ON DECK FOR TUESDAY, NOVEMBER 26

KEY POINTS:

- Tariff man skewers CAD, MXN, RMB

- A baker’s dozen of musings on Trump’s tariff threats

- FOMC minutes should be a stale snoozer

- US confidence, home sales data will seem stale now

- BoC speech spoke about a different pre-tariff world

Tariff man threw on his cape and hit financial markets with his threat to impose tariffs of 25% on all imports of goods from Canada and Mexico and another 10% on Chinese imports above and beyond existing tariffs. Otherwise, modest US data risk and a BoC speech with new meaning will make for relatively light calendar-based developments.

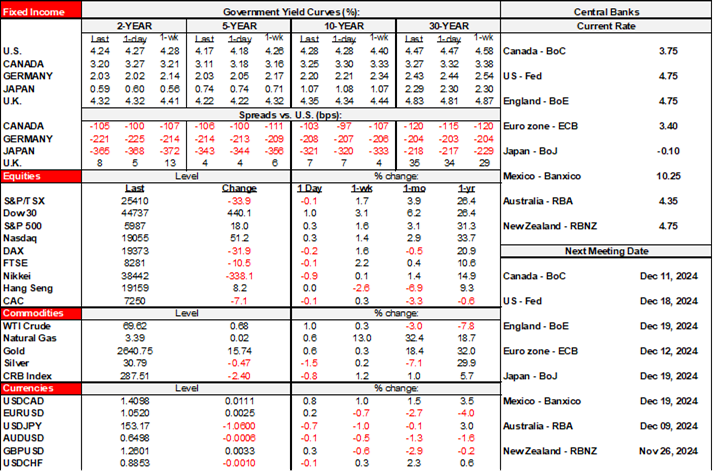

USDCAD punched north of 1.40 and is now at 1.41 for a toward 1.41 for a depreciation of about a penny. MXN is also almost 1% softer to the USD. The RMB is a bit weaker as well. Stocks are broadly lower and led by Asian equities including roughly 1% drops in Tokyo and China’s Shenzhen composite. TSX futures are down by ½% with S&P futures leaning toward a slight decline and European equities down by ½% to 1% across exchanges. US Ts are slightly cheaper along with gilts but EGBs are little changed on balance.

Musings on Trump’s Tariffs

I’ll offer a few thoughts on Trump’s announcement.

1. This is what we should expect by way of the kind of volatility we’re going to be getting during Trump 2.0. There will be high risks, high uncertainty that dampens confidence and the ability to plan, invest and consume at the expense of growth, but also opportunity in financial markets.

2. It’s a threat, but not a certainty, and it may be temporary if executed. This may be why the reaction across financial markets is not bigger; the ‘art of the deal’ is better understood in markets now which makes it potentially less useful as his strategy that involves a lot of hype followed by little action, but that may also drive Trump to be even more volatile and aggressive. We don’t want to be either pollyannaish or incite panic here.

3. On first pass there appear to be no carve-outs for individual categories of goods. Watch for reaction in Canadian price benchmarks such as Western Canada Select. I have a hard time believing that the US administration will not apply carve-outs after this initial threat. Energy and autos would be prime candidates as two of Canada’s biggest exports and that would be likely to see full price pass through into American pocketbooks.

4. Equity investors will have to roll up their sleeves and go granular on the implications on a company-by-company basis. There will be relative opportunities and risks within portfolios depending upon factors such as exposure to the US through exports but – if retaliation by all three countries ensues – also potentially on Canadian and Mexican operations stateside.

5. One reason for some calm in the aftermath of the threat is that US businesses will be hit hard through integrated supply chains that should serve as a moderating effect. This points to the silliness of using tariffs that shoot America in the foot. Imposing tariffs like this will rattle North American supply chains and that is perhaps the best hope for reversing or at least moderating them. GOP members in Congress within states that predominantly trade with Canada and/or Mexico will lean against it, and so will affected US businesses in key industries like autos where US employment is at risk.

6. Another reason for cooler heads to prevail at first is that the lobbying mechanisms are already kicking into place. Trudeau and Trump had a call last night. Walmart immediately warned last evening about higher prices facing Americans if tariffs go through. US businesses will be among the most vocal opponents to tariffs.

7. If executed, North American inflation will rise as tariffs are passed onto shoppers and businesses and government procurement programs and as CAD and MXN weaken. Some of the incidence effects are likely to fall on shareholders through reduced margins.

8. Automatic stabilizers won’t be a panacea to tariffs, but they are kicking in. Currencies of trade-dependent nations will depreciate in response to terms of trade shocks and punt dollar strength back on the US. Trump says he doesn’t want that, but all of his policies are USD positive which will harm America’s trade account.

9. First round effects of such tariffs are likely to mean less monetary easing by the Federal Reserve, BoC and Banxico on the inflation fears. They will turn less dovish if tariffs are implemented as the supply shock dominates concerns and the pandemic-era logic of responding to supply shocks returns in part. Second and subsequent round effects are more uncertain.

10. The thesis in markets that Trump’s more damaging policies would be held at bay is clearly put to the test with these announcements. It seems clear that he intends to follow through on the full suite of policies he campaigned on.”

11. The thesis that Bessent would be a moderating voice against Trump’s trade policies was also dealt a major blow and was unrealistic in the first place to anyone who has watched Trump over the past eight years. The Bessent trade that was hyped by the media yesterday didn’t actually exist; US Treasury yields started falling at the same time as the drop in oil prices that followed movement toward a peace deal between Israel and Hezbollah, not because of Bessent’s nomination. Besides, Bessent’s stances on everything from tariffs to his volatile past voting preferences have not been consistent enough to have that degree of faith. As for Bessent’s ‘roaring 20s’ references, recall that they started with mass emigration to the United States after WWI, not mass expulsion. They ended with tariff wars, rather than beginning with them. And fiscal deficits were being reined in after the war effort, not consistently ramped up with today’s unsustainable long-run fiscal position.

12. America’s drug problem won’t be solved by tariffs that could actually make it worse. Sophisticated criminal syndicates will move production to wherever—including within the US—it is profitable to do so and measures that increase risk increase profit and attract more entry. The US needs to be serious about its drug problem rather than trivializing it with tariffs by asking tough questions about high pharmaceuticals prices relative to elsewhere in the world that make it a lucrative market for legal and illegal drugs. Why do US doctors overprescribe opioids. Socioeconomic problems including high income inequality contribute. Demand and high prices won’t be solved by tariffs.

13. This is an opportunity to take up Canadian grievances with lax US border controls like how Canadian police are constantly saying that the majority of illegal guns confiscated during crimes come from the United States. Lax US gun controls are a significant border risk to Canada. Further, Canada is hardly a rampant source of illegal migration to the US but has the fear that as the US ejects people there could be a flood into Canada from the US.

BoC Speech Faces Fresh Interest

One of the BoC’s DepGovs (Mendes) delivered a speech on “Inflation at 2%: The role of monetary policy going forward.” Go here. Highlights hit at 8:05amET and were inconsequential on a morning like this that makes the speech look past its best before date. There will be audience Q&after we publish. We haven’t heard from a BoC official since Rogers on November 6th. Since then, we’ve received a relatively hotter CPI print and a strong retail set of numbers for September and October. The Federal government also made its announcements last week about more fiscal stimulus. And now we have the tariff threat that questions the whole essence of the speech title.

Question #1 from the audience is likely going to be something like this: “So, Mr. Mendes, how would the Bank of Canada respond to Trump’s tariffs?” The answer may be that they don’t wish to speculate before seeing fact rather than threats which is kind of a duck out. The other part may be to emphasize that Canada has a flexible exchange rate that is working in response to this threatened terms of trade shock. A third part may be that the BoC’s mandate is to target low and stable inflation first and foremost; a supply chain shock is first round inflationary. Governor Macklem’s speech in September made it clear that controlling inflation in a world of higher trade policy risks will be job #1.

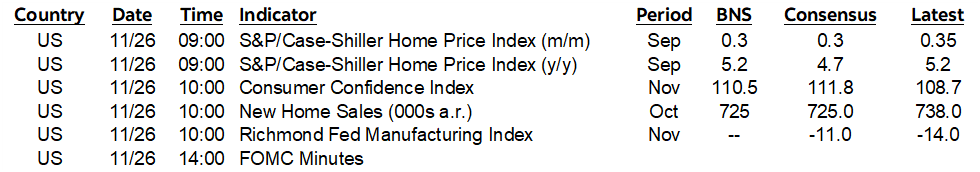

US Releases

Of the US releases, the one that is most likely to be impactful will be consumer confidence as at least a temporary initial verdict on the election’s impact upon the consumer mindset plus other considerations. The Conference Board’s consumer confidence index is due at 10amET) at the same time as new home sales during October (10amET). Repeat sale home prices are due out for September and Q3 at 9amET.

FOMC minutes are likely to be as dry as dust given that the policy announcement and presser were (2pmET).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.