ON DECK FOR FRIDAY, SEPTEMBER 13

KEY POINTS:

- Friday the 13th isn’t so scary to markets

- Markets rally around return of upsizing speculation...

- ….as Fed -50bps speculation is being driven by a baseless WSJ article

- The Fed is thoroughly mismanaging communications into this meeting

- Trump’s latest foolish tax proposal could promote nasty side effects

- Peru’s central bank cut -25bps

- Russia’s central bank delivers another mega-hike to counter war-driven inflation

- Light data on tap

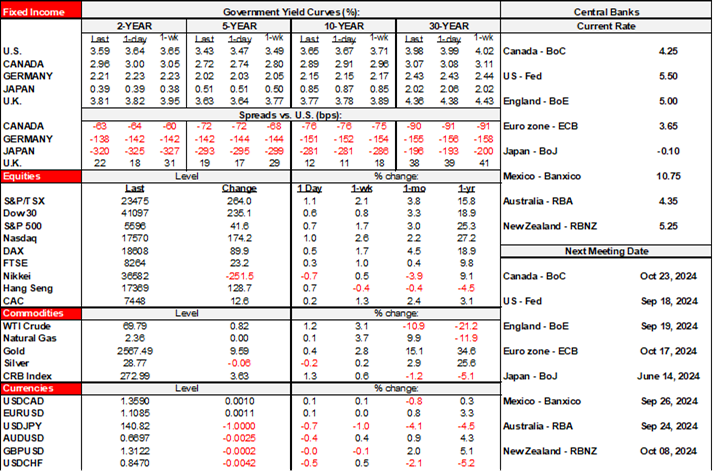

Friday the 13th isn’t so scary so far. Stocks are broadly higher, though gently so. Sovereign bonds are also slightly richer. The dollar is broadly softer. Oil prices are up by about 1%.

The catalyst seems to be the return of speculation toward a 50bps cut by the Fed next week. Markets increased pricing starting early yesterday afternoon around the time that speculative pieces in the WSJ argued a case for 50bps. I didn’t see any attempt at signalling by the Fed in those articles versus just interpreting them as offering the reporter’s loose speculation that spoke to both scenarios (25 and 50).

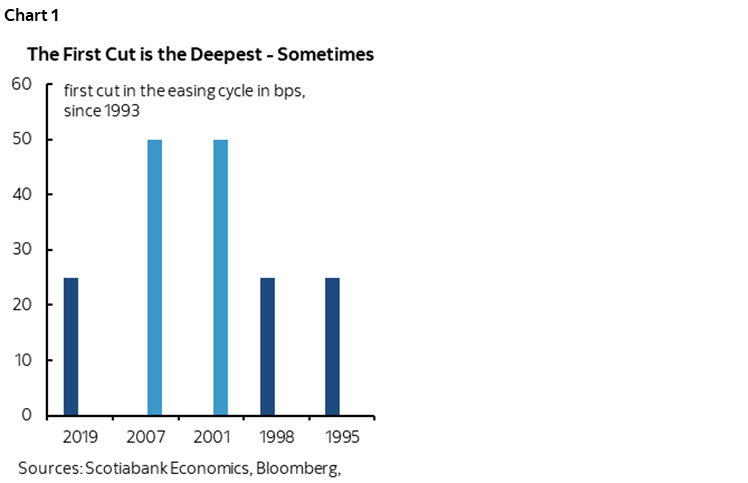

Chart 1 is a reminder of what has happened in past first-moves by the Fed. I still think the case for 25 outweighs the case for 50 and will present both cases in my weekly later today.

If the FOMC is really uncomfortable with market pricing and if such pricing remains on the fence, then the possibility of putting out a message into early next week remains significant.

That said, FOMC communications have been very sloppy and poorly managed around this important issue. Enter chart 2 that shows the gyrations in market pricing for this upcoming meeting dating back to when Chair Powell spoke at Jackson Hole on August 23rd. Either they have abandoned efforts to avoid uncertainty and surprises on game day that guided them throughout the pandemic, or they are truly divided and lacking coordination which isn’t a great signal, or we should expect clarity in story plants between now and early next week.

Otherwise, it should be a relatively light way to close out the week at least in terms of calendar-based risk.

Peru’s central bank cut 25bps last evening as widely expected.

Russia’s central bank hiked by 100bps this morning, taking the policy rate up to 19% that only three out of 13 within consensus had anticipated versus holds for the others. Serves you right, I say. The key rate has risen by 950bps since just before Putin invaded Ukraine in February 2022 and yet the Russian ruble has still depreciated by over 15% to the dollar over this period. Inflation is running at over 9% y/y as a partial consequence to ruble weakness and hence a partial driver of rate hikes. The war is exacting a heavy toll against Russian aggression.

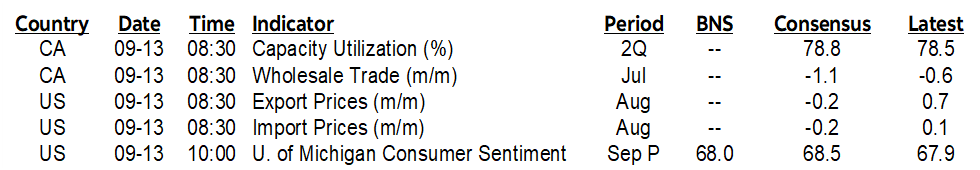

N.A. data will be light with the main feature being UMich consumer sentiment (10amET). The US also updates the terms of trade for August (8:30amET).

Canada updates wholesale sales that were initially guided to have dropped by about 1% m/m SA (8:30amET) along with the Q2 capacity utilization (8:30amET) that probably slipped given the soft tone to GDP after removing the role played by government spending and government cap-ex.

Trump offered another desperate tax policy option late yesterday by saying he’d end taxes on overtime. There goes US productivity! This could drive more shirking during regular hours as the tax incentive at the margin would encourage shifting effort into expanded hours. Tax distortions that create warped incentives to ‘work’ longer hours can further weaken the social fabric including family time. Maybe it would motivate employers to take offsetting measures if this happened, like reducing willingness to have workers work overtime if it comes at the measurable expense of productivity during regular hours. The proposal follows the Biden administration’s loosening of overtime pay rules back in the Spring that added an estimated 4.3 million more eligible workers filing overtime relative to the earlier threshold provisions of the 1938 Fair Labour Standards Act. This post by the left-leaning Economic Policy Institute explains those earlier changes. Trump’s proposal makes as little sense as eliminating taxes on tips.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.