ON DECK FOR WEDNESDAY, MARCH 20

KEY POINTS:

- Markets nervously await the Fed

- Will the FOMC’s dot plot reduce projected easing?

- The FOMC will advance a QT dialogue with no decisions expected

- Gilts outperform on a slight miss by UK CPI

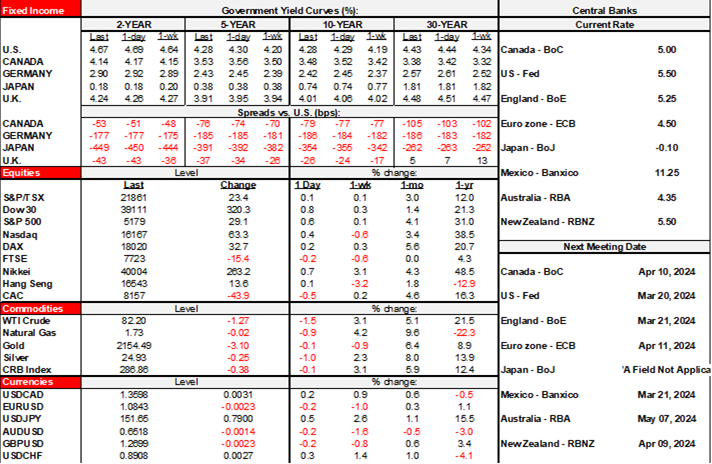

Markets are playing defence this morning in anticipation of what the Fed might deliver this afternoon. The USD is gaining against all major crosses and the trend is yet again defying expectations for broad dollar softening. Equities are flat to slightly lower across major global benchmarks. Sovereign yields are a little lower and led by the UK post-CPI.

UK CPI SLIGHTLY MISSES

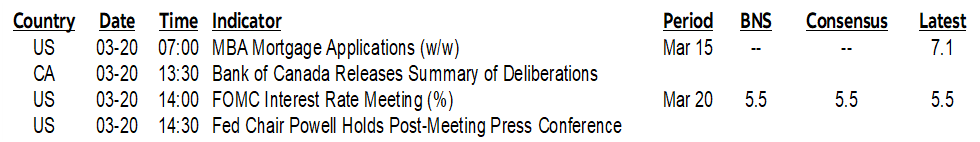

UK core CPI was up 0.6% m/m NSA which was a tick faster than the historical average for like months of February (chart 1). This follows January’s softer than normal reading compared to all like months of January over time. February wasn’t light, but you could average the two and say that year-to-date core inflation has eased off from the warmer than usual reading for December.

What motivated a decline in UK yields that are outperforming other benchmarks was that the broad set of readings came in slightly softer than expected. Headline was up 0.6% m/m (0.7% consensus) and 3.4% y/y (4% prior, 3.5% consensus). Core was up 4.5% y/y (5.1% prior, 4.6% consensus).

Other overnight developments were light. Chinese banks left their 1- and 5-year Loan Prime Rates unchanged this time after the prior cut to the 5-year that is key to the property market. Bank Indonesia held as expected and remains sensitive to rocking the boat on the rupiah in relation to their policy changes compared to when the Fed eases.

FOMC EXPECTATIONS — SHIFTING DOTS, CHEAP TALK ON QT?

As for the FOMC, this will be a full set of communications including the statement (2pmET) and Summary of Economic Projections with the dot plot (2pmET) and followed by Chair Powell’s press conference at 2:30pmET.

Expect a hawkish tone that is in no rush to be easing. The dot plot may downshift from 75bps of cuts this year to two given how close the dispersion of the dots between the two estimates was at the December meeting and comments by some Fed officials. The risk is clearly lower than 75bps, not higher, but whether markets believe it relative to -75bps+ that is priced remains to be seen. It wouldn’t take much change across the individual dots to get the median projection for 75bps to move to 50bps this year. 2025 may be more interesting and uncertain; I can see pushing out and reducing the pace in 2024 but I’m not sure they’d extend that to 2025 at this point. No change in neutral at 2.5% is expected but the range may widen.

Also expect a fuller discussion on balance sheet plans including QT timelines as promised in advance by Chair Powell, but with no decision likely to be announced at this meeting. Nothing I’m reading from key Fed officials makes it sound like they think QT plans need to be adjusted imminently. A recent Bloomberg survey showed only 2 participants expecting an announcement to adjust QT at this meeting and only a minority expecting an announcement in May. Most expect June or later.

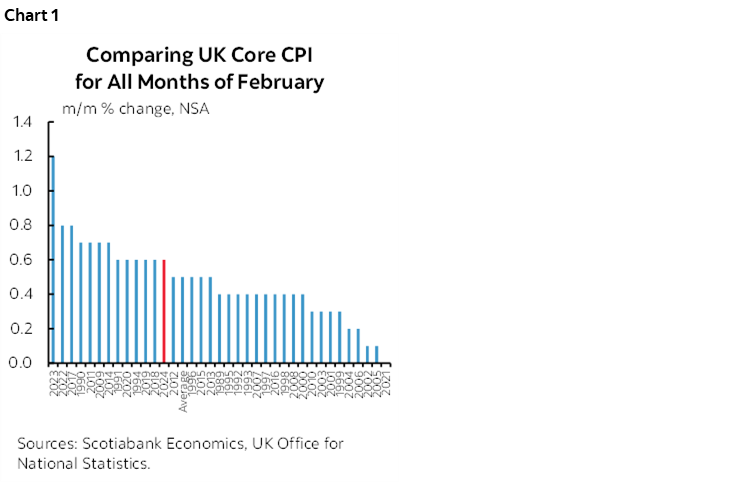

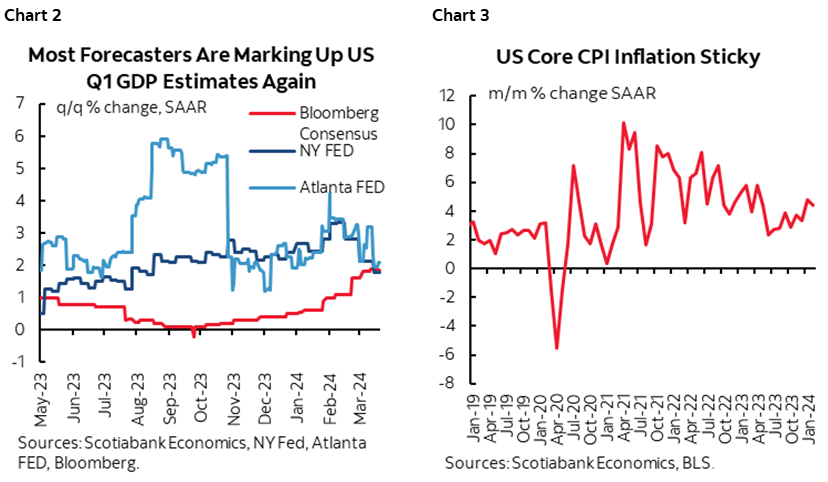

The macro backdrop for the meeting remains one of resilience. Q1 GDP nowcasts are in the 2% vicinity after 3.2% q/q SAAR growth in Q4 which continues to showcase resilience. In fact, economists are repeating the pattern of revising up Q1 GDP growth expectations in consensus estimates (chart 2). Wage growth in m/m SAAR terms was on an upward trend since late last summer and eclipsing productivity growth but suffered a set back to start the new year. Core CPI inflation has surprised higher for the past two months and is trending well above 2% in m/m SAAR terms over the past four months (chart 3). Core PCE has surprised higher once and with the February print not due until next week but expected to put in another 0.3–0.4 reading. Nonfarm gains were revised lower but the 3-month MA is still averaging 265k/month over the latest three months which remains above estimates of a rate of gains that would be compatible with longer-run labour force expansion.

OTHER STUFF

I wouldn’t pay much attention to the BoC’s Summary of Deliberations in the lead up to the March 6th decision (1:30pmET). Deputy Governor Gravelle’s speech tomorrow might offer the BoC’s reaction to yesterday’s CPI which would make it more relevant given that the balance sheet focus is less pertinent after Governor Macklem’s remarks.

Banco Central do Brasil is expected to cut by 50bps later today which would take the Selic rate down to 10.75% for a cumulative 300bps of easing dating back to August and with more to come (5:30pmET).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.