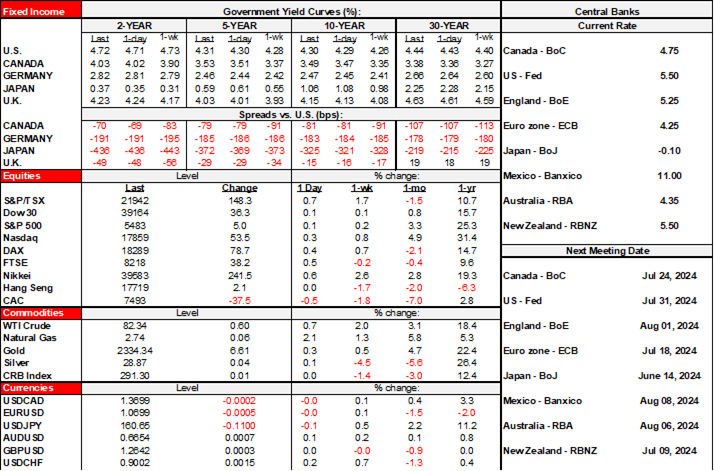

| ON DECK FOR FRIDAY, JUNE 28 |

KEY POINTS:

- Global markets await US inflation, month- and quarter-end

- America should be gravely embarrassed over last night’s debate

- Eurozone headline inflation is landing on the screws so far…

- ...but core inflation continues to flash warning signs

- Tokyo core CPI bounces back, but it’s just one month

- US core PCE is likely to be soft, but more evidence will be needed

- Canada awaits Q2 GDP updates

- Canadian markets to close early ahead of Canada Day

- BanRep expected to cut

Month- and calendar quarter-end, an early close in Canada, and possible last-minute effects into the weekend’s French election will combine with elevated global data risk to end the week, month and quarter with a potential bang. Markets showed no reaction to overnight developments out of Europe, Japan, and including the truly pathetic US debate. There may be volatility around N.A. data this morning.

Eurozone Inflation On Consensus, Core Still Flashing Warning Signs

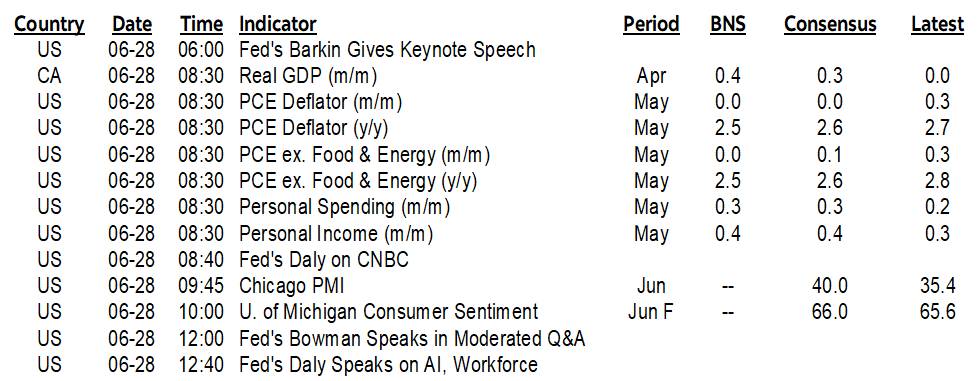

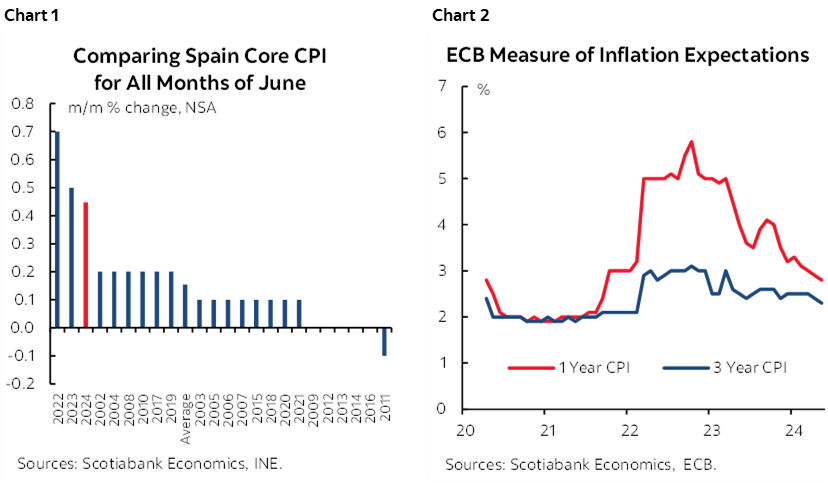

European inflation readings offered no surprises this morning. France (0.1% m/m), Spain (0.3% m/m) and Italy (0.2% m/m) all landed on the screws. That said, there remain signs that core inflation is still running too hot. Chart 1 shows Spanish core CPI in m/m terms and because it’s seasonally unadjusted we compared this June to like months in history to show that it was among the hottest months of June for underlying inflationary pressure on record. ECB measures of inflation expectations ebbed a touch with the 1-year down a tick to 2.8% and the 3-year also down a tick to 2.3% (chart 2). German CPI arrives on Monday and the Eurozone tally will be released on Tuesday.

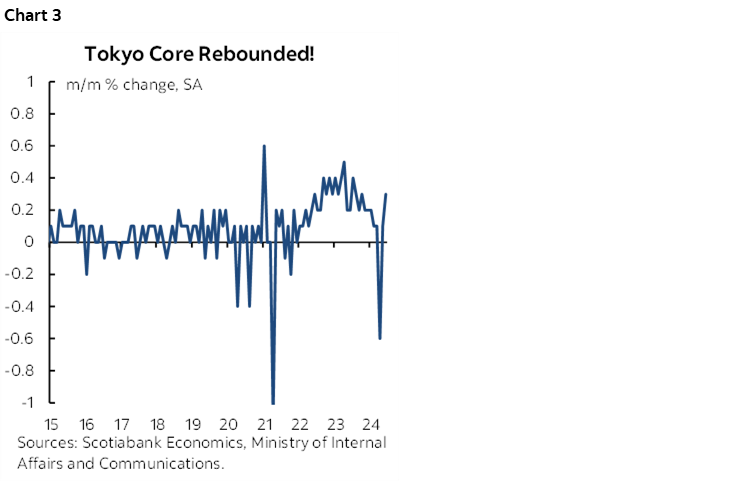

Tokyo Core Inflation Bounces Back

Tokyo core CPI bounced back in June with a 0.3% m/m SA rise (chart 3). The reading has shaken off the distorted -0.6% m/m SA drop two months prior when there were changes to school fees. Still, it’s one month of evidence that core inflation has increased when before the distorted reading the trend had been decidedly lower for about a year prior. The yen couldn’t have cared less.

America Should be Ashamed

I want my 90 minutes back!! I spent the whole 90 minutes of last evening’s Presidential debate feeling flushed, red faced, and appalled for America. These two are the best the country can come up with??! Trump didn’t win. Biden lost. That’s not just semantics. Nothing’s changed with Trump as he remains his usual lying, despicable self and would occupy an office lacking any global respect while driving deep divisions at home. Biden had a better grasp of the content, but his mental acuity and energy are clearly not suited to another term in office that would only bring further deterioration and uncertainty over who is running the administration. Absent a quick and successful effort to replace Biden amid uncertainty that anyone would poll any better against Trump it seems that we’re stuck with this man and his severely misguided policies for another four years amid much higher stakes to the US and world economies and US democracy this time. Watch for the aftermath of polling results through the weekend into early next week as the next step. A CNN poll shows 67% of viewers thought Trump won; maybe debates don’t matter.

Soft US Core PCE Inflation Needs More Evidence

The US updates core PCE inflation for May. Will it be a 0, 1 or 2 as the first decimal point to the m/m core reading? I went with zero, consensus is 0.1, some are at 0.2. The reason I went a little lower is that a) core PCE often undershoots core CPI that itself was only 0.16% m/m in June, and b) core PCE puts a higher weight on cool core services prices and a lower weight on hot shelter prices than CPI does which could combine to drive a rather weak number. Frankly, any of those estimates would indicate a softening of inflationary pressures at the margin but would be insufficient on its own to motivate a dovish pivot by the FOMC.

Tracking Canada’s Economy in Q2

Canada updates GDP figures (8:30amET). We’ll get a better understanding of Q2 GDP growth from the April figures that were initially guided by Statcan to be up by 0.3% m/m and the preliminary estimate for May.

BanRep Expected to Cut

Colombia’s central bank gets the final word when it is expected to cut 50bps (2pmET).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.