| ON DECK FOR THURSDAY, JUNE 20 |

KEY POINTS:

- Relative central bank divergence is on display

- Bank of England sounded marginally more open to an August cut…

- ...but generally stayed out of the election fray

- SNB cuts, drives CHF underperformance, bull steepener

- Norges holds, douses cut expectations for the rest of 2024

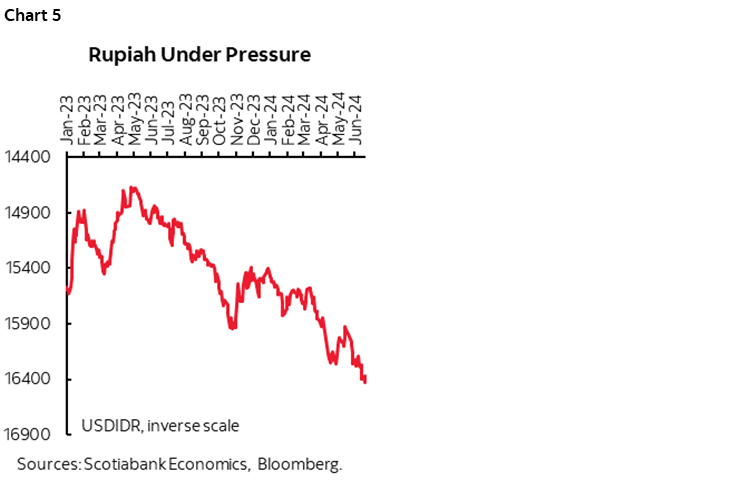

- Bank Indonesia unsuccessfully tries jawboning the rupiah

- Light US data on tap

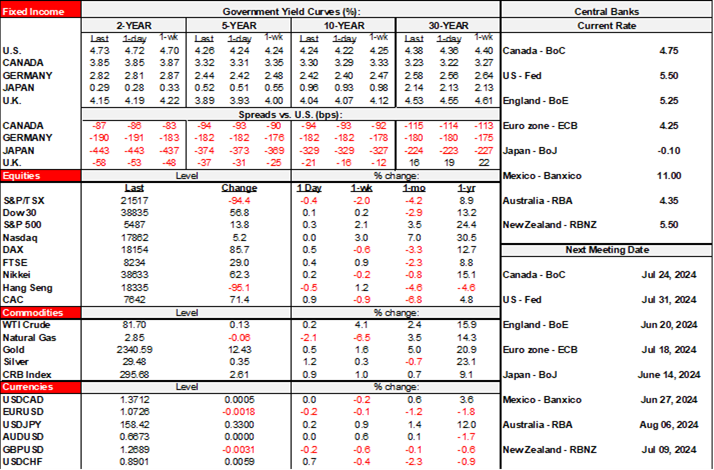

Stocks are broadly richer while bonds and currencies are diverging as American markets are welcomed back from their holiday this morning. There are no real global macro catalysts to this pattern. Relative central bank divergence is on display as four central banks weighed in ahead of light US data.

The Bank of England Inched Closer to an August Cut

The Bank of England’s communications added about 5bps to August 1st cut pricing that now stands at about -15bps priced out of a quarter point reduction.

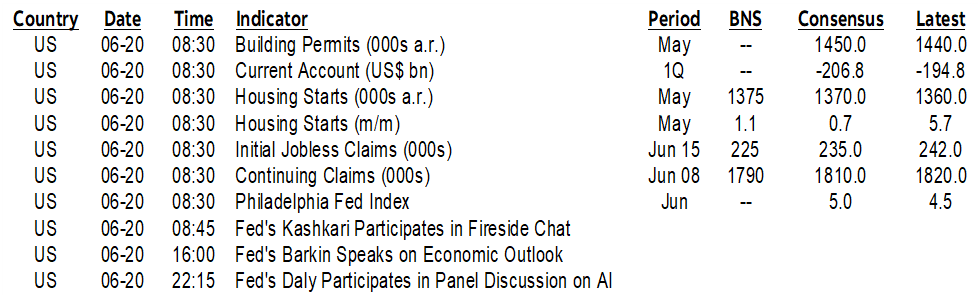

Nobody expected the 5.25% Bank Rate to change. They didn’t disappoint. Bailey and co largely stayed out of the election fray ahead of the July 4th vote. The BoE had previously cancelled any public communications during the election campaign, so expecting them to rock the boat this morning would be a rather unusual call. Furthermore, wage growth remains hot, but job growth is cooling. UK CPI at 0.5% m/m NSA in May was hotter than a typical month of May which extends the pattern of readings that say there should be no rush to ease (chart 1). No new projections were due at this meeting which added to the case for this to be a pretty dull affair.

Still, the Monetary Policy Summary (here) flagged the discussion around the near-term policy rate bias. See paragraphs 47 through 51. Among the seven members who voted to hold today, some indicated that “the policy decision at this meeting was finely balanced.” We don’t know how many out of the 7 felt this way, or whether Governor Bailey is one of them. The remaining two members continued to vote for a cut at this meeting which was the same number as previously.

What this indicates is that more members may be inclined to ease as soon as the August 1st decision.

SNB Cut Was a Modest Surprise

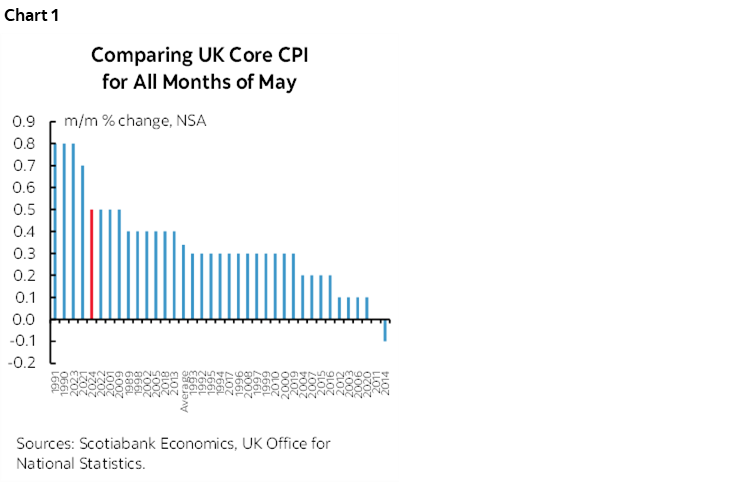

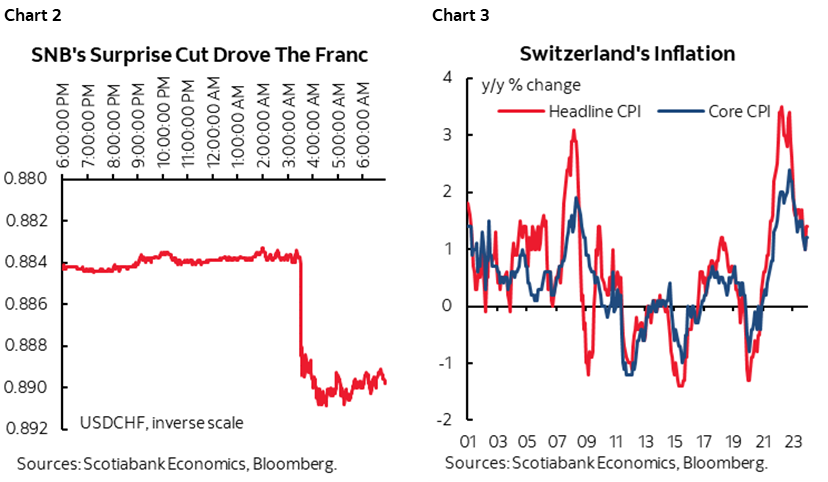

The Swiss National Bank cut its policy rate by another 25bps this morning. It wasn’t totally unexpected, as 12 out of 28 forecasters expected the cut and the rest thought they’d hold. The modest surprise drove the franc weaker (chart 2) and is underperforming other major currencies while the bull steepener is bucking the trend toward higher yields elsewhere. There was a compelling case for easing. A very practical one is that the next formal decision wouldn’t be until September 26th by which time other central banks may be easing and—barring an unusual intermeeting decision—that would have left the franc very vulnerable. The franc had already been appreciating since the last week of May and SNB was uncomfortable with such strength. That’s because inflation at 1.4% y/y and with core at 1.2% is already very low (chart 3).

Norges Bank Pushes Out Projected Easing

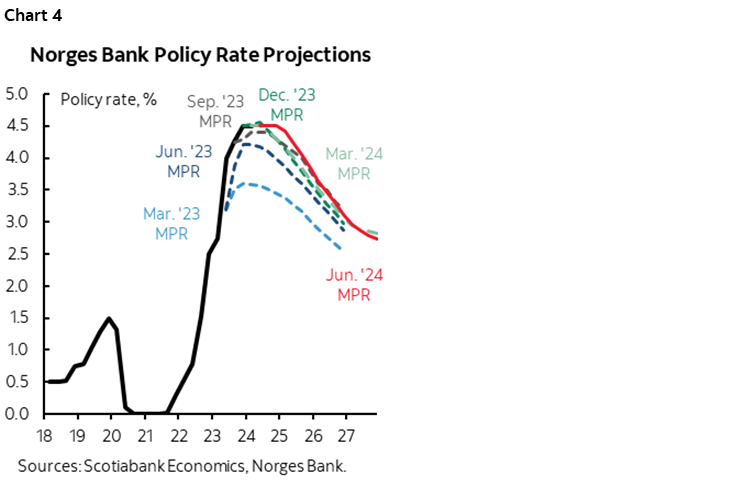

Norges Bank held its deposit rate unchanged at 4.5% as everyone expected, but the hawkish bias drove the krone to strengthen and outperform all other majors and semi-majors this morning while the rates curve is underperforming other global benchmarks. Explicit forward guidance is generally more reliable from this central bank than others, and so what they said indicated even less of a rush to cut that should be taken with greater acceptance than the maligned tool of forward guidance at some other central banks like the BoC. Previously Norges had said they would likely hold until autumn, and they now say “If the economy evolves as currently envisaged, the policy rate will continue to lie at 4.5 percent to the end of the year, before gradually being reduced.” Refreshed policy rate forecasts from the central bank indicate only 75bps of cuts next year as the policy rate path shifted higher compared to prior projections (chart 4).

Bank Indonesia Failed to Stem Currency Weakness

Bank Indonesia tried to jawbone rupiah strength after holding its policy rate unchanged and against tail bets it might have hiked again. It didn’t work. The rupiah depreciated and was Asia’s worst overnight performer to the USD (chart 5). They tried to argue that the rupiah was expected to appreciate going forward and that they would use intervention to stem the currency’s slide. Markets were looking for a more convincing gesture like the hike in April to defend the currency.

Light US Data and a TIPS Auction on Tap

Relatively light US data is on tap into the N.A. open. Weekly jobless claims, housing starts for May and the June edition of the Philly Fed’s metric are all due at 8:30amET ahead of light auction risk with the 5-year TIPS reopening at 1pmET.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.