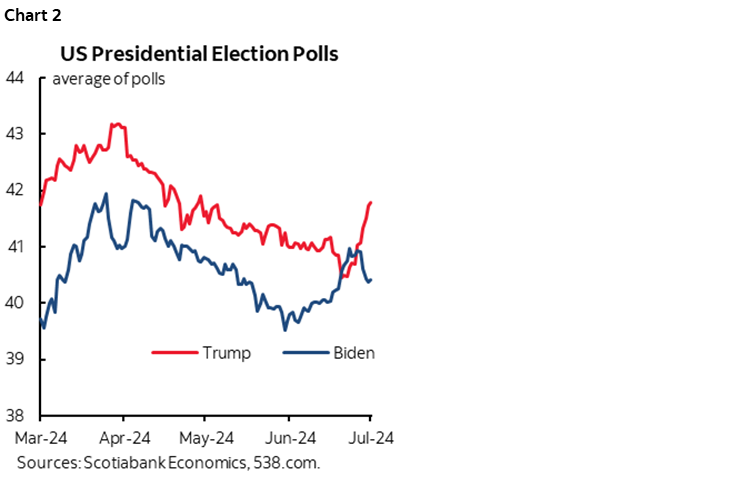

| ON DECK FOR TUESDAY, JULY 2 |

KEY POINTS:

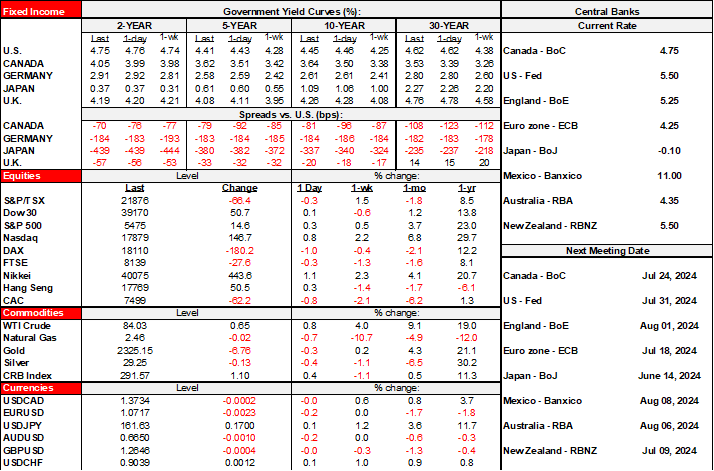

- Canadian yields spike in catch-up to developments

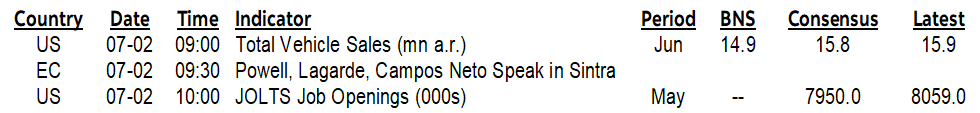

- Warm Eurozone core CPI keeps ECB bets at bay

- Fed’s Powell to speak at Sintra

- US JOLTS to tease ahead of payrolls

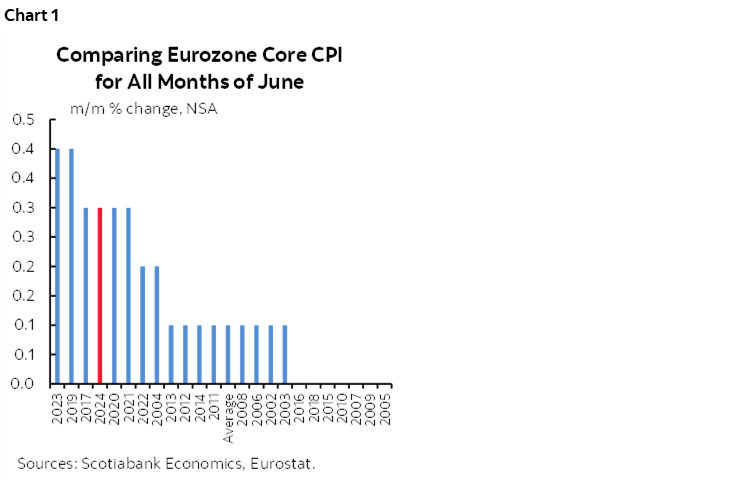

- Post-debate polls show Biden slipping

It’s a relatively quiet start to a holiday shortened week for Canadians and a lighter than usual week for the US ahead of tomorrow’s early close and Thursday’s holiday. Canadian markets are catching up to developments with a spike in yields as the 2-year yield is 5bps higher and the 10 year is 14bps higher.

The macro calendar only has a few things to consider. Stocks are mildly lower this morning, the USD is broadly stronger except versus CAD and sovereign bonds are little changed following yesterday’s EGB sell off after Sunday’s first round of the French elections. French 10s are about 7bps higher since Friday which captures the election effect and closing in on the June 11th high in the aftermath of the EU parliamentary elections. This is the last day for strategic withdrawals by candidates in constituencies to back more centrist prospects and weaker National Rally’s chances of emerging victorious in the second round this coming Sunday.

Warm Eurozone Core Inflation

Eurozone core CPI at 0.3% m/m NSA was warmer than a typical month of June that average 0.1% over the past 20 years. This June was only exceeded by June in 2019 and 2023 (chart 1). Recall that we look at m/m compared to like months over time because the figures are not seasonally adjusted on arrival. This kept the y/y rate unchanged at 2.9% despite base effects and against consensus expectations for a small deceleration. Most of this information was understood through the protracted release of country-specific figures since Friday. Markets continue to price basically no chance at an ECB cut this month and about 17bps of a cut in September.

Fed’s Powell at Sintra

Fed Chair Powell will be on a panel with the ECB’s Lagarde and Brazil’s central bank head Campos Neto this morning (9:30amET). Lagarde spoke last evening at the ECB’s Sintra retreat and didn’t say anything new.

Other Stuff

We’ll also get US JOLTS job openings for May (10amET) as a modest teaser ahead of Friday’s payrolls. Canada updates a little watched manufacturing PMI (9:30amET).

US election polling from Real Clear Politics showed Biden’s chances of winning the election slipping to 45% with Trump at 47%. The 538.com polling composite is shown in chart 2.

The won is among the weaker crosses this morning after South Korean CPI landed softer than expected (-0.2% m/m NSA, +0.1% consensus).

Global Week Ahead Reminder

As a reminder, please see the Global Week Ahead—Ranking the Presidents here. Key topics explored include:

- Ranking the Presidents on the economy and markets…

- EGBs may be on edge after French election

- UK election expected to return Labour to power

- US nonfarm payrolls still resilient?

- ECB’s Sintra often drives euro volatility

- Canada’s job market and the BoC’s exaggerated narrative

- Canadian, US holidays

- The last Eurozone core CPI print before the ECB’s July decision

- Global inflation readings dominate the rest

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.