ON DECK FOR THURSDAY, SEPTEMBER 12

KEY POINTS:

- Risk-on sentiment ahead of the ECB

- ECB to cut 25bps, narrow rate spreads…

- ...and sound data dependent alongside refreshed forecasts

- SNB’s Jordan to speak before coming rate decision

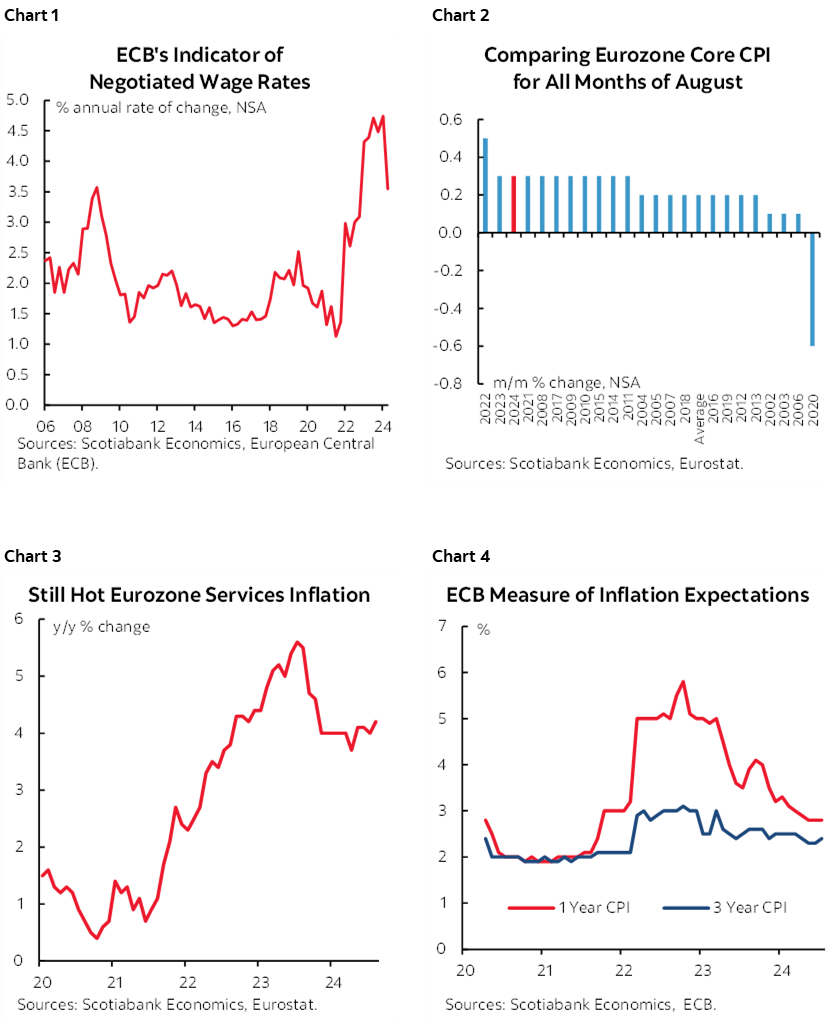

- US producer prices to continue the inflation drum beat

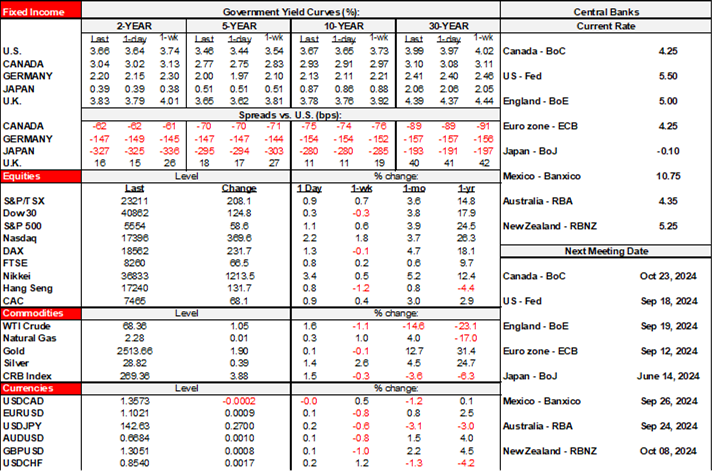

We’re starting off the day in risk-on fashion ahead of the ECB. Stocks are broadly higher including S&P futures that are building on yesterday’s 1% post-debate and post-CPI gain; Trump Media plunged, but the S&P is moving on. Sovereign bonds are broadly cheaper by less than a handful of basis points. Oil is up by over 1%. The dollar is little changed.

After US CPI, the market is priced for a quarter point Fed cut next Wednesday but that still feels too richly priced with over 100bps of cuts by year-end. I don’t see the exigent circumstances that would merit upsizing unless conditions take a rapid turn for the worse which is pure spec at this point. Heck, markets have been dead wrong on the Fed all year long.

But it’s the ECB that will be the day’s main focus, at least in passing. The policy statement lands at 8:15amET and President Lagarde’s press conference starts 30 minutes later. The scope for surprise is probably rather low. They’ve made it clear enough that they are on track toward cutting such that consensus is unanimously expecting a 25bps cut to the deposit rate. It’s also fully priced in OIS. The pre-announced move back in March to cut the spreads on other benchmark rates is also unanimously expected at this meeting as a technical change that has nothing to do with any meaningful shift in monetary policy directions.

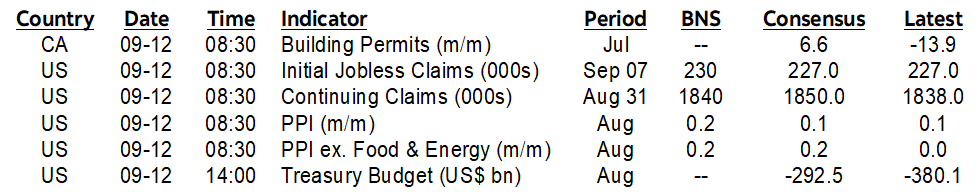

Key, however, will be ECB staff projections that get updated at this meeting plus Lagarde’s presser. I would expect a continuation of the data dependent aversion to teeing up next moves before we start to get the often customary reports of ‘anonymous’ officials objecting one way or the other. That data is still characterized by strong wage gains (chart 1, albeit off the peak), ongoing stickiness in core inflation in m/m terms (chart 2), ongoing pressures on services inflation (chart 3) and lower but above-target inflation expectations (chart 4). We’ll see. Don’t look to consensus for inspiration, as almost all of the 24 economists in Bloomberg’s economist sample are telling the same boring story with the deposit rate falling to around 2½% +/-25bps by the end of next year.

SNB President Jordan speaks this morning (10:25amET) with the next decision looming on September 26th.

More US inflation data arrives with producer prices expected to be soft (830amET). I wouldn’t expect that release to have any influence whatsoever on the Fed’s moves and guidance next week.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.