ON DECK FOR WEDNESDAY, JUNE 12

KEY POINTS:

- Markets face the week’s biggest tests today

- Today’s US CPI on its own won’t sway the FOMC

- FOMC expectations: rates on hold, balance sheet on autopilot…

- …dot plot to downgrade cuts…

- …and GDP forecast may be lowered, with minor PCE and UR changes…

- ...as Powell retains cautious optimism on dual mandate progress

- Scotia’s tentative call remains September for a first cut

- Macklem, Villeroy and Nagel will be on a post-Fed panel

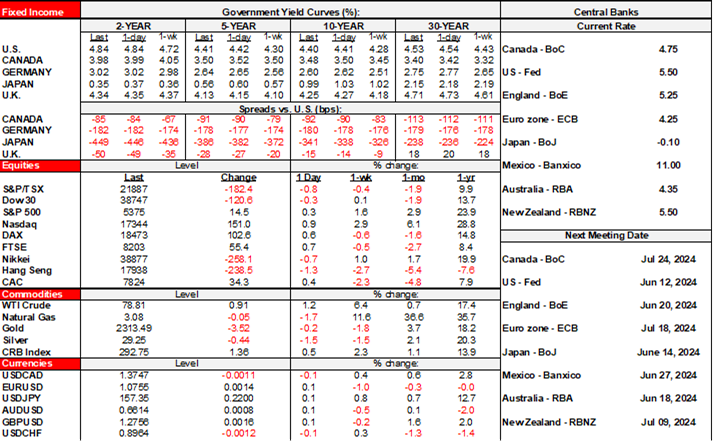

Today will probably be the biggest day of the week for global macro risk. US CPI and the FOMC will dominate.

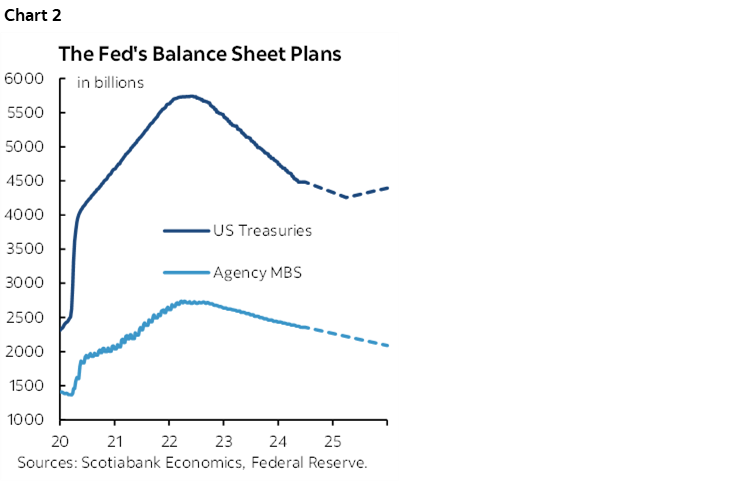

US CPI Expectations—Just One of Several Before Cut Risk May Grow

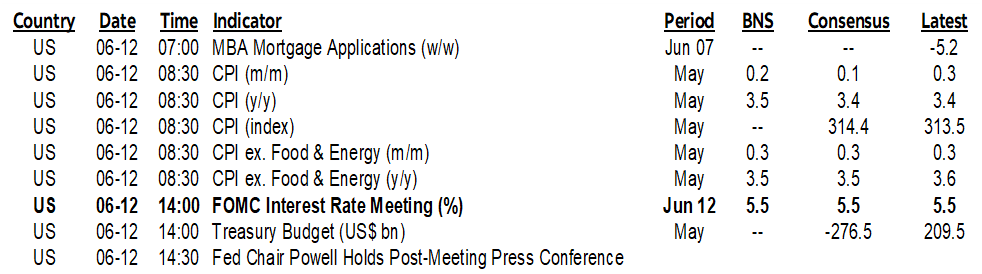

CPI for May arrives at 8:30amET. Lower SA gasoline prices and little change in food prices are expected to drive a softer headline CPI reading in m/m SA terms than core. 57 of 69 in consensus expect 0.3 for core with the remainder in the 0.2 camp. The Cleveland Fed’s ‘nowcast’ sits at 0.1 for headline and 0.3 for core. Drivers are discussed in my week ahead article (here). Evidence on breadth that has been improving will also matter (chart 1).

How much of an effect will this report have on FOMC expectations going forward? Not much on its own because a) it’s not the Fed’s preferred inflation gauge, and b) the FOMC requires more than one report to give it confidence to ease. It’s more about passing the time trading market volatility before the Fed’s communications arrive this afternoon. This is just one of four CPI and three PCE reports before Scotia's first cut may be delivered at the September FOMC meeting. That’s a tonne of price information still ahead of us.

FOMC Expectations

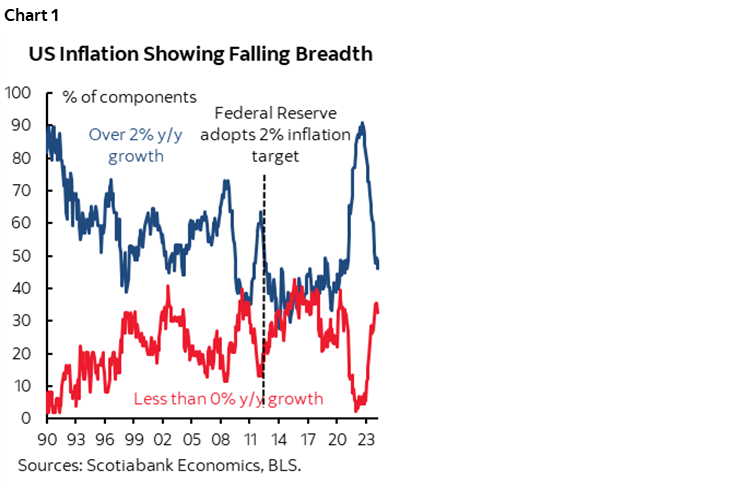

As for the Fed, the statement and Summary of Economic Projections including the ‘dot plot’ arrive at 2pmET. Chair Powell’s press conference starts at 2:30pmET and will last for up to an hour, probably less. Obviously no policy changes are expected. Balance sheet plans are on autopilot since they adjusted QT parameters on May 1st and only began to implement the changes at the start of this month. Chart 2 shows an optimistic path.

Key will be a) the dot plot, b) the economic projections, and c) the presser.

On the dot plot, there is a very low hurdle set to lower this year’s cuts from 75bps to 50bps as it would only take one dot to shift to make that happen. While there will probably be more at 0bps or 25bps for this year, I don’t expect enough dots and the composition of those dots to change toward those votes. As for next year’s dot plot? Oh please. The further out in time the dots go, the worse and worse their performance against what the Fed actually does becomes. If markets haven't learned that by now then there's no hope.

On the projections, the last projection in March was high on GDP growth in 2024 and 2025 compared to our just published update and so the Committee might revise lower in part given the way the year’s math began in Q1. On core PCE inflation, we’re a tick or two lower in 2024–25 than the March SEP. And on the unemployment rate, our projection is similar to the March SEP.

On the presser, I expect Powell to say they don’t have the requisite ‘greater confidence’ that they are on track toward achieving dual mandate goals at this point, but to continue to sound cautiously optimistic that core inflation will ease going forward and to continue to emphasize how the economy is rebalancing. This morning’s CPI update will likely get a nod one way or the other, but with the requirement for more data whatever the outcome.

Soft Q1 GDP growth of 1.3% q/q SAAR is one example of how the economy may be rebalancing. Excess demand moved marginally lower in an output gap framework sense, but volatile tracking for Q2 points to a pick up. Potential GDP growth is getting support from trend gains in productivity and population albeit somewhat inconsistently and with population forecasts very dependent on the US election. Job growth is solid, but openings to unemployed continue to trend lower which is one indication of a rebalancing labour market. I think the arguments for slower growth going forward are stronger than they’ve been in the past couple of years including market tightening of Fed rate cut pricing, tighter lending conditions, the strong dollar’s effects on net trade, that fiscal policy is now a drag on GDP growth and that the US election may induce weaker confidence to invest amid uncertainty over the outcome and the policy implications.

Overall, expect Powell to repeat that monetary policy is working, they are getting there, but have more work to do. He may not sound as opposed to going in July as he sounded ahead of June, however, given that we get two more CPI reports and two more PCE reports before the July 31st statement after which they slip away for summer.

As an aside, BoC Governor Macklem is on a 3:30pmET panel titled ‘Overcoming Economic Volatility’ along with a pair of ECB officials (Villeroy and Nagel) right after Chair Powell’s presser amid low expectations for reliable guidance despite the IMF’s latest rebuke when they called for better communication by the BoC (here). Amen.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.