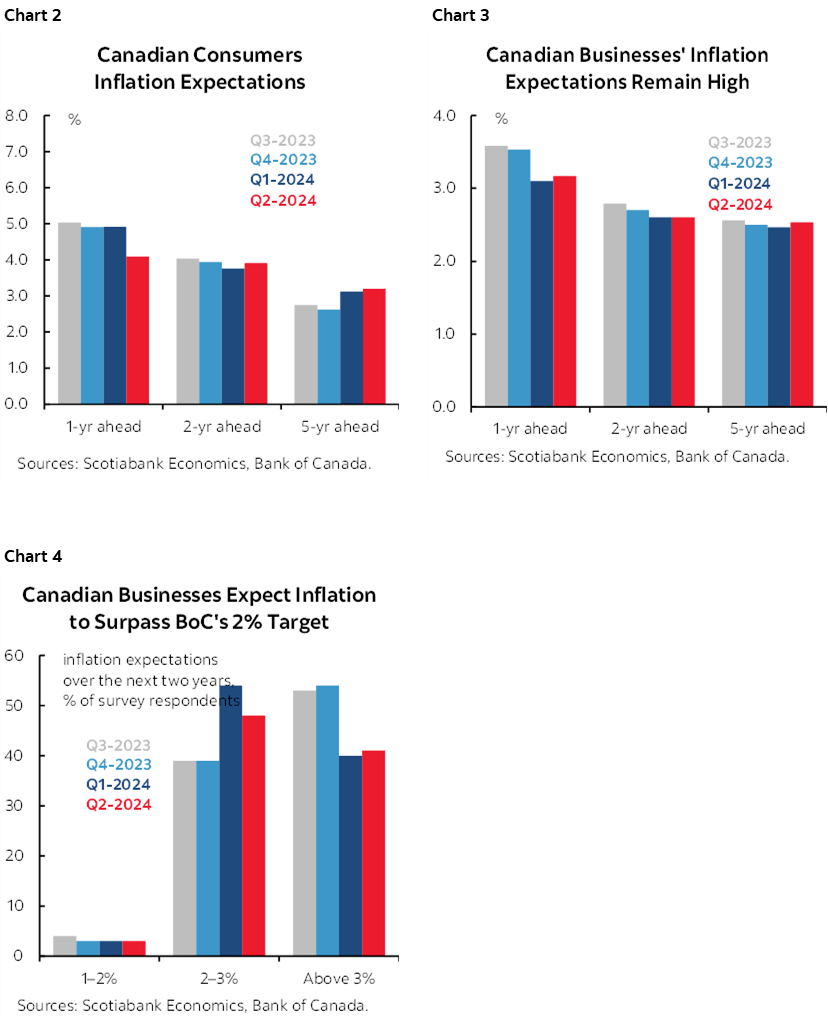

The CPI update follows yesterday’s BoC surveys that didn’t move the dial one bit at least from the standpoint of any market reaction. Consumers’ near-term inflation expectations edged lower (chart 2). Businesses’ inflation expectations remained sticky but mostly in the BoC’s 1–3% target range with a still high share indicating inflation is expected to remain above 3% over the next two years (charts 3, 4).

Canada also updates housing starts for June this morning (8:15amET). They typically garner little to no market reaction even when a major report doesn’t quickly retake the spotlight.

US Retail Sales Are Expected to be Soft

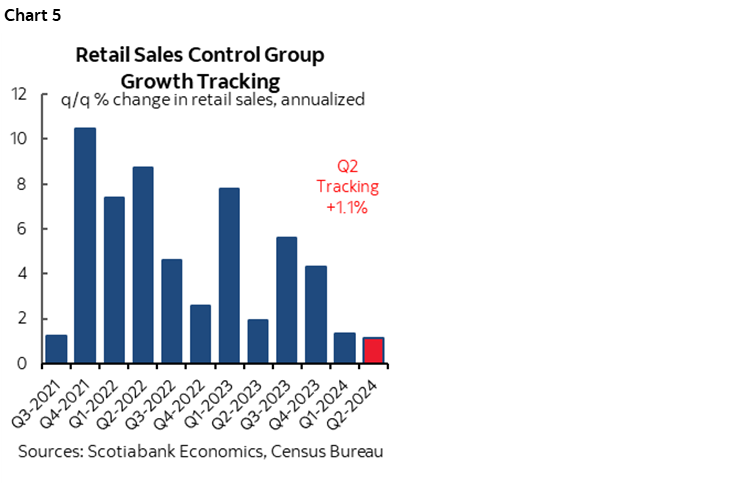

Most expect US retail sales to be lower in June over May in nominal terms and hence lower yet in volume terms (8:30amET). Some of the drivers include lower gasoline prices and lower auto sales. Tracking abilities for core sales and especially the retail sales control group are weak. The latter serves as input into the BEA’s consumption estimates in GDP and it has been tracking softly so far in Q2 with data up to May (chart 5). Watch for revisions that can be significant.

US retail sales may spark market volatility but should play little role as input into timing Fed policy rate expectations. On that note, however, Powell has warned on several occasions that the FOMC has shifted away from explicit forward guidance in advance of meetings to more of a meeting-by-meeting approach.

Trump Appointed a ‘Mini-Me’ As his VP Pick—And What it Means to the Economy, Markets

My what an opportune moment for Trump’s hand-picked ‘judge’ to throw out his confidential documents case yesterday. Equally impactful was Trump’s choice for a VP running mate.

So much for the assassination attempt being a chance to build unity which was a ludicrous concept in some media outlets that had about a 24-hour shelf life. Trump is incurable. He'll never be the unity President. It's not in his blood. He's doubling down.

Trump couldn’t have picked a more divisive guy who is on the immature side of 39 and a product of a highly unstable upbringing. Vance is often criticized as a political chameleon who changes his views when it suits him in the moment. Vance transformed himself into a mini-Trump and was likely appointed because he’ll comply with Trump’s orders.

There is no shortage of articles this morning on what Vance’s pick represents. Here is my take with a bit more of a markets and economics angle as shared with staff and clients yesterday.

- Vance’s chameleon label is well deserved. He’s a born again ‘never-Trump’ guy, having gone from very harshly criticizing Trump (including “Hitler” references) in the past and outside of the “MAGA” camp to supporting him now while having become the poster boy for “MAGA” hype. He also swapped religions from Protestantism to Catholicism. He appears to have undergone a transformation of his own identity to suit the political times and opportunities. If there is one thing I can’t stand in a person it’s unprincipled shiftiness.

- As part of his post-2016 transformation, Vance is an election denier who thinks Trump had a legitimate claim to reject the 2020 election outcome. Vance believed there was widespread voter fraud which has never been proven in umpteen investigations.

- He is blaming the attempted assassination of Trump on Biden’s portrayals of the man and harshly rebukes the Democrats’ portrayal of Trump even though he once advanced the same portrayal. This is obviously an attempt at turning the tables compared to Trump’s repeatedly violent rhetoric in my opinion.

- Vance advocates tougher barriers against corporate mergers.

- He also supports higher minimum wages and is a strong supporter of unions.

- He supports broader protections for US manufacturers.

- He advocates breaking up big tech firms like Google and Meta

- He's a hardliner at whatever cost on the debt limit. He voted against increasing the federal debt limit earlier last year. This is playing Russian roulette with US credit risk and financial markets.

- He wants to remove China from the list of most favoured nations for trade policy purposes.

- He doesn’t believe there is a climate crisis of any shape or form.

- He has argued that the President has full immunity and broad pardon authorities.

- He favours the states setting abortion laws but supports abortion limits even in cases of incest and rape by saying “two wrongs don’t make a right.”

- He supports building ‘the wolll’—the big, 'uuuuge' beautiful wolll.

- I don't know Vance’s views on monpol. He might not either.

- Vance advocates scaling back military aid to Ukraine and ceding territory to Russia. Hello Neville Chamberlain....is that you again? After meeting with Trump and Putin in violation of diplomatic norms, Hungary’s like-minded Orban is saying that Trump has a plan to immediately demand peace talks.

On the latter point, these arrogant superpowers of varying legitimacy always think they can control the outcome by either bashing their way to victory or pulling their support. Clearly they learned nothing in places like Vietnam. Or Afghanistan. There may always be war in Ukraine with or without US support either because someone will always stand with them and/or because an organized rebel group will survive and drive instability for years to come. If the US appeases Putin and it emboldens him to come at another part of Europe, then like it or not, the US will be pulled in, begrudgingly and late as per the norm. The US was never first to the front in major conflicts as we saw in WWI and WWII when the US embraced an isolationist stance at first that is reminiscent of the current isolationist bias.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.