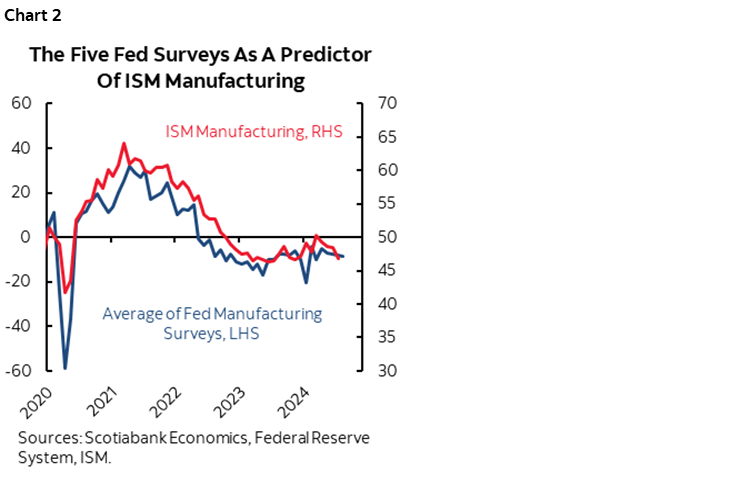

ON DECK FOR TUESDAY, SEPTEMBER 3

KEY POINTS:

- September kicks off with mild risk-off sentiment

- Yen appreciates as BoJ’s Ueda repeats that further tightening is likely

- China’s PMIs remain soft

- Swiss inflation cools, bolstering case for another SNB cut

- US to update soft ISM-mfrg, construction spending

- Canada to update manufacturing PMI, China’s tit-for-tat retaliation

- Chile’s central bank expected to resume cutting, Brazil to update GDP

- Global Week Ahead reminder

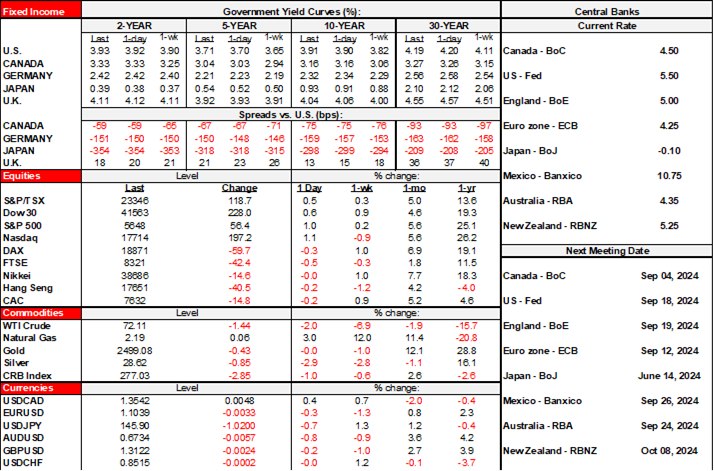

Mild risk-off sentiment is greeting market participants after long weekends in Canada and the US as the calendar flips over to September. Stocks are broadly lower across N.A. futures, European cash markets and after a mixed Asian session. The yen and MXN are outperforming all majors as carry risk creeps higher while the USD outperforms the rest. Sovereign yields are little changed. Oil prices are down by about 2%.

Uncertainty ahead of the week’s developments including US and Canadian jobs and the BoC is emphasized in the Global Week Ahead—Supersize Fries, Not Cuts! (here).

Catalysts include overnight comments by BoJ Governor Ueda who repeated that further tightening of monetary policy is likely if BoJ forecasts are achieved. The yen appreciated a little to under 146 to the dollar.

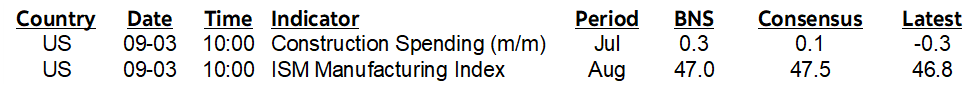

Weekend data out of China was on the soft side. It started Friday evening with the state’s composite PMI that continued to signal little to no growth in the economy with a reading of 50.1 (50.2 prior) as the manufacturing PMI edged a touch lower and the non-manufacturing PMI ticked up. Sunday night’s private Caixin manufacturing PMI conflicted with the state’s version by edging higher to 50.4 (49.8 prior). The private PMI is more slanted toward smaller producers in coastal exporting areas versus the state’s PMI that is more skewed toward SOEs.

Overnight data was light and included inflation reports out of Switzerland and South Korea. Swiss inflation surprised a touch lower (1.1% y/y from 1.3% prior, 1.2% consensus) wit core unchanged and on the screws at 1.1%. The figures lean toward another SNB rate cut on September 26th after prior quarterly cuts in March and June especially in light of another 5% CHF appreciation to the dollar since the June cut.

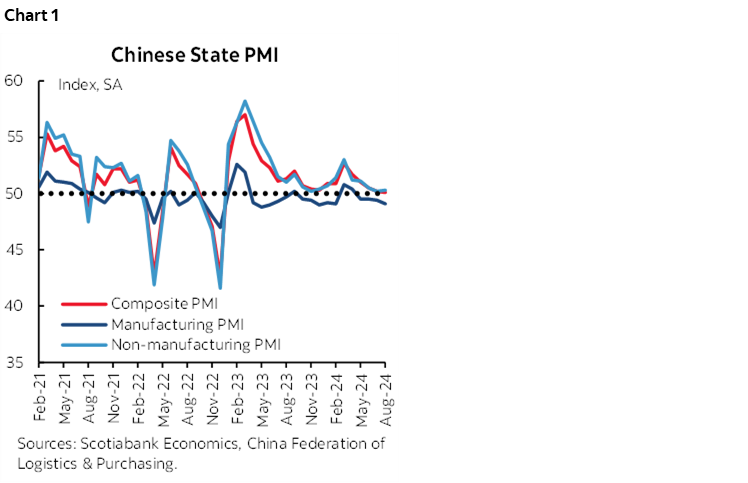

Relatively light US data is on tap this morning. The ISM-manufacturing gauge is expected to remain in sub-50 contraction territory (10amET). Construction spending will try to arrest a two-month declining trend (10amET).

Canada also updates a manufacturing PMI (9:30amET). China is retaliating against tariffs on Chinese EVs, steel and aluminum with a tit-for-tat probe into Canadian exports of canola. The macro effects are negligible outside of the sector.

Across LatAm markets, Chile’s central bank is widely expected to resume cutting this evening (6pmET) after Brazil refreshes Q2 GDP that is expected to post growth of just under 1% q/q SA nonannualized (8amET).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.