ON DECK FOR WEDNESDAY, JULY 24

KEY POINTS:

- US, European earnings drive risk-off sentiment

- Mixed global PMIs were largely ignored by markets

- BoC to cut, leave QT on autopilot, deliver minor forecast tweaks

- The street’s economists failed to do their jobs for the last two Cdn inflation reports

- US homebuilders have a burgeoning inventory problem

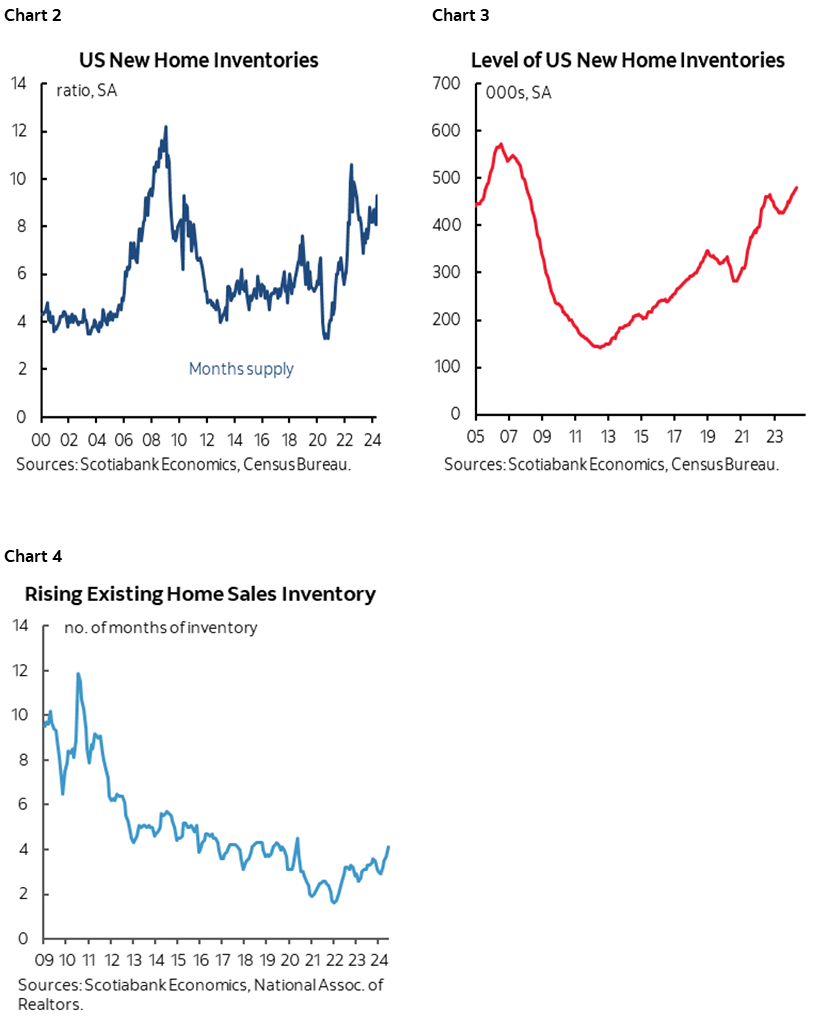

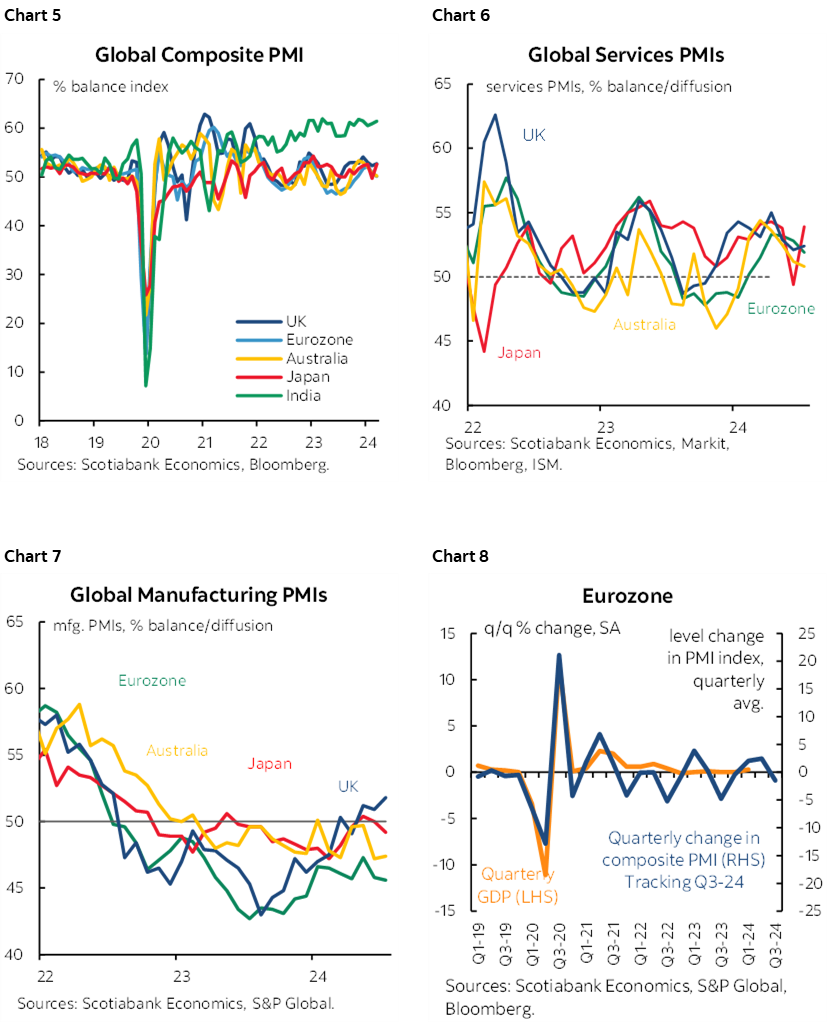

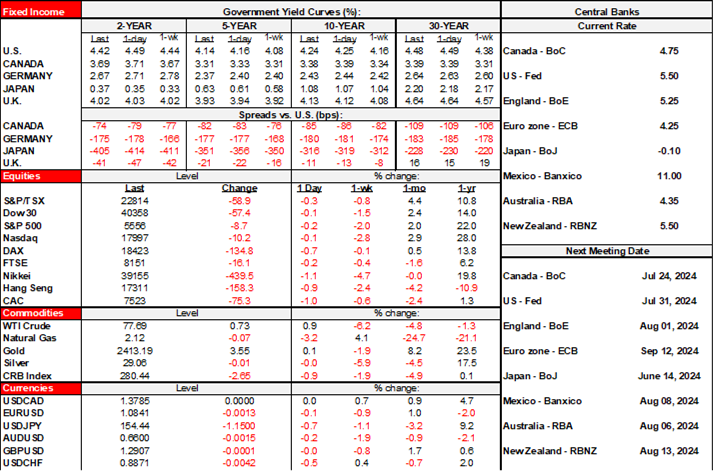

A few soft global earnings reports are driving a mild risk-off market tone into the Bank of Canada’s decision, forecasts, and press conference. US equity futures, for instance, began falling in yesterday’s after-market in response to earnings and guidance from Alphabet and Tesla. Then Deutsche Bank and LVMH—owner of multiple global luxury goods and services brands—added to negativity on signs that the top end is, well, looking toppish. Mixed global PMIs have not really altered the broad market tone as they were slightly stronger in the UK, Japan and India, but slightly softer in the Eurozone—led by German weakness—and Australia. See the back of this publication for charts showing the PMIs.

Bank of Canada—Cut, QT on Autopilot, Forecast Tweaks

I expect a -25bps BoC cut, no change to QT plans, and minor tweaks to forecasts. I also expect Macklem’s press conference to have a dovish tone that is similar to his June presser. I don’t expect any explicit set-up for the September meeting with Mackem simply saying they’ll watch incoming data and developments and decide at that time while wishing everyone a wonderful summer with no communications on the docket until the September meeting.

Macklem will be asked about whether the last two inflation reports change anything in his mind and watch whether they adjust the statement reference to how “recent data has increased our confidence that inflation will continue to move towards the 2% target.” I suspect he’ll say no, even though I think he should be much more careful and circumspect.

One reason he can say no is that the street’s coverage gave Macklem cover, though inappropriately. The community of economists—especially ones with undiversified clientele exclusively serving real estate audiences —failed to do their jobs over the past two months of inflation reports while pumping a confirmation bias. Most of the street’s economists slept walk through the last two inflation reports, nodding their heads in agreement over lower inflation by pointing to y/y headline CPI. Some persist with lies about the role of mortgage interest in inflation data even though it has never been included in the BoC’s trimmed mean and weighted median gauges of inflation at any point in the pandemic and previously.

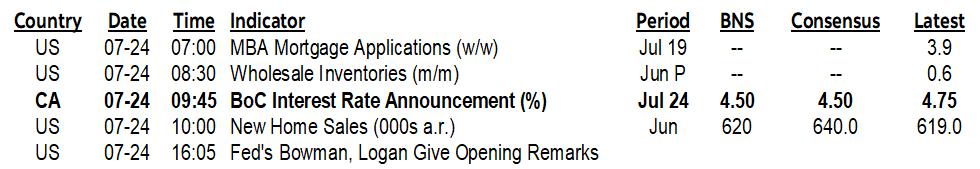

I am totally comfortable being the only one who pointed out that m/m SAAR trimmed mean and weighted median inflation accelerated to 4.1% in May and 2.9% in June (chart 1), thereby ending the four-month soft patch we had over January through April that was driven by unusual temporary factors. The three-month moving averages for trimmed mean and weighted median CPI have now moved back up to their highest since January at 2.9% m/m SAAR 3moMA in both cases. The BoC targets headline CPI over the medium-term but relies upon its preferred core gauges as the operational guides to achieving the headline target.

Expect Macklem to nevertheless reject this observation and to instead point to ‘ups and downs’ in the data and the expectation that the path forward will be uneven toward achieving their 2% inflation goal into next year. Maybe he’ll have his fingers crossed under the table; if not, then surely his toes. We’ll see. The recent data doesn’t support another cut if they’re truly data dependent, but they’re shifting to forward-looking model-dependency and yet models have stunk throughout the pandemic era.

Needless to say, the oddest thing the BoC could do today would be to have hurried only to wait. To have rushed a cut in June against Macklem’s guidance that he wanted “months” of more data, and to then turn around and whiff. To have sounded very dovish in June, and then waver now. To not cut when anyone of note and markets are expecting it after all that would serve as an entry into the BoC’s hall of shame. It would tighten financial conditions after sounding so uber dovish just a few weeks ago.

Five out of six times since the late 1990s when the BoC has begun an easing cycle, they’ve followed it with another cut at the next meeting except for the inapplicable circumstances of early 2015 when the policy rate was already deeply stimulative at 1% before two cuts. When the BoC decides to begin a cycle, they tend to keep at it for a meaningful period before possibly reassessing.

For more of a BoC preview see my Global Week Ahead article here.

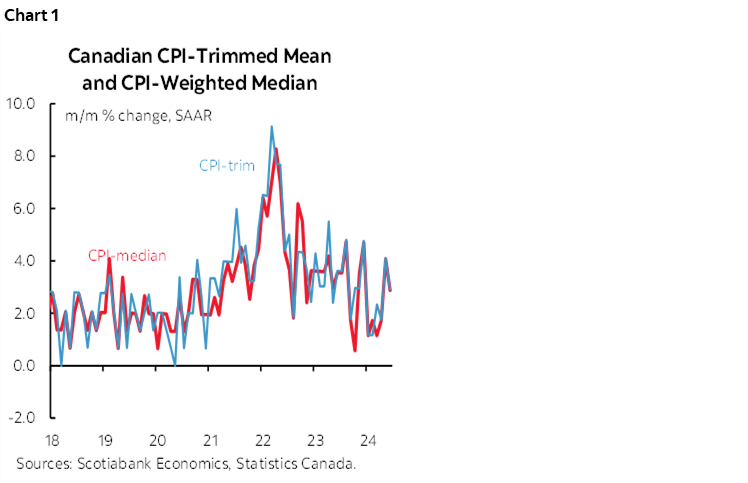

US Housing in Focus

US markets will continue to digest earnings reports plus housing data. New home sales might rebound a touch after the large 11% m/m drop in May (10amET). The sector nevertheless has a burgeoning inventory problem. Inventories of unsold new homes are rising when scaled to current selling rates in chart 2. Chart 3 shows that the outright level of unsold new homes has risen to GFC-era levels. There are also rising inventories of unsold resales, but this is less acute given the unwillingness to list and hence risk giving up a juicy low mortgage rate from years past (chart 4).

Also watch the US advance merchandise trade balance for June (8:30amET) and S&P PMIs for July that land at the same time as the BoC statement and MPR (9:45amET).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.