ON DECK FOR THURSDAY, JULY 18

KEY POINTS:

- Markets yawning into the ECB’s non event

- UK wage growth remains sticky, jobs rise, lending caution to the BoE

- Australia’s job market remains on fire…

- …but the RBA will focus more on coming wages, inflation

- A light N.A. calendar

- If CAD is outperforming because of Carney headlines, then think twice

- Why the BoC won’t adjust QT next week

There are no real global macro forces behind market moves this morning. Instead, the focus is upon UK and Australian employment readings and how they may inform BoE and RBA moves, plus widespread expectations that the only reason for the ECB’s Lagarde to stand at her lectern this morning is because the calendar says that she must. The most exciting thing about it may be what message she wishes her necklace to declare this time!

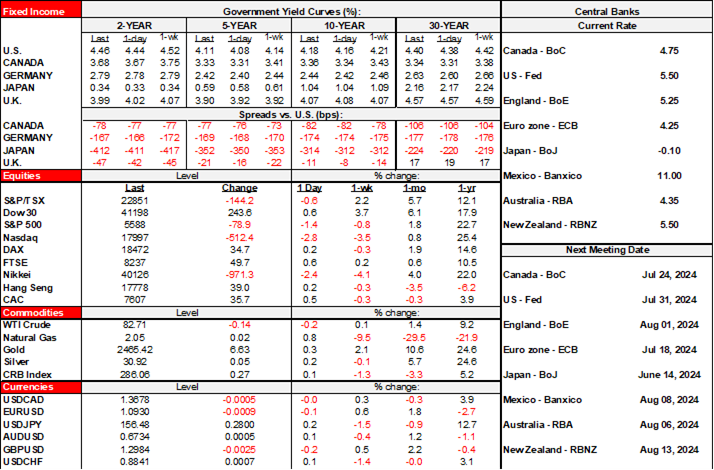

The USD is broadly stronger, except against the A$ (strong jobs) and CAD (see below). Sovereign yields are gently higher across most markets except for a flat UK front-end post jobs which is a questionable reaction. Cash equities are highest in Europe but N.A. futures are little changed.

The ECB’s Non Event

The ECB should be a non-event for the most part. Nobody expects a policy rate change in the 8:15amET statement. No forecasts are due until September. They are waiting for the next round of wage figures and further evidence on inflation when core inflation in m/m terms and wage growth both remain quite warm. Lagarde is unlikely to tee up September when she speaks at 8:45amET. The end. So what are your weekend plans?

UK Wages, Jobs Add to the BoE’s Caution

Markets took the batch of UK job market readings as a case to add a touch more to August 1st BoE pricing that is a 50–50 call. In my opinion, the batch of readings taken together may add to caution at the BoE. Along with relatively firm core CPI in m/m SAAR terms, it could well be that the ‘finely balanced’ part of the MPC that held at the prior meeting with a cut bias may be unlikely to join the minority who favoured easing in the 7–2 vote.

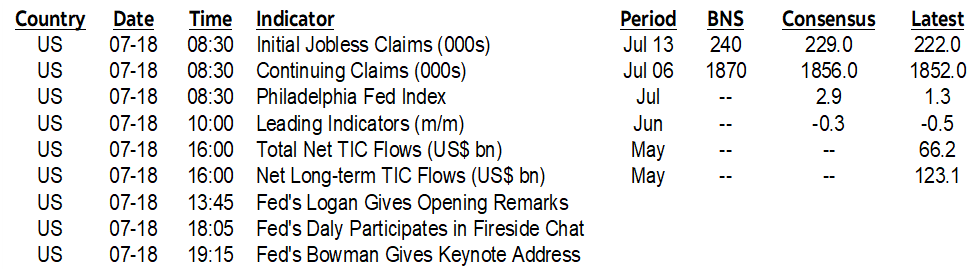

Start with wage growth. UK wage growth remains firm at 5.5% m/m SAAR in May (chart 1). It has been very sticky for an extended period. The year-over-year rate ebbed to 5.2% in May from 5.8% the prior month, but we need to look at the m/m SAAR readings that are free of shifts in year-ago base effects. I don’t know why so many people look at y/y rates when they should have gotten a harsh base effects 101 lesson in the pandemic.

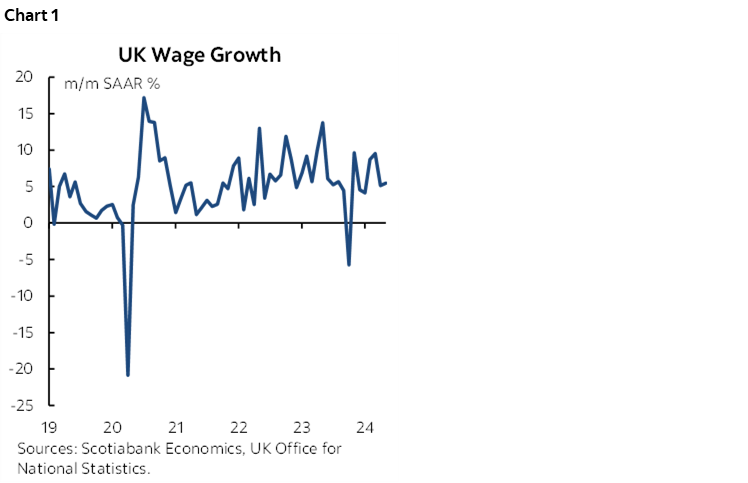

Total UK employment lags, but the May data was up by 32k, reversing the prior month’s decline (chart 2). The trend remains soft. On a year-to-date basis, employment is down by 175k. Fresher payroll employment figures for June were up by 15.5k for a two-month gain of nearly 70k and 91k more payroll positions ytd (chart 3). Squaring the circle arrives at the conclusion that smaller, off-payroll employment is dragging down the overall job market this year.

The UK unemployment rate was unchanged at 4.4% but is up from 3.8% at the end of last year.

Australia’s Job Market Remains on Fire

Australia’s job market remains on fire (chart 4). Another 50k jobs were created in June with almost all of them full-time (43k). The unemployment rate ticked up to 4.1% though as the pace of job growth was greater than the expansion of the labour force (+60k). The participation rate ticked up to 66.9%. Hours worked were up by 0.8% m/m SA.

The result drove the A$ to be the strongest performer versus the dollar this morning. Australia’s rates curve only slightly bear flattened and yet unspectacularly so relative to other curves. August 6th RB hike pricing only edged up a couple of basis points to about a one-in-four chance. This market reaction is probably because the RBA will be much more focused upon CPI figures on July 30th and then Q2 wages on August 12th. Nevertheless, it’s a central bank where the dialogue remains whether policy is tight enough as opposed to any nearer-term push toward easing.

Light N.A. Developments

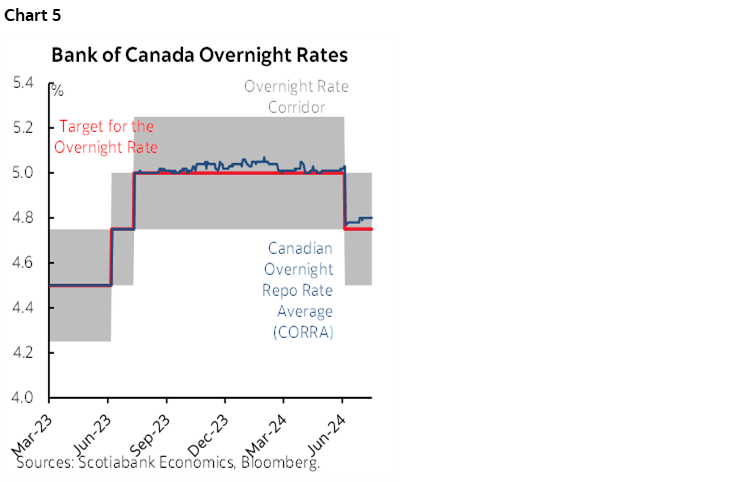

There is only light data including jobless claims and the Philly Fed’s gauge (both at 8:30amET) and a TIPS auction in the US today (1pmET) with nothing on tap for Canada. There are no market moving N.A. earnings on the docket.

Why is CAD Outperforming?

So, why is CAD outperforming this morning? I’m not entirely sure. It’s not because of data or oil or central bank comments or any shift in BoC pricing for next week’s decision. The only headline overnight was about how PM Trudeau asked Mark Carney to join the Libs in a dark Luke-I’m-your-father sort of way, either by seeking a byelection or throwing his hat in the ring for the general election to be held no later than October 2025. I suppose markets might view that as a somewhat more disciplined emergent policy bias given Carney’s gently critique that policy is not focused enough upon growth and productivity. I almost felt like laughing as I wrote that, however, because the pattern to date has been that Trudeau calls the shots when it comes to spending largesse. And I’m sorry, but does anyone really truly think that Trudeau will turn more fiscally prudent into an election year when the Libs-NDP tacit coalition is performing so poorly in the polls? Now, if Trudeau were to step aside, then maybe it’s a different picture <insert louder laughter here>.

BoC Not Expected to Change QT—And Don’t Micromanage the Outcomes!

I would not look for any changes to the Bank of Canada’s policy of quantitative tightening in next week’s communications. The program will remain on autopilot.

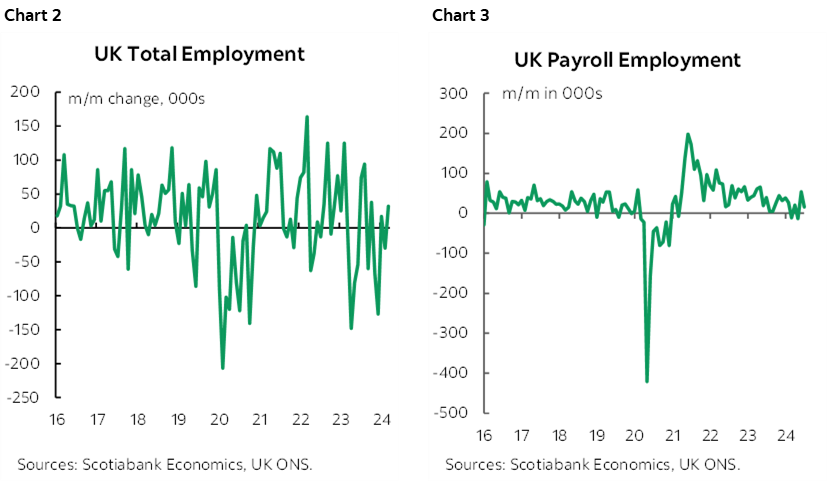

The spread between the Canadian Overnight Repo Rate Average (CORRA) and the BoC’s overnight rate began to widen in early June and hit about 5bps which is testing the limits of past deviations (chart 5). This can be thought of as the analog to if the effective fed funds rate were to materially deviate from where the Federal Reserve is targeting. This is a sign that the BoC’s ability to steer market rates toward the policy rate is being challenged as funding market pressures intensify.

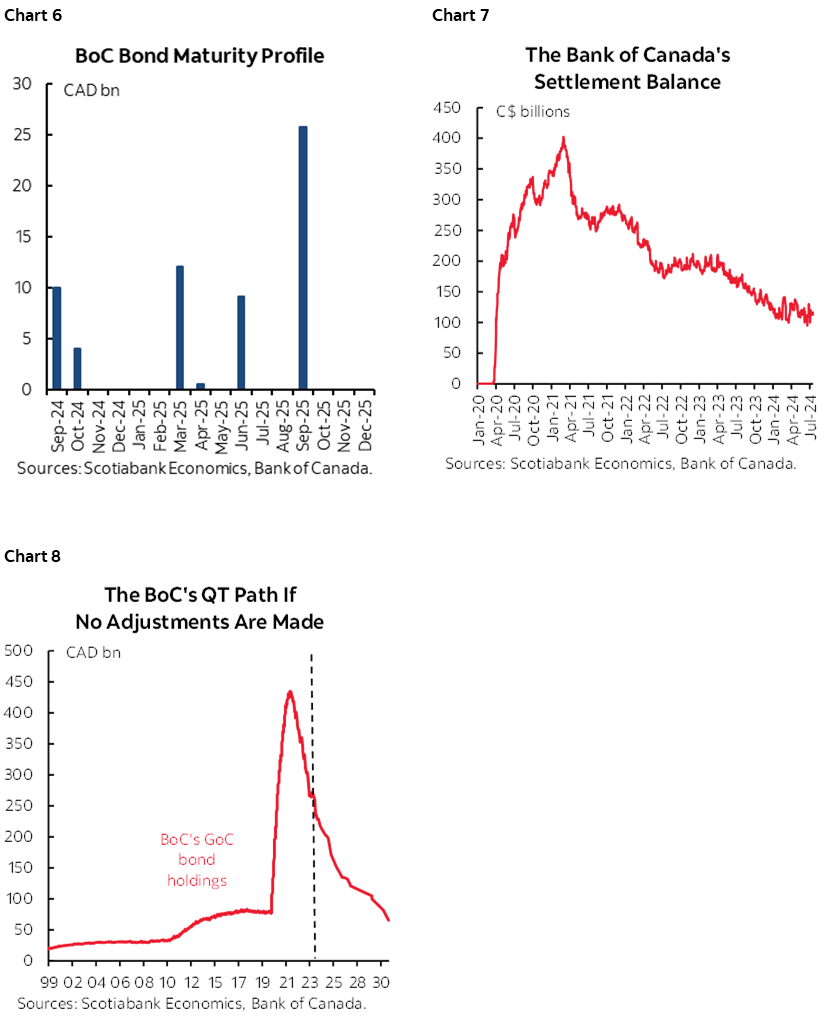

One driver of this intensification might be the BoC’s QT policy that allows its maturing bond holdings to drop off the balance sheet with zero reinvestment. This occurs in lumpy fashion because of the uneven distribution of its holdings (chart 6) and it drains Lynx settlement balances (chart 7). If the BoC retains its 100% roll-off rate, then its holdings of Government of Canada bonds are projected to decline as shown in chart 8. Less liquidity sloshing around the banking system is thought to be contributing to wider spreads, but this may not be true.

One reason why the BoC is very unlikely to alter QT plans at this meeting is because of its practice of communicating balance sheet intentions well in advance. The BoC would likely deliver a speech in advance of a material change rather than springing a surprise that could roil bond markets.

The second reason is that the BoC has previously dismissed QT as the root cause of such spread widening and may do so again now. When the spread widened over the final months of last year and earlier this year, they said that market positioning for expected rate cuts was the dominant driver (here). Market positioning has intensified once again and the BoC may be of a similar opinion on the drivers of wider spreads today.

The third reason is that the BoC is not close to its stated targets for settlement balances. Deputy Governor Gravelle delivered a speech in March that reiterated the goal of bringing down balances to between C$20–60 billion which would equate to somewhere between about ¾% and 2% of 2024 nominal GDP. The balance sits at $116 billion and at almost 4% of 2024 nominal GDP right now and therefore roughly double the BoC’s highest targeted estimate.

The BoC has also made it clear that they prefer using alternative tools for managing the CORRA-overnight rate spread. This has included using repo operations, introducing receiver general auctions, and cash management bills. The BoC just restarted repo operations for the first time since January yesterday with two operations which signals an ongoing preference toward using this tool. Watch how the CORRA-o/n spread evolves and whether the BoC continues to add to repo operations.

I think the BoC should remain neutral toward the narrow distribution of holdings of settlement balances. They should not seek to micromanage the distribution of settlement balances across individual firms or see that narrow distribution as a problem for the overall policy stance on QT. Different firms have different needs for settlement balances, different risks and risk tolerance, different opportunities, and different global funding operations. This guides different choices and the BoC’s job is to target broad conditions, not to pick winners and losers. The BoC has other tools to address potential problems in the system kind of like what we saw in the Fed’s responses to strains across regional banks last year while sticking to its guns on broader policy goals.

Lastly, let’s not lose sight of the BoC’s number one objective here: they want out of bond markets. They wish to normalize their portfolio of Government of Canada bond holdings to a level that is only suited toward what is needed for the normal conduct of monetary policy. There is a very high bar set against knocking them off this course even if it means having to lean on a convoluted and distorting patchwork of supports to funding markets along the way.

Having said all of that, I’ve tried to convey what I think the BoC will do based on their guidance. My personal belief is that they are trying to push settlement balances too low and that they are therefore courting problems in funding markets and possibly future accidents. The FOMC targets excess reserves at 10–12% of GDP and hence vastly higher than the BoC because the FOMC has greater experience and harsh memories of the last time they tried to push cash in the banking system so low. The BoC may face this lesson in future and should tread much more carefully. The one thing the BoC has in its favour, however, is that the FOMC has its back; at the end of the day, it’s how the FOMC manages excess reserves and liquidity that matters the most including its spillover effects into Canada.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.