| ON DECK FOR THURSDAY, JUNE 13 |

KEY POINTS:

- European markets catch up to the Fed

- Little US market follow through on FOMC, US CPI

- Australian jobs beat expectations

- US to auction 30s in another test of bond appetite

- US PPI, claims on tap

- BoC’s Macklem, Kozicki probably offer low risk today

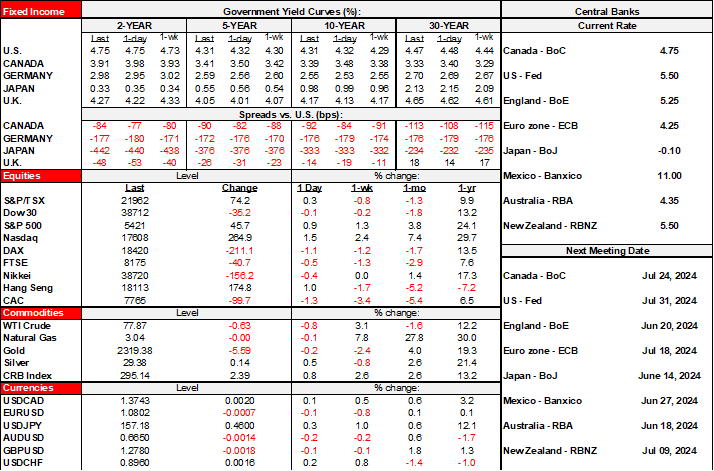

There is mixed follow through this morning on yesterday’s developments that included weaker US CPI (here) and FOMC communications (recap here) that really just said watch the data as they hedged on 25 or 50bps of cuts this year.

US Ts are little changed. Gilts and EGBs are underperforming, however, as yields climb a few basis points across maturities and countries and they are probably just playing catch-up to the Fed that landed after the European close. Stocks are mostly lower except for flat US futures. The dollar is little changed.

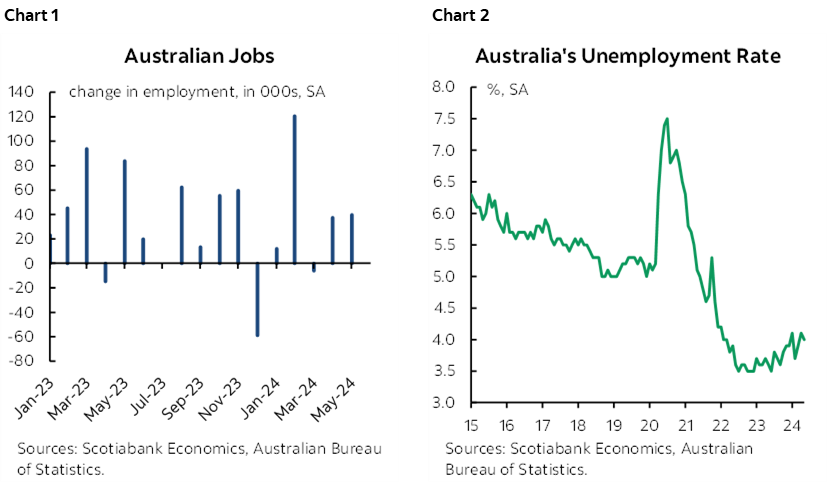

AUSTRALIA’S JOB MARKET

Australia gained about 40k jobs last month (30k consensus) and the mix was solid as they were all full-time (42k). The unemployment rate ticked lower to 4% and the participation rate moved up with revisions in April to 66.8% and held steady in May. This gain followed a similar gain of 37k the prior month and a year-to-date rise of 230k jobs. The job market remains strong (chart 1) and the unemployment rate is about a half point off the bottom (chart 2).

That caused mild cheapening in Australian 2s of about 2bps but this effect was overwhelmed by a drop at the Australian open that was fed by the previous day’s US developments, namely CPI, leaving the yield about 6bps lower on the session. The A$ is underperforming other majors relative to the USD.

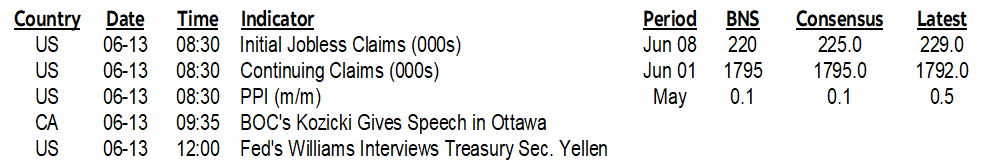

US Data, Fed– and Treasury-Speak on Tap

US core producer prices for May are expected to post a mild gain (8:30amET). US weekly jobless claims are also on tap (8:30amET).

The US will auction 30s in a US$22B reopening at 1pmET.

Fed-speak brings out NY Fed President Williams who will appear with Treasury Secretary Yellen at the Economic Club of New York (12pmET).

More BoC Jawboning

BoC-speak is back again. Macklem will do a fireside chat with no text, press conference, or audience Q&A this afternoon after his appearance yesterday said nothing new (1pmET). One of his deputies will give a history lesson on what they did during the pandemic this morning (9:50amET).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.