ON DECK FOR WEDNESDAY, JULY 17

KEY POINTS:

- USD falls as Trump plays the victim card

- The USD has been strong for domestic reasons, not foreign conspirators

- Taiwan’s stock market drops as Trump signals ambivalence toward defending it

- UK core inflation was fairly soft in June

- NZ inflation continues to decline

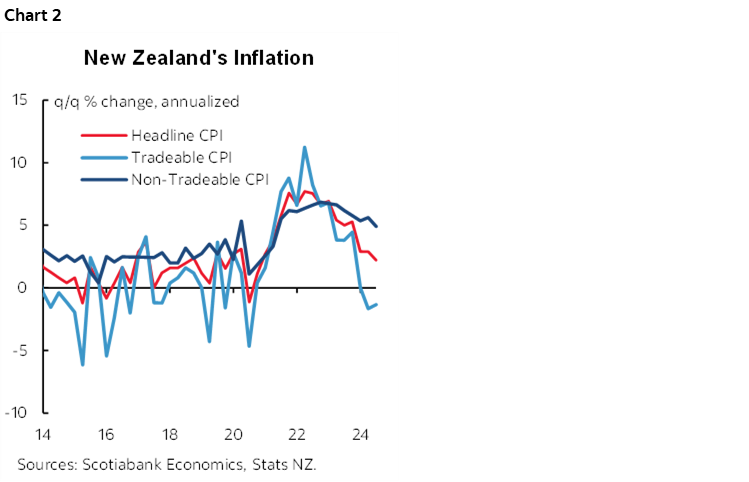

- US IP, housing starts, Beige Book and 20s reopening on tap

- Will Fed’s Waller disagree with Williams?

- Canada to auction 2s

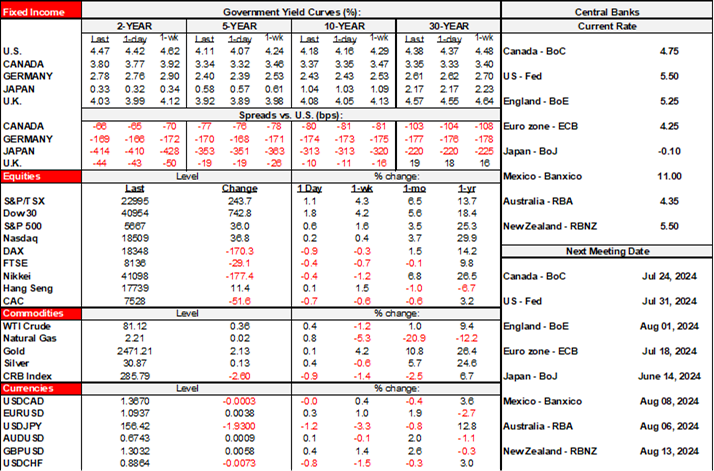

- Bank Indonesia holds, continues to focus on rupiah

Gilts, US Ts and NZ bonds are underperforming other global benchmarks this morning partly on a combination of inflation reports (UK, NZ), Fed comments and Trump’s remarks. US equity futures are broadly lower with European cash markets flat to slightly lower along with TSX futures.

The dollar is broadly weaker partly on comments by Trump who said that “we have a big currency problem,” that its strength is a competitive weakness, and that the yen and other Asian crosses are artificially weak (his view) and hence giving them a competitive advantage which suggests that his administration may target them. He neglected to mention the benefits of a strong dollar, like cheaper imports for American consumers, a check against inflation risk, and a relative advantage in funding markets. There is not a single competent economist in the whole circle of his yes men (mostly) and women.

No folks, the USD has been strong because of a combination of economic resilience (a good thing), persistent inflation risk that has kept pushing out Fed cuts, and the advantage that goes to the US as the world’s preeminent reserve currency. The US spends a lot on consumption and government spending with concomitant debt issuance that drives the developed world’s highest bond yields. Because US consumers and governments spend a lot, the country runs a current account deficit that is funded by a capital account surplus (inflow). The reserve currency status is at risk given the unsustainable path that US government finances are on and a Trump administration would very likely worsen this position.

Regardless, we’re entering a renewed dangerous period in which the Trump administration will play victim and lash out at alleged conspirators with tariffs, as well as allegations of unfair currency practices and potentially punitive policy actions. Allies will be the targets of what Trump has done all his life which is to victimize himself and the United States with warped, cynical and twisted logic and divide everyone in the process. All the while, a Trump administration will deny America’s own policy shortcomings like massive subsidies to agricultural, tech, and transportation sectors among others that distort global trade. Trump is surrounded by ‘yes’ people who fear him and seek to exploit personal opportunity which raises doubt that Congress could be an effective counterweight.

Taiwan’s Stock Market Reacts to Trump’s Comments

Taiwan’s stock exchange fell 1% partly on Trump’s comments that the country “took all our chips business” and that he’s skeptical of the need to defend Taiwan against Chinese aggression especially if they don’t pay for it. Trump also lashed out at Europe as they “treat us violently” on industry policy. Clearly a Trump administration would drive enormous volatility! He pumped his relations with Putin. Trump 2.0 would be a replay of the first time around when allies would suffer his wrath and the biggest beneficiaries would be dictators.

UK Core Inflation Posting Progress

I’m not sure that I agree with the market reaction to UK inflation. The popular narrative is that it was sticky, with headline unchanged at 2% y/y (1.9% consensus) and core also unchanged at 3.5% y/y (3.4% consensus). Ergo gilts are cheaper by about 2–3bps in a slight bear flattener this morning, while sterling is firmer but a middle of the pack performer to the dollar and markets shaved about a couple of basis points off of August 1st BoE cut pricing that now stands at 10bps and put higher odds on a September cut.

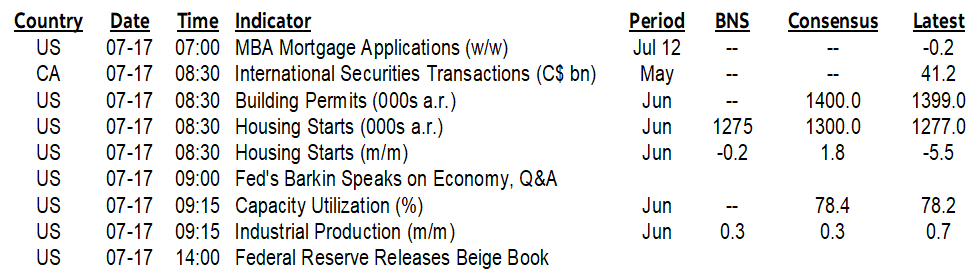

However, month-over-month core inflation was up by just 0.2% NSA which was among the softest beats to the average for like months in history that we’ve seen so far this year (chart 1). The average for a month of June has been 0.1%. That suggests very little by way of any potentially abnormal seasonally adjusted gain.

After the June 20th BoE decision was ‘finely balanced’ for some MPC members in addition to the 7–2 vote for a hold with two dissenters, markets might have reduced August cut pricing prematurely.

NZ Inflation Ebbing, but Fast Enough for the RBNZ?

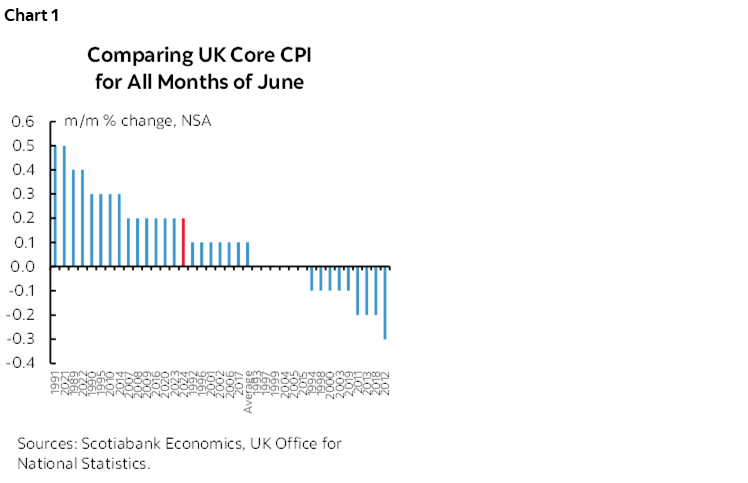

Kiwi inflation ebbed a touch and it didn’t much matter to markets. Headline inflation was up 0.4% q/q NSA nonannualized (0.5% consensus). Tradeable CPI (more connected to global drivers) fell -0.5% q/q NSA (+0.1% consensus). The more important non tradeable CPI —that is more domestically driven—was up by 0.9% q/q NSA (0.8% consensus). All three measures continue to wane in seasonally adjusted q/q annualized terms but are not light (chart 2). Non tradeable CPI, for instance, was 4.9% q/q SAAR in Q2, but well down from the 5.9% cycle peak.

After the RBNZ’s recently dovish turn, it still may be too early to expect a cut by the August 14th meeting which is roughly half priced. That would require a much bigger change to prior explicit forward guidance that a cut wasn’t likely until 2025.

Bank Indonesia Not Open to Cutting Just Yet

Bank Indonesia held its policy rate unchanged at 6.25% as universally expected. The door was left open to easing later this year but not yet as the shorter-term focus is upon the rupiah and hence external influences like the Fed. Governor Perry Warjiyo said “The focus of monetary policy in the short-term is directed at strengthening rupiah exchange rate stabilization and attracting foreign portfolio inflows. Our inflation is low and our economic growth is good, that’s why I said there is room to lower the interest rate if there’s no global influence.”

Fed’s Waller to Follow Williams’ Hesitancy to Cut

Watch Fed Governor Waller’s comments on the outlook (9:35amET) to see if he is more insightful than Powell was after US core CPI surprised lower. Waller does enjoy being ahead of other FOMC officials at times and so I wouldn’t discount the possibility of a market reaction.

NY Fed President Williams perhaps sought to pre-empt Waller’s remarks by stating in a WSJ interview this morning that “I would like to see more data to gain further confidence inflation is moving sustainably to our 2% goal.” His remarks lean against a July move toward September or possibly later.

Minor Data and Auctions in N.A.

US data releases will be light with just industrial production (9:15amET) and housing starts (8:30amET) plus the Beige Book of regional economic conditions (2pmET) on tap plus a 20 year Treasury reopening (1pmET). There are no big names slated to release Q2 US earnings. Canada’s calendar only brings out the 2s auction (12pmET) with no macro developments on tap.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.