ON DECK FOR TUESDAY, JULY 9

KEY POINTS:

- Bond yields up, dollar firms ahead of Powell

- Powell’s testimony is unlikely to offer much that is new…

- ...as he cites progress, but fears another inflation soft patch rebound

- Powell will probably be attacked on potential GSIBs capital changes…

- …that could carry knock-on effects elsewhere

- US small businesses are signalling milder inflation risk

Fed Chair Powell’s testimony will be the main event (10amET). Except that it probably won’t be.

Huh?

Ordinarily there could be high stakes attached to what Powell may say as he delivers round one of his two days of Congressional testimony starting with the Senate Banking Committee. There will be written testimony made available at the beginning before Senate leaders deliver opening comments that are likely to be even more politicized than normal, and then banter ensues. If the testimony matters at all, then it could be via comments on potential regulatory changes and because there is little else for markets to focus upon as they wait for US CPI on Thursday.

Powell Unlikely to Deviate from Comments to Date...

The difference this time is that Powell—and the rest of the Committee—have spoken too much already. They’ve made it clear that they welcome recent reports but that they are waiting for further evidence that inflation is ebbing. The way they are talking makes it sound like they want to see soft inflation over several more reports—and hence not just this week’s CPI—especially since they won’t get their preferred PCE measure before their July decision.

...as Past Soft Patches have Burned Fed Cut Prospects...

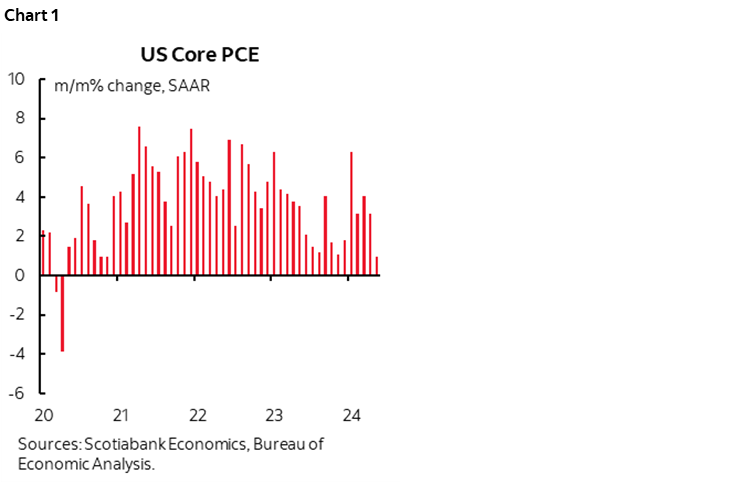

As it should be. Remember last summer? A trio of 0.2% m/m core CPI prints over June through August then gave way to slightly firmer readings on average over the rest of 2023 until it accelerated with a trio of 0.4% readings through 2024Q1. Core PCE was soft throughout the whole back half of 2023 which prompted some—like Governor Waller—to reference how a cut could come in a few months (ie: March). Markets got carried away and pricing 150–175bps of cuts this year. Then core PCE took off again from January through April of this year and crushed those bets (chart 1).

Powell wants proof. Not models that failed him in a vastly more complex world than the decades of connections to drivers they relied upon with high forecast risk even then. And he wants broader proof than just the inflation readings themselves. Hard data and anything that informs inflation risk carries more weight with Powell than trying to forecast where inflation will be 6, 12, 18, or 24 months in the future and beyond. He refers to slowing signs in the economy and labour market but wants to have greater confidence.

The fact that Powell’s testimony is just two days away from a CPI update makes his remarks pretty much stale on arrival until we see the actual numbers.

…But Expect Attacks on Potential Bank Capital Changes

One matter that Powell is likely to be rudely attacked over—lookin’ at you Senator Warren—is a report from Reuters this morning (here) that says the Fed is considering rule changes that would lower capital charges for global systemically important banks (GSIBs). This could amount to billions in redeployed capital at JPMorgan, Citigroup, Bank of America, Goldman Sachs, Morgan Stanley, BNY Mellon, State Street and Wells Fargo. It’s unclear whether there may be implications for Canadian GSIBs—RBC and TD—which depends upon how OSFI may react in a relative competitiveness sense. That could carry implications for non-GSIBs competitiveness as well. Ditto for other countries’ GSIBs (here).

US Small Businesses Signal Less Inflation Risk

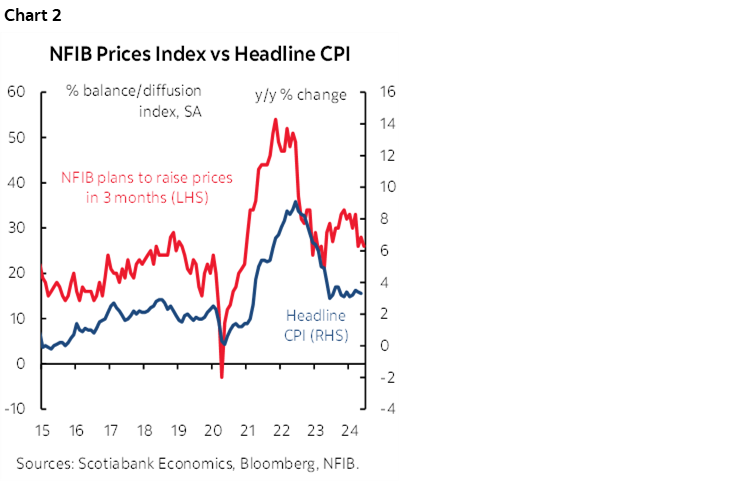

US small businesses were a little more confident in this morning’s NFIB gauge. Given the day’s inflation and Fed theme, what may matter the most is the modest decline in plans to raise prices over the next quarter that has been in place since this measure hit a recent high in March (chart 2).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.