ON DECK FOR TUESDAY, JUNE 25

KEY POINTS:

- Mild risk aversion on light macro developments

- Canadian CPI expectations—and whether it matters

- House prices are at an inflection point higher in Canadian inflation

- CPI basket weight updates may lift inflation a touch higher

- Other milestones on the path to the BoC’s next decision

- Canadian by-election stunner reinforces current election modelling

Canadian CPI is the only main focus by way of calendar-based risk after a dull overnight session marked by mild risk aversion. US consumer confidence might spice it up afterward if it’s a material surprise (10amET).

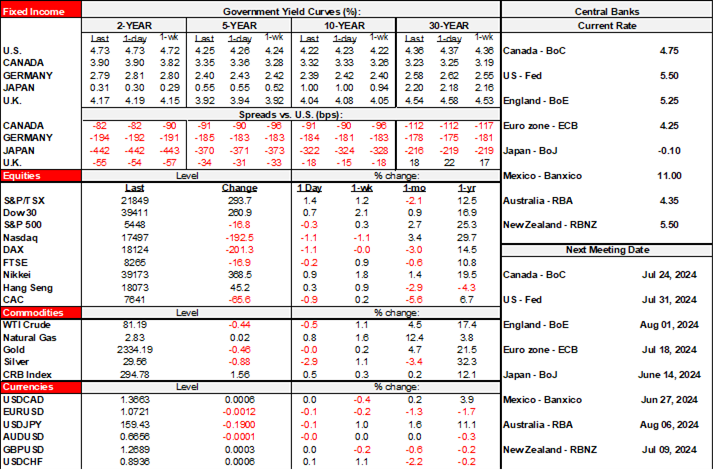

Stocks are mixed with snps up a touch while almost everywhere else either little changed or down as much as 1% in Germany. Sovereign bonds are outperforming in Europe over US Ts.

For May’s CPI report (8:30amET), estimates range from 0.2% (me, 4 in total) to 0.3% (5 forecasters) to 0.4% (2 estimates). Headline and traditional core CPI should be similar given little expected role played by gasoline and good prices.

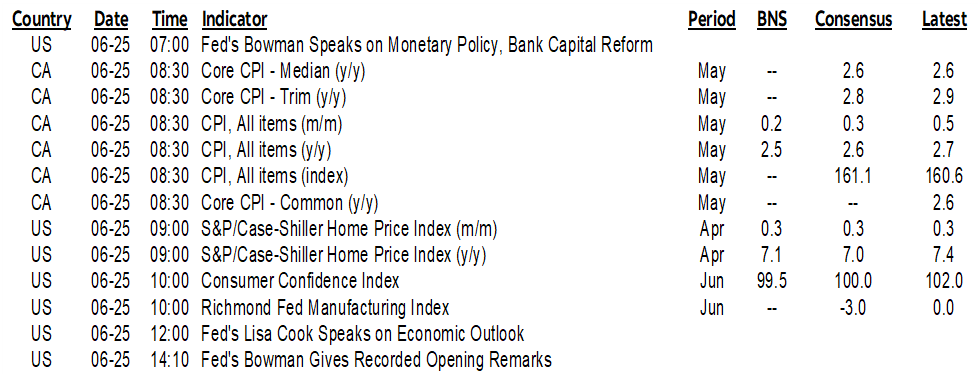

And that doesn’t matter. Trimmed mean and weighted median will matter in m/m SAAR terms as the BoC’s preferred core inflation gauges on a trend basis. If they’re cool again (chart 1), then that could well be sufficient evidence to give the BoC the green light to cut again on July 24th regardless of what happens in the next CPI print before the July decision. If they’re hot, then it’s a little more complicated and we’re left hanging somewhat until the next pre-decision inflation print. A hot one followed by a cool one, for instance, would probably be enough for the BoC to cut again while pointing to the trend and its inflation forecast which may dominate their thinking in any event.

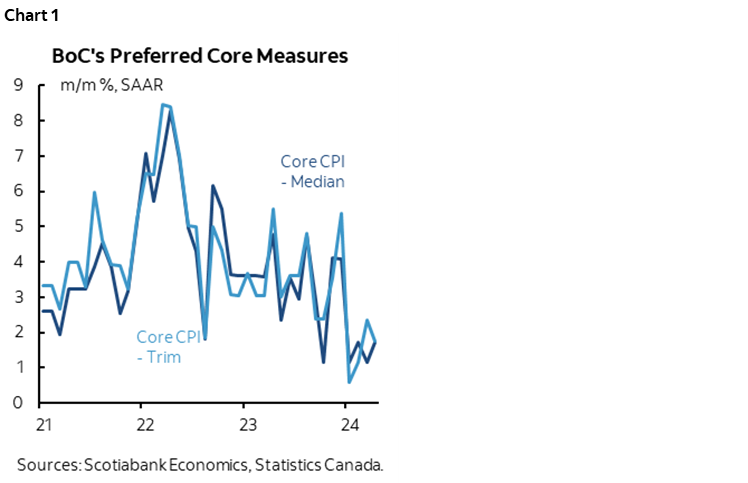

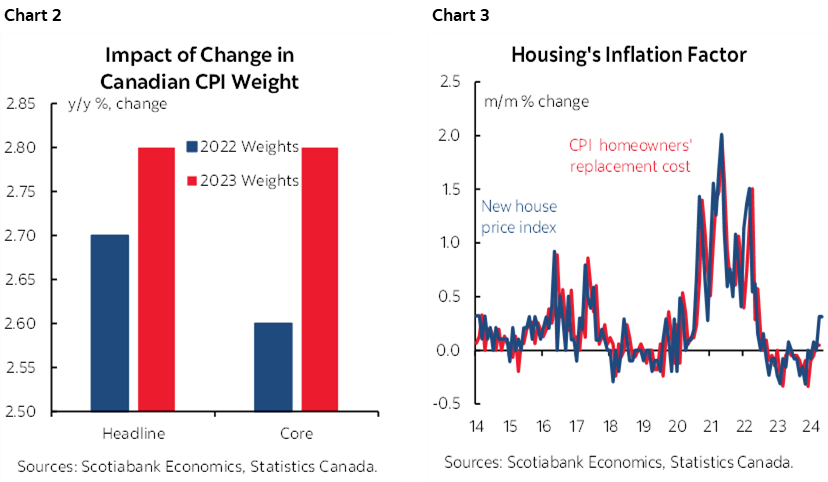

This CPI report will adjust the spending weights in the annual exercise. Statcan does not revise CPI figures for basket weight changes and only incorporates them on a go forward basis at the link month which in this case in May. That said, during the same exercise last year, Statcan made a point of referencing that if old weights had been used in the May figures, then CPI in y/y terms would have been a tenth lower. This time, we’re figuring that based on comparing the effects of the weight changes for April it would have been one-tenth higher on headline CPI and two-tenths higher on core inflation (chart 2). We will also see house prices make a touch more of a still small contribution but one that may well be at an inflection point with probably more to come (chart 3). See my week ahead for further elaboration (here).

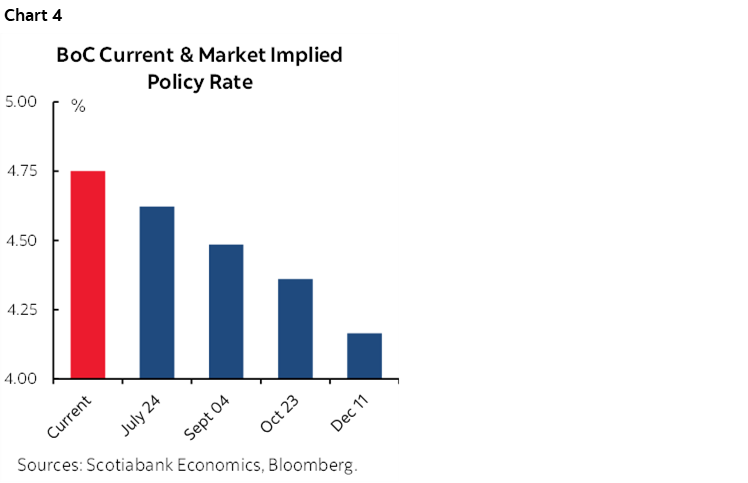

The other markers on the path to the July 24th BoC decision will include the BoC’s household and business surveys including measures of inflation expectations on the 15th, CPI for June the next day, this Friday’s GDP figures for April and May, and next Friday’s jobs report. Markets are priced for about 15bps of a quarter point cut on July 24th (chart 4).

Also see the stunning by-election outcome in Canada where a Toronto riding held by the Liberals for three decades was won by the Conservative candidate by a 42.1% to 40.5% margin (here). Not even the Conservatives truly thought they’d win. Toronto is typically a Liberal town and this particular riding is the heartland of the popularly termed ‘limosine liberals’. The vote was widely viewed as a referendum on the current Liberal leadership and a litmus test of PM Trudeau’s ability to lead the party into the next election. The outcome reinforces current polling and seat projections that predict a Conservative landslide if an election were to be held today (here). An election has to be held by no later than October of next year so there is a lot of ground to cover between now and then.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.