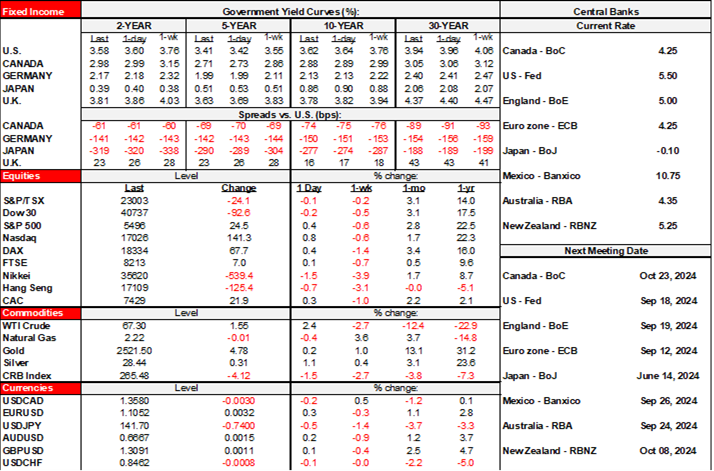

ON DECK FOR WEDNESDAY, SEPTEMBER 11

KEY POINTS:

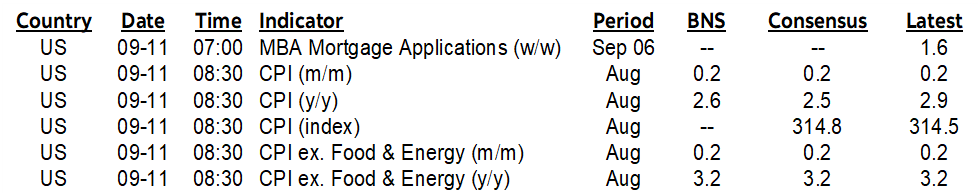

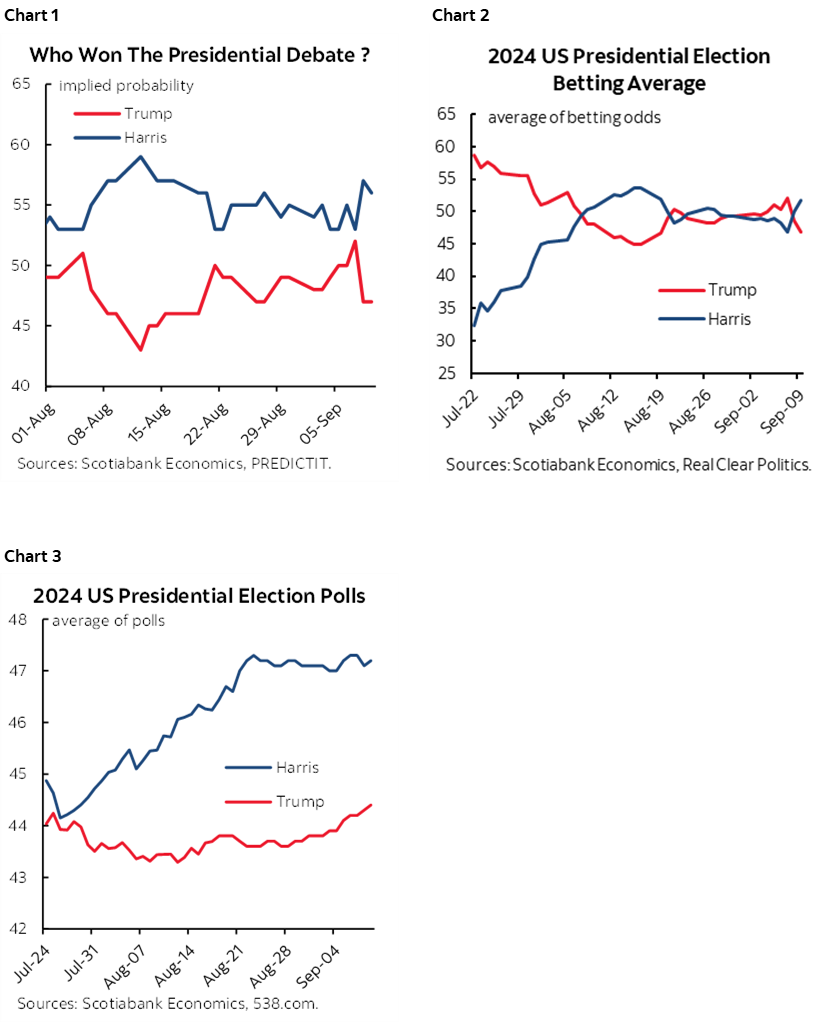

- Markets have spoken. Trump lost the debate.

- US CPI probably won’t materially change anything for the Fed

- Weakness in the UK economy humbled forecasters

I had a great day marketing the global outlook in NYC yesterday with the number one question everyone was asking being ‘are you going to watch?’ The debate, of course, not today’s US CPI that probably won’t move the dial much if at all.

Markets are whispering that Trump lost the debate to Harris while sounding and looking like an old, totally crazy, angry bully with a tired dog-and-pony act. Let’s see what polls show, but election proxies like US equity futures are slightly lower, PredictIt betting is giving the edge to Harris. The dollar is broadly softer perhaps on less safe haven demand and less concern that Fed rate cuts would be thwarted by looney tunes tariffs. Bitcoin is down because of Trump’s hate-on toward the dollar and courtship of the cyber crowd. The MXN, yen and several Asian pairs are among the currency leaders partly on slightly less worry toward potentially very misguided US trade policy. Charts 1–3 show election odds with some pending updates in the debate’s aftermath. Of course, relative polling matters less in the US given the role played by its Electoral College.

The other focus today will be on US CPI for August. Overnight releases were limited to the UK and were weak.

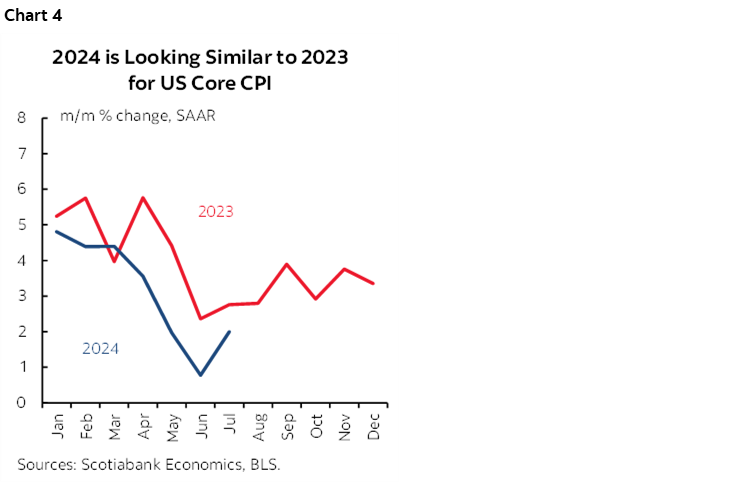

US core CPI (8:30amET) is widely expected to print at 0.2% m/m SA with 55 of 64 (64!!) forecasters expecting such a reading and the tails roughly even. The Cleveland Fed’s nowcast leans slightly toward 0.3%. At this stage let’s just get to the numbers and the clean-up. I doubt the release will matter much to Fed pricing or tip the balance on 25 or 50 with 25 likeliest opening salvo.

Chart 4 is a reminder that even SA inflation data may be following the same seasonally distorted pattern toward hot readings earlier in the year and cooler readings over the summer.

The UK economy struggled in the batch of releases for July that humbled UK forecasters. GDP was flat (+0.2% consensus). Industrial output reversed the prior month’s gain (-0.8% m/m, +0.3% consensus). Construction output fell -0.4% (+0.5% consensus). Services grew slower than expected (0.1% m/m, 0.2% consensus). And the trade deficit widened by more than expected. Peachy.

And so as you might expect, the gilts front-end is outperforming other global benchmarks and sterling is underperforming gains by other crosses against the USD this morning. There is still little priced for the BoE’s September decision, and November’s pricing increased slightly and is over -30bps.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.