ON DECK FOR MONDAY, JUNE 10

KEY POINTS:

- Bonds and stocks cheapen…

- ...driven by European politics, N.A. jobs spillovers, week ahead expectations

- European Parliamentary elections, France’s snap election jolt markets

- Freeland to introduce vague capital gains tax hike plan...

- …and the real reason she’s plowing ahead with the ill-advised measure

- Global Week Ahead—More Daisies Please!

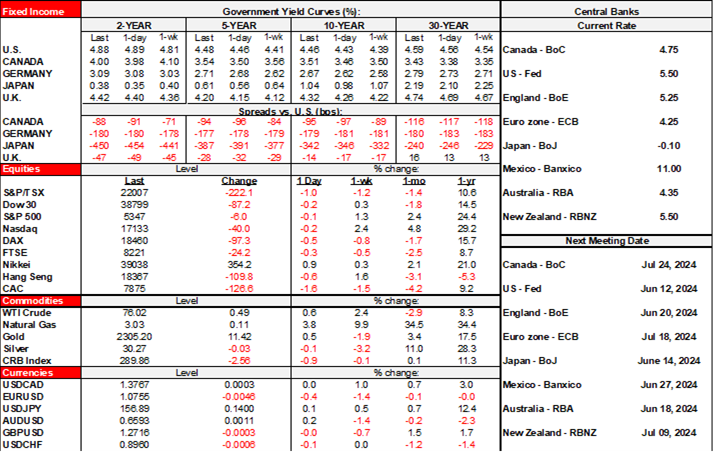

European parliamentary elections are giving markets a jolt this morning. This may be adding to ongoing spillover effects from Friday’s dual US and Canadian jobs reports that showed strong figures for the US and solid figures for Canada including a sharp rise in wages and solid input to Q2 GDP tracking (recaps here and here). Some of the market action could also be in anticipation of the week’s key expected developments like US CPI and the FOMC on Wednesday plus the BoJ on Friday.

France’s Macron Rolls the Dice

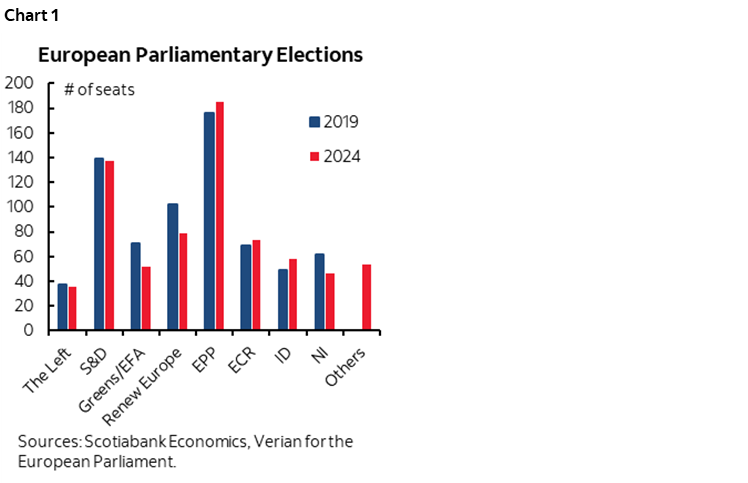

In Europe’s Parliamentary elections, conservative parties gained ground in line with the polls and the three main centrist groups continue to hold majorities. The gains by the right including France’s National Rally (formerly National Front) prompted French President Macron to call a snap parliamentary election in two stages on June 30th and July 7th. His job is not directly on the line, but the ability to execute policy changes between now and the 2027 Presidential election when his term limit arrives could be impacted along with whomever his PM may be in a few weeks.

It also cannot be lost on anyone that the scope for political surprises of consequence to markets is very high so many elections this year from India to Europe, the UK and US, Canada next year and so forth. A significant theme is that center-left governments in places like Europe, the US and Canada are performing poorly in the polls on topics as varied as immigration to managing the economy, security and fiscal policy. The UK is an exception as polls indicate that Labour seems likely to return in its election on July 4th as the Conservatives and Reform UK split the center-right vote perhaps because the Conservatives under Truss and May looked anything but like conservatives (here).

Preliminary results are available here and the provisional change in the number of seats held by party from the 2019 election to now is shown in chart 1. For instance, Macron’s Renew Europe Group and the Greens lost notable numbers of seats.

Markets don't like uncertainty and so equities are broadly lower and led by France's 1.6% drop. Sovereign bonds are broadly cheaper as EGB spreads widen over cheaper. The euro is depreciating from about 1.08 to 1.0755 to the dollar.

We also have some ECB-speak to consider this morning that is leaning toward requiring more data by the September meeting before deciding next steps.

Some of the volatility may be driven by uncertainty ahead of the week’s other key developments including US CPI, the Fed and the BoJ.

Canada Talk Tax Hikes Today

Canadian Finance Minister Freeland will introduce in Parliament today what sounds like just a ways and means motion that provides limited further information on the planned hike in the capital gains inclusion rate from 50% to two-thirds. Vague intent was announced in the Budget way back on April 16th and the government has offered nothing since then. That doesn’t sound like formal legislation versus a mere political rallying cry for the foolish capital gains tax hike. PM Trudeau says there will be a vote in Parliament on it later this week which is more about politics to force parties to formally stake out a position.

From what I understand, it seems unlikely that formal legislation will be introduced before Parliament enters summer recess on June 21st but that the government is sticking to its June 25th implementation date. That begs the question how can you implement something without really saying what it’s all about in terms of the devil being in the details? Legislation might arrive later this summer or some time after Parliament returns on September 16th.

The shambolic nature in which this government and Finance are pursuing this initiative is just stunning. But what’s the real motive? It’s not fairness, as many articles such as this one by one of Canada’ foremost tax experts argues including the point about that at least 1.26 million Canadians are likely to be affected versus the government’s politically lowballed estimate in the mere thousands or tens of thousands. If it was really about tax fairness, then they’d use the proceeds to cut personal income taxes particularly for the middle-income households, rather than spending the proceeds on pet social programs.

Rather, the motive is undeniably the fact that the government is desperate for revenue. After potentially misleading Canadians in the Federal Budget that all fiscal targets would be hit including deficits, figures released on May 31st in the Fiscal Monitor showed that the deficit for the FY2023–24 fiscal year is tracking C$50.9 billion instead of the $40.1B that the Budget claimed. There may be revisions for asset valuations and the full tax year’s haul and possible gimmickry before we see the final numbers this Fall, but thus far, deficit tracking appears to be 27% higher than shown in the Budget.

Enter the capital gains tax hike. The government claims it will bring in C$19.4B of revenue over five years. Others reject this estimate as something that is unlikely to be achieved. Canada faces a Federal election by no later than October of 2025. Governments doing as badly in the polls as the left’s Liberal-NDP quasi-coalition is performing don’t spend less into election years. Badly polling governments of all stripes—such as Harper’s government into the 2015 election—roll out all manner of vote-grabbing proposals for the crowd that likes someone else to pay for their hand-outs even if they themselves wind up paying for the poorly understood incidence effects.

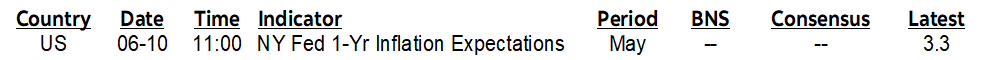

Overnight data was inconsequential and there is nothing material on tap into the N.A. session. We only get the NY Fed’s 1-year inflation expectations gauge for May (11amET).

As a reminder, please go here to see the Global Week Ahead—More Daisies Please! The summary deck is in subscribers’ inboxes. Key topics include:

- Powell likely to retain cautious optimism on inflation

- US CPI: one of four before our September cut call

- FOMC: it’s all in the dots

- The Fed’s balance sheet is back on autopilot

- BoC’s Macklem to speak after violating own guidance, solid jobs

- BoJ may reduce bond purchases

- BCRP expected to cut again

- UK wages still running hot?

- Is Australia’s job market cooling?

- CPI: China, India, Brazil, Colombia, Norway, Sweden

- BoT, CBCT likely to hold

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.