ON DECK FOR WEDNESDAY, OCTOBER 23

KEY POINTS:

- Markets priced for the BoC to cut 50bps with two tailed risk of less and more

- Bank of Canada: 25, 50, or more?

- Recent data may be what changed things for the BoC to probably upsize…

- ...though this cycle’s differences merit a more gradual pace

- Minor US data on tap

- More central bankers speaking at IMF-World Bank meetings

Today is 100% about the BoC as far as I’m concerned. Other calendar-based risk will be practically non-existent with just US existing home sales (10amET) and more central bankers speaking at the IMF-World Bank meetings.

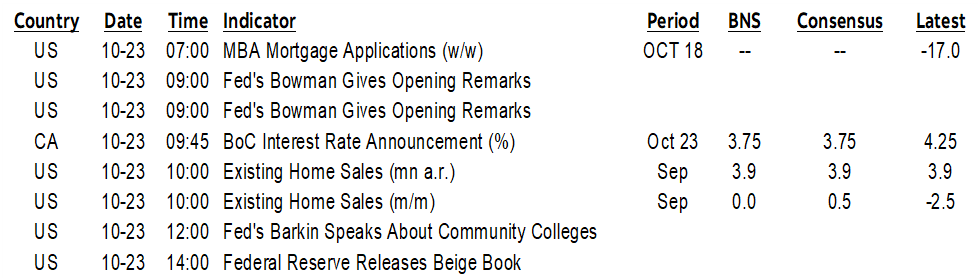

WHAT TO EXPECT AND WHEN

The Bank of Canada’s policy statement arrives at 9:45amET along with the Monetary Policy Report’s forecasts and analysis. Governor Macklem and SDG Rogers host a press conference at 10:30amET.

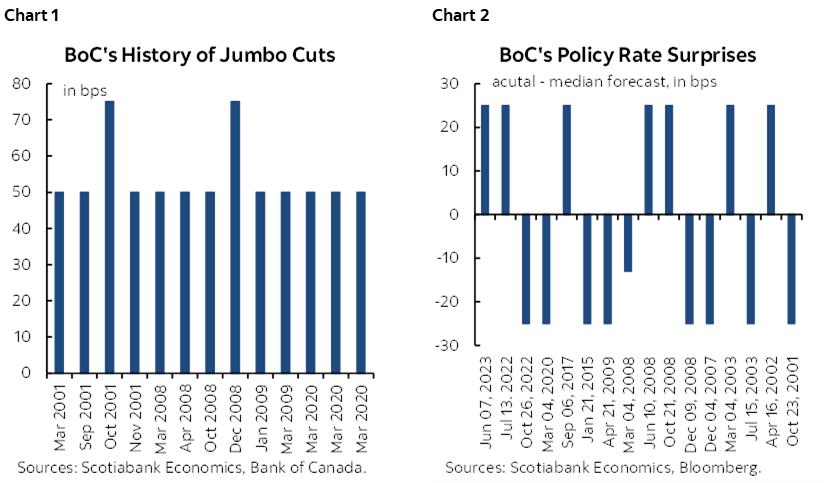

Scotia expects a 50bps cut that is priced and widely expected among domestic shops, plus no change in balance sheet policies. For a full preview go here. Chart 1 shows the times when the BoC has cut by 50bps or more. Chart 2 shows the times when the BoC has surprised consensus in either direction.

I see the case for cutting 50bps judged through the lens of how the BoC is probably going to look at conditions, but would personally prefer that they cut by 25bps in a more careful manner.

RECENT DATA PROMPTED UPSIZING THE CALL

Why would the BoC cut 50bps (or more) today? Judged through the way they would look at it, recent data is very likely to have raised the alarm at the BoC and that’s why you’ve seen expectations change fairly rapidly. Prior speculation toward upsizing was on a lark and baseless in the absence of data. The data we've gotten recently would give the BoC cover to up the size of a cut while saying 'look, we told you, we were increasingly concerned about undershooting 2%, and developments since we said that have raised our concern." It wouldn't be just a mere validation of market pricing, but it would be more difficult for the BoC to explain why it undershot with a smaller cut.

1. Spare capacity unexpectedly widened in Q3 and hence it is amplifying the risk of undershooting the BoC’s 2% inflation target. The BoC had forecast 2.8% q/q SAAR GDP growth in Q3 and we’re getting something as low as 1% by my tracking. Fresher data across a suite of readings shows the economy continuing to lose momentum. Hours worked slipped 0.1% m/m in August which was no big deal after the large surge in July, but they fell by another 0.4% in September’s LFS report on October 11th. I’ve estimated August GDP at -0.1% m/m SA and September is tentatively tracking poorly which is a soft hand-off to Q4. Thus, the already negative output gap was expected to narrow in Q3 but instead widened and could be tentatively viewed as facing the risk of becoming more negative in Q4.

2. Days after the LFS report, the BoC’s preferred core inflation gauges were weaker in the latest batch. Trimmed mean and weighted median CPI averaged 2% m/m SAAR in September (weighted median 2.3%, trimmed mean 1.7% m/m SAAR). Headline CPI inflation fell to 1.6% y/y, surprising forecasters to the downside. The BoC targets 2% headline inflation over the medium-term but uses the core gauges as the operational guide to achieving this. The fact that these core gauges are on 2% now with headline well under 2% y/y amid widening spare capacity shifts the focus more strongly toward concern that inflation will undershoot 2% inflation which requires a more assertive policy response. That could mean -50bps or an even bigger cut.

3. Wage figures have shown a steady deceleration of late and in m/m SAAR terms. September’s gain was one-handled. Job growth was solid, though significantly slanted toward youth, but the drop in hours worked as a GDP signal and the deceleration in wages may count for more to the BoC.

4. We also got the BoC’s surveys on October 11th—same day as the LFS. The BoC can point to very slight improvement in the measures of inflation expectations.

5. On labour supply, Canada’s immigration policy changes are a welcome course correction from the mismanaged non permanent resident program’s runaway excess and the BoC has far bigger issues to focus upon. We can’t beseech governments to curtail their numbers one moment because their numbers were driving higher unemployment especially among youths and housing imbalances in pockets of the housing market, and then admonish them for doing so the next! The labour supply was rising too rapidly, but focused in the temps area, not the core labour market that remains tight.

I don’t believe the BoC feels any great need to validate market pricing. I do, however, think that it would be a more difficult narrative for them to less dovishly surprise with 25 instead of 50 given the above arguments. Macklem has said they are increasingly concerned about the risk of undershooting 2% inflation and now they have added reason to be concerned which to me is a signal to pick up size and pace.

On the bias, I expect Macklem to be data dependent and noncommittal toward future moves other than repeating the line that it is reasonable to expect further reductions. His forward guidance is weak anyway and so I would spend no time on speculation toward whether the bias in the aftermath will be incrementally dovish, hawkish, neutral etc. It will be some variation of dovish imo but not in any useful way that would inform future size and pace pricing.

THE COUNTER-ARGUMENT

Now, the main counterpoint to upsizing (and where I lean) is explained in my Global Week Ahead preview. I short, I believe that going too far too quickly will risk unleashing the household sector, shutting spare capacity faster than expected, and returning us to facing upside risk to inflation concerns expressed in the curve later next year and transitioning into 2026. That may not happen if it’s just one 50bps move followed by a more cautious path, but the signal would be consistently more assertive policy easing.

1. Household leverage turns to an outperformance argument for Canada in a declining rate environment as the opposite to how leverage hurt in a rising rate environment.

2. Pent-up demand is significant.

3. Immigration remains excessive.

4. Pent-up savings to finance this spending remain very high.

But I don't think that for now the BoC will weight their decisions in that direction. They will want to shut spare cap as quickly as possible and deal with whatever happens later. Ergo, upsize now, then brace for the consequences later.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.