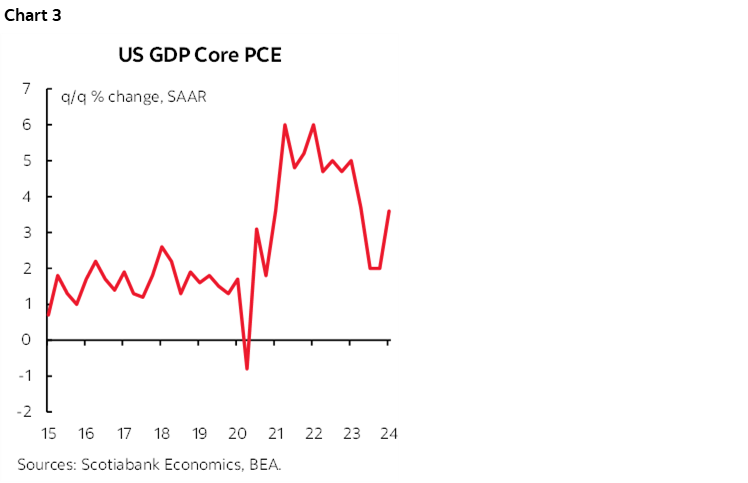

ON DECK FOR THURSDAY, JULY 25

KEY POINTS:

- A classic risk-off trade is sweeping through global markets

- Theories behind why risk appetite may be suffering

- Fastest yen appreciation since late last year…

- …as BoJ bets intensify, rock global carry trade

- PBOC unexpectedly cuts another reference rate

- US Q2 GDP, core PCE could inform Fed pricing

- South Korea’s economy unexpectedly shrank

- Soft US core durable goods orders due for an update

- Was the jump in US jobless claims a holiday distortion?

- Canada to update one of the BoC’s wage measures

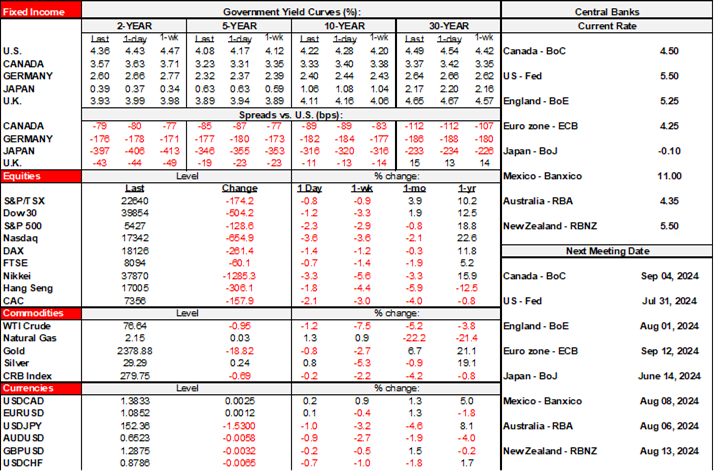

A classic risk-off trade is sweeping through asset classes this morning. The USD, yen and Swiss franc are leading gainers with the euro holding its own to the dollar. Stocks are falling again with US futures off by roughly ¼% and TSX futures down ¾%. European cash markets are lower by between ¾% to 2¾%. Sovereign bonds are rallying with US Treasuries and Canadas outperforming. Markets are pricing another 50bps of BoC cuts by year-end which remains our forecast (BoC recap here).

Why is Risk Appetite Suffering?

It’s not fully clear why risk-off sentiment is unfolding but there are a few plausible explanations. One catalyst is the lacklustre global earnings season.

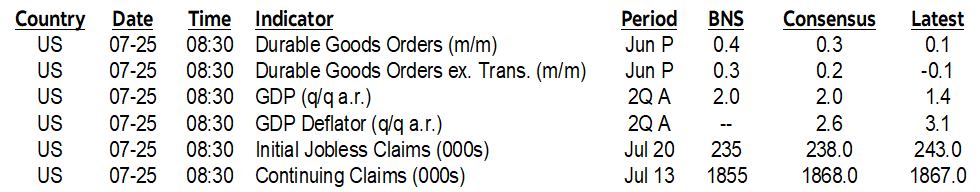

Another is apprehension ahead of next week’s Bank of Japan decision that may deliver a rate hike which is why JGBs are underperforming other sovereign bonds this morning particularly via mild front-end cheapening. This is helping the yen in addition to safe haven flows as carry trades are vulnerable; the yen has appreciated from 162 to the buck on July 10th to 152 now which is the largest move seen since the final six weeks of last year (chart 1).

It could also be that China’s hurried monetary policy decisions following last week’s dull Third Plenum are creating a negative signalling effect, as in what else does the PBOC see that worries it? Maybe the overnight disappointment in South Korea’s economy that unexpectedly shrank for the first time in six quarters adds to regional despair.

Concern about the health of the US economy is something I would not discount. Growth is slowing and will probably continue to slow. Signs like soaring US homebuilder inventories are not helping. There is rising sentiment that the Fed is slow footed and may be pushed into more aggressive action. The NY Fed’s probability of recession in 12 months derived from the curve went from nothing in 2023 to about 56% odds now. By contrast, the median forecasters’ probability of recession has fallen from over 60% odds last year to 30% now fwiw….

Markets may also be repricing US election probabilities. Whether correct or not—and I don’t view markets as the greatest arbiter of the complex debate with its myriad potential policy influences—the sentiment has been that Trump would be better for equities. Harris is from the far left (aka ‘progressive’) wing of the Dems (see Tuesday’s note on that here) and her past policy stances would be quite negative for markets. Risk appetite may be evolving more negatively as the Dems regain some momentum while Trump is getting classically unglued as he behaves like a nervous brat watching his favourite toy being taken away.

US data could also be impactful this morning if it influences Fed expectations (see below).

Another possibility is preparation ahead of peak summer vacation period in Europe and N.A. through August. Ok, maybe that’s just what I’m looking forward to, bwah!

What Has the PBOC Suddenly in a Flap?

To describe Chinese monetary policy as erratic and hurried would be an understatement given developments over the past week. After holding the 1-year Medium-Term Lending Facility Rate unchanged on July 14th as per the normal schedule, the PBOC decided to cut it by 20bps last night which is a relatively large move. The rate has moved 65bps lower since the beginning of 2022 but had not changed since last August. This cut follows the decision on Monday to cut the 7-day repo rate by 10bps which is also the first cut since last August. China’s 1- and 5-year Loan Prime Rates were also cut by 10bps each on Monday.

The yuan took it in stride. In fact, it appreciated overnight. That could be because markets had already adjusted to the cut as the yuan depreciated slightly on Monday in response to the first cuts. Last night’s cut didn’t do much to help out Chinese equities that fell, but by less than the sharp declines in Tokyo and Seoul that followed yesterday’s US sell off.

US GDP and Core PCE Could Inform Fed Expectations

Today’s main focus will be US Q2 GDP and core PCE (8:30amET).

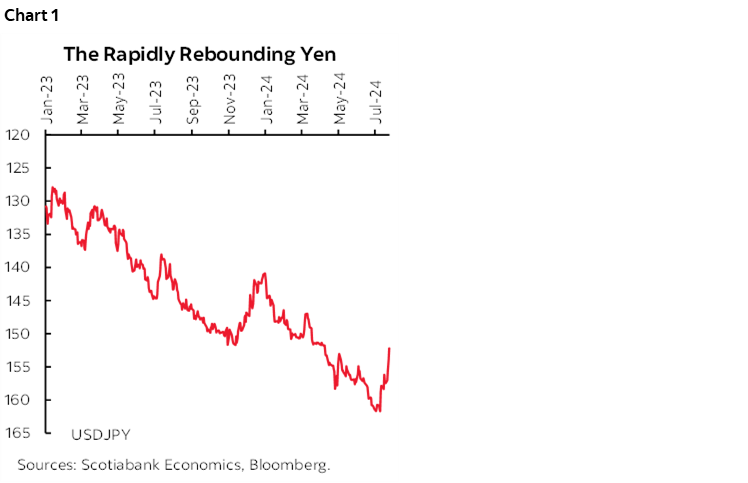

Consensus expects 2% q/q SAAR US Q2 GDP growth. Scotia is the same. Most are within 1.5–2.5%. The Atlanta Fed’s nowcast is 2.6% which is the same as the New York Fed’s nowcast. Nowcasts have trended up a little more than consensus of late (chart 2). See my GWA text for more about the uncertainties.

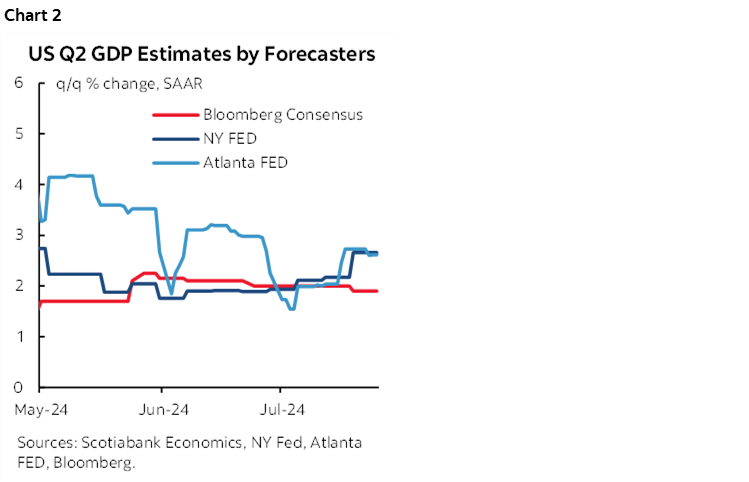

US core PCE inflation is expected to slow to 2.7% q/q SAAR from 3.7% in Q1 when it rebounded from the prior softening pattern (chart 3). This includes a 0.1% m/m SA estimate for June. Q2 will embed the June estimate that we get on Friday but may also include revisions to prior months, so be careful with inferring from the overall Q2 number what may have happened to June.

US durable goods orders in June (8:30amET) and weekly jobless claims (8:30amET) are also due this morning. Core durable goods orders (ex-air and defence) are a proxy for business investment and have been on a weak trend. Watch US claims to see if they may come back down after falling during the July 4th week and rebounding the week after even though the figures are seasonally adjusted. Canada updates its lagging SEPH payrolls report including one of the wage figures the BoC watches (8:30amET).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.