ON DECK FOR FRIDAY, MARCH 22

KEY POINTS:

- Bonds ending the week in rally mode

- Canadian retail sales were resilient

- UK retail sales post a slight beat along a weak trend

- Canada’s 15% projected cut to temporary resident immigration…

- …will still result in excessive immigration flows to Canada...

- ...that will stimulate demand and inflation risk with little to no wage effect

- Japanese core inflation continues to ebb

- BanRep to cut today

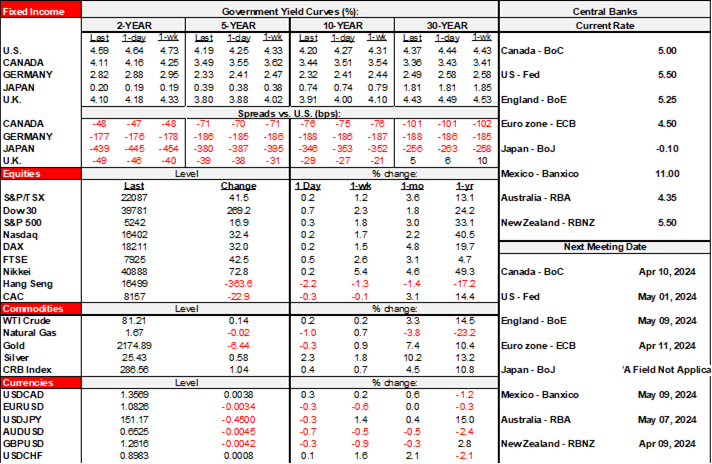

The week is ending with bonds rallying but this time alongside more mixed evidence across equities. There are only light fresh developments to consider in terms of data and central banks.

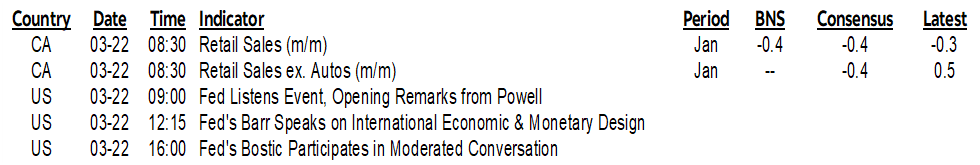

Japanese Disinflation

Japan’s national CPI print merely confirmed evidence from the previously released Tokyo gauge earlier this month. National core CPI ex-food and energy was up by just 0.1% m/m SA in February, matching the Tokyo estimate. That was the softest reading since April 2022 as clearly Japanese core inflationary pressures have ebbed (chart 1). This approach omits food and energy as beyond the influence of the central bank and per convention elsewhere, and also evaluates evidence at the margin instead of using base-effect driven year-over-year estimates. The chart clearly shows that core inflation is moving well past its peak such that sustainably hitting the BoJ’s 2% target will strongly rely upon a broadening of more durable wage pressures transmitting into the core basket.

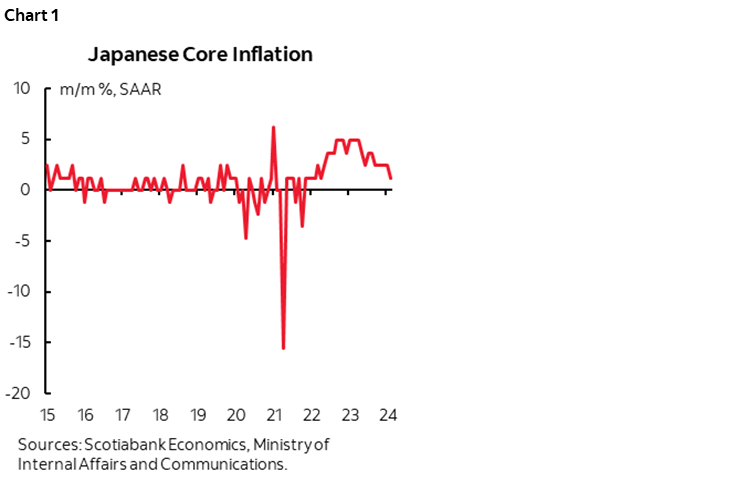

Mild European Data

UK retail sales volumes were a little better than expected. February’s flat print (-0.4% m/m consensus) was accompanied by a slight upward revision to the prior month (3.6% m/m instead of 3.4%). Ex-fuel sales were up 0.2% m/m (-0.1% consensus) and with the prior revised up two-tenths to 3.4%. Still, the oscillating pattern of gains and losses leaves the trend in UK retail sales volumes quite flat and for an extended period of time (charts 2, 3).

German business confidence picked up in March’s IFO readings. Expectations jumped by 3.1 points for the second consecutive improvement and to the highest reading since last May. That reinforces the gains in German PMIs and the ZEW measure of investor expectations as soft data strengthened this month.

Canadian Consumers Remain Resilient

Canadian retail sales were ok. In value terms, they were down by –0.3% m/m SA in January versus Statcan’s earlier flash guidance of –0.4%, but that was all due to lower prices as volumes were up by 0.2% m/m SA. Tentative guidance for February points to a mild 0.1% m/m SA gain in the value of retail sales which probably implies little change in volumes. Chart 4 shows tracking for the quarter that is probably up by around 3% q/q SAAR after a prior quarter gain of over 5%. Folks wrote off the Canadian consumer prematurely especially after considering that in Canada, retail sales do not include any services that are instead included in total consumer spending (chart 5). Chart 6 shows what drove the m/m change in the volume of sales in January as several sectors drove the gain. Some say take out sales of gasoline and gas station merchandise volumes which makes no sense to me. It’s a mobility gauge that indicates folks are driving around, probably consuming lots of services too. Or how about removing vehicles and parts that according to Statcan was led by a big drop in sales at new vehicle dealers which defies what the industry reports to have been a large gain in new vehicle sales (here). #can’tcherrypick.

BanRep is expected to cut 50bps today (2pmET).

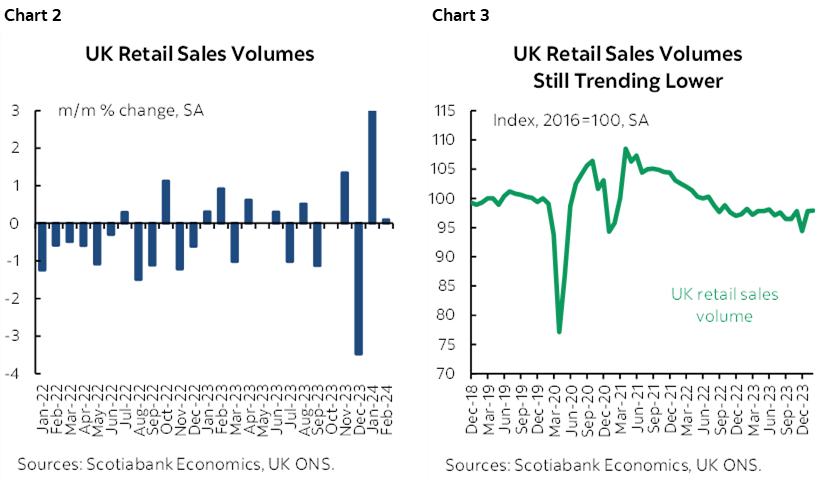

CANADA’S IMMIGRATION POLICY REMAINS EXCESSIVE

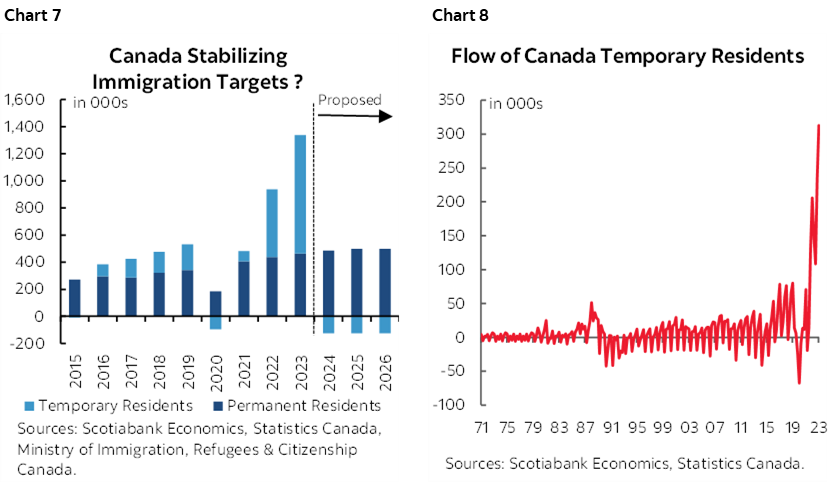

As an aside, chart 7 shows the targeted path for Canadian immigration over the next three years including the effects of yesterday’s announcements. The plan is to reduce temps from 2.5 million or 6.2% of the population now, to 5% of the population in three years. Because the population will be larger in three years, 5% at that point would imply a net reduction of about 375k in the temps category over this period. That’s about a 15% reduction from the dizzying heights that were registered in 2023 when the flow of temps to Canada soared (chart 8). On an annualized quarterly basis, this planned reduction will only take us back to where the temp level was around the middle of last year which isn’t much of a rollback!

If they succeed in bringing temps down while leaving the permanent resident targets unchanged, then immigration will drive a 1.11 million increase in Canada’s population over the next three years through netting out the plans for the two categories. That’s still too much in my opinion. Canada is still struggling to accommodate the massive surge of the past couple of years and will continue to struggle for a while yet, only to continue to face further large increases in immigration over the medium-term. In my view, that will remain a source of demand stimulus to the Canadian economy and continue to pressure inflation risk, thereby complicating the BoC’s efforts.

I’ve long argued that the immigration targets are too high relative to the ability of the economy to absorb this many and continue to believe as much in the wake of yesterday’s announcement. That could turn out to be especially true if Ottawa’s first move into announcing targets for temps turns out to be a bust if they can’t reach agreement on targets and credible enforcement with the provinces when negotiations kick off over coming months. I’m sure educational institutions will be pressuring provinces against curtailing the temps category since they get the benefits of much higher tuition from international students than domestic students while bearing little to no responsibility for their housing and other needs. Of course, that’s speaking only of the credible educational institutions, not the strip mall pop-ups that have been abusing the system.

As for the opposite narrative that immigration dampens inflation risk by expanding the labour supply pool and curtailing wage growth, let’s just say I’m no fan of the Donald Trump school of economics. When he said that into his first term, none other than the Cato Institute—typically a supporter—put out this survey of the US literature on the immigrant wage elasticity effect that concluded, well, that there wasn’t any! That’s likely also the case in Canada since a lot of the type of immigration in temps including international students, asylum seekers and temporary foreign workers is not much a substitute for existing workers. This is also something for US shops to bear in mind given I’ve heard some of them saying that surging immigration into the US will clearly dampen wage growth; that view defies the literature and ignores the composition of recent immigration.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.