ON DECK FOR WEDNESDAY, JUNE 26

KEY POINTS:

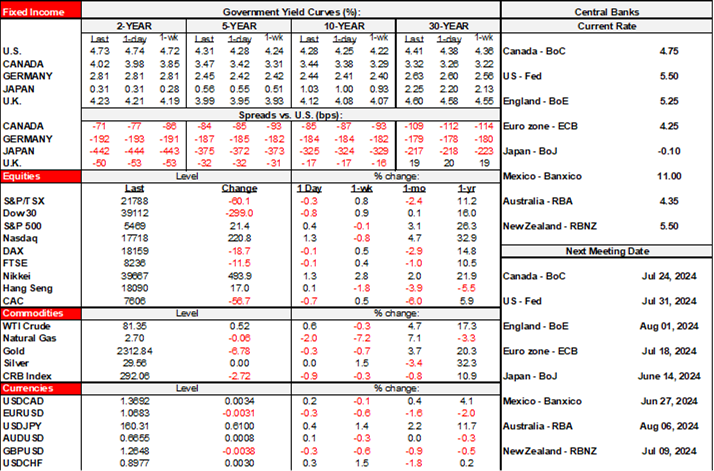

- Bonds slightly cheaper, equities little changed…

- …on light macro developments

- Markets shouldn’t treat inflation risk in Canada/Australia as portable into US, Europe

- Australia’s rates spike, A$ outperforms after another hot inflation report…

- ...that feed RBA hike risk

- Canada quiet ahead of tomorrow’s 2s, Friday’s GDP…

- …as markets assign low odds to a July BoC cut

- US auction risk continues, new home sales on tap

It’s a light session by way of fresh macro developments that has sovereign bonds broadly cheaper, equities little changed, and the dollar broadly stronger. The catalysts are not clear in my opinion. There was a slight cheapening bias in US Ts before hot Australian CPI landed and drove further cheapening.

Nevertheless, to pin slightly cheaper US Ts this morning on Australian and Canadian inflation data suggests markets are applying some casual empiricism if they think that the unique drivers of US inflation have something in common with those two other countries at this point in the cycle. During the pandemic, the challenges facing global supply chains drove more correlated global inflation risk. Right now, I think inflation risk is more idiosyncratic and market-specific such that it’s more likely that what happens in places like Canada and Australia is more likely to stay in Canada and Australia rather than being treated as portable risk into places like Europe and the US.

RBA HIKE PRICING INTENSIFIES AFTER HOT CPI

Australian monthly inflation surprised higher and that drove serious underperformance by Australia’s rates curve and a stronger A$. The real test will come on July 30th when full Q2 Australian CPI figures are released since RBA Governor Bullock has put significant emphasis upon that report in terms of potential hike risk.

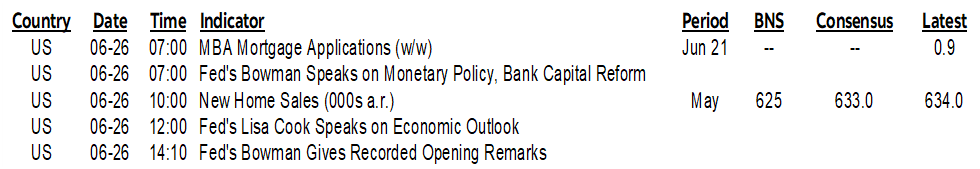

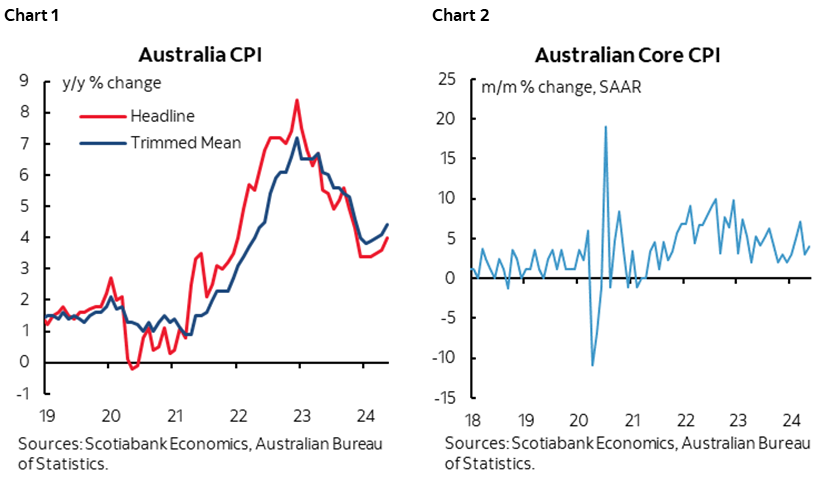

For now, May’s CPI was up 4% y/y (3.8% consensus, 3.6% prior) and key was that the trimmed mean CPI measure climbed to 4.4% and has been on a steady upward trend this year (chart 1). Higher frequency m/m core (not trimmed mean) inflation at a seasonally adjusted and annualized rate was 4% and hence remains materially above the RBA’s 2–3% inflation target range (chart 2). In Australia’s case, trimmed mean CPI takes the middle 70% of the CPI basket and trims out the tails to focus more closely upon central tendencies (Canada takes the middle 60%).

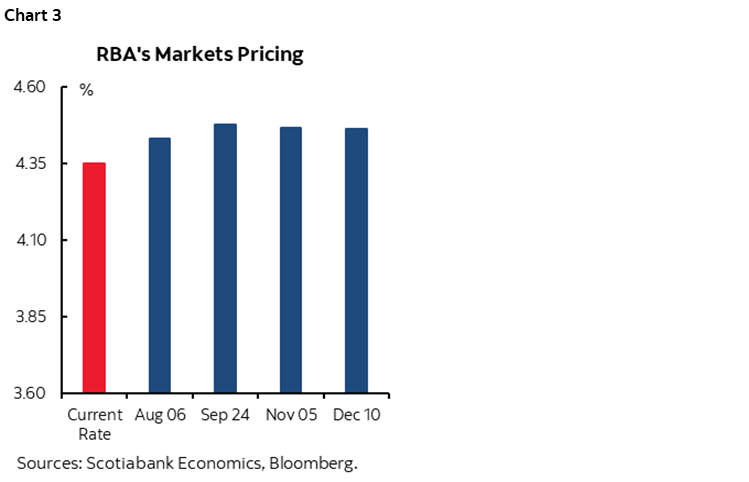

The result pushed August RBA hike pricing about 7bps higher to a still slim 8bp and added 7–8bps to September pricing which is now a 50–50 call (chart 3). Australian 2s cheapened by 18bps and 10s were up 11bps while the A$ is outperforming almost all major and semi-major crosses this morning.

RISING PRESSURE ON FUTILE YEN INTERVENTION

The yen continues to soften on a morning of broad-based USD strength and is now at 160. That will put more pressure upon the MoF to intervene. And they’ll fail. Again. One-sided intervention against fundamental macro drivers can only at best temporarily manage a currency but without lasting consequences.

LIGHT US DEVELOPMENTS

US auction risk continues with 2-yr FRN (11:30amET) and 5-year Ts auctions (1pmET).

US new home sales may face downside risk given the correlations with model home visits that have been weakening (10amET).

MARKETS LARGELY WIPED OUT JULY BOC CUT PRICING

There is nothing out in Canada today ahead of tomorrow’s 2s auction in the wake of yesterday’s hot CPI, and Friday’s GDP figures. Markets now see only 6bps of a cut priced for the BoC’s July 24th decision, down from about 15bps of a cut priced before yesterday’s CPI figures (reminder recap here). A lot of data is still ahead before the next decision including another CPI report, the BoC’s surveys of businesses and consumers including measures of inflation expectations, a jobs report, and both April and May GDP estimates.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.