| ON DECK FOR THURSDAY, JUNE 27 |

KEY POINTS:

- Mild risk aversion has few drivers

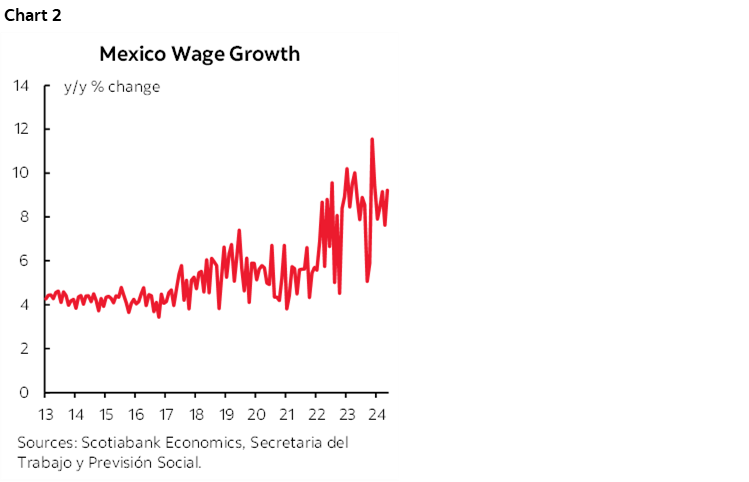

- US core PCE & GDP revisions, durables, claims, home sales on tap

- Banxico expected to hold today

- Canada to auction 2s after CPI took an axe to the front-end

- Riksbank was slightly more dovish

- BSP continues to guide nearer-term easing

- Japanese consumers are feeling frisky

- The worst of US politics will be on display tonight

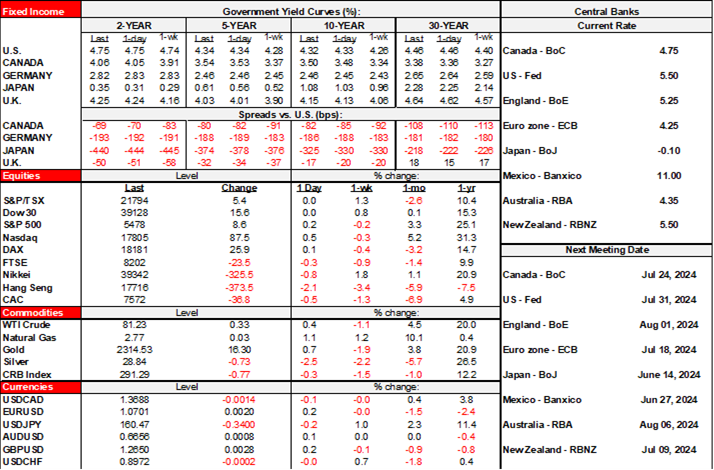

Stocks and bonds have a mild cheapening bias to start the morning. The USD is slightly softer. There are no fresh global catalysts so far. Overnight developments were light ahead of today’s potential US core PCE revisions and other US macro data risk, Mexico’s central bank decision, and Canada’s 2-year auction.

A pair of central bank decisions and solid Japanese data were the only overnight developments ahead of the day’s developments.

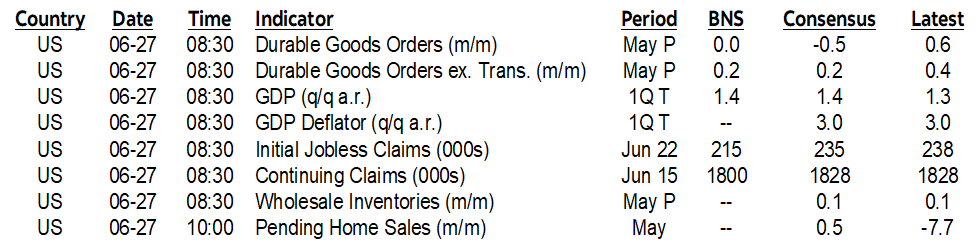

Sweden’s Riksbank Entertained a Little More Easing

Sweden’s currency is underperforming while the front-end of its rates curve is outperforming global benchmarks after slightly more dovish than expected guidance from the Riksbank. It left the policy rate unchanged at 3.75% as universally expected, but changed explicit forward guidance from two more cuts this year to saying “If inflation prospects remain the same, the policy rate can be cut two or three times during the second half of the year.” Other than that, forward guidance was very similar to the prior path in March (chart 1). Forecasts backed up that additional possible cut when they revised the inflation outlook lower with underlying inflation projected to be 2% this year (2.3% previously) and 1.8% next year (1.9% previously).

Japanese Consumers Are Feeling Frisky

Japanese consumers are feeling a little frisky these days. Retail sales were up 1.7% m/m in May, doubling consensus. They were up 0.8% the prior month and have risen by about 4% ytd non-annualized. In dollar terms, sales are at a record high. Markets shook off the figures.

BSP Continues to Guide Pending Cuts

The Philippines’ central bank left its policy rate at 6.5% as widely expected and repeated that prior guidance toward a first cut in August is now more likely. Guidance pointed to 50bps of cuts this year and at a quarter point pace in the cycle.

On tap into the N.A. session is a focus on US data, appetite for Canada’s front-end, and Banxico.

US Core PCE, GDP Revisions Highlight the US Calendar

The US will take a third swing at Q1 US GDP and core PCE (8:30amET). The third and final estimate incorporates more services data. Revisions to core PCE are less likely at this stage but can be impactful ahead of tomorrow’s PCE figures for May that are expected to be quite soft.

US data risk will be a bit of a warm-up to tomorrow’s PCE figures and also includes durable goods orders ofr May (8:30amET), claims (8:30amET), pending home sales (10amET) and the merchandise trade balance (8:30amET).

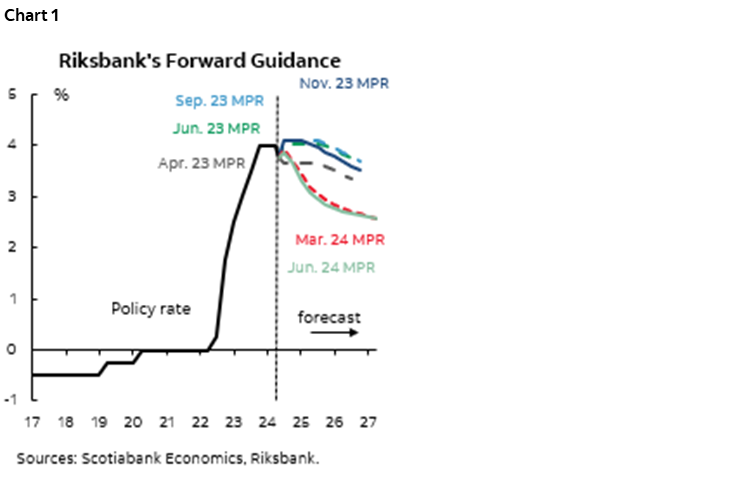

Banxico Expected to Hold

A small minority think Banxico could cut but almost everyone is in the hold camp (3pmET). While every meeting is ‘live,’ Banxico is expected to hold its overnight rate at 11% again for the second consecutive meeting after it delivered a 25bps cut in March, beating the BoC in North America. The nearly 10% slide in the peso’s value to the USD since May 17th and including the aftermath of the general election on June 2nd merits caution in terms of pass through risk into inflation. Governor Victoria Rodriguez indicated that this risk should be evaluated “with caution” which doesn’t sound like a central banker on the verge of further easing. Furthermore, nominal wage growth has since accelerated to over 9% y/y (chart 2). The stubborn persistence of strong wage gains since 2022 is a complicating risk facing the ability to get inflation down from 4.7% y/y (4.2% core) to Banxico’s 3% +/- 1% inflation target.

Turkey’s central bank held its policy rate at an eye-watering 50% and guided it expects disinflationary pressure over 2024H2.

Canada to Auction Cheaper 2s

Canada updates lagging payrolls for April after a 51k rise in March (8:30amET). Next Friday’s LFS figures for June will matter much more as it is more complete—such as including off-payroll employers—and vastly more timely. I still will never understand why the US—a much bigger economy—can release household and payroll figures on the same day, but Canada releases payroll figures months later.

Canada auctions C$5.5B of 2s at noon after CPI took an axe to the front end. The 2s yield is up by about 16bps post-CPI.

The Worst of US Politics Will be On Display Tonight

And if none of that does it for you, then the first US Presidential debate between President Biden (81) and candidate Trump (78) will be tonight at 9pmET. The tightened rules could make it a tamer affair including no audience and muted mics. I’m sure the behaviour will set another low point and awful example for young people as usual. I'll be watching for will be which one loses their stream of thought or falls asleep first!

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.