ON DECK FOR FRIDAY, JUNE 21

KEY POINTS:

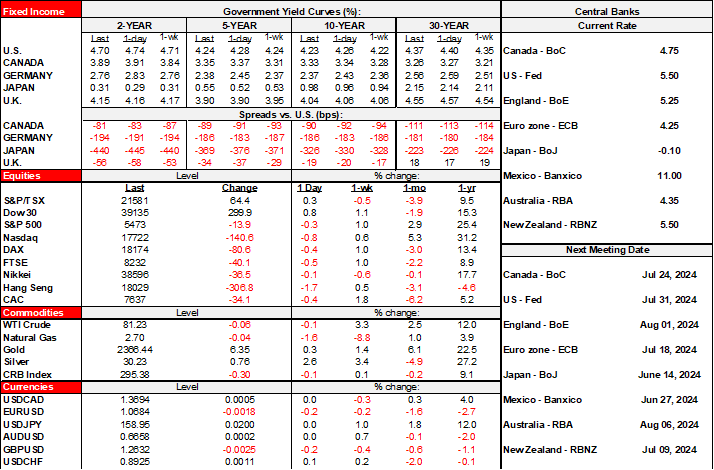

- Bonds richer, stocks poorer as politics bite

- Global PMIs deteriorate…

- …likely reflecting policy angst driven by election fever

- Volatile UK retail sales soar, but the trend is still weak

- Canada to update retail sales for April and May

- EVs: an economist’s nightmare

Data, data on the wall, who’s the fairest of them all? None of you!

That’s the unequivocal take across the latest monthly batch of purchasing managers’ indices. From Australia to Japan, and the Eurozone to the UK, all major industrialized regions of the world stumbled. That is contributing to dearer sovereign bonds and weaker equities across all major markets as the weak readings signal a sudden slowdown in the global economy.

The outcome could be a harbinger of what’s to come as policy uncertainty intensifies which was the theme of this past week’s Global Week Ahead (here).

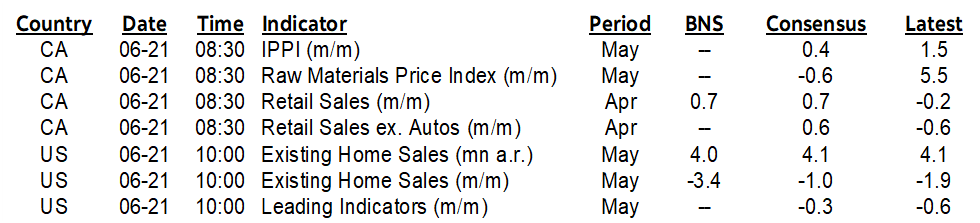

Some caution is always in order when evaluating PMIs. It’s soft, sentiment-driven data and it can be highly reactionary as a result. It’s possible that political developments are driving some of the weakening in PMIs and what supports this view is that the composite PMIs had generally been improving along an upward trend since late last year and then suddenly dipped in June (chart 1). Still, the global deterioration may also suggest that other factors may also be at work such as the lagging effects of tighter monetary policy and pushed out easing by the Fed.

Still, given the suddenness of the declines across all major PMIs, it would be crazy—irresponsible in fact—to put on horse blinders and choose to ignore the intensified policy risk that may come out of Europe’s elections, pending elections in France and the UK, and the coming US election. I continue to believe it’s an environment in which central banks will need to tread very carefully through the confidence effects on markets and c-suites.

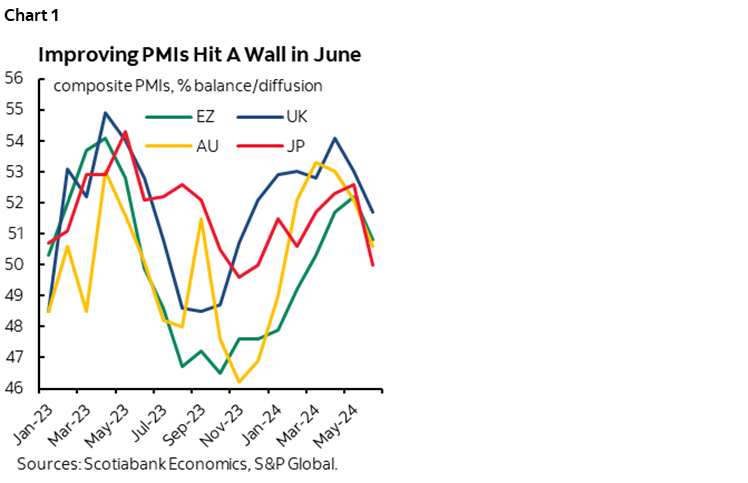

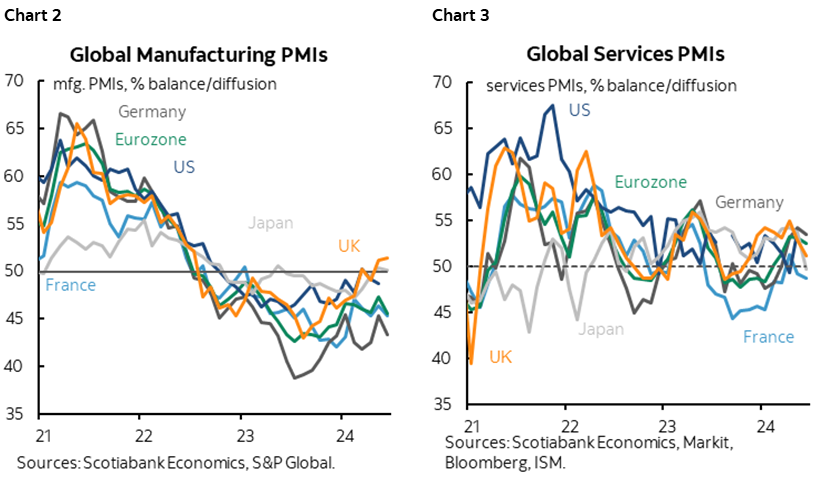

Charts 2 and 3 shows the patterns across markets as softening services joined contracting manufacturing. Here's the run down and with more details available in the releases here.

- Australia’s composite PMI fell 1.5 points to 50.6. Services fell by 1.5 points to 51 and manufacturing fell 2.2 points to 47.5.

- Japan’s composite PMI fell by 2.6 points to 50 mainly due to a sharp four-point drop in the services PMI to 49.8.

- India’s composite PMI held firm at 60.9 with a small gain in manufacturing.

- The eurozone’s PMI fell 1.4 points to 50.8 mainly due to manufacturing (45.6 from 47.3) but services also decelerated (52.6 from 53.2).

- Within the Eurozone, France was already in contraction and slipped a little further but more of the overall Eurozone decline was led by Germany (50.6, 52.4 prior).

- The UK also weakened as its composite PMI fell 1.3 points to 51.7 due to a softer services PMI.

The US releases its PMIs later this morning (9:45amET) along with existing home sales for May that are expected to dip (10amET).

Strong UK retail sales might be why gilts are underperforming other global benchmarks that are richening by more. May’s sales were up 2.9% m/m in volume terms (1.8% consensus) and the prior month’s drop of 2.3% m/m was revised up to a smaller decline of 1.8%. Sales ex-fuel were up by the same amount as the headline. Still, it’s a tough environment for UK shops at least from a planning standpoint given the enormous volatility in the data; down 3.6% m/m in December, then +3.9%, then a pair of mild declines, then -1.8% in April and now up 2.9%. Cutting through all of that noise over the months paints a picture of basically flat volumes dating back to the start of last year.

Canada will update retail sales for April and May this morning (8:30amET). We have a bit of a running head start given Statcan preliminary guidance that April retail sales were solid; volumes and other details, plus preliminary May guidance may matter more.

Trade tensions are on the rise globally and one part of that continues to be showcased in the auto sector. So, Canada is imposing tariffs on Chinese EVs and joining the US and EU. I get the whole state-directed and lack of market drivers thing about China. But speaking as an economist and as a matter of principle, I would never buy an EV no matter who makes them and where and for as long as humanly possible. The whole industry is the poster child for everything that economists don't like to see: massive subsidies; paying obscene amounts per job created; fleecing taxpayers; rampant protectionism; restricted choice; and unintended consequences like not having adequate power generation. The US, Europe, China and Canada among others are all equally bad players.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.