ON DECK FOR FRIDAY, JUNE 14

KEY POINTS:

- Safe havens in demand on a not-so-happy Friday

- German bunds rally double digits on French election worries

- The G7 family picture could soon look very different

- Global central bank outlooks clouded by European turmoil

- ECB’s Lagarde to speak amid political turmoil

- The BoJ announced QT intentions, plan details deferred to July…

- …and Ueda guided that a July hike is feasible

- Peru’s central bank surprises with a hawkish hold

- Swedish markets ignored hotter inflation

- Canadian data could reinforce solid growth tracking

- UMich sentiment expected to improve

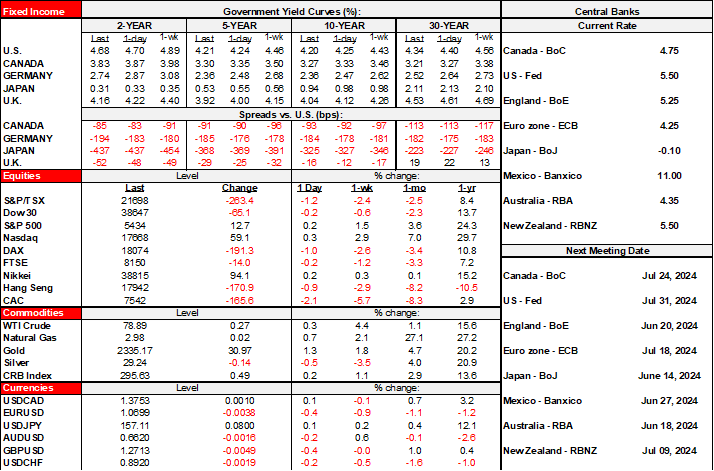

Anyone thinking that politics can be separated from economics is getting another rude awakening this morning. It’s a not-so-happy Friday as safe havens are in demand primarily due to ongoing uncertainty in Europe that is centered upon France’s elections with the first round two weeks from now. The CAC40 and Milan’s exchange are leading decliners with roughly 2½–3% declines. London is off by ½%, other European exchanges are down by 1%+, and N.A. futures are ½% to ¾% weaker. The USD is firmer except against other havens like CHF and maybe the yen that is also impacted by the BoJ, while the peso leads decliners along with the NZ$, Scandies, and the euro. Global sovereign bond benchmarks are all rallying and led by double digit declines in bund yields across the curve.

The G7 Family Picture May Soon Look Very Different

A look at the latest G7 leaders’ family photo naturally has one thinking it will probably be a very different picture within 12–18 months as most of them could well be out of their jobs given current polling.

UK PM Sunak may be first after the July 4th UK election. Biden (November 5th) and Trudeau (no later than October 2025) are polling very poorly. German Chancellor Scholz’s three party alliance only secured 31% support amid record participation and a 70% personal disapproval rating. This is driving pressure to call German elections as early as this summer but no later than October of next year. Japanese and Italian governments are inherently unstable. With the UK’s exception—where a sequence of conservative prime ministers has looked like anything but—most of these countries could turn further to the center-right unless France’s left continues to gain.

Macron’s resignation rumours could have something to them despite denials if his party loses badly as current polling suggests. The other day’s poll by Elabe showed Marine Le Pen’s National Rally (formerly National Front) party securing 31% of the vote, an alliance of left-wing parties getting 28%, and Macron’s Renaissance party getting 18%. That’s a close outcome between left and right and roughly within polling error. Macron’s approval rating sits at 24%, his lowest since 2018. The latest poll points to only 40% of Macron’s MPs qualifying on June 30th for the second-round vote on July 7th. The four French left wing political parties agreed yesterday to form an alliance. Losing this badly and having to appoint Le Pen as prime minister could well be too much for Macron to accept with the next Presidential election not scheduled until April 2027 but he would very likely lose an election held now.

What is at stake in France is concern that a Eurozone break-up premium may resurface and be driven by parties less amenable to the EU. Fiscal policy is an added concern as France’s National Rally is feared to favour expansionist policies that risk ratings downgrades. I’m not saying it’s a base case or even close to being one at this point, but one has got to keep a part of one’s mind open to the possibility that central bank plans could be thrown into a state of upheaval toward greater easing pressures if market turmoil intensifies over the summer.

The BoJ’s July Meeting Will be Key

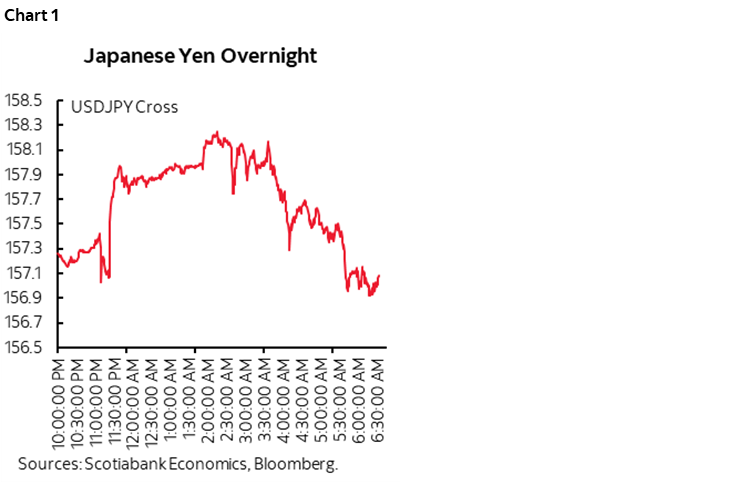

The BoJ decided by an 8–1 vote that it will reduce bond purchases at the next meeting on July 31st but deferred details until then and will consult with market participants. Governor Ueda said during his press conference that a reduction would be ‘substantial’ and that a rate hike at the same time is possible. The lack of detail was disconcerting to some and drove a mild rally in JGBs, but an initial sell off in the yen subsequently reversed during Ueda’s press conference and as European influences upon global markets took over during a volatile overnight session (chart 1). JGBs are also caught up in a general surge in demand for global sovereign bonds today.

Peru’s Central Bank Delivers a Surprise Hawkish-Hold

Peru’s BCRP surprised most within consensus who expected a 25bps cut last evening by holding at 5.75%. A minority of 3 out of 12 expected the hold. The statement had a bit more of a hawkish feel to it as it noted that core inflation “is showing some persistence associated with the services industry.”

Swedish Markets Ignored Hotter CPI

Swedish inflation was hotter than expected but markets ignored it in favour of global drivers. Headline and underlying CPI were both up by 0.2% m/m (-0.1% consensus for both).

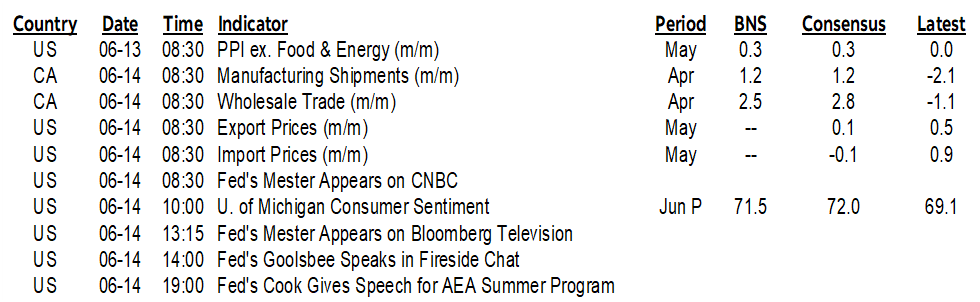

Modest Data Risk Into the N.A. Session; Lagarde On Tap

Modest data risk arrives in Canada with a pair of readings that are expected to reinforce expectations for solid economic growth in April (8:30amET). Manufacturing sales were previously guided by Statcan to have risen by 1.2% m/m and wholesale sales were guided to be up 2.8%. Revisions and details like volumes could matter.

US UMich consumer sentiment is also on tap (10amET). Amid increased political uncertainty, ECB President Lagarde will deliver a keynote dinner speech at a conference in Croatia this afternoon (1:30pmET).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.